MEXC vs. KuCoin (2025): Fees, Features and Security Compared

MEXC and KuCoin are top cryptocurrency exchanges offering spot, futures, and copy trading services to new and experienced traders. These two exchanges are popular for their competitive fees, support for various cryptocurrencies, robust security measures, advanced trading tools, and products designed to help users earn passive income while trading.

Although they have similar products and services, they also have distinct features that make each stand out. MEXC offers more leverage (up to 200x), higher liquidity, and lower fees while supporting more cryptocurrencies than KuCoin.

On the other hand, KuCoin offers its users a debit card, automated trading tools (bots), and more than a dozen products to help them earn passive income. Since MEXC and KuCoin have similar trading features, it can be challenging to decide on the best exchange for your trading needs.

To guide you through this decision, this article provides a detailed comparison of MEXC and KuCoin, breaking down their trading fees, best features, security and regulatory standards, and supported coins to help you choose the exchange that best fits your needs.

MEXC vs KuCoin: A Complete Overview

The key difference between KuCoin and MEXC are their fees, features, number of supported cryptocurrencies, and KYC verification requirements. MEXC Exchange offers lower futures and spot trading fees than KuCoin. Unlike KuCoin, MEXC allows users to make deposits, trade, and withdraw assets without identity verification.

On the other hand, KuCoin offers bots for automated trading, an NFT marketplace, and a platform for users to vote for their favorite projects to be listed on the exchange. Though MEXC and KuCoin offer some distinct products, they still have similar innovative features, such as advanced charting tools, copy trading, paper trading, and futures and spot trading.

Here is a summary of MEXC vs KuCoin features to help you spot their differences quickly.

| Exchange | MEXC Global | KuCoin |

| Founded | 2018 | 2017 |

| Key Features | Low fees, futures, spot trading, MEXC Launchpad, and futures demo trading. | Trading bots, GemVote, KuCoin, and KuCard. |

| Supported Cryptocurrencies | 2,700+ and 3,000+ trading pairs. | 750+ and 1,300 pairs. |

| Trading Fees (Spot) | 0% for makers and 0.02% for takers. | 0.1% maker/taker. |

| Trading Bot | No | Yes |

| Demo/Paper Trading | Yes | Yes (paper trading) |

| Copy Trading | Yes | Yes |

| Launchpad | Yes | Yes (Spotlight) |

| KYC Requirement | Optional | Mandatory |

| Security | Cold storage, Two-Factor Authentication, and withdrawal address whitelisting. | Cold storage, Two-Factor Authentication, anti-phishing codes, and an insurance fund. |

| P2P Trading | Yes | Yes |

| Earn Products | Yes | Yes |

| Accepted Payment Methods | Crypto, third-party services, and bank transfers. | Crypto, credit/debit cards, third-party services, and bank transfers. |

| Trading Options | Spot and margin trading. | Spot, options, and margin trading. |

Claim up to 10,800 USDT plus a 10% trading fee discount on MEXC.

What Are the Fees of MEXC vs. KuCoin?

Let’s compare the deposit, withdrawal, and trading fees of MEXC vs. KuCoin in the sections below.

MEXC vs. KuCoin: Deposit and Withdrawal Fees

MEXC and KuCoin do not charge fees for depositing crypto or fiat currency deposits. However, deposit fees may apply from third-party payment providers for fiat deposits, depending on the payment method you use.

Meanwhile, MEXC and KuCoin withdrawal fees vary based on your withdrawal method and blockchain network. When comparing KuCoin vs MEXC withdrawal fees, MEXC charges less than KuCoin for some coins. For instance, MEXC traders pay 0.0003 BTC for Bitcoin withdrawals, 1 USDT for Tether (USDT) withdrawals, and 0.005 for Ethereum (ERC20).

On the other hand, KuCoin charges 0.0005 BTC for Bitcoin and 0.005 ETH for the Ethereum network (ERC20). For Tether (USDT), the fee differs based on the network you use. For example, withdrawing USDT via the ERC20 network costs 10 USDT, while using the TRC20 network costs 1 USDT.

MEXC vs. KuCoin: Trading Fees

MEXC offers lower fees than KuCoin Exchange. For spot trading, MEXC charges 0% for maker fees and 0.02% for taker fees, while KuCoin charges a flat 0.1% for both maker and taker fees.

For futures trading, MEXC’s fees are 0% for makers and 0.01% to 0.03% for takers, whereas KuCoin charges 0.02% for makers and 0.06% for takers.

Fortunately, both exchanges offer discounts on trading fees. KuCoin gives discounts for the following investors: those with a high 30-day trading volume and traders holding the platform’s native token, KCS. Meanwhile, MEXC traders can enjoy fee discounts by trading “special pairs,” increasing their 30-day trading volume, or holding MEXC’s native token, MX.

What Are the Best Features of MEXC vs. KuCoin?

The best features of MEXC are low fees, spot and futures trading, MEXC Launchpad, futures demo trading, and a wide range of cryptocurrencies. The best features of KuCoin are the crypto trading bots, GemVote, KuCoin Earn, and KuCoin Card (KuCard).

Below is a detailed breakdown of the best features of both exchanges, starting with the MEXC Exchange.

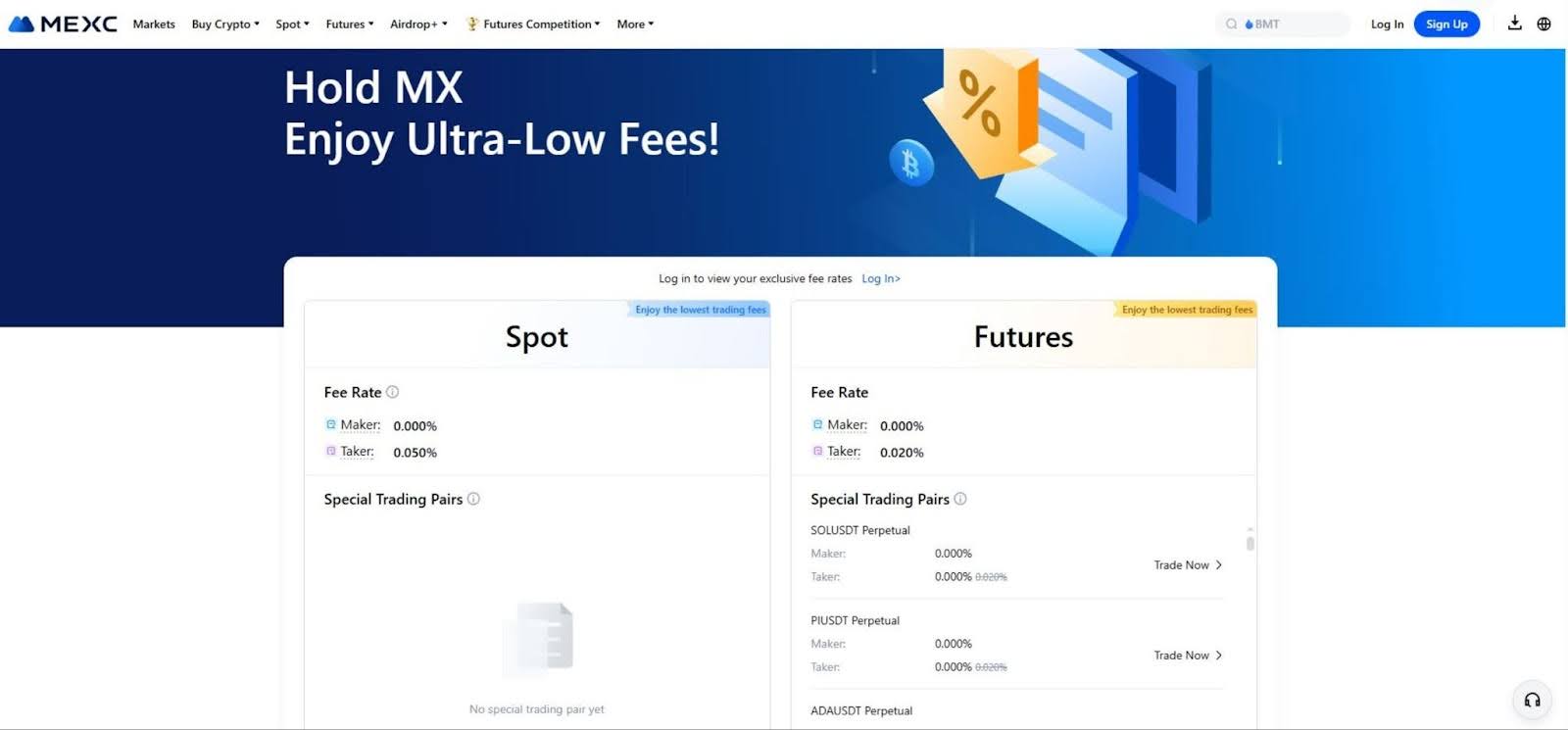

- Low Fees

MEXC Exchange has very low trading fees in the crypto space. For spot trading pairs, maker fees are 0%, and taker fees are 0.05%. The platform also offers special trading pairs that allow makers and takers to trade for free. For futures pairs, MEXC charges 0% for maker fees and 0.02% for taker fees.

The exchange provides multiple opportunities for users to reduce their futures and spot trading fees. To get fee discounts, do any of the following:

- Use MX to Pay Fees: Use MEXC’s native token, MX, to pay your transaction fees and receive a 20% discount.

- Hold MX: Hold at least 500 MX within a 24-hour window and receive a 50% discount on spot and futures fees.

- Trade Special Pairs: MEXC Global offers special trading pairs, which are updated on their official website regularly. At the time of writing, some special futures trading pairs on MEXC are SOLUSDT Perpetual, PIUSDT Perpetual, DOGEUSDT Perpetual, and TONUSDT Perpetual. You can trade any of these pairs for free.

- Spot and Futures Trading

Spot trading on MEXC allows users to buy and sell cryptocurrencies at current market prices. The crypto exchange provides a user-friendly interface, basic trading tools, and a TradingView chart for in-depth technical analysis, giving traders flexibility in executing their trades.

MEXC offers advanced trading features for more experienced crypto traders, including technical indicators and advanced charting tools. The exchange has over 2000 tradable digital assets and frequently lists new tokens, so investors have multiple trading options.

MEXC also provides futures trading, which allows users to speculate on the price movements of cryptocurrencies without directly owning them. Futures trading on MEXC includes perpetual and standard futures contracts, enabling traders to take long or short positions depending on market expectations.

The crypto exchange also provides features like isolated and cross-margin modes and advanced risk management tools, such as stop-loss and take-profit orders, to help traders manage their exposure. For traders who want to amplify their trades, MEXC offers high-leverage trading options up to 200x, which can increase potential profits, even though it has higher risks.

- MEXC Launchpad

MEXC Exchange offers a Launchpad, a platform for new cryptocurrency projects to raise funds and gain exposure among traders. The Launchpad also enables MEXC users to participate in token sales, often at an early-stage discounted price, before the tokens are officially listed for trading.

To join these sales, you need to:

- Buy and hold at least 1,000 MX tokens in your spot wallet for 30 consecutive days.

- Commit your MX tokens during Non-lockup Events using MEXC’s Quick Commit feature.

Airdrops are distributed based on the tokens you commit, so the more MX tokens you hold or stake, the higher your chances of securing allocations in the token sale.

- Futures Demo Trading

MEXC provides a futures demo trading feature for traders who want to experience futures trading without risking real funds. This demo trading interface is designed to help beginners familiarize themselves with futures contracts, leverage, and various trading strategies without losing money.

When you start using the demo, MEXC will allocate virtual funds to you. The funds and simulated environment will allow you to practice placing long and short positions, setting stop-loss and take-profit orders, and experimenting with different leverage levels.

The best features of Kucoin (crypto trading bots, GemVote, KuCoin Earn, and KuCoin Card) are discussed below.

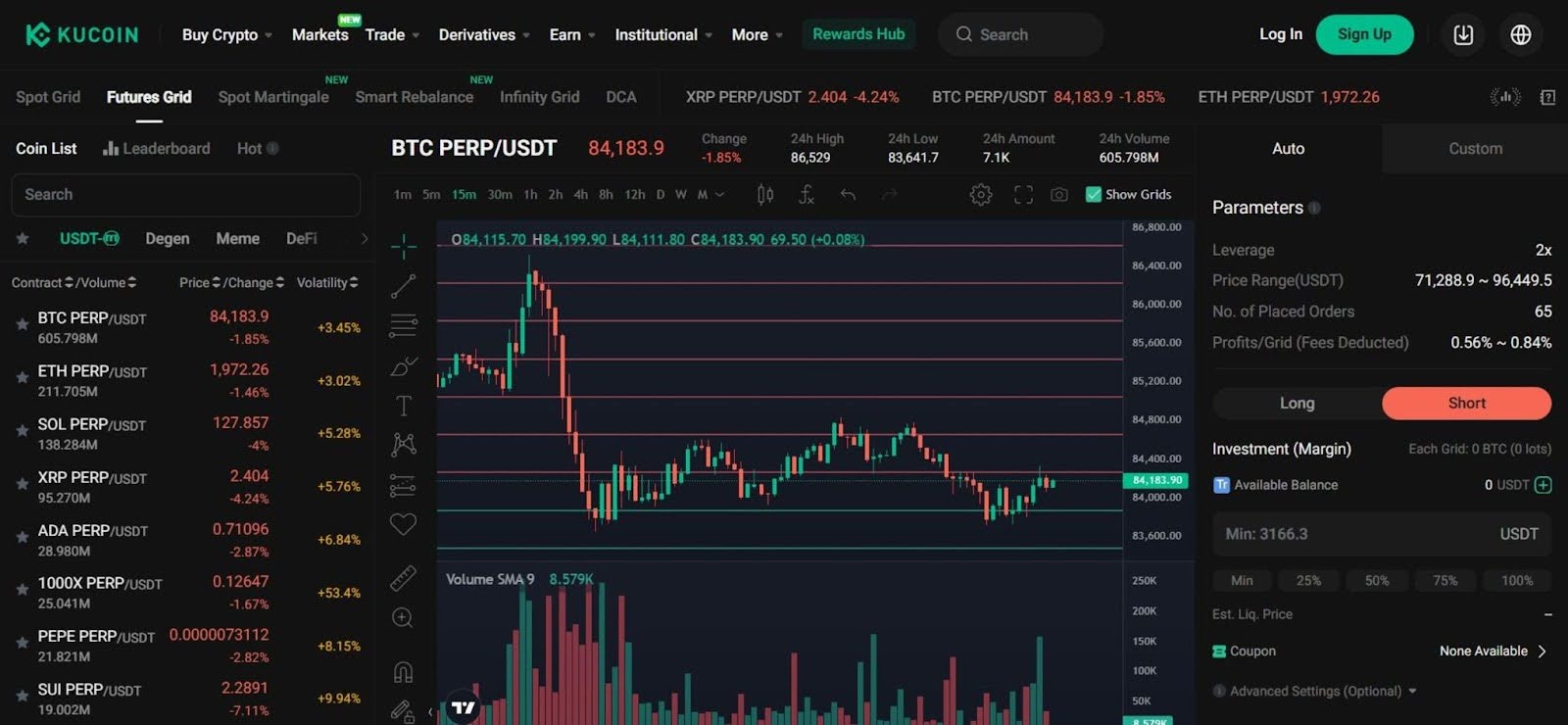

- Trading Bots

KuCoin Exchange offers bots that help traders execute trades, track market changes, and manage positions based on predefined parameters. This automated trading tool helps KuCoin investors capitalize on price fluctuations, make profits, or stop losses without constantly monitoring their open positions and trading charts.

The trading platform offers about six trading bots to accommodate all traders. Here is a rundown of these bots and how they function:

- Spot Grid: The crypto market is highly volatile, and investors need a strategy for quick execution. The Spot Grid does exactly that. This bot kills volatility by selling high and buying crypto assets when their prices are low.

- Futures Grid: This is similar to the Spot Grid but operates in the futures market. The bot allows traders to go long (bet on price increases) or short (bet on price decreases) to profit from market trends rather than just price fluctuations.

- Spot Martingale: The Spot Martingale bot buys crypto assets in increasing amounts as prices drop and then sells everything at once when the price rises to a profitable level.

- Smart Rebalance: This bot is designed for long-term investors who want to spread risks long-term and maintain a stable portfolio balance.

- Infinity Grid: The Infinity Grid is ideal for bullish trends. It continues buying and selling crypto as prices rise without setting an upper limit, capitalizing on an upward-moving market.

- DCA (Dollar-Cost Averaging): This bot invests a fixed amount at regular intervals regardless of price. It is perfect for long-term investors who prefer a steady accumulation strategy.

Note: KuCoin trading bots are free. You can copy other users’ trading strategies or create yours under the exchange’s six strategies.

- GemVote

GemVote is KuCoin’s community voting process that allows traders to vote for their favorite project to be listed on the cryptocurrency exchange platform. To avoid rugpulls, users do not nominate projects; instead, KuCoin pre-vets various projects and provides users with voting options.

At the end of the voting period, the top-ranked projects are evaluated by KuCoin’s listing team and ranked based on priority; once approved, they will have a chance to be listed on KuCoin. You need tickets to vote. You can earn voting tickets by completing GemVote tasks like inviting new users, holding KCS (KuCoin’s native token), completing identity verification, and more.

- KuCoin Earn

KuCoin Earn offers traders multiple ways to earn passive income through professional asset management. Depending on their investment goals, users can choose from various financial products, including Simple Earn, Staking, Structured Products, and Specialized Products.

Simple Earn allows users to earn interest on crypto deposits through flexible savings or promotional offers. Staking, on the other hand, requires locking up digital assets like ETH or KCS for a set period in for higher returns.

For more experienced traders, Structured and Specialized Products provide advanced investment products for higher returns. Among these products, you will find KuCoin Spotlight, a token launch platform that gives investors access to promising crypto projects before they are listed.

- KuCoin Card

The KuCard is a VISA debit card that allows traders to spend their crypto holdings at millions of merchants worldwide. It converts crypto into fiat currency at the point of purchase, ensuring smooth and instant transactions wherever the card is accepted.

KuCard also offers exclusive perks, including cashback on purchases, discounts at partner stores, and more. However, it is currently available only to citizens and residents of the European Economic Area (EEA).

Join KuCoin now to maximize your earnings with exclusive bonuses—100 USDT just for signing up and up to 10,800 USDT in total rewards!

What Are the Security and Regulatory Standards of MEXC vs Kucoin?

In this section, we will compare the security and regulatory standards of KuCoin vs. MEXC. Let’s start with the security measures and regulatory standards of the MEXC Exchange.

- Withdrawal Whitelist: You can add multiple wallet addresses to the whitelist and withdraw funds to only pre-approved wallet addresses. This security feature prevents hackers from transferring funds to any wallet address not listed, even if they gain access to your account.

- Cold Wallet Storage: MEXC stores a significant amount of user funds in offline wallets (cold wallets) rather than online wallets (hot wallets).

- MEXC Regulatory Standards: MEXC Global is regulated by more than 15 financial regulators in various countries. However, the crypto exchange does not offer its products to traders in regions where it faces regulatory issues. The restricted locations include the US, North Korea, Cuba, Syria, Hong Kong, Iran, Mainland China, Singapore, the UK, and Canada.

KuCoin security measures and regulatory standards are:

- Anti-Phishing Codes: This helps users recognize official emails from the cryptocurrency exchange platform. Once you set it up, every email from KuCoin will carry that code. So, if you receive an email from KuCoin that doesn’t have the code, it is likely a phishing attempt.

- Insurance Fund: KuCoin has set aside a reserve fund to compensate users in case of security breaches. To fund the reserve, KuCoin allocates 10% of its trading fees to the fund.

- KuCoin Regulatory Standards: KuCoin complies with global regulatory standards, reinforcing its commitment to transparency and legal adherence. The exchange recently made it mandatory for all users to complete KYC to comply with regulatory requirements.

Also, its services are unavailable in the US, Mainland China, Hong Kong, Singapore, Thailand, Puerto Rico, Iran, North Korea, Malaysia, Syria, Sudan, and Cuba.

How Many Cryptocurrencies Are Supported on MEXC vs. KuCoin?

MEXC Exchange supports about 2,700 cryptocurrencies and has 3,000+ trading pairs. Meanwhile, KuCoin supports only 700+ cryptocurrencies plus 1,200+ pairs. If you compare KuCoin vs MEXC based on the number of supported coins, MEXC is the best option. However, if extensive coin offering is not your primary focus, both exchanges support major cryptocurrencies for trading and often list new and trending tokens early.

MEXC vs KuCoin: Which Exchange Best Fits Your Needs?

MEXC is best suited for:

- Traders Who Prioritize Privacy: You can start trading on MEXC with your email and a secure password. The cryptocurrency exchange allows users to trade anonymously without completing identity verification, but there is a daily withdrawal limit of 10-30 BTC.

- Smaller Altcoin Traders: The platform currently has over 2000 coins and 3,000+ trading pairs and frequently lists promising projects at low prices for traders to invest in. If these projects do well, investors could 1000x their trading capital.

- Beginners With Low Budgets: MEXC has a low fee structure, with fees going as low as 0%. So, the crypto exchange will be a good fit if you don’t mind the steep learning curve (due to extensive product offerings).

Open a new MEXC account and get up to 8,000 USDT in welcome bonuses.

KuCoin is better suited for:

- Experienced Traders: The platform provides advanced trading features for professional and institutional traders, such as margin, leveraged trading, VIP Lending, and API services, making it the best choice for experienced traders who can manage high-risk strategies.

- Automated Traders: KuCoin Exchange offers six trading bots that automatically execute trades, allowing you to continue your daily activities. The bots are easy to set up and can help you take advantage of price fluctuations and potentially make profits.

- Passive Income Seekers: KuCoin offers multiple passive earning opportunities through staking, lending, dual investment, KuCoin Bonus, and other Products. This makes it ideal for traders looking for steady income streams. See all the features you can use to earn money in this KuCoin Exchange review.

Sign up on KuCoin today and claim your 100 USDT welcome bonus, plus unlock up to 10,800 USDT in rewards.

MEXC Summary

MEXC is popular for its high order execution speed, multiple selection of cryptocurrencies, solid security track record, and low fees, ranking it at the top of our list of best zero-fee crypto trading platforms.

The crypto trading platform provides various basic and advanced trading features and supports staking, lending, and borrowing services. Read this MEXC Exchange review to learn more about the platform’s best features and how to get started as a new user.

Who Should Pick MEXC?

MEXC is best for traders who want access to new altcoins, no KYC trading, and lower fees. The crypto exchange has high liquidity, a user-friendly interface, and a demo trading feature for practice. Additionally, the platform offers exclusive rewards to new users. You can find details on how to redeem your bonuses in this MEXC referral code article.

Is MEXC a Trusted Exchange?

Yes, MEXC is a trusted cryptocurrency exchange. It uses industry-standard security tools to protect user funds and data while providing basic and advanced tools for beginners and experienced crypto traders.

Kucoin Summary

KuCoin is a global cryptocurrency trading platform that offers spot, futures, and derivatives trading and a comprehensive suite of earning products to 30+ million traders worldwide. The KuCoin Earn programs allow users to earn high returns on investments, daily bonuses, and tickets to vote for crypto projects that should be listed on the exchange.

Like MEXC Global, KuCoin also offers bonuses to new users to help them kickstart their trading journey. So, before you open an account on KuCoin Exchange, check out our guide on using the KuCoin referral code to get exclusive rewards.

Who Should Pick KuCoin?

KuCoin is best for traders who are looking for free automated trading bots, ways to invest their money and make passive income, institutional traders, and NFT collectors.

Can I Use KuCoin in the US?

No, KuCoin is not available in the US. The crypto exchange discontinued its services and closed all US users’ accounts in January 2025.

The post MEXC vs. KuCoin (2025): Fees, Features and Security Compared appeared first on CryptoNinjas.