72% Of Binance Traders Go Long On Dogecoin, What Does This Mean For Price?

Despite the Dogecoin price struggling and dropping recently, it seems investors are still very bullish on the meme coin. This is evidenced by the fact that there are now a large majority of crypto traders who are choosing to bet on a recovery for the meme coin rather than further decline. This is mostly visible on Binance, which is the world’s largest exchange, seeing a sharp drop in short accounts in favor of traders who are long on Dogecoin.

72% Of Binance Traders Are Bullish

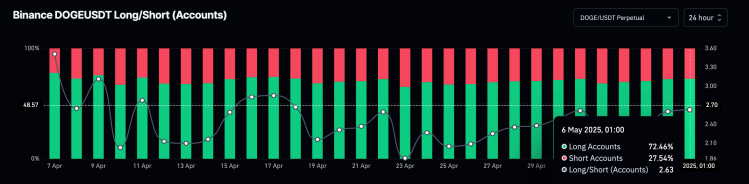

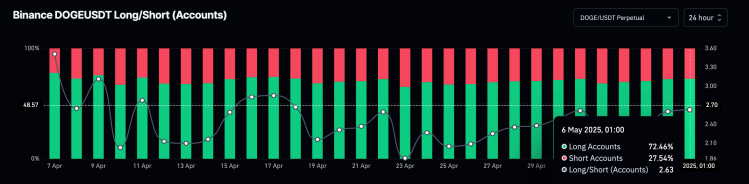

According to data from Coinglass, there are presently more bulls as regards to the Dogecoin price compared to bears. The Long/Short Ratio on the website helps to map out where crypto traders are leaning and how they are placing their bets. Using percentages, it shows how the vast majority are betting in regards to any coin and exchange, and for Binance, the results have shown more longs than shorts.

Currently, of all open bets on Dogecoin on the Binance crypto exchange, a whopping 72.46% are long at the time of this writing. This leaves only a smaller percentage of 27.54% of traders who are short. On this account, it shows that bullishness is on the rise for the meme coin.

Interestingly, this turn in sentiment seems to be mostly localized to the Binance exchange. Looking at the broader Long/Short Ratio for Dogecoin, there are still more shorts than longs. Total exchanges figures comes out to 51.86% of all open bets in the market currently being short, coming out to over $1.15 billion at the time of this writing. In contrast, only 48.19% of open bets are in favor of longs, coming out to less than $1.1 billion.

This gap, despite being quite small, shows that sellers are still dominating the market now. This would explain the decline in the Dogecoin price despite the daily trading volume rising above $700 million.

Can The Dogecoin Price Recover?

The open interest when it comes to Dogecoin is still quite low as traders are trading more conservatively right now. This has followed the price decline and the fear sentiment that has gripped the market. However, times like these are usually when reversals begin, with many not expecting one.

A crypto analyst has also pointed out that the Dogecoin price is forming a strong Ascending Wedge pattern. Now, if this pattern is completed, it could put the meme coin on the path to a long-lasting rally. The target for this has been placed at $1.161, meaning the analyst is expecting the Dogecoin price to explode by more than 580% from here.