OKX Crypto Exchange Review: Is It Safe & Legit to Buy Bitcoin in 2025?

OKX is a top cryptocurrency exchange formerly called OKex. It was founded in 2017 to offer crypto investors a user-friendly platform for buying, selling, and trading crypto assets. OKX has a clean interface, provides automated trading tools, and offers opportunities to earn passive income through various crypto products, making it a top choice for experienced and new traders.

OKX crypto exchange is considered safe to buy and sell crypto in 2025 for beginners and master traders. The trading platform offers various security measures, like cold storage, anti-phishing codes, and a risk shield to protect users and digital assets.

In addition to security features, this OKX review will illuminate some basic information about OKX and provide information to answer the following questions: Where is OKX based? What are OKX supported and restricted countries? What are OKX trading fees?

Finally, you will also gain insights into the best features of OKX’s crypto exchange, how to open a new account and trade on OKX, and whether OKX is safe and legitimate for trading crypto and Bitcoin in 2025.

OKX Review: What is It?

OKX is a cryptocurrency exchange that offers user-friendly trading interfaces and options, such as spot, margin, and futures contracts. The platform also provides advanced tools, such as crypto trading bots, block trading, and a portal to the Web3 ecosystem.

OKX crypto exchange also runs its own blockchain, the X-layer blockchain network, and a native token, OKB. This native token is used to pay trading fees, reward investors for holding OKB through OKX earn programs and grant users access to voting and governance on the trading platform.

The exchange has many more features, which we will discuss further in this article. But before we get into the full OKX crypto exchange review, here’s a summary of basic information about all the features and services the OKX crypto platform offers.

| Exchange | OKX |

| Founded | 2017 |

| Headquarters | Seychelles |

| Founder | Star Xu |

| Features | Spot trading

Derivatives (margin, futures, perpetual, and options) Automated trading tools (bots and copy trading) OKX Earn (staking, lending, etc.) NFT marketplace Crypto borrowing |

| Supported Cryptocurrencies & Trading Pairs | 350 cryptocurrencies and more than 500 trading pairs. |

| Security Measures | OKX risk shield, cold wallet storage, multi-factor authentication (MFA), and anti-phishing measures. |

| Margin Trading | Yes |

| Fees | Low fees. 0.08% maker and 0.10% taker fees. |

| Trading Options | Spot, futures, margin. |

| Payment Methods | Visa, bank transfer, cryptocurrency, MasterCard, and Apple Pay. |

| Geographic Restrictions | OKX is not supported in the following locations: the US, Belgium, France, Iran, Cuba, Bangladesh, North Korea, Bolivia, Malta, Crimea, and Syria. |

Where is OKX Based?

OKX is based in Seychelles, but its global presence extends far beyond that. As a provider of crypto exchange and Web3 services, OKX operates offices in key locations worldwide, including Hong Kong, Singapore, the UAE, Silicon Valley, and the Bahamas, ensuring comprehensive support for its users worldwide.

What are OKX Supported Countries?

OKX supports cryptocurrency trading in over 100 countries, including South Africa, Singapore, Kenya, Australia, the Netherlands, Argentina, and Seychelles. Its broad reach ensures a seamless trading experience for users across diverse regions worldwide.

Register on OKX today and Get a 30% discount on trading fees and up to USD 10,000 for new user rewards.

Is OKX Available in US?

No, OKX exchange is not available in the US. However, they offer Web3 services to US users.

What are OKX Restricted Countries?

OKX exchange has some partially restricted countries, while others are prohibited completely. Users in countries that are not fully restricted have limited access to the platform’s services. Some of them include:

- Belgium, Japan, Malaysia, and Cuba: Users in these locations are restricted from using margin and derivatives-related services, including futures, perpetual, and options trading.

- Canada: Existing users can access OKX, but new OKX account registrations are not allowed at the time we write this review.

- Hong Kong: The company’s derivatives services are unavailable in Hong Kong.

- The United Kingdom, the Bahamas, and the Netherlands: These countries are prohibited from using the platform’s derivatives-related services.

Note: Potential users from most of these countries cannot currently register on OKX. Only existing traders can use the permitted products and services on OKX.

OKX Completely Restricted Countries

OKX crypto trading exchange is unavailable to traders in the United States and its territories, Belgium, France, Iran, Cuba, Bangladesh, North Korea, Bolivia, Malta, Crimea, Syria, Donetsk and Luhansk regions, and Ireland.

The company might update the list of restricted countries as regulations in those locations evolve. If you are interested in using their services, regularly check for updates or, better still, explore other alternatives.

What are OKX Trading Fees?

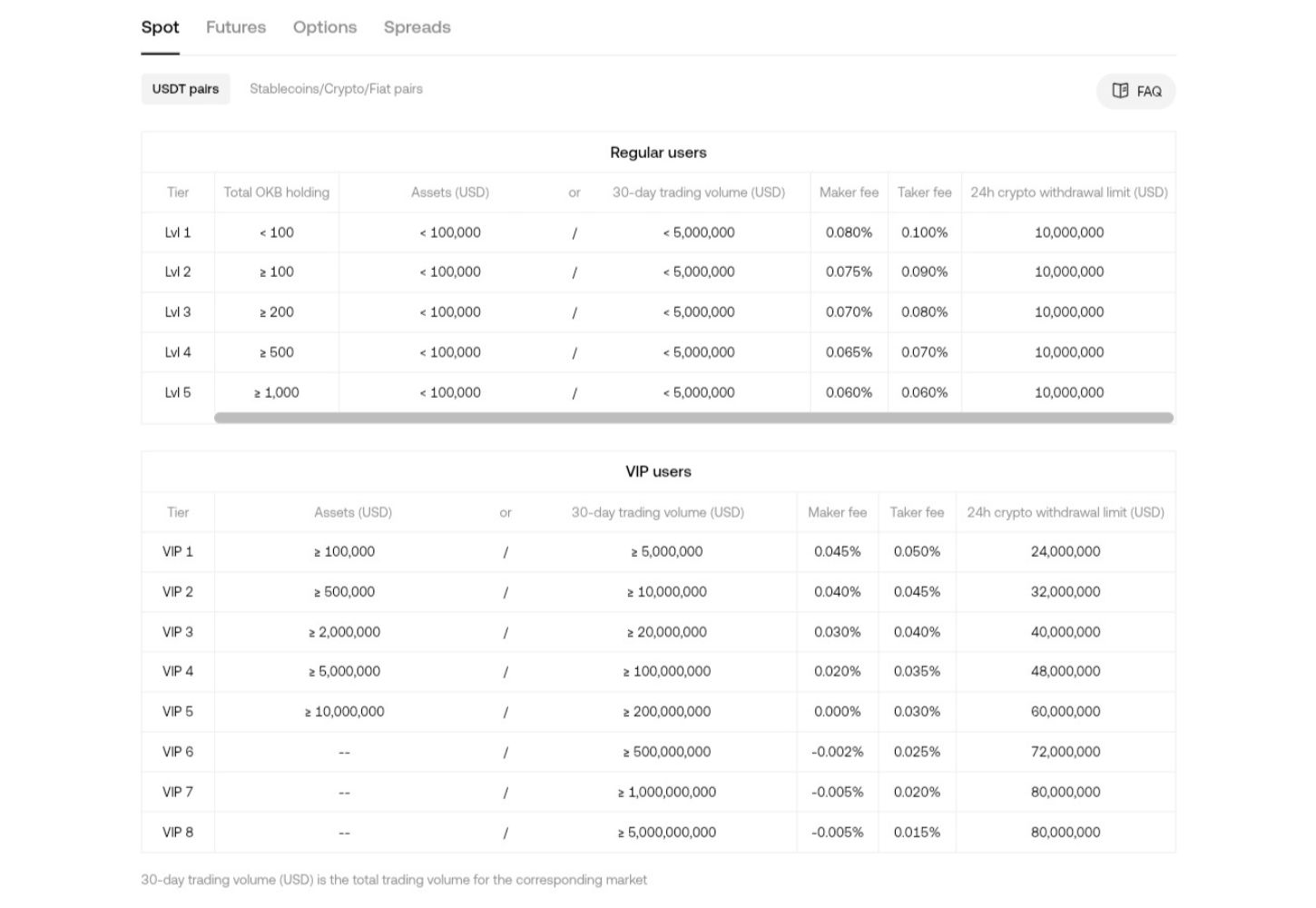

OKX trading fees are based on the market taker and maker model like many other exchanges. OKX exchange has low trading fees, starting at 0.10% for takers and 0.08% for makers, and higher VIP-level traders will pay lower fees than this standard.

The maker is the trader who created a limit order to sell their crypto. Because this order is not filled immediately, some exchanges, including OKX, charge them lower fees because they add liquidity to the platform. On the flip side, the taker picks up an existing order or purchases the crypto the maker sells from the order book. These traders want their orders filled immediately, thereby taking liquidity away from the platform.

For example, if the current ETH lowest ask price is 2,700 USDT and you create a maker order with a bid price of 2570 USDT, this order cannot be filled immediately. OKX will enter it into the order book until someone (a taker) fills it.

Here is a rundown of the fees for spot, futures, options, and spreads trading on the OKX crypto exchange.

1. Spot Trading Fees

OKX charges regular users 0.10% for takers and 0.08% for makers. The spot interface allows users to buy or sell crypto immediately or when the particular coin reaches a specific price, depending on whether they choose a market or limit order.

Since the platform uses a tiered rating that depends on traders’ 30-day trading volume and the number of OKB tokens the traders hold, transaction fees can be discounted to 0%.

Note: The above fees are for USDT pairs. OKX charges less fees for crypto, other stablecoins, and fiat pairs depending on users’ 30-day trading volume.

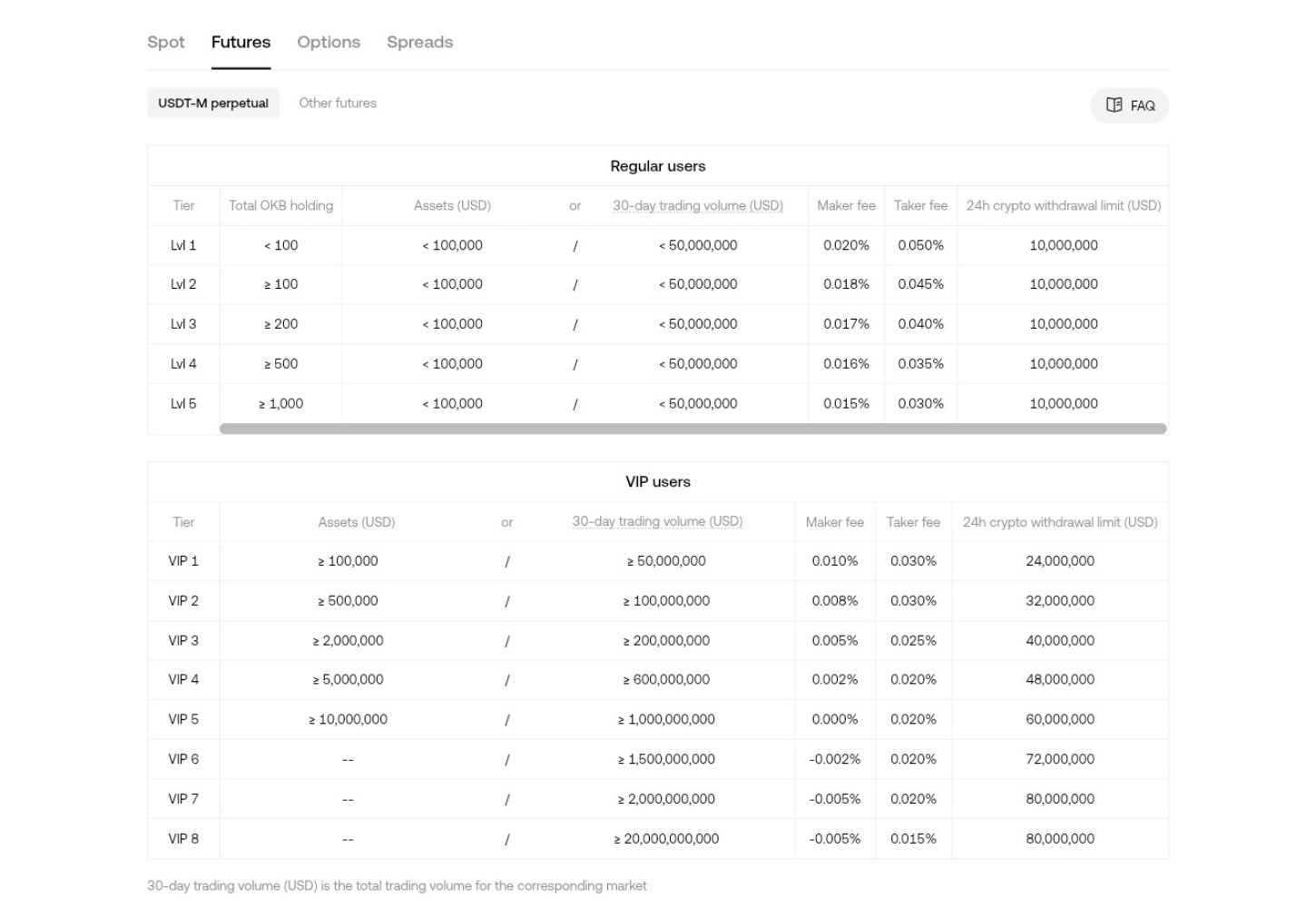

2. Futures Trading Fees

For futures contracts, OKX charges;

- Taker Fee: 0.05% for non-VIP users.

- Maker Fee: 0.02% for non-VIP users.

The fees are lower for VIP users, with VIP 1 users paying 0.03% (taker) and 0.01% (maker) for futures. The image below summarizes the fees for various VIP levels by trading volume or amount of OKB token the user is holding.

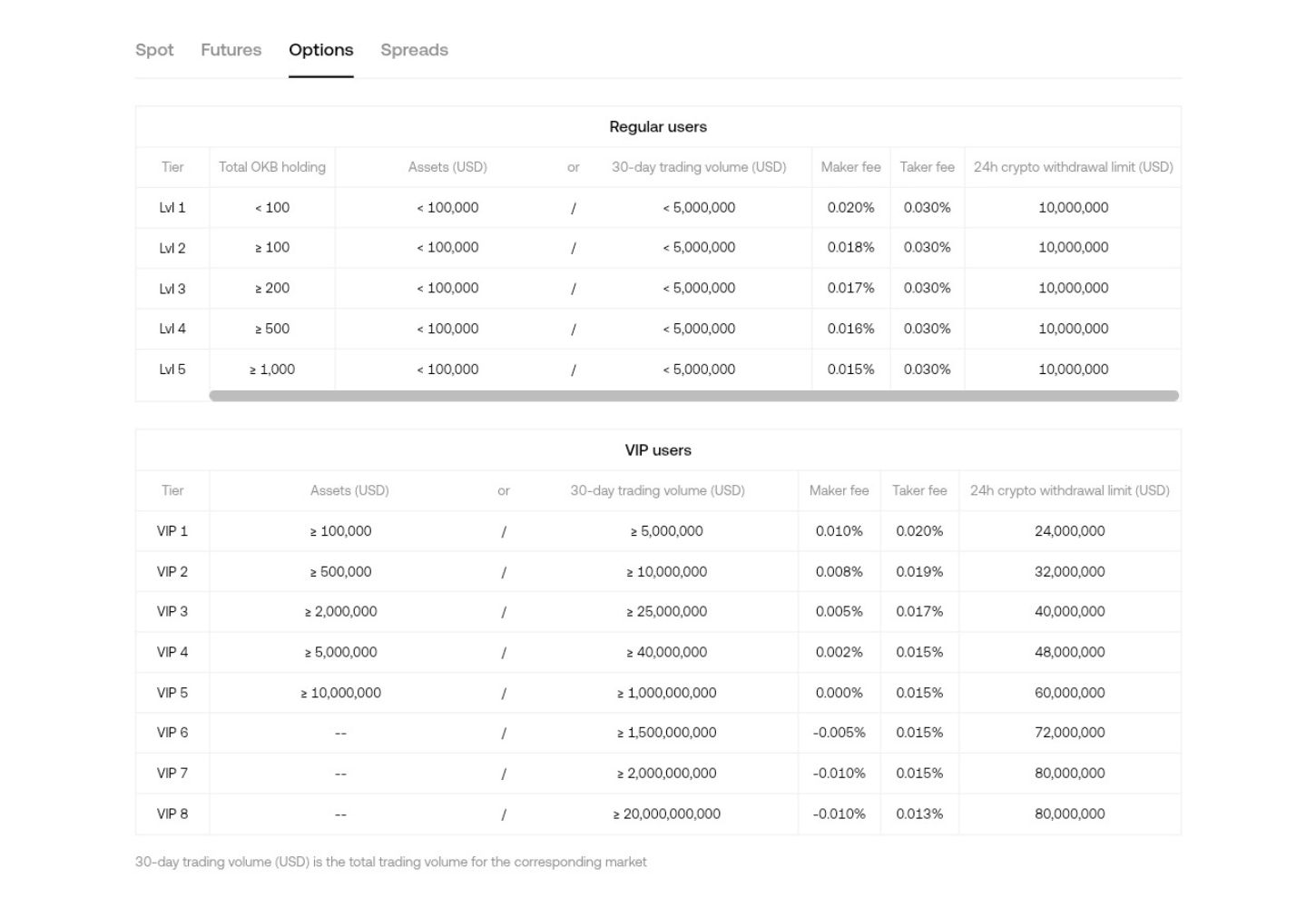

3. Options Trading Fees

OKX transaction fees for options start at 0.02% for makers and 0.03% for takers, and the options fees are calculated differently, even though trading volume is also an important factor here. OKX also charges a forced liquidation fee and an exercise fee, which is not applicable if you initiate a 1-day options that doesn’t expire on Friday.

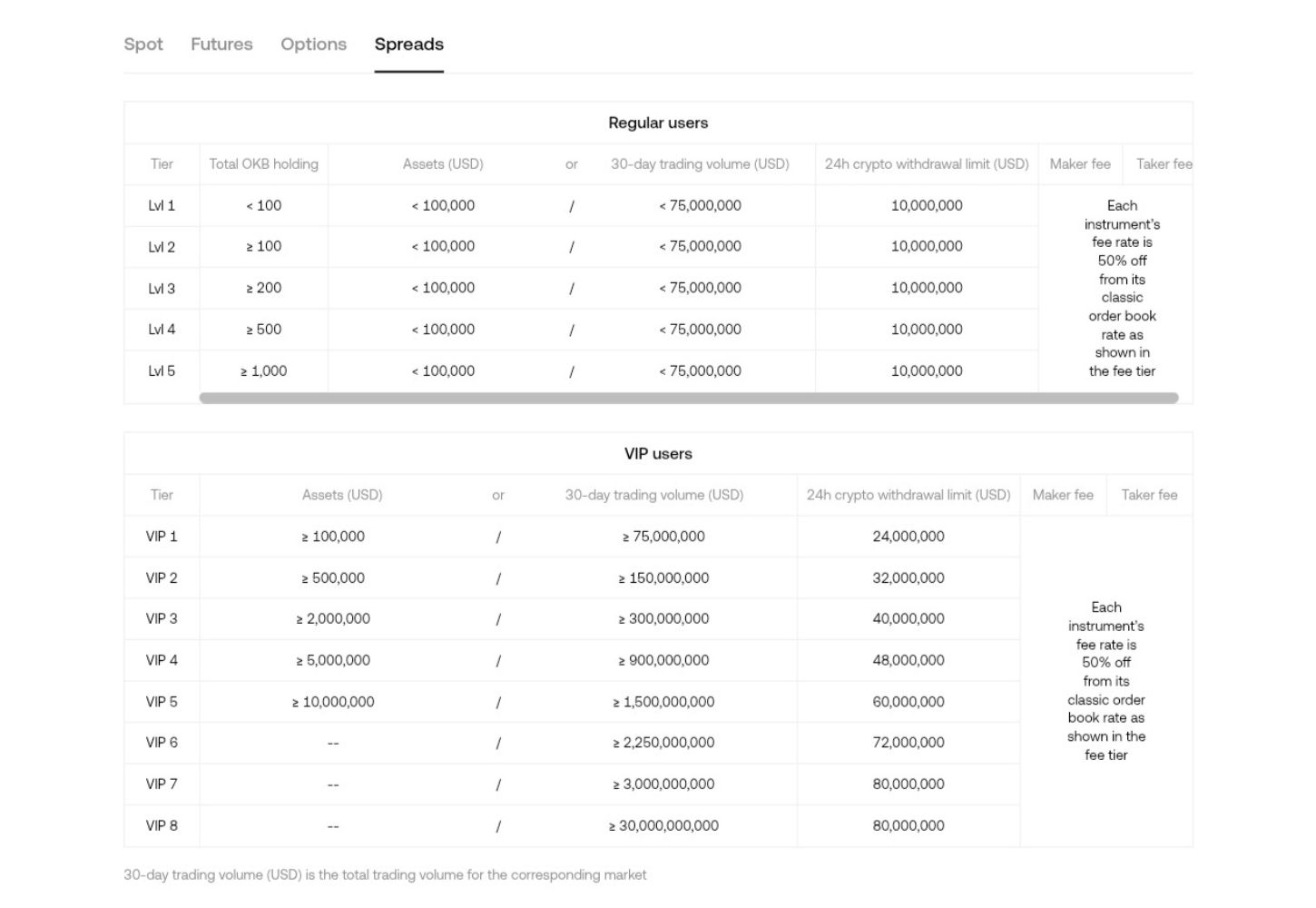

4. Spreads Trading Fees

A 50% discount applies to the standard fee rate for all users on spread trading fees. So, if you are VIP 1 opening a BTC/USDT-margined perpetual spread, the transaction fee will be 0.04% for makers and 0.05 for takers.

What are the Best Features of OKX Crypto Exchange?

The best features of OKX are the OKX trading bot, OKX copy trading, OKX wallet, and OKX mobile app. Here’s a rundown of these features and how they ensure a smooth trading experience for beginners and advanced traders alike.

OKX Trading Bot

The trading platform offers about 11 bots to help users automate their trades and earn even when they are inactive. The grids include spot and futures grid, futures DCA, smart arbitrage, spot DCA (martingale), recurring buy, signal bot, iceberg, TWAP, smart portfolio, and arbitrage.

Here is a breakdown of how some of these bots help you earn more without constantly monitoring your trades.

- Spot Grid

The Spot grid mode splits your starting funds between the two digital assets of your chosen trading pair, say BTC/USDT. The bot then creates a grid of price points between the upper and lower limits and divides your capital equally between the number of grids used.

The bot automatically buys more of the asset when the price drops to a lower grid level. Then, when the price rises to an upper grid level, the spot grid bot automatically sells some of the assets.

Each time the price reaches the upper grid line, the bot automatically sells a portion of the asset and buys the traded asset when the price reaches the lower grid line. You make money from the difference between the prices at which the bot buys and sells.

- Futures Grid

The futures grid aims to make money from price fluctuations within a range. OKX offers various types of futures grid strategies:

- Long Futures Grid: The bot buys futures at the current price and sells them when the price rises. This strategy is best for markets that are expected to go up but still have some volatility.

- Short Futures Grid: The bot sells futures at the current price and buys them back when the price drops. This strategy is best for markets that expect to go down but still have some volatility.

- Neutral Futures Grid: The bot trades in both directions, buying when the price is low and selling when it’s high, no matter the market trend.

The goal of the futures grid is to earn small profits from each price movement, whether the market is going up or down or staying within a range.

- Smart Arbitrage

OKX smart arbitrage helps traders make steady profits while reducing the risk of price changes in the market. It uses a Delta-neutral strategy, which means holding equal but opposite positions in two markets:

- Buying a cryptocurrency in the spot market (long position).

- Selling the same cryptocurrency in the perpetual swap market (short position).

This bot helps balance gains and losses, so price changes have less impact, and profits come from funding fees earned during the holding period. There are two types of smart arbitrage strategies on OKX:

- Custom Mode: You choose your strategy and set profit targets.

- Smart Mode: The system recommends the best strategy and automatically manages profit-taking, stop-loss, and adjustments.

Unlike smart arbitrage, there are four ways to set up the OKX futures and spot bots. You can either set the parameters based on your analysis, fill in parameters recommended by the crypto trading bot, use AI strategy, or copy lead traders’ winning bots.

OKX Copy Trading

OKX copy trading is a program that allows new users to copy strategies from more advanced traders and automatically execute them in the spot or futures markets. When you copy a seasoned trader, you will imitate their trades and automatically open and close positions when the trader you copy opens or closes theirs.

Transaction fees for the trades users copy are usually the same as the regular fees for the user’s tier level. However, you will need to share your profit with the lead trader, usually about 8 – 13% of your results. Additionally, you can set a maximum amount per order and a maximum amount for the trader you are copying.

For instance, you can set your maximum amount per order at 50 USDT and your maximum amount for the trader at 500 USDT. After the lead trader has opened 10 positions, you will have an invested margin of 500 USDT, which is your maximum limit. So, if the trader opens an eleventh position, you won’t copy them.

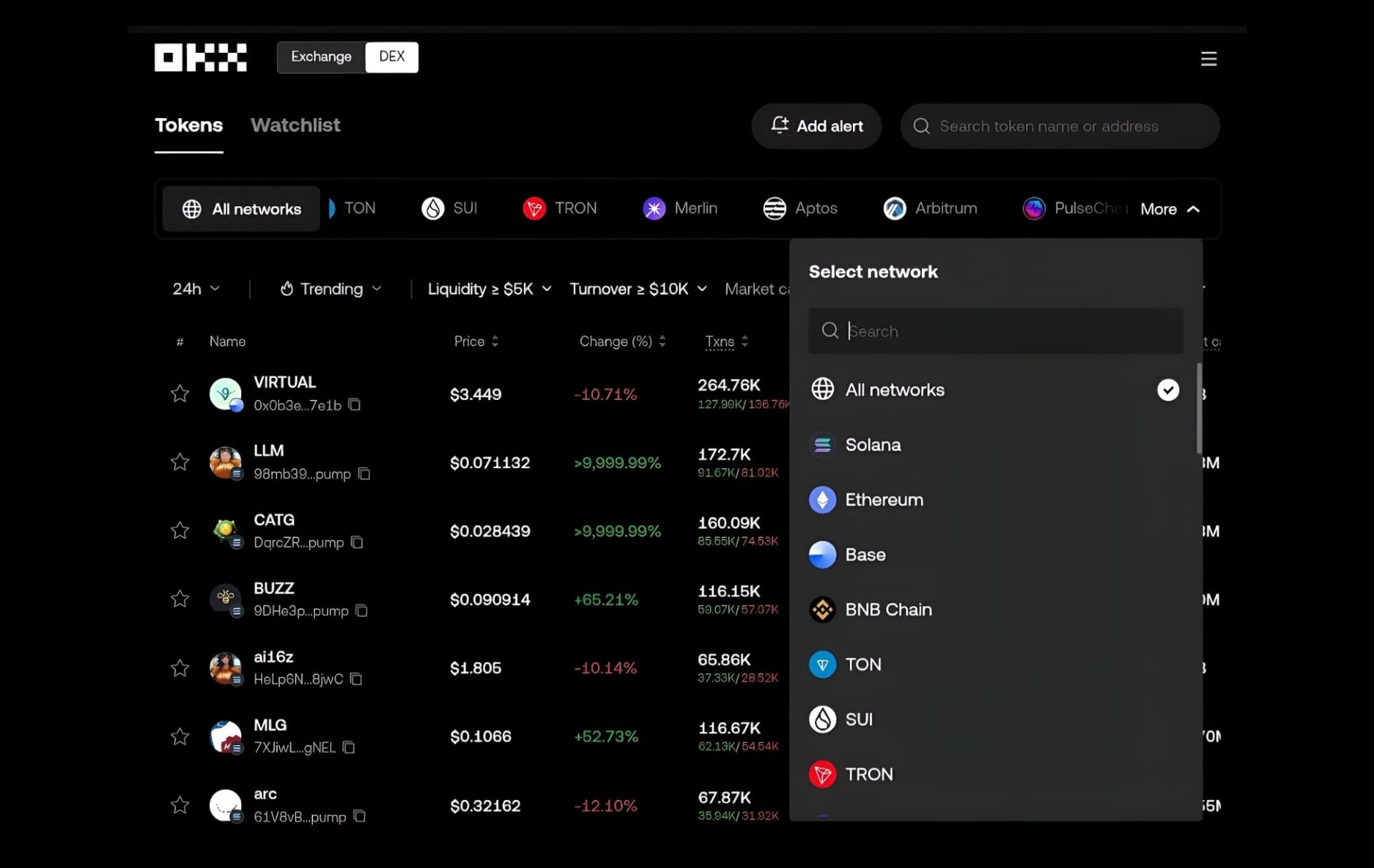

OKX Wallet

OKX Wallet is now one of the best-decentralized wallets on the market. It supports many blockchain networks and enables users to access and explore the Web3 world. Unlike the OKXX exchange, with the OKX wallet, you have full control of your assets and private keys because the wallet is entirely decentralized and non-custodial.

The OKX Web3 wallet is designed to provide a full-fledged and seamless Web3 experience. It has a built-in DEX aggregator for multi-chain and cross-chain transactions, so you can switch between supported networks instead of creating multiple wallets on various chains.

Additionally, you can engage in yield farming, go through the NFT marketplace, and explore over 1,000 DApp protocols. Now, here are the benefits of using the OKX web3 wallet:

- Gives you full control and ownership of your assets and wallet.

- Quick crypto withdrawals without an approval process, unlike crypto exchanges.

- Multi-chain wallet that automatically recognizes and connects to different blockchain technology networks without requiring manual user switching.

- Manage crypto assets on over 60 chains, including Ethereum, Aptos, Optimism, and BSC.

- Available on iOS, Android, and web browsers.

Remember that the OKX Web3 wallet does not save your seed phrase, private key, or password; you are responsible for these.

OKX Mobile App

OKX offers a mobile app with a user-friendly interface for buying, selling, trading, and managing crypto even when you are on the move. Unlike the desktop interface, the OKX app provides a simple and clean view, perfect for beginners, and an advanced mode for more experienced traders.

The OKX app is available on Apple Store and Play Store, and the registration process is straightforward. While the mobile app version is faster and more user-friendly, it still has all the tools available on the web interface and everything you need to manage your digital assets.

With a few taps, you can easily buy, sell, and convert crypto using fiat or other crypto assets, even though fiat withdrawals may not be as smooth as crypto withdrawals. Users can also explore the various trading options, set limits, and market orders with TP/SL, trail stops, etc., as you would do in the desktop version.

In addition, the OKX app offers margin trading with leverage of up to 10X. For derivatives, its futures contracts and perpetual swaps have leverage up to 125X, and you can set alerts to receive notifications when specific changes occur in your trades.

How to Open New Account and Trade on OKX?

Follow these steps to open an account and trade on OKX.

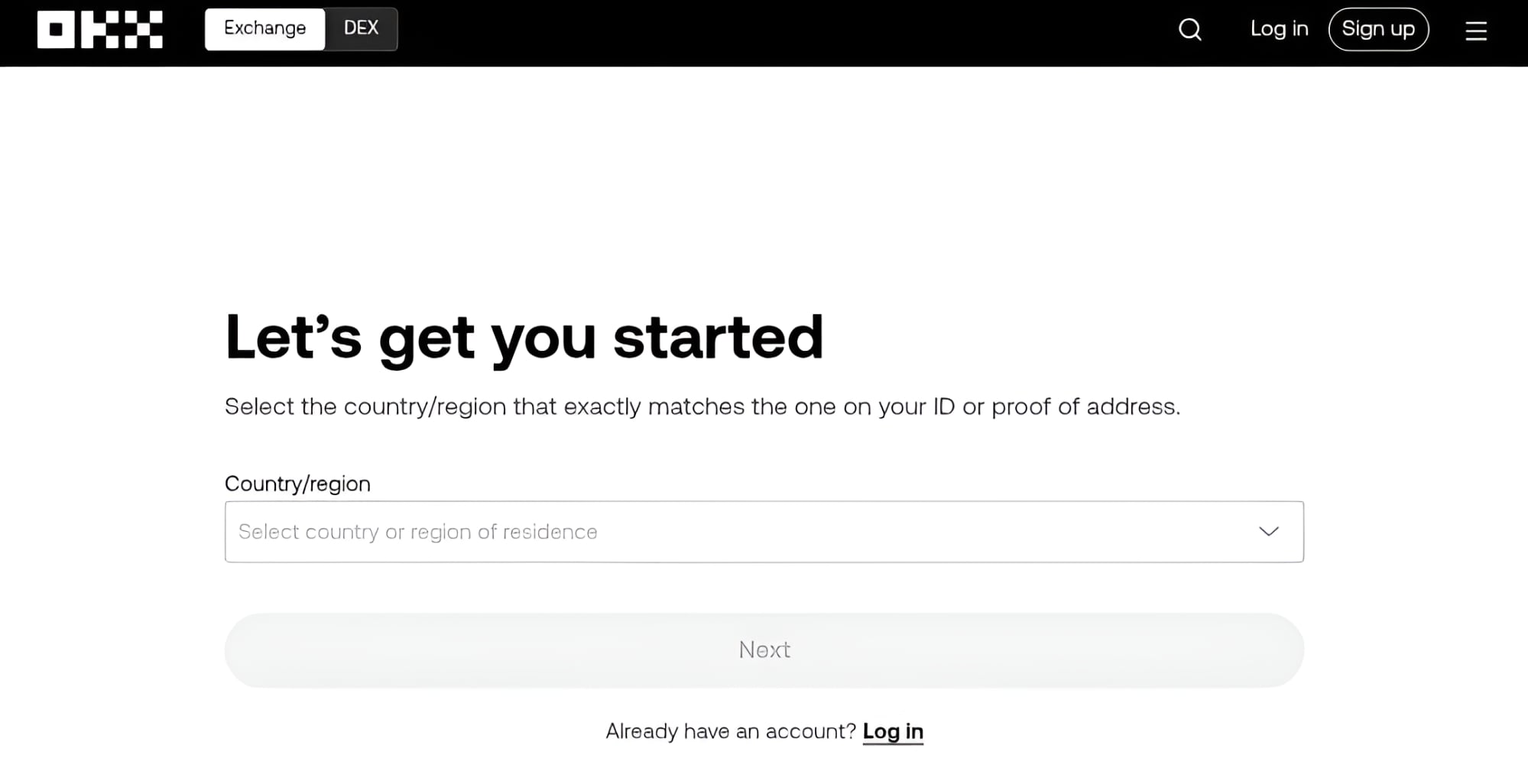

Step 1: Select your country or region and agree to the terms and privacy agreement, then click “Next.”

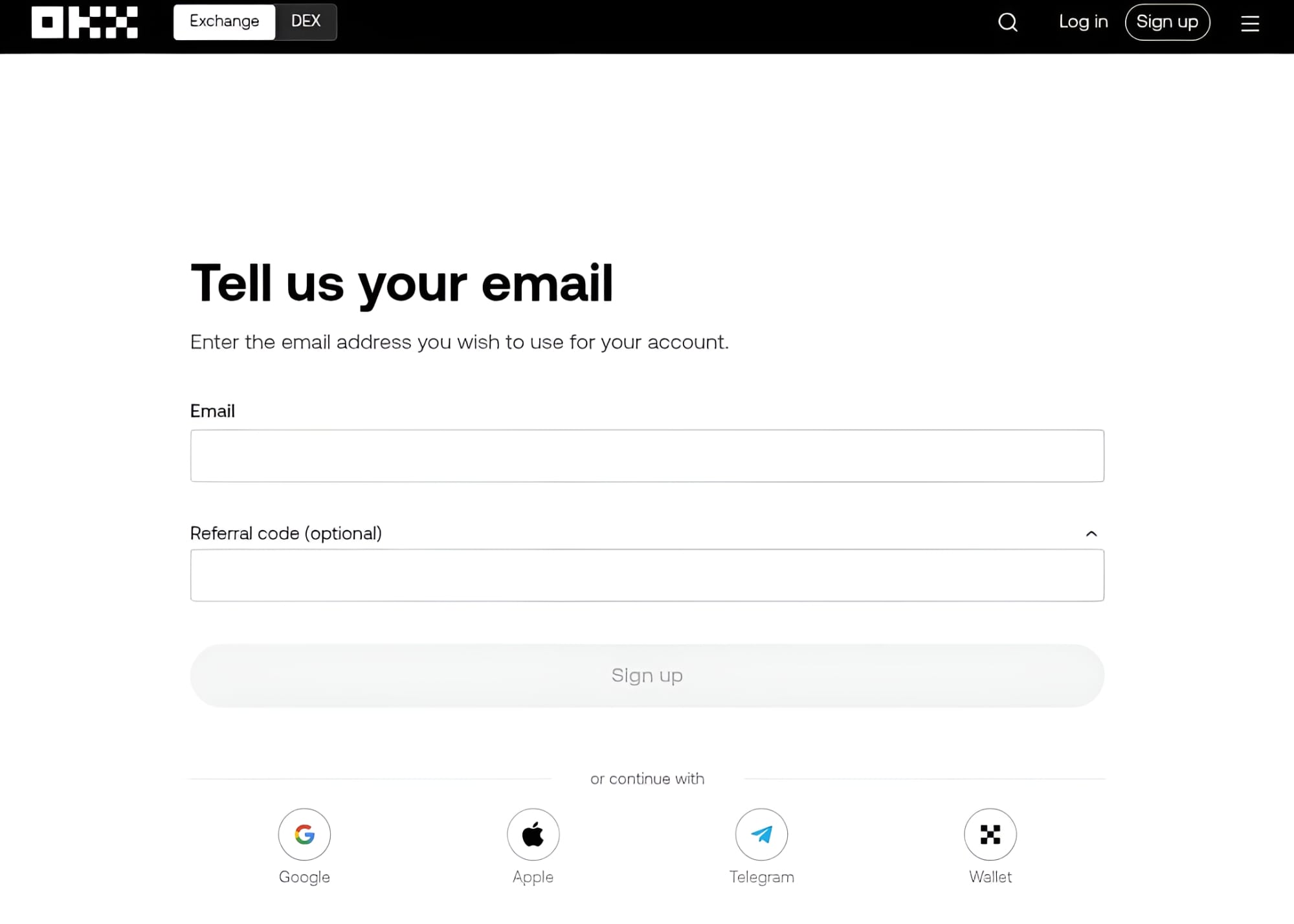

Step 2: Use your email to register and add the OKX referral code “CNJREVIEW.”

Step 3: OKX will email you a verification code. Once you add the code, it’s time to verify your number. They will send you another code via text.

Step 4: Create a secure password to protect your OKX account. We recommend creating at least a 12-word long password.

Step 5: Verify your identity by completing the KYC verification process. OKX will verify your documents within 24 hours.

To start trading crypto on OKX, follow the following steps:

Step 1: Deposit Funds

You need to fund your OKX account to begin cryptocurrency trading on OKX. You can deposit cryptocurrency from another wallet or use fiat options like credit cards (Visa, Mastercard), bank transfers, or peer-to-peer (P2P) transactions.

If you want to deposit crypto, go to the ‘Assets’ tab and select ‘Deposit.’ Choose the cryptocurrency and the network you want to deposit. Then, transfer the cryptocurrency to the generated wallet address.

Step 2: Choose Your Trading Method

Go to the ‘Trade’ section to see the various trading options OKX crypto exchange offers. Depending on the kind of trade you want to do, choose between spot or derivatives (futures, margin, and perpetual swaps).

For beginners, starting with the spot market or using the copy trading tool to imitate experienced traders is advisable.

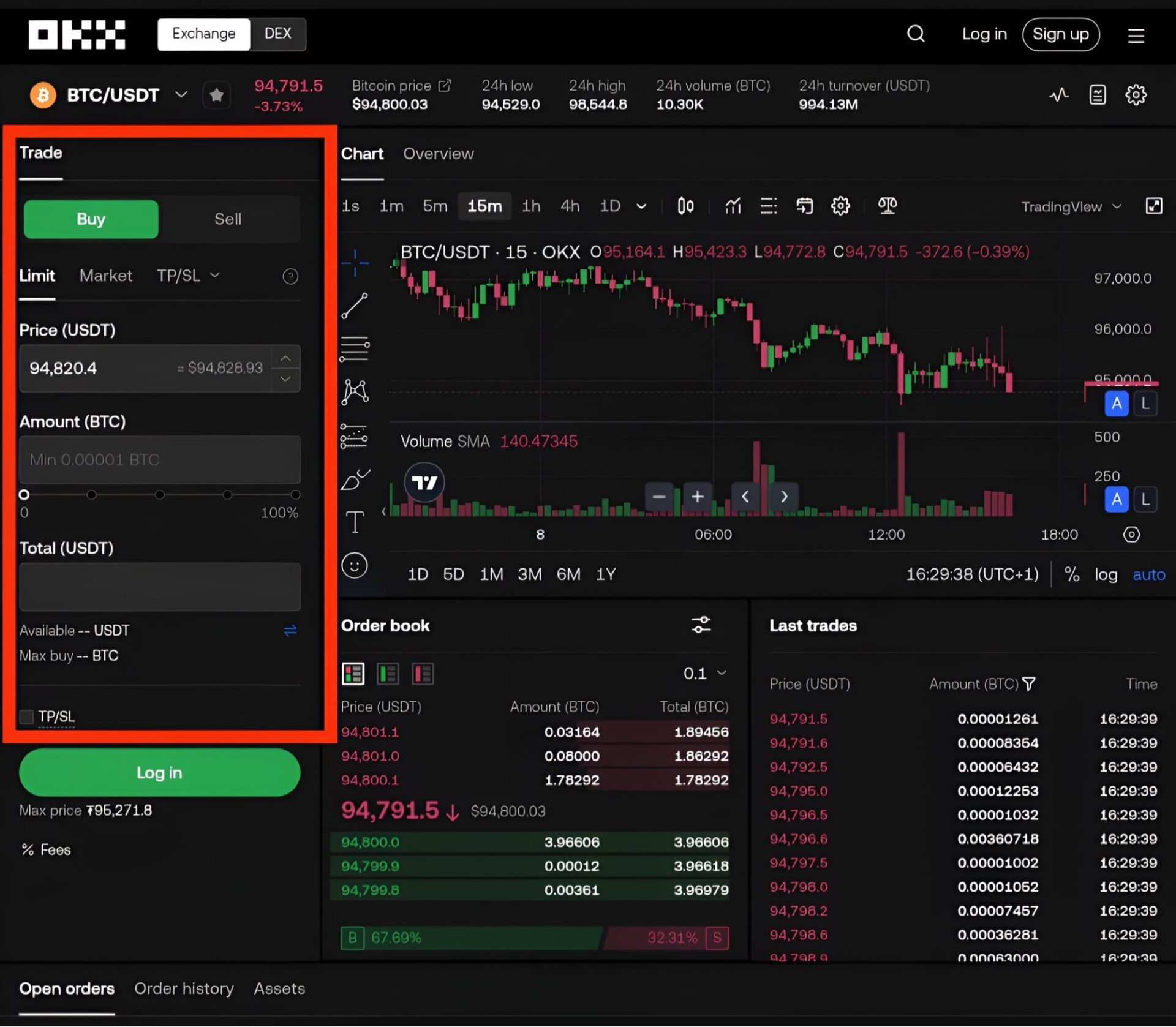

Step 3: Place Your First Trade

Select the pair you want from the spot or futures market, like PEPE/USDT or BTC/USDT. Since this is your first trade, we recommend you use a small amount of money to trade.

Use the order window on the right to place buy or sell orders. You can choose between different order types:

- Market Orders: Execute immediately at current prices.

- Limit Orders: Set a specific price you want to buy or sell crypto.

- Stop Orders: Execute when a certain price condition is met.

Finally, confirm your order, and it will be executed according to the order types you choose.

Does OKX Require KYC?

Yes, OKX does require KYC. The process is similar to that of other exchanges. To confirm your identity, you must submit personal identification documents, such as a selfie, a passport, or a driver’s license. Ensure that the information on your ID matches the region/country you picked during the account registration process.

Is OKX Safe and Legit to Trade Crypto and Bitcoin?

OKX is safe and legitimate to trade crypto and Bitcoin. The platform is considered as one of the best cryptocurrency exchanges with the cleanest interfaces. It is designed with simple and advanced modes to cater to various users. Additionally, if you are a beginner, the mobile app is better for learning, and you don’t have to worry about missing anything because it has all the features on the desktop version.

OKX offers some security features, including offline asset storage, a risk shield, multi-factor authentication, passkeys, anti-phishing codes, and withdrawal address whitelisting.

- Cold Wallet Storage

95% of assets on OKX are stored in offline wallets, which are not susceptible to hacks and security breaches. The company limits how much cryptocurrency can be stored in a single cold wallet address to further protect user funds assets stored offline.

Each address can hold a maximum of 1,000 BTC. This spreads the total amount of offline assets across multiple wallets, preventing a single point of failure. Once the funds in one cold wallet are withdrawn, new deposits will no longer be received.

- OKX Risk Shield

OKX crypto exchange sets aside a percentage of the platform’s assets, over $700 million, to safeguard money and users from potential breaches. The risk fund is similar to Binance’s Secure Asset Fund for Users (SAFU), which protects against security breaches and market volatility.

3. Multi-factor Authentication

Once you open an account on OKX, it is important to up your security. You can do this through the profile icon. There, you will find various security measures to activate.

Start with two-factor authentication (2FA), then activate passkeys and authenticators. If you decide to activate the Google Authenticator app, keep the code you will be given safely. If you lose your phone or change devices, you can use it to log in to your authenticator app.

4. Anti-phishing Codes

This security feature allows users to double-proof their account security. When you activate it, OKX will email you a code that helps you differentiate between legitimate communications and suspicious emails.

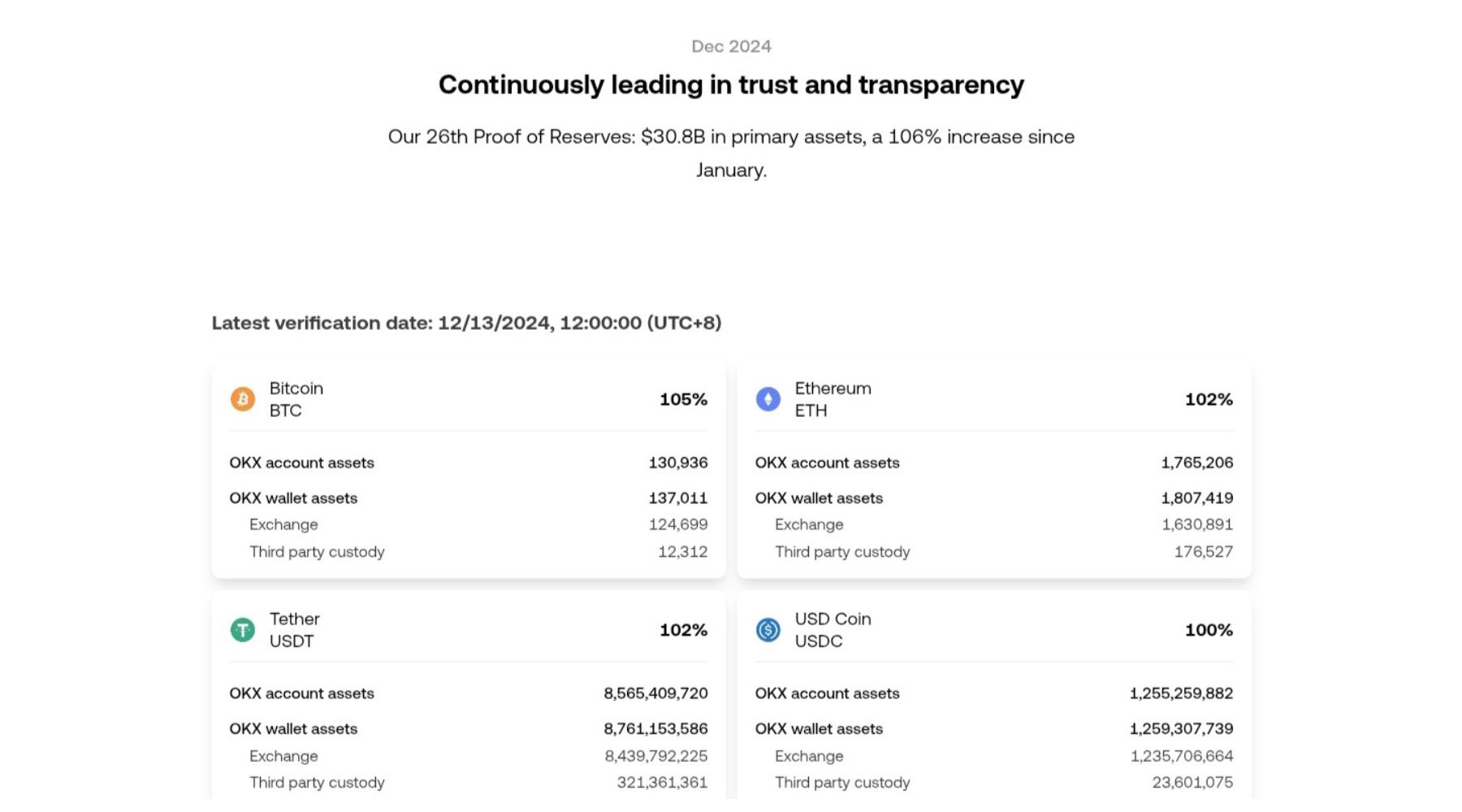

5. Proof of Reserves

OKX published their December 2024 proof of reserve data and they’re holding over USD 30.8 billion in reserves. This includes some of the most popular cryptocurrencies like Bitcoin (105%), Ethereum (102%), and stablecoins such as Tether USDT (106%) and USD Coin (100%).

The PoR is published monthly, and the company uses advanced cryptographic methods, including zero-knowledge proofs, to ensure full transparency while protecting user privacy. You can independently verify your assets through OKX’s dashboard and public wallet addresses.

6. Withdrawal Address Whitelisting

OKX allows users to choose which wallet addresses are allowed for withdrawals through the address whitelisting feature. Any address outside the pre-approved addresses will automatically be blocked. So, even if someone tries to hack into your account, they cannot move funds to any address since they are not on the list.

The post OKX Crypto Exchange Review: Is It Safe & Legit to Buy Bitcoin in 2025? appeared first on CryptoNinjas.