Dirty players in a dirty game. And an enlightening read….

In August 2020, Terraform Labs was looking for a “good advocate in the west,” so it made an offer to Galaxy’s ventures team: Galaxy could receive a preferential deal if it agreed to promote the token publicly. During their negotiations Terraform Labs cofounder Do Kwon revealed that the most generous offer had been for a 30% discount with a 12-month lockup.

What Galaxy was able to get was far sweeter: it would receive 18 million tokens over the course of a year, in monthly tranches, at a price of $0.22, representing a 30% discount on the market price with the tokens vesting monthly as well. This meant Galaxy would be able to sell the tokens they received every month.

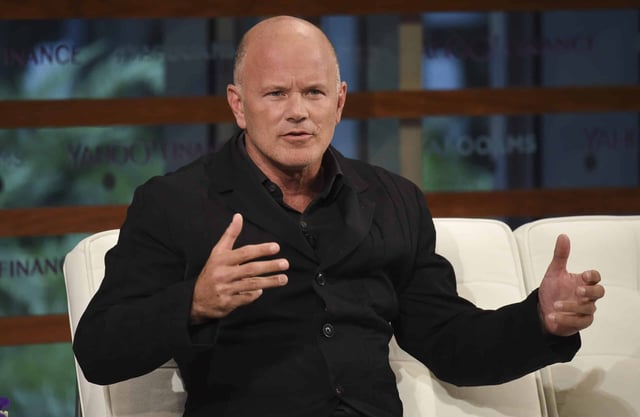

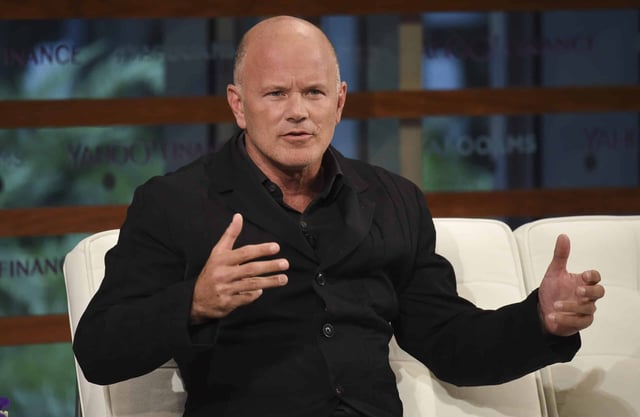

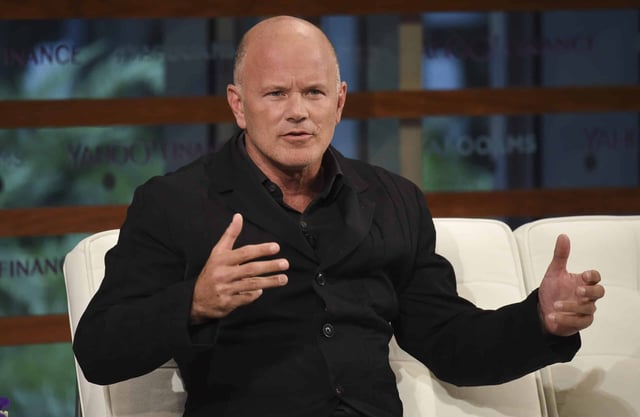

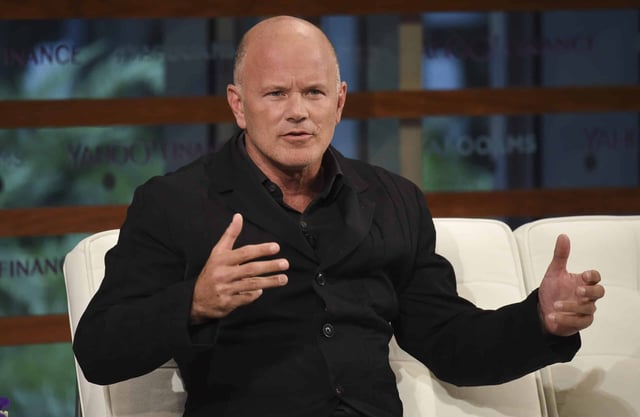

On March 2, 2021, on Twitter, Novogratz praised Terra founder Do Kwon as an innovator who was “well on his way to being the next SBF [Sam Bankman-Fried].”

That same day, Galaxy received over 1.5 million LUNA tokens from Terraform Labs — Galaxy sold the entire batch the very next day at prices ranging from $7.35 to $7.70.

In the fall of 2021, the assurance notes multiple instances of bullish posts by Galaxy founder Mike Novogratz as well as a research report giving a positive mention to LUNA along with other well-regarded cryptos such as ETH and SOL, timed near sales of LUNA at prices ranging from $43 in October to $73 in December.

In December of that year, Novogratz tweeted he would get a tattoo commemorating LUNA breaking $100. The filing notes multiple instances of Novogratz tweeting bullish sentiment about LUNA timed near, and sometimes on the same day as, Galaxy’s sales of LUNA into the public markets, without disclosure.