Breaking: Nasdaq-Listed Webus Plans $300M XRP Reserve via SEC Filing

Key Takeaways:

- Webus enters a $300M digital asset management agreement with SEC-registered Samara Alpha in a blueprint defining pivot towards crypto treasury operations.

- The attention is given to XRP and no assets have been transferred at this point but the framework and agreements are ready for swift deployment.

- SEC filing (6-K) confirms strategic intent, aligning Webus with institution-grade crypto portfolio management standards.

Webus International Limited makes a significant foray into the crypto space. On June 2, the Nasdaq-listed AI mobility firm disclosed a strategic alliance with Samara Alpha Management LLC, enabling the management of up to $300 million in digital assets—primarily XRP. No money has yet changed hands, but the company’s SEC filing does lay out a clear framework for its digital asset treasury ambitions.

A Quiet SEC Filing with Massive Implications

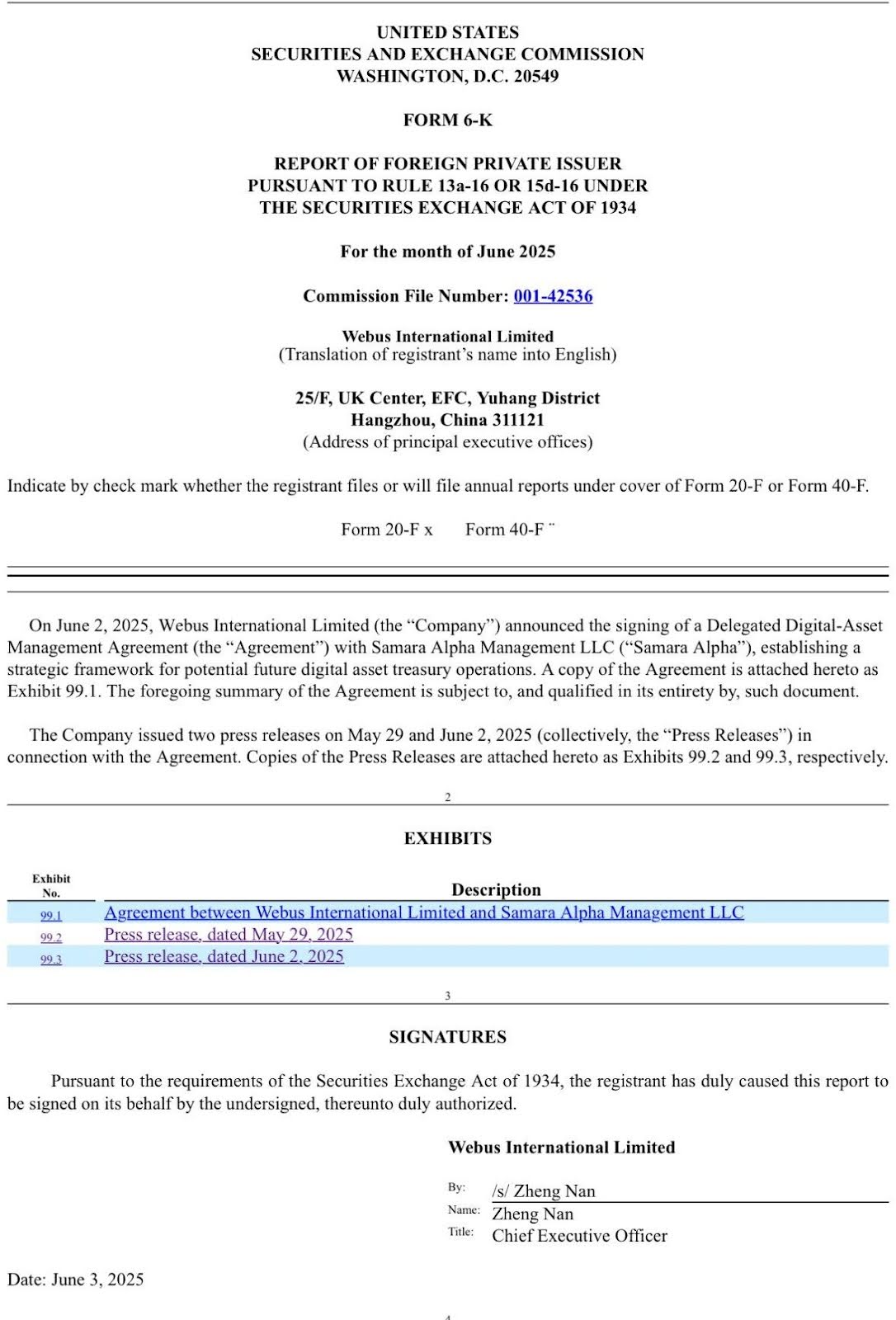

On May 28, 2025, Webus International Limited completed a Delegated Digital Asset Management Agreement with Samara Alpha Management LLC, a US-based SEC-registered investment advisor. Several days later, the company submitted a Form 6-K to the U.S. Securities and Exchange Commission (SEC)—commonly an indication of material changes for public companies.

Relatively unknown to date, the document details the intention to establish a $300 million crypto treasury reserve, which Samara Alpha would be the sole manager for. The partnership is tailored to XRP, one of the most institutionally recognized yet regulatory-scrutinized digital assets in the space.

Webus’s decision to go public with the filing—not via marketing fanfare but through regulatory compliance—adds weight to the long-term seriousness of its treasury diversification strategy.

Read More: SEC Uncovers $110M Crypto Scandal: Unicoin’s ‘Asset-Backed’ Claims Fall Apart

Inside the Crypto Treasury Agreement

Structure and Organization of Management

Under the agreement:

- Samara Alpha shall have discretionary and delegated oversight of Webus’s digital assets transferred.

- The components include staking allocations, on-chain strategies, OTC execution, and custodial platforms.

- Maximum in other assets under management: $300 million, unless waived or adjusted.

Nothing happens under the contract until there is an exchange of the underlying asset -programmematic staging, it would seem, to deal with market timing, and regulation.

Custody and Control Mechanism

One of the most important features of the agreement is its security architecture:

- All the funds will be kept in multi-signature wallets, so no one can spend the money without the other party.

- Webus keeps one signature key systems to maintain control, mitigate counterparty risk.

These are considered best practices in crypto custody, meaning the deal is aligned with the type of institutional-quality that regulators and stakeholders in general are seeking more of these days.

Institutional Dynamics and Fee Schedule Configuration

Here are the financial mechanics of the deal in a way that should sound familiar to any hedge fund manager:

- 2% of assets under management fee (annualized AUM, paid quarterly).

- 20% performance fee, which is, in turn, benchmarked over a high-water mark.

- 80/20 in favour of Webus on the split of the staking rewards.

- Other fees are charged at cost, for example: custody fees, gas charges, audit fees, etc.

These prices are high in comparison to typical treasury benchmarks, but are on par with high-end crypto asset managers—especially those with secure, regulatory-friendly operations.

Why XRP? Timing, Strategy, and Liquidity

Webus’s emphasis on XRP is no accident. Against a tough regulatory history with the SEC, XRP still holds status as one of the most liquid, cross-border friendly and institutionally integrated assets.

The token is popular with companies trying to test-drive a digital asset reserve without being subject to the same volatility as a smaller token. Additionally:

- Ripple’s international partnerships are still as strong as ever in Asia, Latin America, and the Middle East.

- There are a number of exchanges and custodians that offer fully compliant on/off ramps for XRP.

For a company like Webus—operating a luxury AI-based mobility network with international scope—the ability to hold and manage a globally interoperable asset makes strategic sense.

Role and Image of Samara Alpha

Samara Alpha may not be a household name, but in institutional circles, it carries clout. A registered investment advisor with the SEC, the company offers digital asset management to clients who seek regulatory adherence and financial performance in a convoluted regulatory space.

Under the leadership of CIO Adil Abdulali, Samara Alpha has been focusing on tracking portfolio strategies that translates core finance theories in traditional finance into evolving crypto markets.

Crypto Treasury: A Growing Corporate Trend

Webus is the latest in a string of public and private companies exploring crypto asset reserves. As much as the MicroStrategy Bitcoin play may get the headlines, other companies are following the trend toward multi-asset treasury strategies, which usually focus on stablecoins or utility tokens such as XRP.

The post Breaking: Nasdaq-Listed Webus Plans $300M XRP Reserve via SEC Filing appeared first on CryptoNinjas.