SEC Reviews 72 Crypto ETF Applications in Push Toward Broader Market Integration

Key Takeaways:

- SEC is considering an unprecedented 72 crypto ETFs covering a broad range of digital assets.

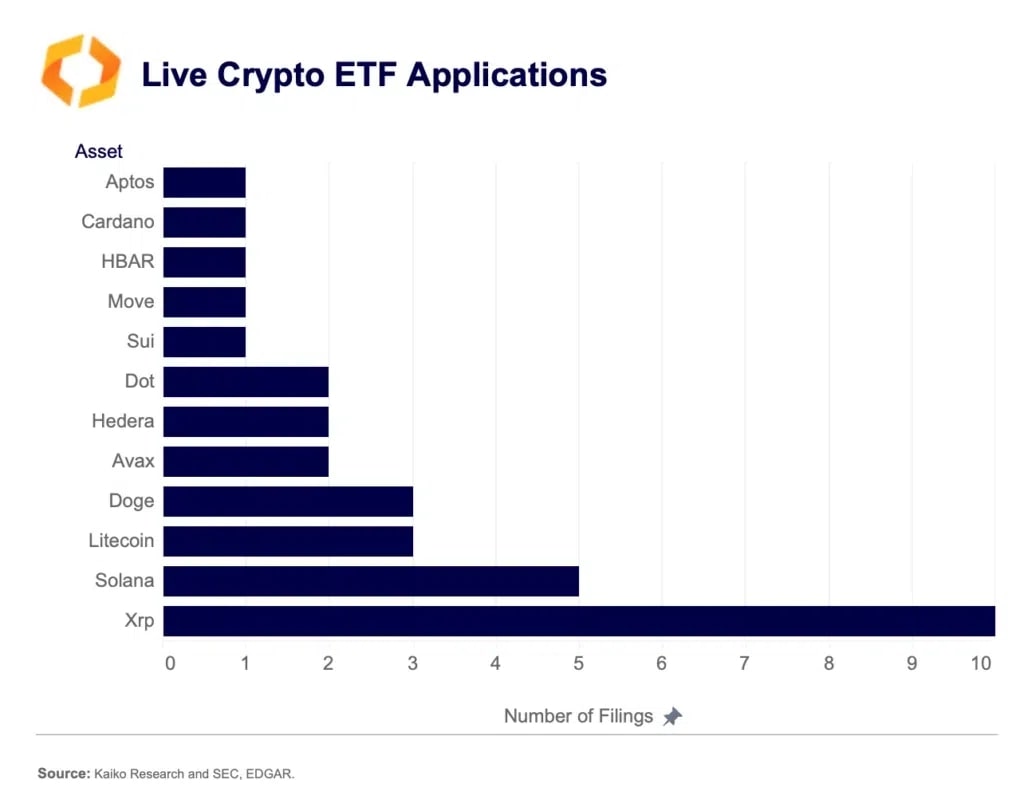

- Most ETF submissions have been for XRP, Solana, and Litecoin.

- Bitcoin remains dominant, expected to maintain over 80% of crypto ETF market share.

Rise in Applications for ETFs Signals Increased Interest in Crypto

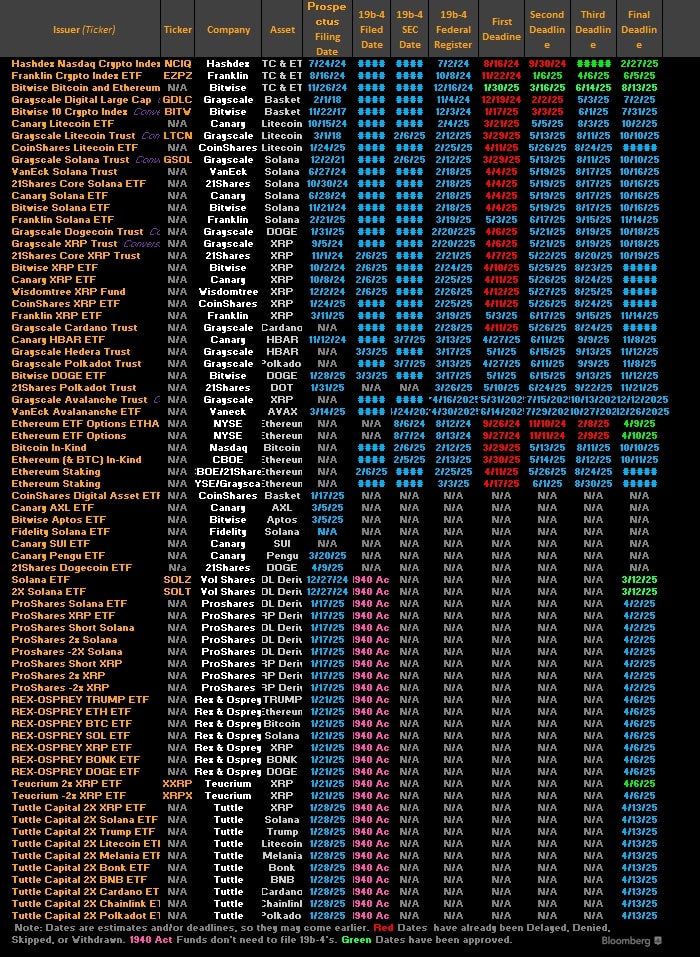

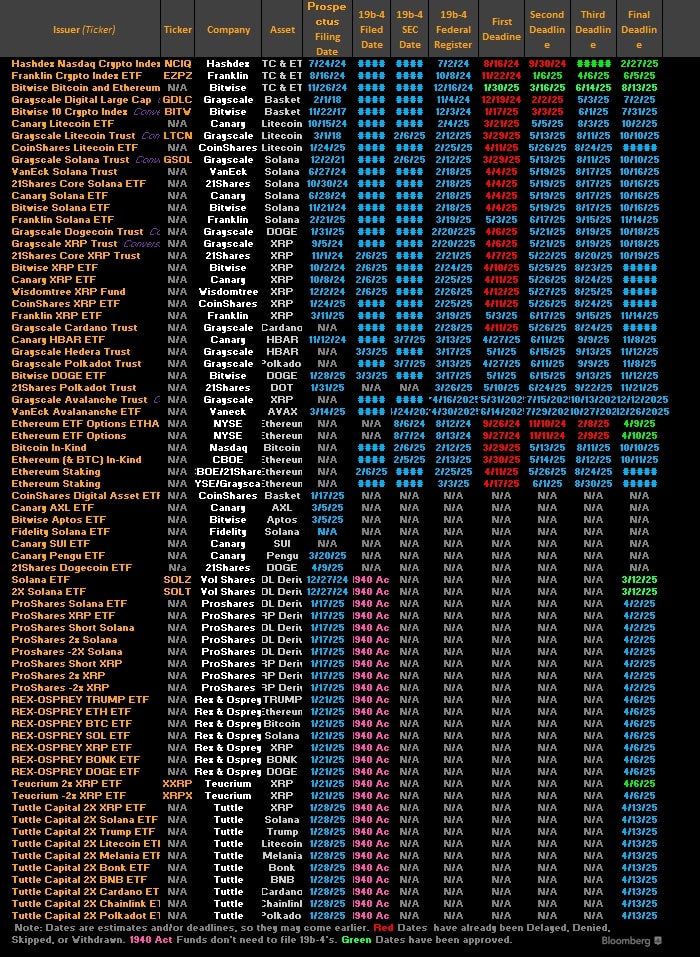

Eric Balchunas, an ETF analyst, announced that the U.S. Securities and Exchange Commission (SEC) is looking over a total 72 crypto-related ETF applications.

Applications include spot ETFs, options products, and leveraged or inverse ETFs. Assets include major cryptocurrencies like XRP, Litecoin (LTC), and Solana (SOL), as well as memecoins like Dogecoin (DOGE) and novel tokens such as a leveraged fund based on the Melania Trump token.

XRP, Solana Lead Filing Counts as Institutions Come Knocking

XRP leads the filings with 10 dedicated applications, highlighting its strong appeal to fund issuers. Solana, meanwhile, has five filings, while Litecoin and Dogecoin each have three.

These assets were not selected at random. Their inclusion represents some combination of market capitalization, active user bases and investor interest. However, the broader landscape of crypto ETFs is still taking shape. The appeal of Solana is its fast blockchain infrastructure and growing ecosystem in NFTs and DeFi.

These filings suggest that institutions are no longer solely interested in Bitcoin and Ethereum, instead diversifying across the crypto asset class.

New ETF Applications Indicate the Crypto Culture Has Landed

Indeed, while mainstream cryptocurrencies make up the majority of the filings, a number of applications indicate a shift in the nature of these assets to those driven by internet culture. And amid all the news-driven volatility, novel, risk-oriented products like a suite of leveraged and memecoin-themed ETFs — one being “Melania 2x” offered by Tuttle Capital — have gained attention for their novelty and risk-driven design.

Links on one of the applications even reference Pudgy Penguins, a famous NFT project, indicating just how deeply the spread of internet memes and digital collectibles has influenced the design of financial products.

They might sound fringe, but these proposals show how crypto-native culture is starting to bleed into the way Wall Street structures and sells financial products.

The SEC’s Timing Will Determine How Markets Will Open

The fate of these 72 ETFs is now in the hands of the SEC, which will hand down decisions over the coming months, some of which have deadlines extending into mid-2025. Despite recent approval of Bitcoin spot ETFs signaling a somewhat more lenient regulatory approach, the possibility of approval for an ETF covering a broad basket of crypto assets remains murky.

Yet, issuers remain hopeful. Many of the funds, including ones from ProShares and Tuttle Capital, have filed applications not only for spot exposure but also for options trading and inverse strategies, seeking to provide the flexibility for both institutional and retail investors.

This orientation to cautious regulation slowed crypto ETF progress to merely Bitcoin futures in past cycles. The current round of applications is an attempt to help accelerate crypto’s integration into traditional portfolios.

SEC Reviews Suggest Bitcoin to Remain Dominant in ETF Market

Even with this wide range of applications, Bitcoin still stands as the cornerstone of the ETF market. Balchunas notes that 90% of all global crypto fund assets are in Bitcoin ETFs, and even with dozens of new funds being launched this year, Bitcoin’s share is likely to remain between 80% and 85%.

The number not only represents Bitcoin’s long-standing dominance, but its recognition as a safe portal for the institutional trade, especially as new entrants to crypto want simplicity and stability over experimental assets.

While ETF will surely be diversified with memecoins and altcoins, Bitcoin will most likely continue to receive the overwhelming majority of inflows due to its trustworthiness, liquidity, and familiarity from a regulatory standpoint.

SEC ETF Filings Signal Growing Institutional Access to Crypto

Crypto ETFs are quickly becoming the easiest way to gain regulated crypto exposure.

The approval of any at all of 72 pending filings could radically expand the market, opening access not only to hedge funds and banks, but also to pension funds and individual investors through retirement institutions.

More News: SEC Postpones Decision on Grayscale’s Ethereum Staking ETF Until June 1, 2025

The post SEC Reviews 72 Crypto ETF Applications in Push Toward Broader Market Integration appeared first on CryptoNinjas.