Best Low Cap Cryptocurrencies to Invest in 2025 for Next Bull Run

The best low-cap cryptos to watch in 2025 for the next bull run are Solaxy ($SOLX), SUBBD ($SUBBD), Mind of Pepe ($MIND), Best Wallet ($BEST), Bitcoin Hyper ($HYPER), Bitcoin Bull ($BTCBULL), Kyber Network Crystal ($KNC), Kamino ($KMNO), LooksRare, and Omni Network (OMNI). The best low market cap coin is a cryptocurrency with a market capitalization of around $100 million that shows strong potential for growth due to its innovative technology, solid team, and growing community interest.

To choose the best low-cap cryptocurrencies, you need to consider factors such as use case, community engagement, liquidity, trading volume, team credibility, and broader market sentiment. This guide will cover the best low-cap cryptos to invest in right now. We will also discuss what the best low-cap crypto is, its benefits and risks, and provide a step-by-step guide on where to buy low-cap cryptocurrencies.

1. Solaxy ($SOLX)

Solaxy ($SOLX) is the best low-cap crypto and the first Layer-2 scaling solution for the Solana network. Solana, although fast, occasionally experiences congestion, particularly when traffic is truly high volume, resulting in slower or failed transactions. Solaxy offers to solve these problems by handling transactions off the main Solana chain and then batching up these transactions to be validated more rapidly on Solana’s mainnet. In its presale, $SOLX has raised over $41 million, with tokens priced at approximately $0.001738.

Use Cases: Solaxy’s primary use case is to enhance the Solana ecosystem. By batching transactions, it makes the network significantly more scalable and faster, which is beneficial for all kinds of decentralized applications, or dApps. It also has plans to create a bridge between Solana and Ethereum, and this may turn out to be a major feature because it allows assets to transfer freely between these two blockchain networks.

Growth Potential: The future seems promising for Solaxy, particularly with the Solana ecosystem growing so quickly. The project’s move to provide staking rewards, with 96% APY rates currently, is alsoan incentive for long-term holding. Upcoming listings on major exchanges could boost $SOLX’s visibility and investment.

2. SUBBD ($SUBBD)

SUBBD is another low-cap ERC-20 cryptocurrency, primarily developed for content creators and their supporters. It focuses on bringing Web3 capabilities with AI capabilities in the content creation process. SUBBD addresses common creator challenges, such as high platform fees and lack of content ownership. In its presale, SUBBD received some excellent traction, raising more than $547,000, with $SUBBD token now valued at approximately $0.0555.

Use Cases: For creators,SUBBD offers multiple revenue streams, such as subscriptions, pay-per-view content, and even NFT sales, all while reducing fees. The platform provides AI tools to assist creators with image creation and workflow automation. For fans, holding $SUBBD tokens grants access to premium content and can even offer you a discount on subscriptions. You also get to stake your tokens at 20% APY and even gain early access to new features.

Growth Potential: The growth prospect of SUBBD is linked with the traditional content creation industry, which is quite a large industry, likely to reach approximately $90 billion by 2033. As valuations for the industry rise, so does the demand for more effective content creation and revenue streams. The team prioritizes marketing and development, allocating 30% of tokens to marketing and 20% to product development.

3. Mind of Pepe ($MIND)

Mind of Pepe ($MIND) is a new low-cap crypto project backed by AI that combines meme culture and advanced technology. Developed on the Ethereum network, it has an AI agent that evolves on its own to monitor social media and blockchain data to identify market trends early. This AI not only analyzes but also interacts, posting on social media sites such as X and even creating its own tokens. $MIND token holders will be given access to these insights and early opportunities. As of recent data, Mind Of Pepe has raised over $11 million in its presale, with tokens priced at approximately $0.0037515. Verify current figures on the official website.

Use Cases: Mind of Pepe has a variety of uses. Its AI agent offers real-time market insights, and it also interacts with social media. Plus, the AI is capable of creating and deploying new tokens, offering $MIND holders early access to such opportunities.

Growth Potential: The growth potential for Mind of Pepe appears quite promising, especially with the current hype around AI in the crypto market. The fact that the presale has been so successful, raising significant capital and attracting a large number of staked tokens with up to 214% APY, indicates strong community support and long-term commitment. As the meme coin market and AI agent continue to evolve, it could become a valuable tool for traders and investors.

4. Best Wallet ($BEST)

Best Wallet Token is another low-cap crypto to invest in right now. It is provided by the Best Wallet, a non-custodial crypto wallet. Unlike many new projects that are merely concepts, Best Wallet offers a functional product on Google Play and the App Store, which is a huge advantage. The project has already gained some decent traction, raising over $12.7 million in its presale, and has more than 500,000 users.

Use Cases: The $BEST token is very much integrated within the Best Wallet ecosystem. Having $BEST in your wallet provides some valuable benefits, such as lower fees on transactions within the wallet. You even receive early access to new crypto project presales by using their “Upcoming Tokens” feature. Apart from that, $BEST holders are also granted governance rights. Here, you can vote on decisions regarding the future development of the project.

Growth Potential: Best Wallet aims for a significant market share in the crypto wallet space, targeting up to 40% based on its multichain strategy. Their business model leverages a multichain strategy, supporting numerous blockchains including Bitcoin, Ethereum, and Solana. Their user-friendly design and focus on security features like MPC security and Fireblocks-backed insurance could help them attract a wide user base.

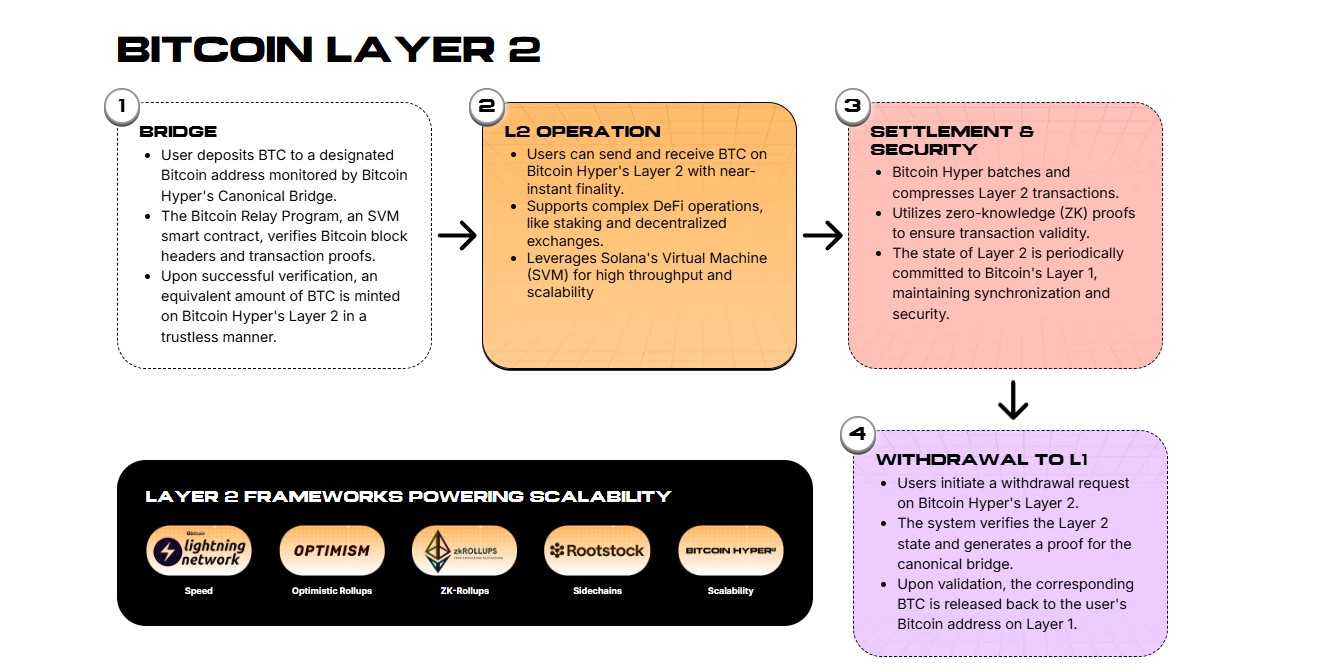

5. Bitcoin Hyper ($HYPER)

Bitcoin Hyper ($HYPER) is a Layer 2 platform built for Bitcoin, meaning it is based on the current Bitcoin blockchain in order to achieve faster and cheaper transactions. You can send and receive BTC at near-instant finality on Bitcoin Hyper’s Layer 2. It also supports DeFi transactions, such as staking and decentralized exchanges. Currently, Bitcoin Hyper is at its presale stage, with tokens available at about $0.011675.

Use Cases: Bitcoin Hyper will enable quick transactions for payments in BTC. This implies that you would be able to use Bitcoin for daily purchases, such as purchasing a coffee or making small payments to friends, without the anxiety of high fees or long confirmation times.

Growth Potential: The growth of Bitcoin Hyper appears to be based on whether or not it can actually fix Bitcoin’s scalability problem and increase its real-world usage. If it can fulfill its promise of allowing Bitcoin to be fast and affordable for everyday transactions and DeFi, it could attract a lot of users and developers. There’s significant demand for solutions that enhance Bitcoin’s utility while preserving its core principles.

6. Bitcoin Bull ($BTCBULL)

Bitcoin Bull ($BTCBULL) is another low market cap cryptocurrency that mixes fun with rewards. It quickly gained popularity after raising over $6 million in its presale. The token, on Ethereum, has a 21 billion coin supply, distinct from Bitcoin’s 21 million cap, to balance accessibility and scarcity.

Use Cases: Bitcoin Bull ($BTCBULL) offers a few interesting features that set it apart. First off, it aims to reward its holders with actual Bitcoin ($BTC) through airdrops when Bitcoin reaches specific price milestones, like hitting $150,000 or $200,000. Beyond the Bitcoin rewards, $BTCBULL also has a deflationary mechanism. This means that a portion of the token supply gets “burned” or permanently removed from circulation as Bitcoin hits other milestones, such as $125,000, $175,000, and $225,000.

Growth Potential: The future of BTCBULL depends a lot on how Bitcoin performs. Many people think Bitcoin could go up to $225,000 by the end of 2025. If that happens, BTCBULL will give out more rewards and burn more tokens, which may make it more in demand.

7. Kyber Network Crystal ($KNC)

Kyber Network Crystal, or KNC, is the token native to the Kyber Network, a decentralized liquidity platform in the blockchain space. The entire purpose of the Kyber Network is to enable DeFi (Decentralized Finance) applications, decentralized exchanges (DEXs), and general users to access different liquidity pools with ease, ensuring they receive the best rates.

Use Cases: KNC is not only a token; it’s actually quite significant to how the Kyber Network operates. To start with, KNC is a governance token. What this does is allow the holders of KNC to vote on the important decisions for the network via something called KyberDAO. They can vote on features like fee structures and protocol updates.

Growth Potential: Considering KNC’s potential, there are several things that catch the eye. With the DeFi ecosystem growing, protocols such as Kyber Network, which offer critical liquidity infrastructure, are bound to witness greater demand. Kyber’s multi-chain strategy, where swaps are possible across different blockchains such as Ethereum, Polygon, and BNB Chain, expands its scope and potential customer base. The token has a deflationary component as well, which means some part of the KNC gathered as fees is burned, effectively decreasing the overall supply over time.

8. Kamino ($KMNO)

Kamino Finance ($KMNO) is a decentralized finance (DeFi) platform based on the Solana blockchain. It combines lending, liquidity provision, and leverage into one simple interface. Kamino’s market cap is approximately $102 million as of recent data on platforms like CoinMarketCap.

Use Cases: Kamino provides liquidity vaults that automate the process of supplying liquidity on decentralized exchanges (DEXs). In addition to that, you can lend your crypto holdings and receive interest through Kamino, or borrow using the assets you already have. They also provide “Multiply Vaults,” where you can have leveraged exposure to yield-generating assets, and even “Long/Short Vaults” for users who wish to have leveraged positions.

Growth Potential: Kamino’s growth potential appears strong, primarily due to its position within the fast-growing Solana ecosystem. Solana itself has been seeing a lot of activity in DeFi, and Kamino is well-placed as a key liquidity layer on top of Solana’s concentrated liquidity DEXs.

9. LooksRare ($LOOKS)

LooksRare is the best low-cap crypto in the NFT space. Basically, it is a decentralized NFT marketplace launched in 2022. As of recent data, the $LOOKS token trades at approximately $0.0165, with a $16 million market cap; verify current prices on exchanges.

Use cases: LooksRare provides a platform for users to buy and sell NFTs, rewarding them with LOOKS tokens for their activity. Users can also stake their LOOKS tokens to earn a share of the platform’s trading fees. The platform also offers features like collection and trait offers, allowing users to make bids on entire collections or specific NFT traits.

Growth Potential: LooksRare’s performance and growth fully depend on how the NFT market performs in the future. The NFT market currently faces low liquidity and reduced activity, but a bullish recovery could boost LooksRare’s platform. This affects trading volumes and keeps the demand for NFT marketplace tokens very low. But this can change if the market turns bullish again. As more users return to NFTs and trading volume picks up, LooksRare may see a rise in sales and user activity on its platform. That could directly push up the value of its LOOKS token in the coming months.

10. Omni Network ($OMNI)

Omni Network ($OMNI) is built on Ethereum and acts like a bridge, connecting all the different scaling solutions, or “rollups,” that are out there. It aims to solve the problem of fragmentation within the Ethereum ecosystem, allowing for smoother interactions and a more cohesive experience for both developers and users. Omni Network, a Layer-1 blockchain, integrates rollup technologies for scalability, security, and interoperability.

Use Cases: Omni Network helps applications built on Ethereum work across different rollups without breaking up the flow of money or users. This means developers can create “globally-native” applications that can reach all of Ethereum’s users and liquidity by default. The $OMNI token itself plays a crucial role too. It’s used as the “gas” to pay for transactions on the Omni EVM (Ethereum Virtual Machine).

Growth Potential: Looking at the future, Omni Network has some huge growth potential. The biggest thing going for it is its focus on solving Ethereum’s fragmentation problem. As more and more applications and users come onto Ethereum, the need for seamless communication between different rollups will only grow. If Omni Network can effectively bridge this gap, it could become an essential piece of infrastructure.

What Are the Best Low-Cap Cryptocurrencies in 2025?

The best low-cap cryptocurrencies in 2025 are Solaxy ($SOLX), SUBBD ($SUBBD), Mind of Pepe ($MIND), Best Wallet ($BEST), Bitcoin Hyper ($HYPER), Bitcoin Bull ($BTCBULL), Kyber Network Crystal ($KNC), Kamino ($KMNO), LooksRare ($LOOKS), and Omni Network ($OMNI).

What Is Low Market Cap in Crypto?

Low market cap in crypto refers to cryptocurrencies that have a relatively small total value in the market. To calculate a crypto’s market cap, you need to multiply its price by the number of circulating coins. So, if a coin is $0.50 and there are 200 million of them, then the market cap is $100 million.

But, how are low-cap cryptocurrencies distinguished? Usually, low-cap cryptos are those with a market cap below $100 million, or even up to $300 million at times. These are usually newer ones, or lesser-known ones, and they normally have lower volumes.

By contrast, mid-cap cryptos typically have a value of a few hundred million to a few billion dollars. They’re more established than the low-caps but still have some potential for growth. And then there are the large-cap cryptos, such as Bitcoin or Ethereum, which have market caps ranging from tens of billions to hundreds of billions of dollars.

What Are the Benefits of Investing in Low Market Cap Cryptos?

The benefits of investing in low market cap cryptos are significant growth potential, early adoption opportunities, portfolio diversification, and community involvement.

- High Growth Potential: Because these cryptos are launching at a very low cap, a little bit of increased popularity or adoption can create enormous price jumps. We’re talking about the possibility of 10x, 100x, or even 1000x returns if you happen to choose the right project that blows up.

- Early Adoption Opportunities: Entering low market cap cryptos usually makes you an early adopter of emerging and revolutionary technologies. You may be funding a project that’s working to address a problem or propose something revolutionary in the blockchain universe. So, being ahead of the curve when it comes to such innovations can be thrilling and extremely rewarding if the project works out.

- Portfolio Diversification: Having a few best low market cap cryptos included in your portfolio can help diversify your risk outside of just the larger coins. They tend to have independent moves from the large-cap cryptos, which can provide a hedge. If your main holdings are losing value, a low-cap project could be gaining value because it has some independent development or community momentum.

- Influence and Community: Many low market cap projects are very community-driven. As an early investor, you often get to be part of that core community, contribute to discussions, and sometimes even have a say in the project’s direction.

What Are the Risks Involved in Investing in Low Market Cap Cryptos?

The risks involved in investing in low market cap cryptos are high volatility, lower liquidity, high chances of project failure, and regulatory risks.

- Extreme Volatility: This is likely the biggest risk. Since low-cap cryptos have low trading volumes and fewer investors, their prices can swing wildly in very short periods. A relatively small buy or sell order can drastically influence the price, resulting in huge gains one day and gigantic losses the next. They are extremely uncertain.

- Lower Liquidity: Liquidity refers to how easily you can buy or sell an asset without significantly affecting its price. Low market cap cryptos tend to be low in liquidity. That is, if you try to sell a large portion of your holding, there may not be sufficient buyers at your preferred price to force you to sell for much lower or in pieces throughout the day, maybe even missing out.

- Higher Chance of Project Failure: Most low market cap projects are untested, new, and usually operated by small groups with minimal resources. The likelihood of these projects not fulfilling their promises, exhausting their funding, or just being abandoned is far greater than that of well-established cryptos.

- Regulatory Uncertainties: The regulatory landscape for cryptocurrencies is constantly evolving, and this is especially true for smaller, lesser-known projects. New regulations could impact the legality or viability of certain low market cap cryptos, potentially leading to delisting from exchanges or outright bans.

Where to Buy Low-Cap Cryptocurrencies?

You can buy low-cap cryptocurrencies on centralized exchanges, decentralized exchanges, and their own presale websites. Here is a simple step-by-step guide on how you can buy the $SOLX token from its presale website.

Step 1: Set Up a Secure Crypto Wallet

First things first, you need a wallet to store your cryptocurrencies. For $SOLX, which is an ERC-20 token on Ethereum during its presale, go for a wallet that supports Ethereum or Solana. We recommend Best Wallet; it’s free, easy to use, and supports both blockchains. You can download it from the App Store or Google Play. Once installed, create an account, set a strong password, and turn on two-factor authentication to keep your funds safe.

Step 2: Fund Your Wallet with Crypto

To buy $SOLX during its presale, you’ll need $ETH, $USDT, or $BNB. If you don’t already own these, head to a trusted crypto exchange like Binance, Coinbase, or Kraken. Sign up, verify your identity, and purchase your chosen crypto using fiat currency like USD. Then, transfer the tokens to your Best Wallet. Also, if you want to skip the exchange, Best Wallet offers a fiat-to-crypto option where you can buy $ETH or $USDT directly with a credit or debit card.

Step 3: Purchase $SOLX

Now, go to the official Solaxy presale website at solaxy.io. Click “Connect Wallet,” choose Best Wallet, and approve the connection. Enter how much $ETH, $USDT, or $BNB you want to spend, and the site will calculate how many $SOLX tokens you’ll receive after gas fees. Your tokens will be available to claim after the presale ends.

How to Identify Low-Cap Altcoin Gems With 1000x Potential?

To identify low-cap altcoin gems with 1000x potential, you need to consider factors such as use case and utility, community engagement, liquidity and trading volume, team credibility and roadmap, and market trends and sentiment.

Evaluate Use Case and Utility

A low-cap altcoin with 1000x potential usually has a real-world problem it’s trying to solve or offers a unique service. If it has a clear purpose and people might actually want to use it, that’s a good sign. For more promising coins with good utility, read our guide on the best undervalued cryptocurrencies to buy.

Analyze Community Engagement

A healthy community is like a fanbase. If there is a lot of active discussion about the project, sharing of ideas, and genuine enthusiasm about its potential on platforms like Twitter, Telegram, or Discord, it’s a good sign. An enthusiastic community and one that is expanding can make a project successful, spread the word about it, and even assist in the development process. It indicates that there’s genuine interest and conviction in what the project is building.

Review Liquidity and Trading Volume

This means how easy it is to buy and sell crypto without price slippage. Liquidity means there’s enough of the altcoin available to trade easily. Trading volume tells you how much of it is being bought and sold. For a low-cap gem, you don’t want super low volume where your small trade could swing the price wildly. You want to see some decent activity, which means there’s genuine interest. You can also read our in-depth guide on the best meme coins for more liquid and high-volume coins.

Assess Team Credibility and Roadmap

Who is behind this project? That is a big question. You want to see a team with actual experience, maybe even in the crypto space or related industries. Also, do they have a clear strategy, a “roadmap,” of what they intend to do and by when? This roadmap should have realistic milestones and demonstrate real progress. A good team with a good vision and record of fulfilling its commitments makes a project even more reliable and increases its likelihood of success.

Monitor Market Trends and Sentiment

You should monitor market trends and sentiment by staying updated with what is happening in the digital asset space. Follow current trends like artificial intelligence, real-world assets, smart contracts, or blockchain gaming. Also, focus on the best altcoins to buy that fit well with these growing trends. Track general market sentiment to see how people feel about crypto or specific coins.

Disclaimer

Please remember, the information in this article is for educational purposes only and not financial advice. Investing in cryptocurrencies, especially low-cap altcoins, carries significant risk, and you could lose your entire investment. Always do your own thorough research and consider consulting with a qualified financial advisor before making any investment decisions. The company and author are not responsible for any financial losses.

The post Best Low Cap Cryptocurrencies to Invest in 2025 for Next Bull Run appeared first on CryptoNinjas.