Ethereum ETF Inflows Hit $4.97B as SEC Clears Path for Staking—Is a New ETH Cycle Here?

Key Takeaways:

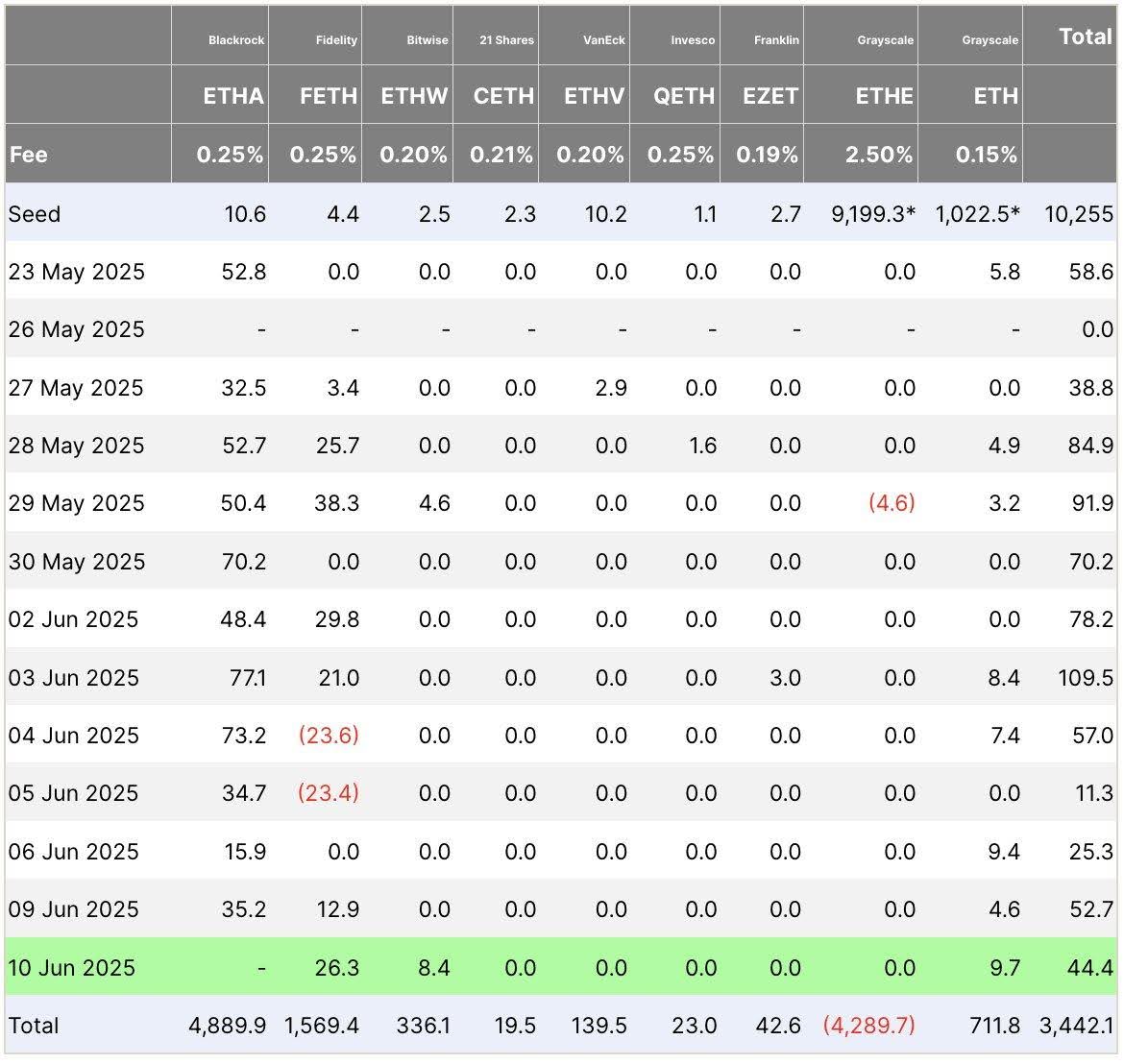

- Over $4.97 billion has flowed into Ethereum spot ETFs, with BlackRock’s ETHA dominating the leaderboard.

- The SEC’s landmark clarification on staking removes a major regulatory roadblock, boosting institutional confidence.

- Bitget CEO Gracy Chen says the market is entering a “true $ETH cycle” as ETF demand and regulatory clarity converge.

Ethereum has just received a significant boost from both regulators and Wall Street. On June 11, Bitget CEO Gracy Chen publicly reaffirmed her bullish stance on Ethereum, citing sustained net inflows into Ethereum ETFs and a game-changing SEC clarification on staking. Given a nod of approval from regulators, institutional investors also look poised to pour in — possibly kick-starting an exciting new chapter for ETH.

Read More: Ethereum ETFs Experience $103M Outflow as Bitcoin Sees Massive Inflows

Ethereum ETF Inflows Soar: Institutional Confidence Peaks

Ethereum spot ETFs now have multiple weeks of net inflows for the first time in weeks, indicating a stark change in investor attitude.

BlackRock and Fidelity Surge Ahead

As of June 10:

- BlackRock’s ETHA brought in $80.58 million in one day, bringing its total inflow to a monstrous $4.97 billion.

- Fidelity’s FETH took in $26.32 million per day, raising its overall assets to more than $1.55 billion.

In total, Ethereum ETFs have amassed over $10.65 billion in net assets, equivalent to around 3.18% of ETH’s total market capitalization. This is on par with early stage Bitcoin ETF inflows after initial approval, suggesting that investors are increasingly seeking exposure to Ethereum as a regulated financial asset.

SEC Clarifies Staking: ETH Enters New Regulatory Era

A development that is perhaps even more important in this respect is the SEC’s position on crypto staking, which it published on May 29.

What Changed?

The SEC made it clear that the staking itself, including both self and delegated staking, would not be considered as securities transactions, and, as such, do not qualify as registration. This applies to custodial and non-custodial mechanisms and is seen as a foundational regulatory green light for Ethereum’s Proof-of-Stake model.

“This removes a key roadblock for ETH ETF issuers looking to incorporate staking models,” said Nate Geraci, President of the ETF Store.

This update aligns with the view of Commissioner Hester Peirce, who called staking “a core element” of decentralized networks. However, it drew pushback from Commissioner Caroline Crenshaw, who argued that it undermines the application of the Howey Test, a key legal benchmark for determining what constitutes a security.

Despite the dissent, the guidance is now in effect—fueling speculation that ETF issuers may soon enable on-chain staking rewards for investors.

Could Staking Integration Spark a New Ethereum Bull Cycle?

Bitget CEO Gracy Chen sees this moment as pivotal. In her June 11 post on X, Chen said:

“I’m still bullish on $ETH. Net inflow into spot ETFs for 3+ weeks is a positive signal of strong investor interest. SEC approval for staking could unlock a true $ETH cycle.”

Her message reflects the optimism spilling from institutional desks. Soon, Ethereum ETFs can begin earning yield. This can only mean more yield: With staking now cleared, Ethereum ETFs can start earning additional yield in the form of staking rewards, making them not just capital-growth tools but also yield-generating assets.

This has 3 important implications:

- ETF attractiveness increases: Investors may gain passive ETH rewards in addition to price exposure.

- Ethereum demand surges: More ETH will need to be accumulated by ETF issuers to allow for scalable staking.

- Validator participation expands: With staking moving into the mainstream, more institutions may choose to become validators or stake through custodial platforms.

Read More: Bitget Investigates Suspicious VOXEL/USDT Trading Activity Following Sudden Price Spike

Numbers Never Lie: Contextualising Ethereum’s ETF Performance

Here is how the current market for Ethereum ETFs looks:

| ETF Provider | Daily Net Inflow (June 10) | Total Net Inflow | Net Asset Value |

| BlackRock ETHA | $80.58M | $4.97B | Highest among all |

| Fidelity FETH | $26.32M | $1.55B | Second-highest |

| All ETH ETFs | $125M (daily) | $10.65B | 3.18% of ETH Market Cap |

Such aggressive accumulation over a short span is rare, especially for an altcoin ETF product. Bitcoin ETF adoption alone took months to hit similar numbers, which may hint at the fact that Ethereum’s mix of use case utility, staking, and now finally clarity is causing demand to speed up more quickly than what was anticipated.

Still Not Risk-Free: Regulatory and Tax Headwinds Persist

Despite the optimism, not everything falls into place.

IRS Yet to Clarify Tax Treatment of Staking in ETFs

One outstanding issue has been raised by Nate Geraci and other analysts: The tax treatment of staking rewards within ETFs. Staking is no longer a securities related transaction, however the IRS has not promulgated the rules on how to treat staking income for funds.

Will rewards be taxed as income, or capital gains? Will ETF issuers need to issue 1099s for yield distributions? The lack of clarity here could impact both ETF architecture and investor appetite until resolved.

Additionally, Commissioner Crenshaw’s vocal opposition to the SEC guidance hints at potential internal policy reversals—especially under a future administration. If the political landscape shifts, staking regulations could come under review again.

The post Ethereum ETF Inflows Hit $4.97B as SEC Clears Path for Staking—Is a New ETH Cycle Here? appeared first on CryptoNinjas.