FDUSD in the Crosshairs: Justin Sun’s $500M Fraud Accusation and First Digital’s Rebuttal

Key Takeaways:

- Justin Sun accuses First Digital Trust of misappropriating $500 million in FDUSD reserves.

- First Digital responds with an attestation report confirming 1:1 backing of FDUSD.

- The incident contributes to stablecoin transparency and corporate governance issues.

- Despite the controversy, FDUSD is still operational and reportedly fully collateralized.

The Accusation That Shook the Stablecoin Community

Justin Sun took to social media to publicly accuse First Digital Trust, the custodian supporting the FDUSD stablecoin, of misappropriating $500 million in reserve funds. His claims suggested a breach of fiduciary duty and initiated conversation across the digital asset ecosystem about stablecoin backing and custodial obligation.

The accusation centered on Sun’s claim that First Digital had “taken” a significant volume of assets intended to back FDUSD, one of the fastest-growing stablecoins in the market, without permission. He warned that the action posed a risk to the broader stablecoin ecosystem and told users to be on their guard.

First Digital’s Swift Denial

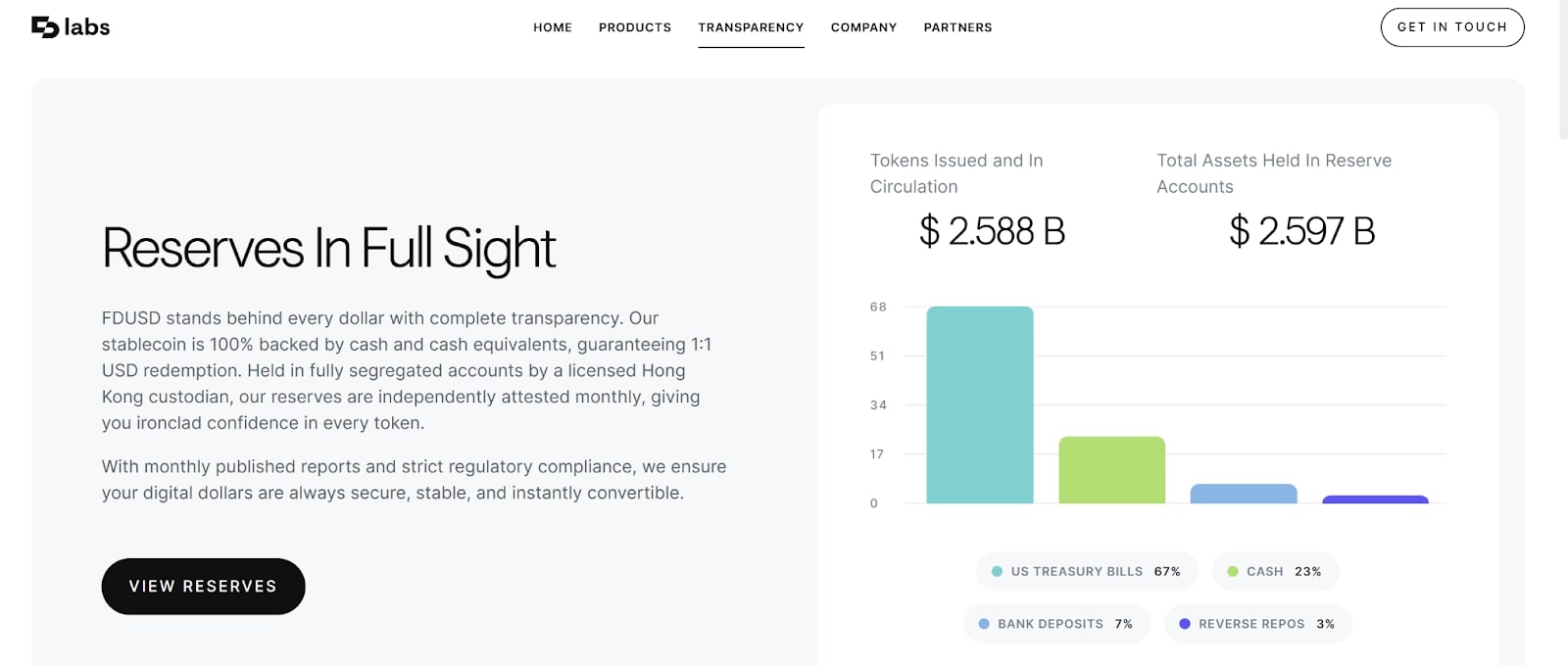

In response, First Digital wasted no time. The company released an attestation report from independent audit firm Prescient Assurance, showing that all FDUSD tokens in circulation are fully backed by fiat reserves held in segregated accounts. The report covered the period ending April 14, 2025, and offered a line-by-line breakdown of assets and liabilities.

Highlights from the Report:

- Total FDUSD issued: Over $3 billion

- Total fiat reserves held: Same or slightly more than issued amount

- Custody accounts confirmed segregated from operational funds

- No evidence of any unauthorized transfer of funds

FDUSD Transparency Dashboard: Reserves vs Circulating Supply

The report underscored the 1:1 reserve ratio and assured stakeholders that no funds had been “taken” or misallocated. First Digital also noted that they are in full compliance with legal and financial requirements in Hong Kong, where the company is incorporated.

Justin Sun’s Role and Motivation

While Sun’s motive for the public allegation is unclear, the event triggered speculations within the community. Some believe that this could be a part of a deeper dispute between Tron-related projects and FDUSD developers, such as access to reserves or settlement issues.

Others believe this could be a strategic move, attempting to shift attention away from Sun’s own legal issues. In 2023, Sun and his affiliated companies were targeted by the U.S. SEC for allegedly selling unregistered securities and market manipulation. These legal issues remain pending and continue to tarnish his reputation.

Community Reactions and Market Impact

The crypto community responded with mixed sentiments. While the majority commended First Digital for transparent reporting, some investors were cautious due to the seriousness of the accusation. FDUSD briefly experienced bigger-than-usual outflows, but there was no depeg observed.

Market Observations:

- FDUSD maintained its 1:1 peg on the big exchanges.

- Trading volume of FDUSD pairs briefly increased.

- Some users moved assets to other stablecoins like USDC and TUSD.

- Binance reaffirmed support for FDUSD, adding it to the list of priority trading pairs.

FDUSD did not lose popularity among institutional users, and big platforms still implemented

More News: Binance Launches LDUSDT: Dual-Purpose Margin Asset With Real-Time APR Rewards

The post FDUSD in the Crosshairs: Justin Sun’s $500M Fraud Accusation and First Digital’s Rebuttal appeared first on CryptoNinjas.