BlackRock Quietly Amasses Over 3.25% of Bitcoin Supply—What It Signals for Crypto’s Future

Key Takeaways:

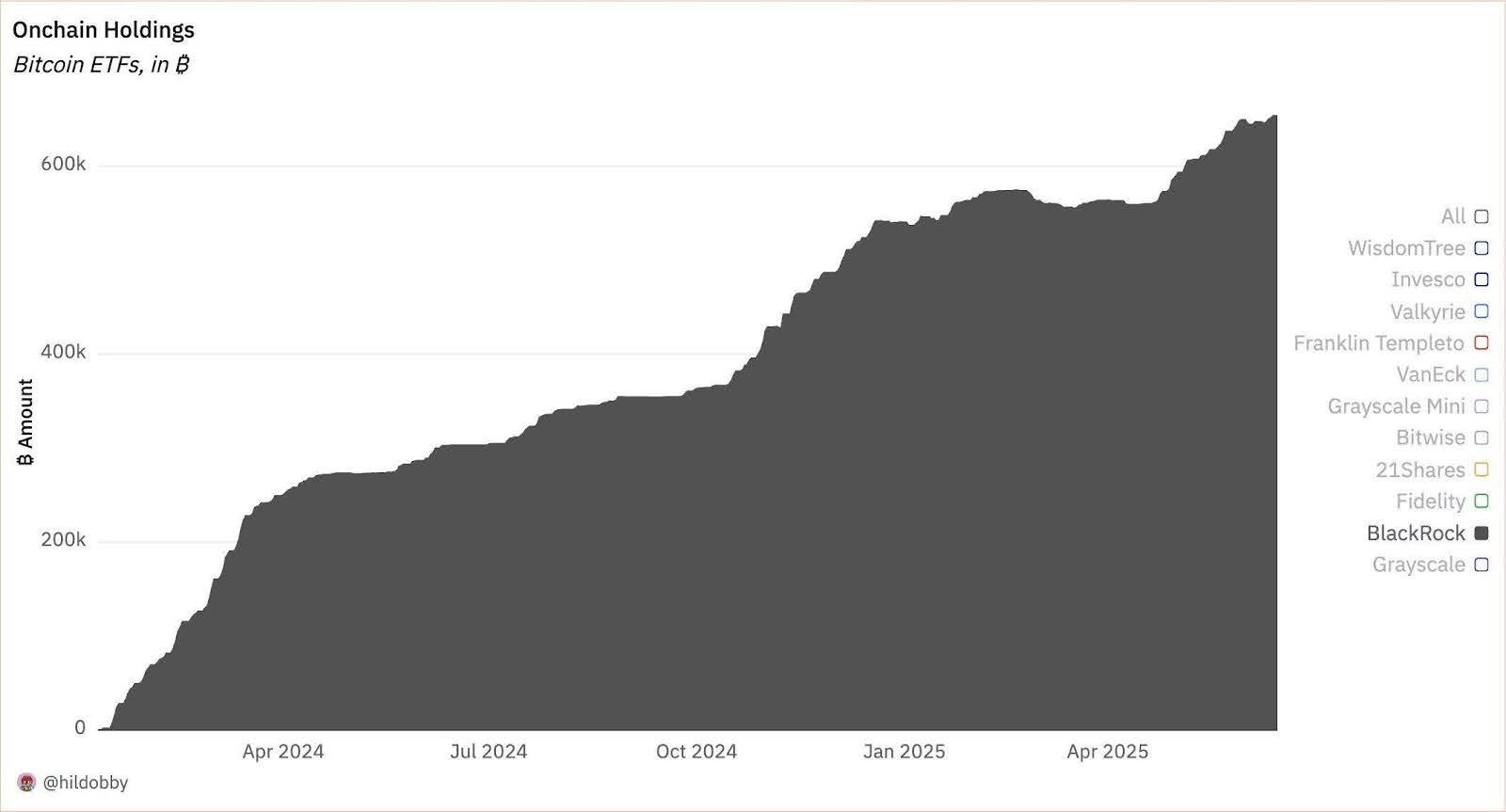

- BlackRock’s iShares Bitcoin Trust (IBIT) now holds over 3.25% of all Bitcoin in circulation, making it the single-largest holder among spot ETFs globally.

- IBIT has absorbed over $69.7 billion worth of BTC, dominating over 54.7% of the US spot Bitcoin ETF market.

- Institutional accumulation is rising sharply, while retail participation slows, signaling a shift in Bitcoin market dynamics.

BlackRock’s embrace of crypto has evolved from a symbolic moment to a market-moving force. A Bitcoin ETF started by the asset management giant just over a year ago has hit a historic milestone: over 3.25% of the fixed 21 million supply of Bitcoin. However, there is a story behind the figures: it concerns a turn of the balance of power, altered investment trends and the rising influence of classical finance in the crypto world.

The Numbers Behind BlackRock’s Bitcoin Play

IBIT’s Rapid Accumulation and Market Share

By the middle of June, 2025, BlackRock, which takes over the iShares Bitcoin Trust (IBIT) offers, is allegedly sitting on in excess of 3.25 percent of the aggregate number of Bitcoins, a number over 682,500 BTC, the price of which equates around $69.7 billion.

The ETF already commands over a half (54.7%) of the US spot Bitcoin ETF market, and has left Fidelity’s FBTC and ARK 21Shares in its dust. After the spot Bitcoin ETFs were approved by the United States Securities and Exchange Commission in January 2024, BlackRock has been on an aggressive buy spree, leading other funds in daily net inflows.

To put the scale in perspective:

- 3.25% of 21 million BTC is a huge holding for a single regulated investment product.

- That places IBIT among the top 25 ETFs in the world by assets, compared with legacy funds that track the S&P 500 index and a global bond index.

The speed is as striking as the volume. IBIT was able to cover that sum in less than 18 months and there were no signs of liquidation and outflows. BlackRock has also not sold any BTC since June 2024 according to analysts, indicating that it holds a strong long-term bullish sentiment.

Read More: BlackRock Files for Digital Shares in $150 Million Money Market Fund to Use Blockchain Tech

Supply Shock and Bitcoin’s Next Phase

The Role of ETFs in Reducing Liquid Supply

One of Bitcoin’s defining features is its fixed supply of 21 million coins. Estimates suggest that up to 20% of BTC may already be lost or locked in long-term holdings. With IBIT’s 3.25% share, and all US Bitcoin ETFs combined holding 6.12%, more than 1.28 million BTC is now tied up in regulated vehicles.

This tendency has a serious implication in terms of liquidity:

- ETFs are black holes to Bitcoin – once an asset is sucked into it, it is rarely traded in the spot markets.

- This limits the supply leading to the possible price pressure when the demand is high.

- The supply squeeze, caused by the ETF, is all the more pronounced when attached to the slowdown in the printing of Bitcoin that is occasioned by halving events, a slowdown that takes place after every four years.

IBIT’s consistent accumulation, alongside eight straight days of net inflows in June totaling $388 million, shows no sign of slowing. This suggests that institutional demand could become a structural feature of the market, not just a temporary narrative.

Read More: BlackRock Engages Anchorage Digital to Enhance Crypto Custody and Tokenized Asset Infrastructure

The ETF Shift: What’s Different in Bitcoin’s Market Now

Bitcoin Becomes an Asset Class

Mainstream finance had often dismissed Bitcoin for more than a decade. Now, it is uneventfully making its way into the strategic asset allocation of some of the world’s most conservative investors.

BlackRock’s action is not just about the crypto hype. It’s part of a larger shift:

- Pension funds, sovereign wealth funds and endowments gaining exposure to Bitcoin through regulated ETFs.

- BlackRock brand is legitimate and also a source of trust especially to advisors who may acquire clients with risk-averse behaviors.

As this trend strengthens, expect the following:

- Additional products with similar structure to IBIT with a potential focus on going after multi-asset exposure with BTC in the center.

- The market matures and its volatility in the long-term horizons becomes reduced under the stewardship of institutions.

- Fewer speculative bubbles driven by retail FOMO (fear of missing out), and more price action shaped by macroeconomic factors and fund flows.

The post BlackRock Quietly Amasses Over 3.25% of Bitcoin Supply—What It Signals for Crypto’s Future appeared first on CryptoNinjas.