Bitcoin Regains $90K With Funding Rates Indicating Momentum Toward $93K

Bitcoin has finally reclaimed the psychologically $90,000 level once again following a recent period of significant correction that brought it to trade as low as $74,000 in recent weeks.

So far, BTC has now steadily rebounded, rising by 13.1% in the past two weeks to currently trade at $90,279, marking a 3.3% increase in the past day.

This price movement has coincided with notable changes in derivatives data and on-chain behavior. CryptoQuant analysts have particularly pointed to the rise in funding rates on Bitcoin futures, alongside diverging actions between long-term and short-term holders.

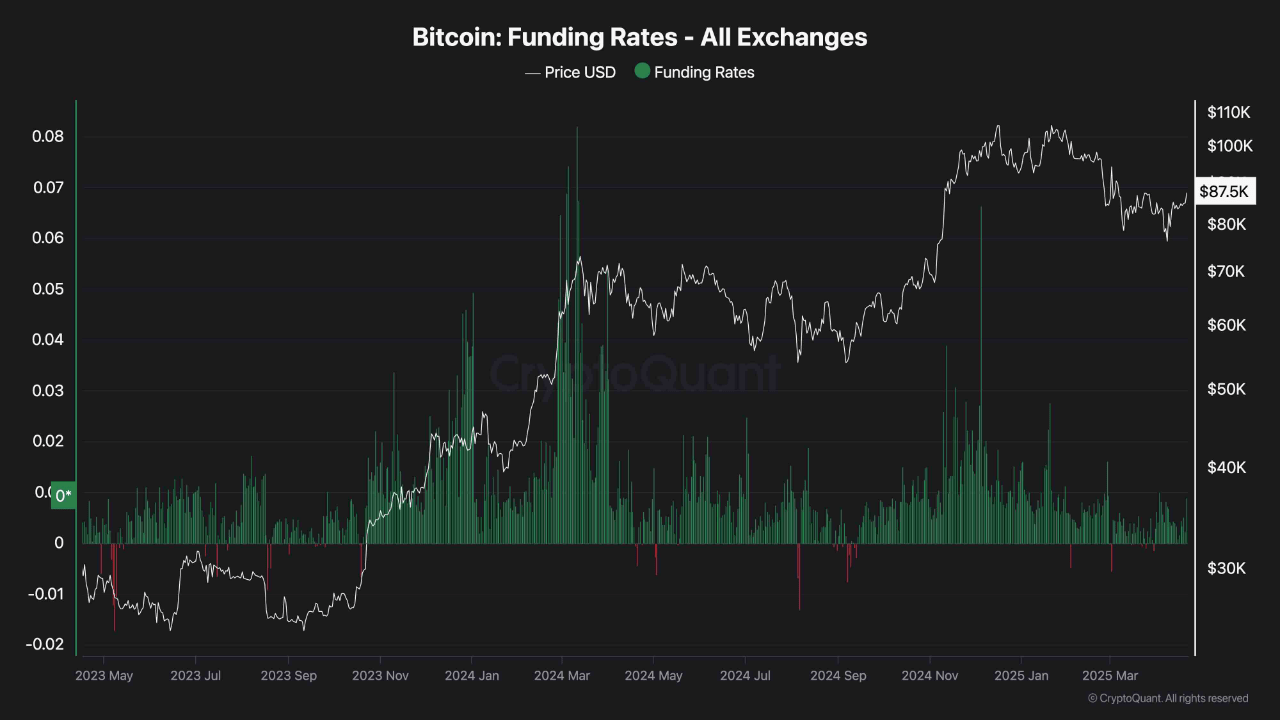

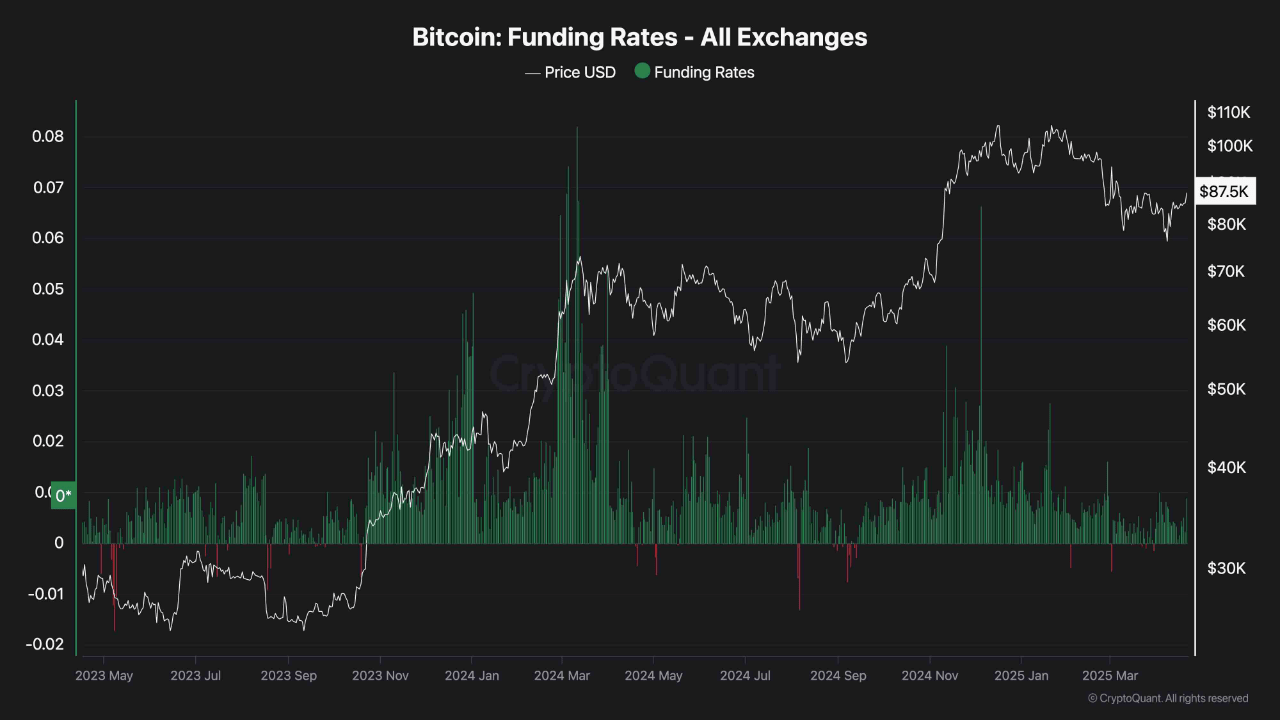

Bitcoin Funding Rate Reversal Suggests Further Upward Move

CryptoQuant analyst known as ShayanBTC has drawn attention to the recent trend in Bitcoin futures funding rates, which have rebounded sharply following the market’s prior correction.

According to his analysis, the simultaneous decline in both price and funding rates during the sell-off pointed to a reduction in speculative positioning. This pattern bears resemblance to conditions between March and September 2024—a period marked by sideways movement before a notable rally.

Now that funding rates are rising again, it suggests that traders are becoming more aggressive in opening long positions. This shift may indicate growing confidence in continued upside potential.

If this trend sustains, Shayan notes that Bitcoin could test the $93,000 resistance level, a key area to watch before any attempt to challenge its all-time highs.

Funding rates are often viewed as sentiment indicators within the derivatives market, with positive rates reflecting increased demand for long exposure among traders.

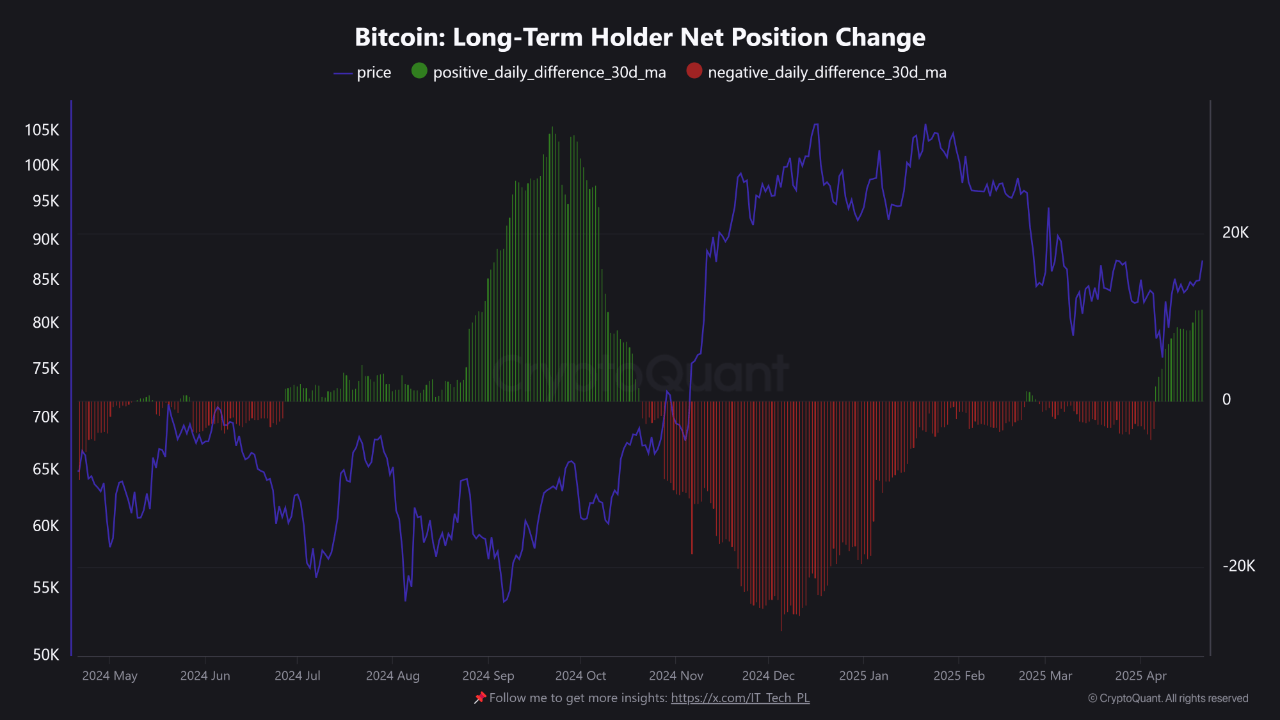

Long-Term Holders Accumulate as Short-Term Participants Exit

A separate analysis from another CryptoQuant analyst, IT Tech, highlights a clear divergence in the behavior of different investor groups. Long-term holders (LTHs), defined as those holding BTC for more than 155 days, have resumed net accumulation for the first time since the last local market peak.

This shift suggests that experienced participants are beginning to reposition, potentially in anticipation of a broader recovery. LTH activity is typically associated with strategic investment decisions rather than short-term trading.

In contrast, short-term holders (STHs) continue to exit the market, with net position change data showing negative outflows. These movements are often driven by immediate price action and short-term volatility, and such capitulation has historically coincided with local market bottoms.

The combination of renewed LTH accumulation and STH exits may point toward the early stages of a re-accumulation phase—a setup that has previously supported future upward momentum in Bitcoin’s price.

Featured image created with DALL-E, Chart from TradingView