Connecticut Bans Bitcoin Investments by the State—While Others Race to Build Crypto Reserves

Key Takeaways:

- Connecticut has officially passed a bill banning all state and local government investments in Bitcoin and other cryptocurrencies.

- The new legislation also prohibits the creation of a strategic reserve of digital assets, going against a growing trend in other U.S. states.

- Tighter rules for crypto businesses now include mandatory disclosures, AML compliance, and restrictions for users under 18.

In a significant turn away from the rising tide of state-level crypto adoption, Connecticut has taken a firm regulatory stance by passing a bill that bars government entities from investing in digital currencies. The move contrasts sharply with states like New Hampshire, Texas, and Arizona, which are actively exploring or have enacted Bitcoin reserve policies.

Connecticut’s Blanket Ban on State Crypto Investments

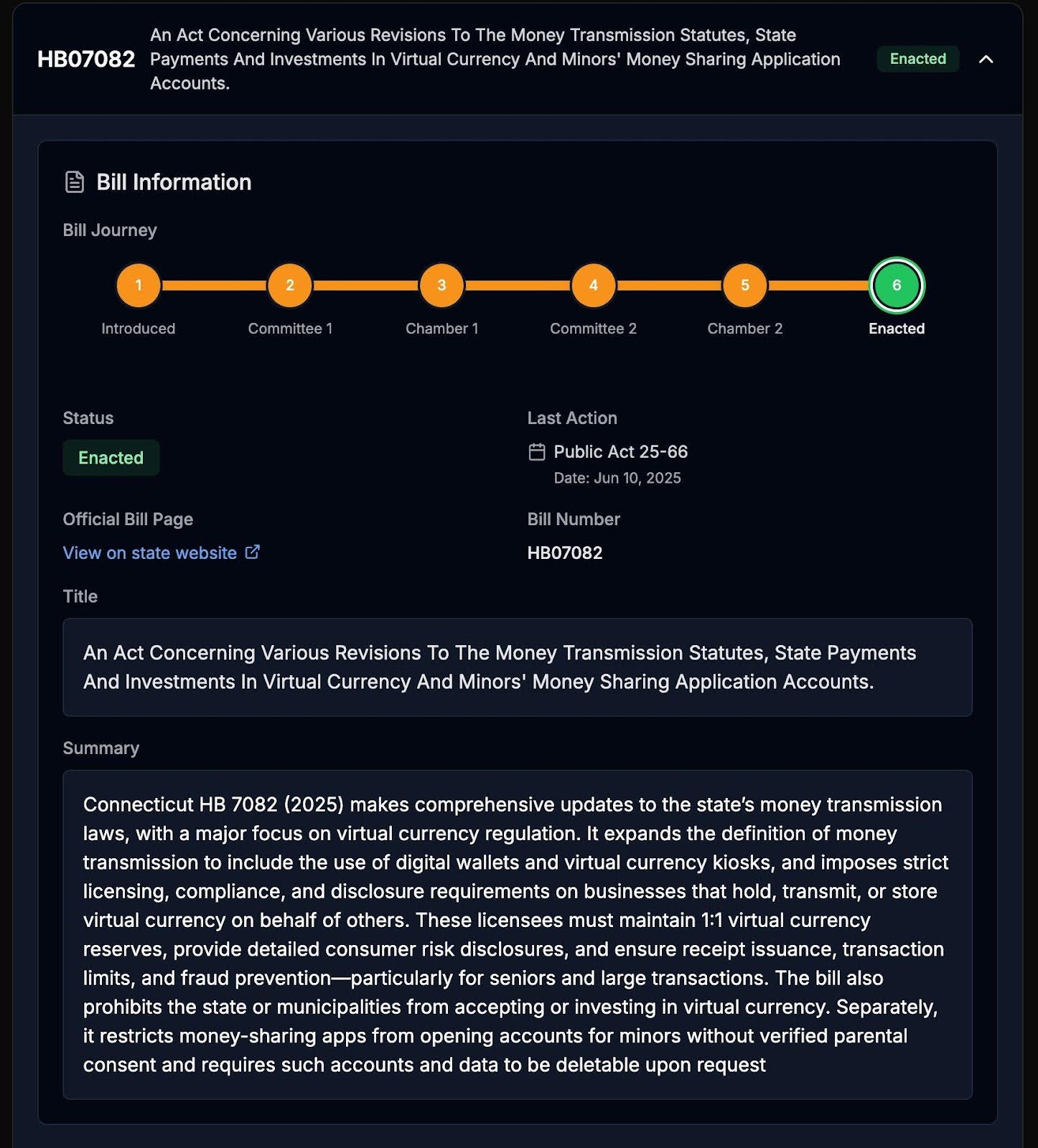

The legislation—Substitute for Raised H.B. No. 7082, now Public Act No. 25-66—clearly prohibits any state or municipal entity in Connecticut from purchasing, holding, or investing in virtual currencies, including Bitcoin. It also blocks these entities from accepting crypto as a form of payment or creating any crypto reserves.

This legislative move appears to be preemptive, preventing any future scenario in which public funds could be used to speculate on volatile crypto assets.

Under the bill:

- The state treasury, local governments, and public agencies cannot hold or transact in crypto assets.

- All levels of government are banned from creating a Bitcoin reserve, despite growing national momentum for doing exactly that.

This comes at a time when several states have framed Bitcoin as a hedge against inflation or a long-term store of value—a notion Connecticut lawmakers are firmly rejecting.

Read More: Texas Proposes Strategic Bitcoin Reserve Amid Push for Crypto Sovereignty

Key Crypto Compliance Mandates for Businesses in Connecticut

While the investment ban made headlines, the legislation goes further by imposing strict requirements on crypto money transmission businesses operating in the state. These businesses, often including exchanges and payment apps dealing in digital assets, must now meet detailed regulatory obligations, including:

Disclosure, Custody, and User Protections

- Clear Disclosures: All crypto businesses must now provide users with explicit, understandable warnings about the risks associated with digital asset transactions. These disclosures must be:

- Written in English

- Conspicuously displayed

- Inclusive of material risks such as price volatility, lack of insurance protections, and fraud exposure

- Receipts and Custody Terms: Customers must receive detailed receipts and be informed about who has custody of their assets. If the business engages a third party for custody, the customer must be made aware of this.

- Minor Protections: For the first time, digital financial platforms operating in Connecticut must verify parental or legal guardian consent before allowing users under 18 to create or use crypto-related money-sharing accounts.

- Clarification of Ownership Rights: The bill also defines virtual currencies held by licensed entities as property interests that can be claimed by customers, adding an extra layer of protection in bankruptcy or insolvency scenarios.

These new requirements align Connecticut more closely with traditional financial regulations, emphasizing consumer safety and financial transparency.

Connecticut Out of Step with Other States Embracing Bitcoin

While Connecticut clamps down on crypto engagement at the state level, several U.S. states are moving in the opposite direction:

- New Hampshire passed legislation establishing a state-level Bitcoin reserve, citing Bitcoin’s potential as a digital store of value.

- Texas, on the strength of a budget surplus, has embraced the notion of diversifying state holdings with Bitcoin.

- Arizona also took a step toward a crypto reserve policy this year.

Florida, Wyoming, South Dakota and North Dakota, on the other hand, have shuttered or tabled comparable crypto moves in 2025, due to worries about volatility and regulatory uncertainty.

Read More: Florida Takes Bold Step to Add Bitcoin to State Treasury Reserve

At the federal level, former President Donald Trump just signed an executive order to support creating a national Bitcoin reserve, but the order is vague and its near-term implementation not clear.

Connecticut follows suit with these more conservative states by shielding public funds from what its lawmakers see as a volatile, high-stakes financial world.

Crypto Weighs In: Chlling Effect?

The passage of H.B. 7082 has sparked mixed reactions from industry participants:

- Crypto advocacy groups say that Connecticut is closing the door on innovation and trends in future finance. They caution that the shift could discourage blockchain-based startups from doing business in the state.

- Supporters of the bill in the regulatory community and among lawmakers say it’s a needed guardrail to prevent abuse of public funds and ensure crypto-related companies operate prudently.

Some observers think this could lead to a schism in innovation hubs, with states that are crypto-friendly, like Texas, drawing even more blockchain investment and such as Connecticut losing out as innovation moves elsewhere.

The Bigger Picture: Is This the Start of a Regulatory Domino Effect?

Connecticut’s is not the only such decision. It contributes to a larger discussion playing out across the United States about how much state governments should meddle in crypto — whether through strategic investment, payments infrastructure or regulatory oversight.

As the SEC and the CFTC fight over how digital assets should be categorized at the federal level, states are going their own vision ways. Connecticut’s ban could inoculate other risk-averse legislatures to issue similar bans at a moment when crypto-native states double down on their support.

The post Connecticut Bans Bitcoin Investments by the State—While Others Race to Build Crypto Reserves appeared first on CryptoNinjas.