$40B Bitcoin Bet: Why Michael Saylor’s Wild Plan May Push BTC to $1M Sooner Than You Think

Key Takeaways:

- Michael Saylor says if $MSTR crashes to $1, the company will buy back stock and double down on Bitcoin.

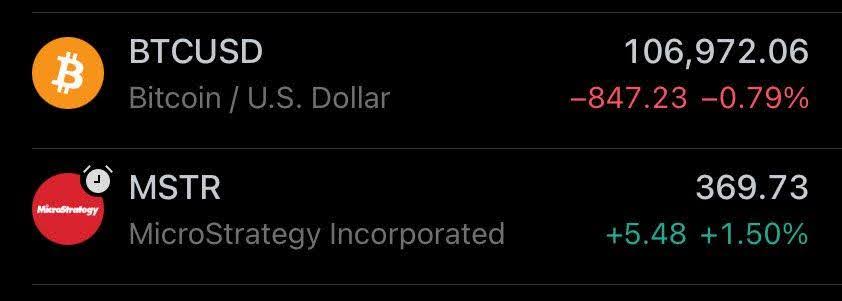

- Strategy now holds 580,250 BTC, valued at over $40.6 billion, and may trigger a Wall Street supply squeeze.

- Saylor claims the Bitcoin Standard is coming, and the era of $1 million BTC could begin if institutions hold just 10% of the supply.

At the Bitcoin 2025 conference in Las Vegas, Michael Saylor, Executive Chairman of Strategy (formerly MicroStrategy), made waves with a bold, calculated response to growing doubts around the company’s leverage-heavy Bitcoin strategy. Facing criticism over $MSTR’s stock plunge, Saylor fired back with a multi-billion dollar plan that could reshape institutional adoption—and possibly Bitcoin’s future price trajectory.

Read More: $1.34B Bitcoin Buy Sends Shockwaves as Strategy Nears $40B BTC Holdings—Is a Pullback Coming?

Strategy’s Nuclear Option: Buybacks, Bitcoin, and Short Squeezes

Saylor didn’t shy away from tough questions, especially around what would happen if $MSTR’s multiple to net asset value (mNAV) plunged below 1 again—a scenario that spooked investors during previous crypto winters. His answer? Use preferred instruments like STRK and STRF to repurchase common shares, squeeze the shorts, and buy more Bitcoin.

“If our stock went to $1 tomorrow, we’d just recapitalize the company by selling preferreds and buying back equity,” said Saylor.

Unlike Grayscale’s GBTC, which is structurally inflexible, Saylor emphasized that Strategy is an operating company with full access to debt markets, at-the-market (ATM) offerings, and recapitalization tools. This financial agility, he argued, makes MSTR not just resilient—but dangerous to short sellers betting against it.

Social media has already picked up on this threat. Crypto commentator Against Wall Street posted a viral clip of the event with the caption:

“Saylor is now aware of how far $MSTR has fallen… He might be protecting the common stock to squeeze the shorts. Then buy Bitcoin again. Awesome plan.”

If that plays out, Strategy could force a short squeeze that pushes $MSTR up while accumulating more BTC—fueling a flywheel effect with long-term implications.

Bitcoin as Capital: Saylor Declares the Fiat Era Over

In a passionate keynote, Saylor made a sweeping declaration: Bitcoin is incorruptible capital, and it’s now at the heart of a massive global shift.

“In the age of Artificial Intelligence, Bitcoin is the center of capital,” he said. “Bonds, real estate, and fiat currencies are inferior assets—and they will be replaced.”

Saylor views Bitcoin not merely as an asset but as a base layer of trust for the 21st-century economy. With AI transforming how capital and labor operate, digital stores of value like Bitcoin will, he claims, become the only credible long-term hedge against inflation, monetary debasement, and instability.

He even compared the shift to a civilizational evolution, arguing that Bitcoin will become the conservative foundation of a new financial order.

The $1 Million Bitcoin Thesis — How Wall Street Fits In

Why 10% Institutional Allocation Could Be the Catalyst

One of the most sensational moments of Saylor’s talk came when he outlined a clear numerical path to a $1 million Bitcoin:

“We hold 580,250 BTC—about 2.5% of the total supply. If Wall Street moves to own 10%, that’s when we enter the $1 million era.”

According to public records and company filings, Strategy’s current average cost basis for its Bitcoin is $69,979, with total investments surpassing $40.6 billion. While Bitcoin hovers just below $70,000 today, a significant increase in institutional buying could strain supply dramatically.

Saylor’s logic is straightforward:

- There will only ever be 21 million BTC.

- About 19.7 million have already been mined.

- Large institutions holding even a small fraction of this supply could create an epic supply crunch.

In that world, Saylor believes Strategy’s early positioning gives it a “once-in-a-century” advantage—like owning oil reserves before the invention of the combustion engine.

Strategy’s Strategic Resilience: Why It’s Not GBTC

In defending Strategy’s approach, Saylor took direct aim at legacy vehicles like GBTC, which lack the tools to react to market volatility.

“GBTC is a closed-end trust… no operational flexibility,” he noted. “We can do ATMs. We can issue debt. We can move fast.”

With active financial engineering, Strategy can hedge downturns, attract new capital, and play offense when others retreat. The company has already used convertible debt, preferred equity, and ATM programs across multiple jurisdictions to grow its Bitcoin position—sometimes through aggressive accumulation even during price dips.

This makes Strategy a unique crypto-adjacent equity: not a tech stock, not a Bitcoin ETF, but a hybridized balance sheet that moves with macro forces while playing the long Bitcoin game.

What This Means for Crypto Markets

Saylor’s reaffirmation of his Bitcoin strategy is more than rhetoric. It signals to institutional players that holding BTC through public proxies like $MSTR may be more than a speculative play—it could be a strategic asset acquisition model.

If Strategy triggers a buyback to squeeze shorts, institutional buyers may:

- Rush into $MSTR as a Bitcoin proxy

- Drive BTC spot price upward due to renewed accumulation

- Increase demand for regulated exposure via ETFs or direct buys

With BlackRock, Fidelity, and others already in the game, and Bitcoin ETFs now holding over 1 million BTC combined, Saylor’s 10% Wall Street allocation thesis might not be far-fetched.

The post $40B Bitcoin Bet: Why Michael Saylor’s Wild Plan May Push BTC to $1M Sooner Than You Think appeared first on CryptoNinjas.