Binance Is Getting Close to 300 Million Users: Is Cryptocurrency Going to Be the Next Big Thing in Finance?

Key Takeaways:

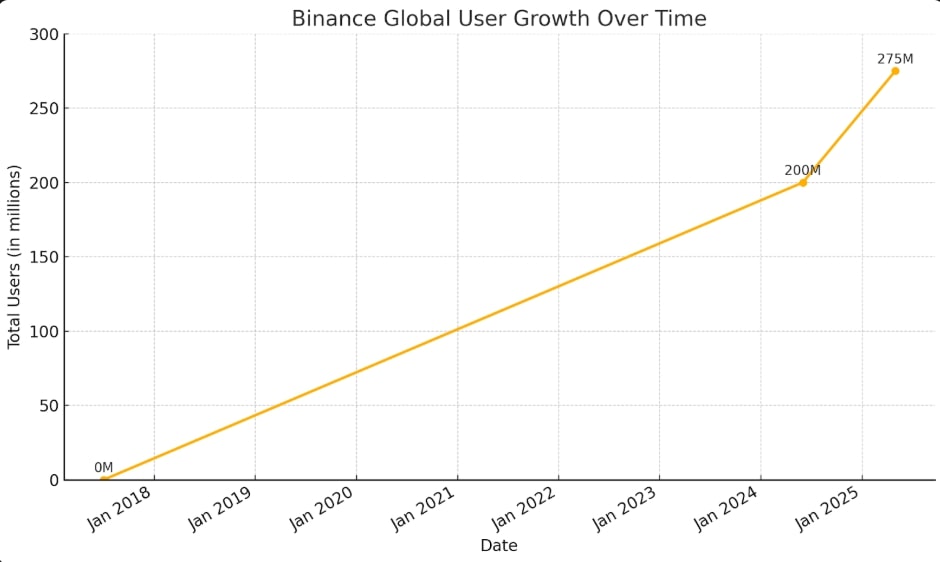

- As of May 2025, Binance has 275 million users around the world, up from 80 million in five months.

- More than 150,000 people sign up every day, which shows that more people are using crypto, especially in areas with few banks.

- Binance Pay makes it possible to use crypto in the real world for things like groceries and emergency assistance, which is a challenge to traditional banking.

Binance, the biggest cryptocurrency exchange in the world, has reached an amazing 275 million registered users around the world, and it’s getting close to 300 million. Since the beginning of 2024, the number of users has grown quickly, changing how people throughout the world see, use, and trust digital assets. Binance’s power is not only growing as the crypto ecosystem matures; it is also changing the way that global finance works.

Read More: Binance Review 2025: Is It Legit? What Are Binance Pros and Cons?

Binance’s Record-Breaking Growth: 275 Million and Counting

User Growth Outpacing Tech Giants

Since January 2024, Binance has welcomed more over 80 million new users, or more than 1.8 new users every second. To put this in perspective, it took Netflix more than 20 years to reach a similar number of people throughout the world. Binance has done it in less than eight years, and they’ve done it by introducing people to a whole new kind of money.

Even in the tech industry, this kind of momentum is rare. While social platforms like Twitter (now X) and Facebook grew by leveraging familiar user behavior—posting, scrolling, liking—Binance’s growth is fundamentally different. It’s behavioral change at the core of financial decision-making.

The majority of new users are not coming from mature financial markets alone. Based on internal data and how people use the service in different regions, Binance is growing quickly in Latin America, Africa, Southeast Asia, and Eastern Europe. These are areas that traditional banks have not served well for decades.

Why Binance’s Growth Matters for Crypto Adoption

Real Assets, Real Engagement

Binance is not a platform for consuming content; it is a platform for exchanging assets. There is a big difference. People aren’t just looking around; they’re buying, trading, staking, and moving digital assets that are worth actual money.

In May 2025 alone:

- The spot and futures markets on Binance had a trading volume of more than $2.7 trillion.

- Binance Pay handled tens of millions of transactions, many of which were for everyday use and retail.

- The average user held crypto assets worth over $1,200, according to internal estimates—further proof of deep financial engagement.

This is engagement that reflects trust. People don’t just interact with Binance the way they might with social media; they entrust it with their wealth.

From Investment to Infrastructure: Binance Pay and Utility

Turning Crypto Into a Daily Tool

Usability is the next big thing for Binance, and it’s already making progress. In a big step, Binance Pay connected with Brazil’s national payment system, Pix. This made it possible to make crypto-to-fiat payments straight in the app. This means that paying with bitcoin in São Paulo is as straightforward as swiping a card in New York.

In the Philippines, agreements with top fintech companies are making it possible to buy things directly from big stores using BUSD, USDT, and BTC.

Binance Pay has shown its worth in life-or-death situations, not only for shopping:

- In 2024, cross-border crypto payments solved a medical emergency between France and Algeria in a matter of hours, instead of days that traditional banks would have taken.

- Binance Pay helped get emergency relief money to people in Turkey, Pakistan, and Brazil within hours during natural catastrophes. Traditional banks couldn’t do this.

Read More: What Is Binance Pay and How to Find Its ID?

The Strategic Advantage: Growth in the Global South

A big element of Binance’s dominance is that it can reach markets that traditional finance can’t.

For example:

- After the central bank of Nigeria cracked down on cryptocurrency, Binance P2P trade shot up by more than 60% in the first quarter of 2025.

- In Argentina, where inflation is still over 100% a year, people are using stablecoins like USDT and BUSD through Binance to protect themselves from economic volatility.

- Ukraine has been able to stay connected to the global financial system throughout wartime disturbances thanks in part to the rise of cryptocurrencies, which Binance has assisted with.

A New Financial Identity for a New Generation

Once seen as a fringe part of banking, crypto is now a real way for millions of people to get into the global economy. Binance isn’t simply a part of that tale; it’s the main component.

Chainalysis says that more than 60% of new crypto users in emerging economies chose Binance as their first platform. That amount of trust in the brand, especially in areas where money is poorly managed and capital controls are in place, implies that Binance is more than just a platform; it’s a way to get financial freedom.

And the demographics are telling:

- The average Binance user is 27 years old, digitally native, and actively seeking alternatives to outdated financial institutions.

- More than 45% of users use Binance Earn, showing a shift from short-term speculation to long-term asset management.

The post Binance Is Getting Close to 300 Million Users: Is Cryptocurrency Going to Be the Next Big Thing in Finance? appeared first on CryptoNinjas.