INIT Tokenomics Breakdown on the Launch of the Initial Mainnet

Key Takeaways:

- Initia reserves 5% of its 1B INIT supply for an airdrop to early supporters.

- The two largest allocations—each 25%—go toward staking and community rewards.

- Tokens for the team and investors are subject to a 4-year vesting schedule, including a 1-year lock-up.

Initia Launches Mainnet with 1 Billion INIT Supply and Community-First Airdrop

Initia has officially launched its mainnet — a major step toward building a modular, interconnected multichain future. To mark the occasion, the team has launched the long-awaited INIT airdrop. A total of 5% of the 1 billion token supply—50 million INIT—will be distributed to early supporters, testers, and the broader community.

Eligible users can claim their allocated tokens through May 24, 2025, by visiting and interacting with Initia’s official airdrop portal. The distribution excludes team and internal contributors, reinforcing Initia’s community-first approach.

Strategic Token Allocation Aims to Balance Incentives and Security

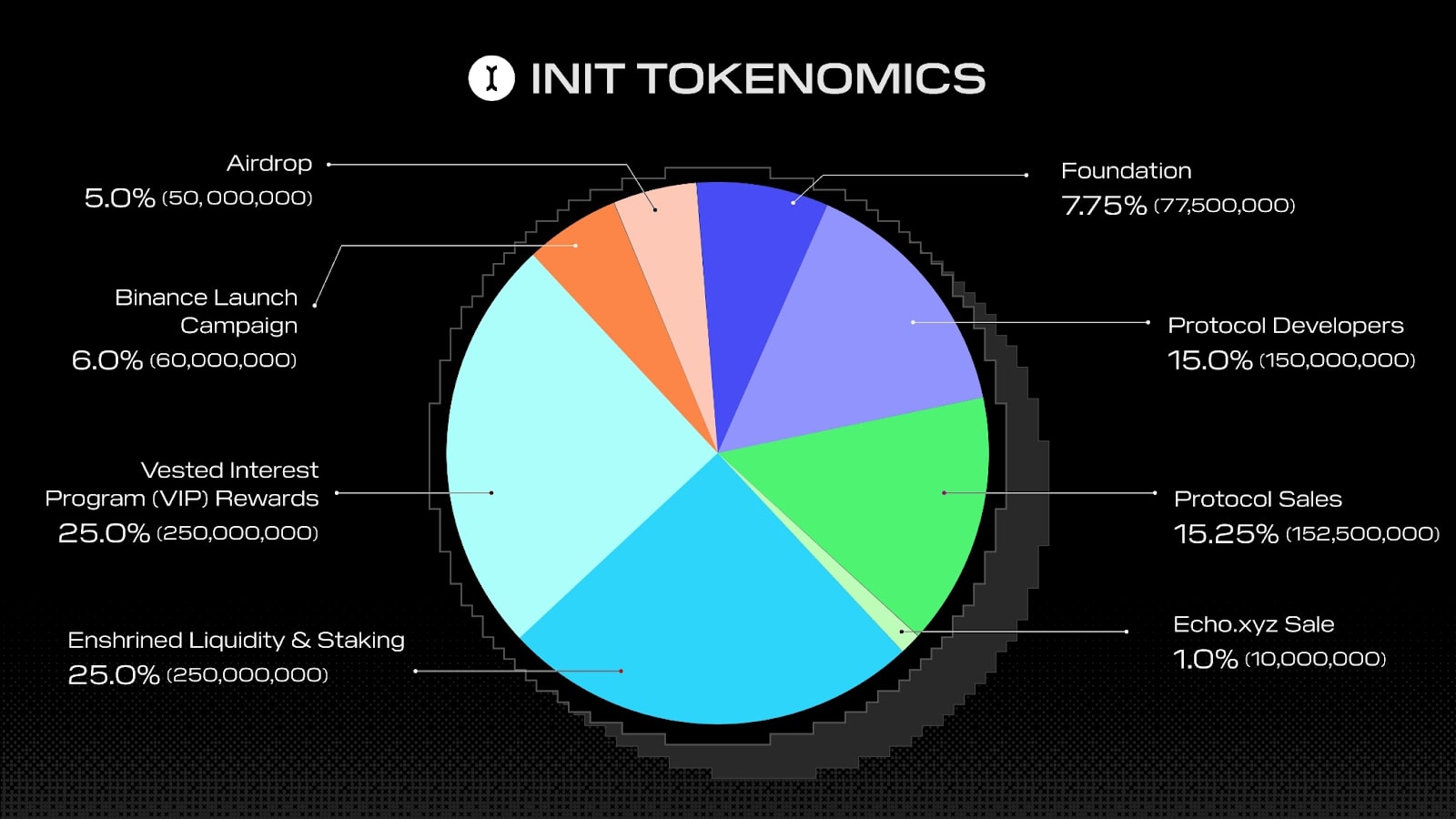

Initia’s tokenomics reflect a nuanced strategy, blending user incentives with long-term sustainability and protocol security. Here’s how the 1 billion INIT tokens are allocated:

25% – Locked Liquidity & Staking (250M INIT)

This mechanism, called Enshrined Liquidity (EL), replaces traditional PoS staking and serves as the cornerstone of Initia’s economic security. Liquidity providers help secure the network and receive staking rewards, trading fees, and ecosystem incentives. Unlike traditional staking systems where tokens are simply locked, Enshrined Liquidity ties economic security directly to real liquidity provision, creating a more capital-efficient model. The 5% annual block-by-block release rate incentivizes long-term participation under this design.

25% – Vested Interest Program (VIP) Rewards (250M INIT)

VIP rewards are designed to motivate positive behavior at all levels of the Interwoven Economy — from regular end users to professional dApp builders. They are escrowed and only made available upon satisfying performance-based conditions, at an initial release pace of 7%/year. The mechanism ensures long-term incentive alignment across multiple epochs.

15.25% – Protocol Sales (152.5M INIT)

Investors from Initia’s three fundraising rounds receive 15.25% of the INIT token supply. The group prioritizes low dilution and locked liquidity; this is supplemented by the fact that these tokens will accordingly have a 4-year vesting schedule (1 year locked, 3-year linear release). Backers of Initia include YZi Labs, Delphi Ventures, and Hack VC, who reportedly invested over $24 million.

15% – Protocol Developers (150M INIT)

For long-term development, 15% of INIT is reserved for the core team and future contributors, which is subject to the same vesting schedule as the investors. Further underpinning these facts are the dedication to sustainability and responsible token distribution.

7.75% – Foundations (77.5M INIT)

The Initia Foundation is responsible for ecosystem development and managing strategic projects like validator delegations and grants going forward. The tokens dedicated to the foundation are necessary for providing early-stage liquidity support and extending the ecosystem’s reach.

6% – Binance Launch Campaign (60M of INIT)

In order to bootstrap liquidity of centralized exchanges, Initia has partnered with Binance to allocate 60 million tokens (6%) for launch-related campaigns, ensuring healthy price discovery and smooth user onboarding during the Token Generation Event (TGE).

5% – Community Airdrop (50M INIT)

The airdrop is split among:

- 90% (44.7M INIT) is allocated to early testnet participants, most of whom were non-technical users involved in stress-test campaigns such as the Jennie pet app.

- 4.5% (2.25M INIT) reserved for users of partnered protocols like LayerZero, IBC, and MilkyWay.

- 6% (3M INIT) for the community participants that are active from Discord, Telegram and X (Twitter).

1% – Echo.xyz Sale (10M INIT)

These tokens are allocated to supporters from the Echo.xyz investment round and will vest in four equal tranches between 12 and 24 months after the mainnet launch.

A Modular and Owned Token Design

Initia is built on top of Cosmos SDK with support for multiple VMs: EVM, MoveVM, WasmVM, making it possible for developers to create their own rollup: “Minitias” for anything ranging from DeFi protocols to fully onchain games.

The INIT token serves as an economic driver and governance mechanism in a rollup-first world of chains where application-specific chains natively interoperate. By giving developers both ownership and liquidity, Initia solves for fragmentation — one of the three biggest pain points for appchains until now.

More News: Binance Launchpool Lists Initia (INIT): Farm by Staking USDC & FDUSD

Early Momentum Strong as Ecosystem Expands

Already, there are more than a dozen Layer 2s building on Initia’s infrastructure, and the testnet has so far attracted more than 190,000 wallets. As evidenced by the high engagement figures, Initia could emerge as a significant player in the multichain landscape, competing with the likes of Arbitrum and Optimism.

Unlike the hype or token price action itself, Initia is hedging its bets on ecosystem utility, shared development and a highly-incentivized community to induce adoption.

More News: Binance Lists Balance (EPT) on Alpha and Futures Ahead of Token Generation Event

The post INIT Tokenomics Breakdown on the Launch of the Initial Mainnet appeared first on CryptoNinjas.