Berachain Ecosystem Surges as TVL Soars with Innovative Proof-of-Liquidity Model

Key Takeaways:

- TVL in Berachain’s DeFi protocols has surged to $3.351 billion.

- PoL incentivizes liquidity to enhance network security.

- Bitcoin Suisse has added Berachain (BERA) to its trading and custody offering, an indication of the project’s growing credibility.

There are exciting things happening in the Berachain ecosystem, fueled by its pioneering Proof-of-Liquidity (PoL) consensus. This innovative approach to blockchain security and governance is attracting significant attention and investment.

A Look at How Proof-of-Liquidity Works on Berachain

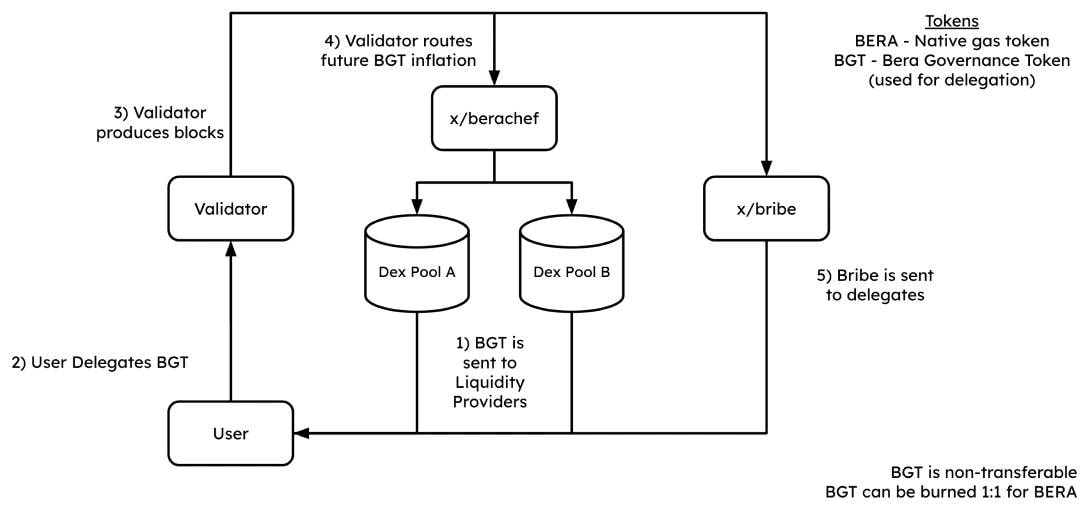

Berachain is an EVM-compatible Layer 1 blockchain that has introduced an innovative Proof-of-Liquidity (PoL) mechanism to reshape cryptoeconomics. Instead of staking, Berachain incentivizes liquidity provision, diverging from the incentive structure of conventional Proof-of-Stake (PoS) ecosystems, where users stake tokens to become validators.

Rather than just staking BERA, Berachain’s native token, users participate in DeFi liquidity pools and earn the Berachain Governance Token (BGT). These BGT tokens can only be earned (and they are non-transferable for the foreseeable future) by providing liquidity.

Berachain: A Brief Overview on TVL Growth and Market Performance

According to data from DefiLlama, the total value locked (TVL) in Berachain’s DeFi protocols has soared to $3.351 billion, up 15.76% in a week. Leading protocols driving this growth are Infrared Finance, a liquidity staking protocol, as well as decentralized exchanges (DEXs) such as Kodiak and BEX.

This is very impressive considering that Berachain only launched its mainnet in February 2025. As Jahnu Jagtap of a crypto news hub also mentions, even the BERA token itself has been bullish lately, gaining over 37% in price within a week. Some investors may worry they are late to Berachain, but strong fundamentals suggest ongoing potential. Berachain currently has a market cap of $880 million and a fully diluted value of $4 billion, with a circulating supply of 108 million BERA.

Why Berachain Is Looking Like a Valuable Investment

Berachain’s PoL model tackles the liquidity dilemma in a big way. This encourages users to contribute liquidity to DeFi protocols within the Berachain ecosystem, fostering a stronger, more sustainable network overall. Berachain has already achieved a new high in its DeFi ecosystem and has surpassed prominent cryptos such as Avalanche (AVAX) and Arbitrum (ARB) in terms of Total Value Locked (TVL).

Moreover, the project has also received substantial investments from notable investors, such as Polychain Capital and Framework Ventures. Berachain completed a $42 million Series A in April 2023 led by Polychain Capital. A year later, they raised another $100 million in a Series B round co-led again by Polychain Capital and Framework Ventures, bringing the valuation up to $1.5 billion.

Berachain Adoption Industry-Wide

Bitcoin Suisse adding BERA to its trading and custody offering is a sign of Berachain’s increasing popularity. According to Bitcoin Suisse, by connecting with Berachain, they are giving their clients access to cutting-edge innovations in the digital asset sphere.

It also gives clients round-the-clock trading access and industry-leading custody services for BERA, which is further legitimizing the project.

Berachain’s Proof-of-Liquidity: Sustainable Long Term Solution?

Even though this PoL model can present itself as a foundational alternative to the traditional PoS, the long-term stability of the approach is still being questioned. The model is based on validators allocated new BGT tokens proportional to their BGT stake. A validator who owns a lot more BGT can enhance its rewards even more as well as increase its power on network governance.

And Berachain certainly isn’t the only project making use of novel consensus mechanisms to address existing issues. Another recently added project in Bitcoin Suisse’s offerings is RedStone — an Ethereum-based oracle service that aims to address the inefficiencies of current blockchain oracle systems. RedStone demonstrates how innovation in the blockchain space never stops, just like Berachain.

A sudden liquidity crisis in the ecosystem could pose risks to network security. The primary drawback for some investors is the fact that BGT is non-transferable which may not appeal to those who prefer to be able to trade their governance tokens.

Berachain’s initial success indicates that PoL may provide a much-needed solution to many blockchain networks’ liquidity challenges.

More News: Unichain and Berachain Surge: New Blockchains Reshape the DeFi Landscape

The post Berachain Ecosystem Surges as TVL Soars with Innovative Proof-of-Liquidity Model appeared first on CryptoNinjas.