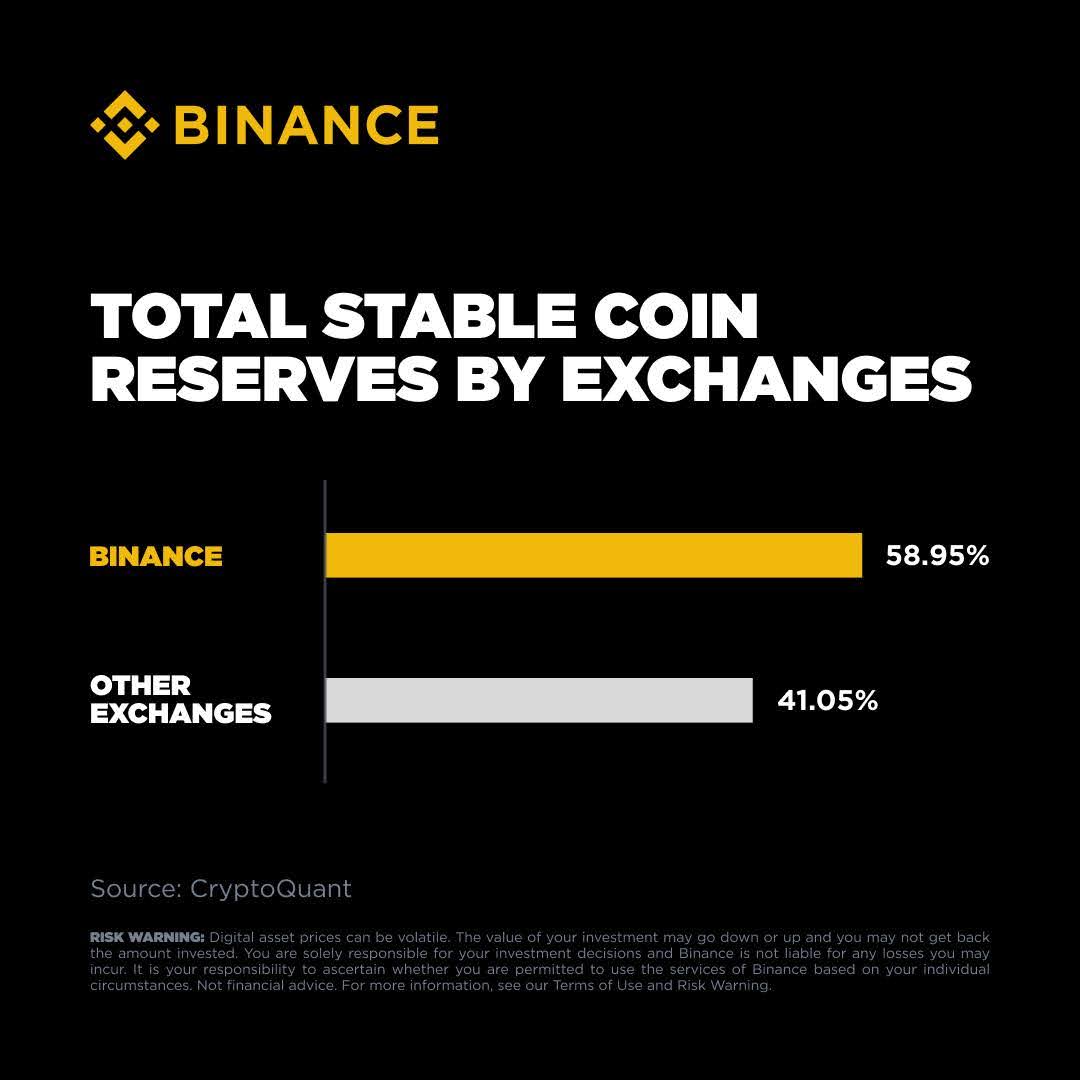

Binance Holds $31B in Stablecoins—Nearly 60% of All CEX Reserves

Key Takeaways:

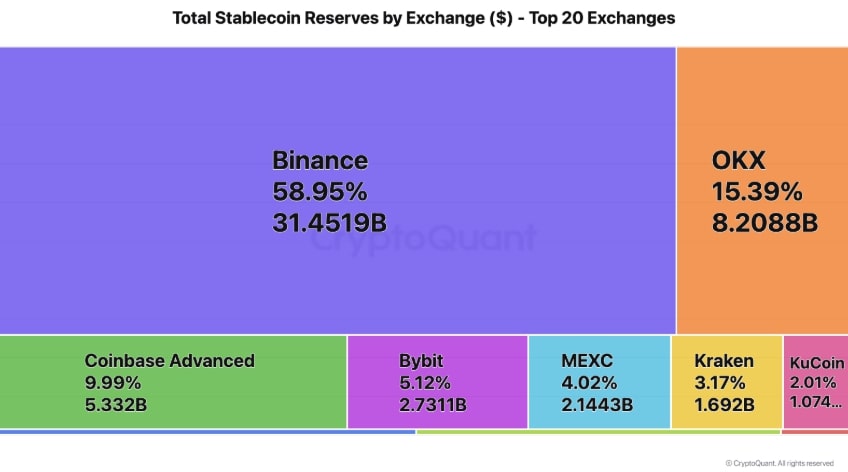

- Nearly 59% of all stablecoin reserves are on centralized exchanges and Binance holds the most reserves on these exchanges (at over $31 billion in USDT and USDC) as of May 2025.

- Stablecoin deposits are becoming an important indicator of user confidence and liquidity constraints, leading Binance to become the world’s leader in capital flow in cryptocurrencies.

- Bitcoin Inflows above the norm with stablecoins point to increasing institutional confidence, establishing Binance as the main hangout for short-term trading, and long-term investments both.

In a market where price swings and trending tokens are so often the focus of headlines, the true story is to be found in where capital flows and finds rest. A new look at on chain data shows just how much stablecoins are actually being held on the Binance exchange, indicating that it’s influence as the top cryptocurrency platform by volume may continue.

Binance’s Dominance of Stablecoins: What the Numbers Say

Stablecoins, or digital assets backed by dollars and other major currencies, provide traders and investors a place to escape the volatility while they make quick trades in and out of positions. Binance has almost $31 billion in USDT and USDC, now the world’s largest crypto exchange according to blockchain analytics firm CryptoQuant, as of May 2025. This amount is around 59% of the total stablecoins on centralized exchanges in the world.

And this dominance is not merely serendipitous or a matter of timing. Instead, it shows broad-based confidence from retail and institutional traders. When people transfer stablecoins onto Binance, they are signaling readiness — to trade, to invest, to deploy capital in decentralized finance (DeFi) strategies.

This level of concentration also shows that Binance is morphing into the de facto bridge for crypto liquidity and capital onboarding. Binance has brought in an astonishing $180 billion worth of stablecoins year-to-date, indicating its position as crypto’s gateway to world markets.

Beyond Stablecoins: Bitcoin Flows Confirm Binance’s Growing Clout

Stablecoins show readiness, and Bitcoin inflows suggest conviction. Bitcoin (referred to as digital gold) is still the base asset in which many hold long term confidence. Binance, the king of all things stablecoins as it holds the most reserve, has also just received large Bitcoin deposits.

For example, on May 22, 2025, at the time that Bitcoin took its new all-time high at $112,000, for Binance, you have the average deposit of 7 BTC per transaction (much higher than the competition, which includes Bitfinex, OKX, Kraken, and Coinbase, among others). This indicates that large investors such as institutions and high-net-worth individuals are depositing BTC on Binance.

Read More: Binance vs. Coinbase Comparison in 2025: Fees, Safety, and Security

This two-lever trend—giant stablecoin liquidity alongside big-time Bitcoin inflows—speaks volumes about Binance’s universal appeal. It’s both a place to park assets safely and a wily conduit where capital is always ready to jump or accelerate.

Why Binance Remains Crypto’s Capital Magnet

Liquidity and Execution Depth

A trading venue depends on liquidity like other businesses depend on water. Binance has some of the lowest trading fees among the best exchange platforms to trade on because it has some of the deepest order books with high volume on the biggest altcoins. This is better pricing for traders at less risk of price impact.

A Wide-Ranging, Embedded Product Suite

Binance’s product suite spans spot trading, futures, options and leverage transactions. It also includes a number of advanced order types as well as automated trading robots, staking services which are aimed at a wide range of users from those who enjoy the action to those more concerned with long-term gains for their portfolio.

Global Extension and Availability

With operations in over 100 countries, Binance ensures that its users can always access its services easily regardless of where they happen to live. The company’s payment facilities are expanding real-world potential for crypto use; a contactless system which makes transnational movement of money simple and money flows borderless.

Security and Trustworthiness

In the face of continuing worries over exchanges being hacked and scams, Binance’s Secure Asset Fund for Users (SAFU) gives peace of mind to move funds in an emergency. A conscientious practice, transparent policies and auditing bolster user confidence further.

What This Means for the Crypto Market

This flow of capital has wider implications than just an increasing user preference. It is a sign that the crypto ecosystem as a whole is maturing. Stablecoins are becoming ever more essential in crypto finance; they now serve as collateral for DeFi, instruments in cross-border remittances, and form the base currency for many trade pairings.

At the same time, Bitcoin’s steady inflow only confirms its dual role as a store of value and an important item in any diverse investor’s portfolio. The confluence of these trends playing out at Binance speaks to an increasingly sophisticated market, one that here calls for two things: liquidity and security.

Institutional adoption is becoming more robust and retail appetite still solid growth as a result Binance, the infrastructure behind moving capital in crypto. The concentration of liquidity on one exchange naturally raises some concerns from regulators—but this centralisation also pushes down volatility fluctuations and contributes to market stability.

The post Binance Holds $31B in Stablecoins—Nearly 60% of All CEX Reserves appeared first on CryptoNinjas.