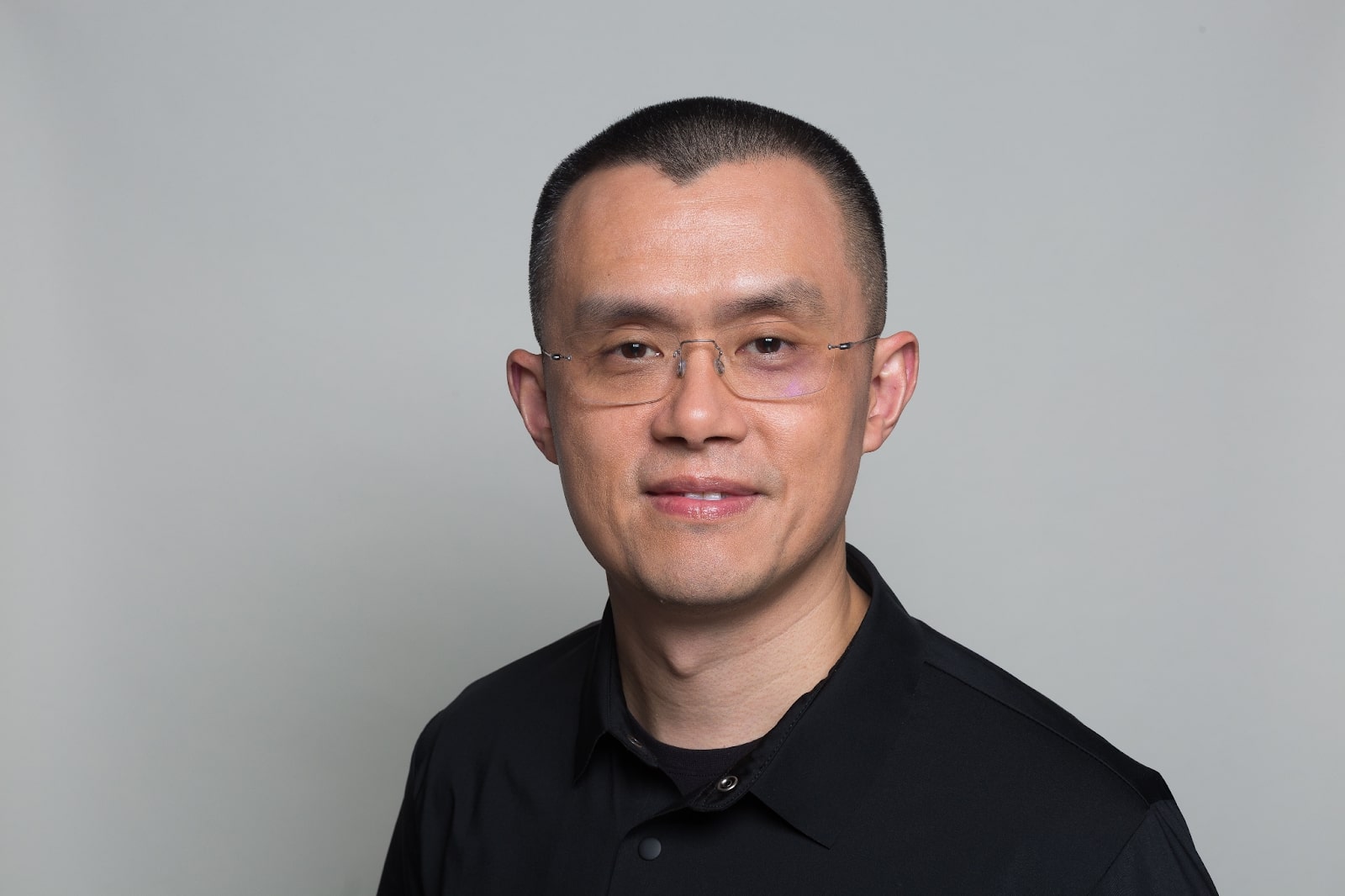

Changpeng Zhao of Binance Denies Money Laundering, Fraud Allegations Amid WSJ Claims

Key Takeaways:

- Zhao Changpeng clarified there were no actual money laundering or fraud charges filed against him.

- He said customer assets are safe and untouched.

- The report that Zhao testified against Justin Sun was vehemently denied by both parties.

CZ Hits Back: No Fraud, No Laundering, No Secret

Changpeng Zhao, the founder of Binance and one of crypto’s most prominent figures, has strongly denied the allegations against him regarding money laundering and fraud in recent reports. The controversy comes on the heels of an article from the Wall Street Journal titled “Crypto’s Fastest Founder Faces US Criminal Probe” which cited unnamed sources claiming Zhao had cooperated with the U.S. prosecutors in an investigation into Tron founder Justin Sun.

Zhao contended that media outlets have conflated the failure to prevent money laundering — a regulatory lapse — with actual money laundering, which is a criminal offense. The former, he explained, is criminal activity, with the latter being a regulatory failure.

He emphasized that no charges were ever filed against him, even after extensive scrutiny by several agencies and that customer assets remain fully protected.

Taking a jab at the WSJ, Zhao remarked that government witnesses usually avoid jail time — unlike himself, who had already spent four months in U.S. custody, suggesting he had not received any immunity in exchange for cooperation.

Ah, you are part of that force…

To be clear, there were NO “money laundering” or “fraud” charges.

You are confusing “ANTI-money laundering” to “money laundering”. One is a failure to prevent/police. One is doing it yourself. Two very different things. Many media tried this…

— CZ

BNB (@cz_binance) April 12, 2025

Binance vs. The Wall Street Journal: A Battle of Narratives

After a WSJ report that Zhao supposedly tried to help the DOJ in its probe of Justin Sun, controversy soared. The report connected this to Zhao’s plea deal. But the accusation was quickly condemned by both parties.

Zhao jokingly hinted on X (formerly Twitter) that the WSJ may have had “incentives” to tarnish his image, sarcastically adding that the paper seems to have “forgotten who went to prison and who didn’t.”

Justin Sun publicly defended Zhao over the accusations, calling him a mentor and close friend. He had denied any awareness of the investigative agreement and portrayed the report as a coordinated effort to break apart the crypto industry at a time of extreme regulatory pressure.

Sun also faces charges from the SEC over market manipulation and the unregistered sale of TRX and BTT. Sun reached a temporary pause in litigation with the SEC earlier this year to explore settlement possibilities.

BNB Holds Strong Amid Regulatory Turbulence

BNB, on the other hand, managed to rise slightly despite the legal drama. On April 12, 2025, BNB was priced at $598.16 with a market capitalization of $85.22 billion (3.14% market dominance). The token rose 1.85% in 24 hours, but it had lost 13.88% in the past 90 days.

The price action of BNB mirrors continued regulatory pressure. BNB has faced similar storms in the past, which have included reports from the WSJ claiming that Zhao sought a presidential pardon from Donald Trump, a claim that Zhao himself labeled “factually incorrect” but also added that there was no one in his position who would walk away from a chance at a pardon.

Ongoing regulatory scrutiny is expected to play a decisive role in shaping Binance’s next steps. But even under extreme duress, including a record $4.3 billion fine and Zhao’s $50 million personal penalty last year, Zhao’s leadership and the platform’s ability to constantly adapt have kept Binance afloat.

Personal Reputation Is Not the Whole Story

In denying the accusations, Zhao sought not only to protect his reputation but also to maintain investor confidence. He distinguished between regulatory shortcomings and criminal acts — emphasizing that while the former may warrant penalties, they do not imply malicious intent or wrongdoing.

He also made a pointed assertion that he might now be “the most regulated person on the planet,” which only highlights the staggering level of scrutiny Binance has been subjected to.

Yet not everyone is sold on the narrative. Industry commentator Ari Paul went on to accuse Zhao of lying about various parts of his plea deal, alleging that on-chain data reveals transfers potentially linked to illicit activity. Paul, a longtime critic, contended that Zhao had manipulated the legal process masterfully but cautioned that he may not be so fortunate next time around.

The ongoing tension between crypto leaders, regulators, and the media now reflects deep divisions in the industry. To some, Zhao is a scapegoat of overzealous bureaucracy, while to others he’s a master operator playing the old game of bending but not breaking the rules.

Unity or Division? Industry Watches Closely

The coordinated response from Zhao and Sun underscores a broader effort to keep the peace in an industry that faces almost daily global regulatory attacks. But their united front stands in contrast to the growing skepticism among both regulators and crypto insiders.

More News: Binance Staff Suspended Amid Insider Trading Allegations

The post Changpeng Zhao of Binance Denies Money Laundering, Fraud Allegations Amid WSJ Claims appeared first on CryptoNinjas.