Bitcoin’s Futures Sentiment Weakens, Is The Ongoing Recovery Running Out of Steam?

Bitcoin’s upward momentum appears to be slowing down following a recovery phase earlier this week. After climbing close to $86,000, BTC has retraced slightly, hovering just above the $84,000 mark at the time of writing.

The mild pullback comes after a 10% rise seen over the past seven days, which helped the asset recover from recent corrections triggered by macroeconomic pressures. While the price movement may suggest a healthy retracement or consolidation phase, market sentiment tells a more complex story.

According to CryptoQuant contributor abramchart, futures sentiment has not mirrored the price surge, indicating caution among derivative traders. This divergence between price action and market sentiment could suggest growing uncertainty or a broader shift in investor behavior.

Bitcoin Futures Sentiment Signals Cooling Conviction

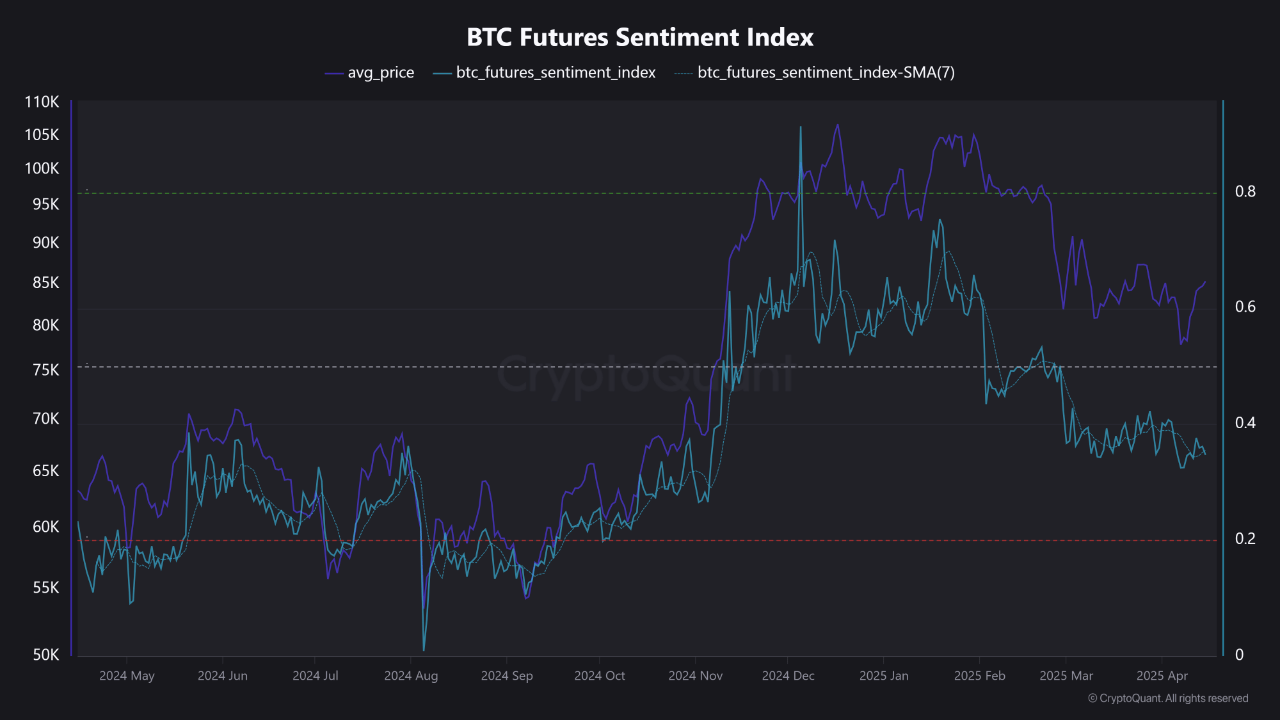

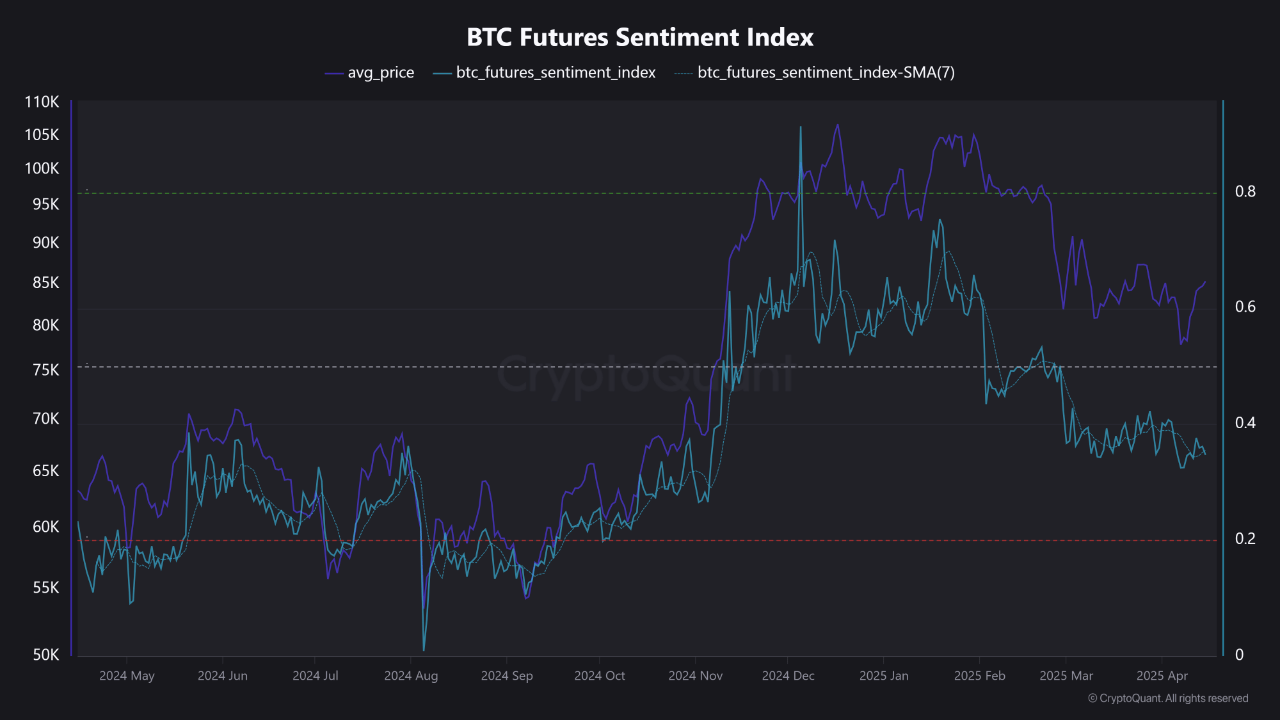

In his recent post titled “Weakening Futures Sentiment Signals Caution Amid Bitcoin Rally,” abramchart explained how sentiment indicators have not kept pace with BTC’s recent price movements.

From November 2024 through early 2025, Bitcoin experienced strong gains, but the futures sentiment index peaked early and has since been declining steadily. Despite prices staying relatively high, the index now trends near the support zone around 0.4, suggesting increased bearish sentiment.

The sentiment index’s resistance is historically around 0.8, with support near 0.2. According to abramchart, the index hovering closer to support may reflect ongoing profit-taking, growing macroeconomic uncertainty, or investor hesitation around regulatory developments.

He also noted that Bitcoin’s average trading range between $70K and $80K suggests possible accumulation rather than strong directional conviction. If sentiment continues to linger at current levels, further consolidation or downside action may be expected in the absence of strong bullish catalysts.

Weakening Futures Sentiment Signals

“The chart shows that while Bitcoin reached significant highs, futures sentiment weakened, which can be a warning signal of potential retracement or at least a lack of strong bullish conviction.” – By @abramchart pic.twitter.com/zzSmUJsQ8Y

— CryptoQuant.com (@cryptoquant_com) April 16, 2025

Binance Derivatives Show Bullish Signs Returning

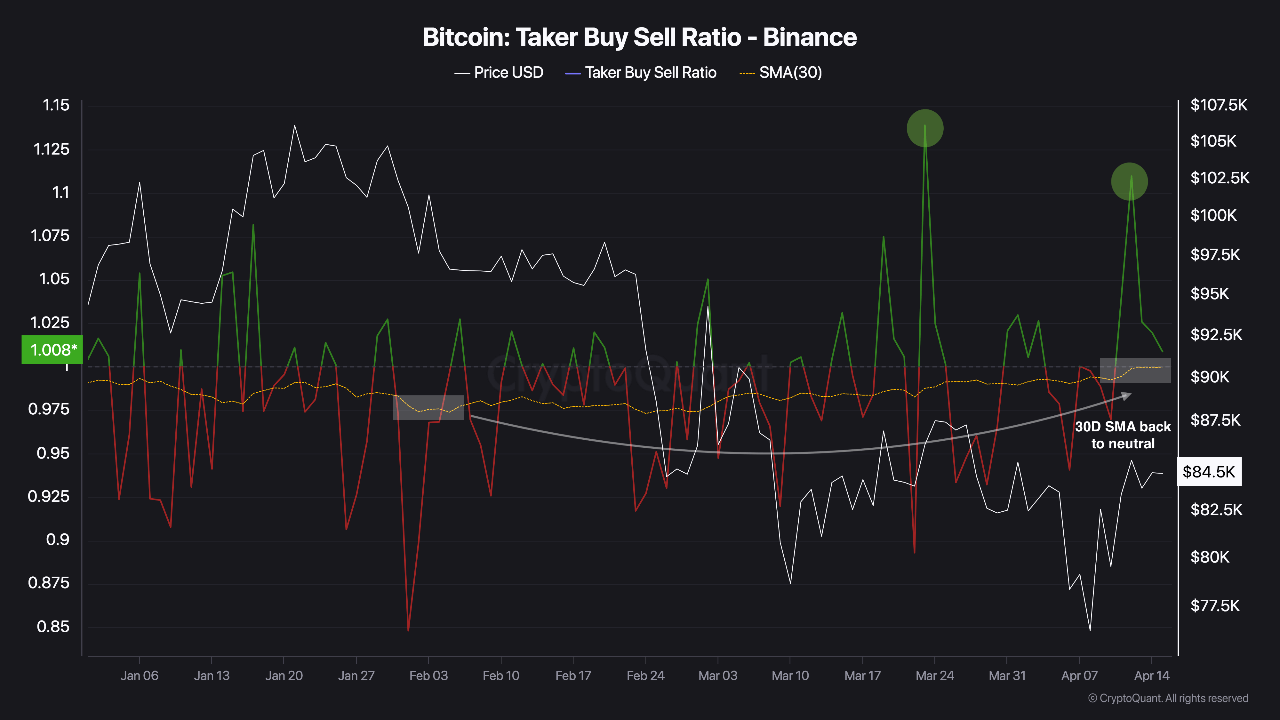

In contrast to the cautious sentiment observed in the broader futures market, activity on Binance derivatives is showing signs of renewed optimism.

Another CryptoQuant analyst, Darkfost, highlighted a shift in the Binance taker buy/sell ratio—a metric used to measure which side, buyers or sellers, is dominating trading volume on the exchange’s derivatives platform.

According to Darkfost, the 30-day exponential moving average of this ratio had remained below 1 for much of 2025, indicating sustained bearish sentiment.

However, recent readings show a return to neutral territory, with bullish activity picking up. The ratio trending above 1 indicates buyer dominance, and current data suggests that long traders are becoming more active again.

Although this doesn’t guarantee a market reversal, it may signal short-term momentum returning in favor of bulls, especially on trading venues like Binance that play a key role in crypto price discovery.

Featured image created with DALL-E, Chart from TradingView