CleanSpark Increases Bitcoin Holdings by 6% in March: What to Expect?

Key Takeaways:

- CleanSpark’s operating efficiency saw it add 6% more Bitcoin to its stash in March.

- CleanSpark remains in a healthy financial state of affairs and has focused on Bitcoin despite stock headwinds.

- The four strategic expansions it has done in as many states reflect the company’s plans for future growth in this competitive landscape.

One of the more notable figures in the Bitcoin mining industry, CleanSpark, has urged a major expansion of its Bitcoin treasury. Their latest report shows the company’s holdings increased by about 6% in March. While the stock market presents challenges for Bitcoin miners, CleanSpark continues to methodically grow its Bitcoin position. This steady accumulation strategy underscores CleanSpark’s confidence in Bitcoin’s long-term value and resilience despite market volatility.

Mining Performance — Let’s Deep Dive

In February, CleanSpark mined 624 Bitcoins. With the Bitcoin price at around $89,000 at the time of publication, that haul was worth more than $55.6 million. Even more impressively, they did so in February, a shorter month. Such output reflects the company’s commitment to operational performance and mining expertise. By maintaining high production levels even during shorter months, CleanSpark showcases its ability to optimize mining operations efficiently.

One of CleanSpark’s main facets is efficiency. Their average fleet efficiency was 17.07J/Th (Joules per Terahash) and peak efficiency was 16.82J/Th. Miners are particularly interested in this metric. A highly efficient mining fleet not only reduces operational costs but also enhances profitability, making CleanSpark a strong competitor in the industry. A lower J/Th means more energy efficient and saves money, resulting in greater profits. This makes them uniquely positioned in a field where energy usage is a critical focus point.

Treasury Management: A Long-Term Approach

CleanSpark is not only actively mining and managing its Bitcoin holdings, but also strategically managing its treasury. In February, CleanSpark disposed of minuscule amounts from its Bitcoin — only 2.73 BTC, at an average price north of $95,000 per BTC. Most of that mined Bitcoin went into their corporate treasury.

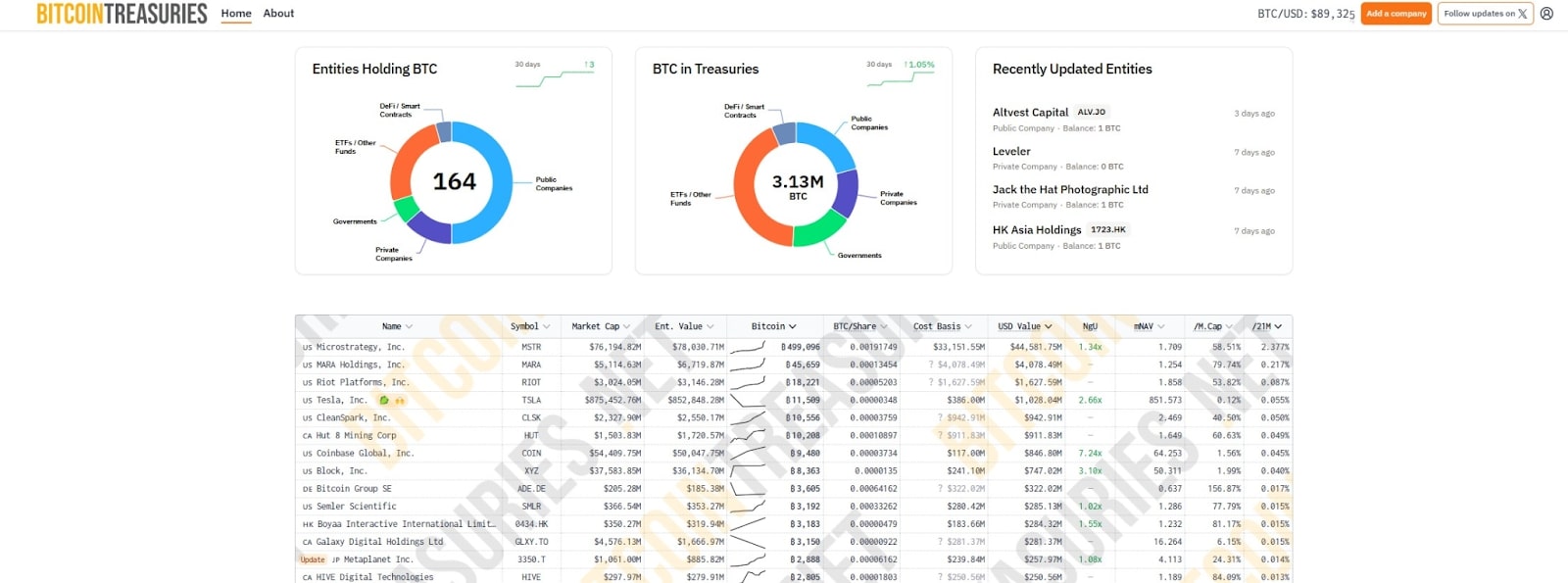

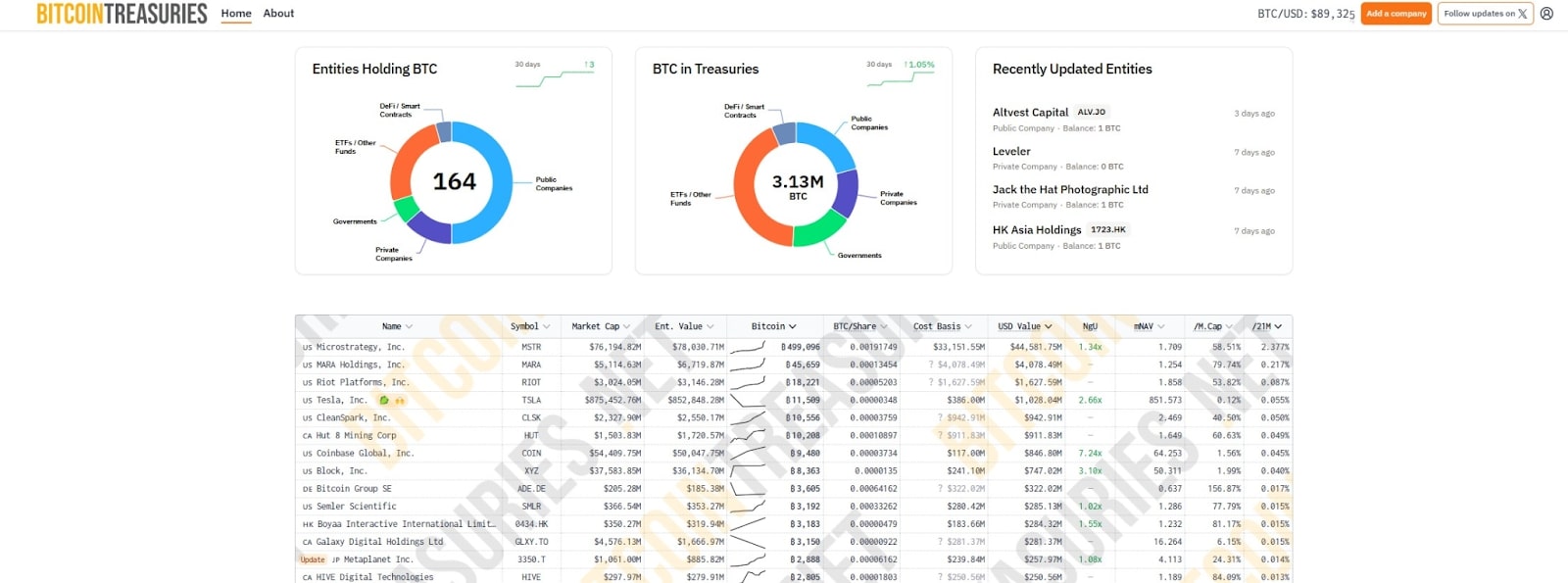

And as of Feb 28th, CleanSpark owned 11,177 BTC. This puts them among the largest corporate holders of Bitcoin in the world. According to data from BitcoinTreasuries.net, CleanSpark has become one of the largest BTC treasuries in the world belonging to a single corporation.

CleanSpark is the 5th largest Bitcoin holder.

Creating the Basis for Growth: Growth through Strategy

CleanSpark isn’t simply sitting on its current mining operations. Indeed, the company was on the move, expanding its infrastructure throughout a half-dozen states. These expansions will allow them to greatly expand their mining capabilities and fortify their place among peers in the market. With an increasing number of miners entering the field, CleanSpark’s proactive approach to expansion ensures it remains ahead of the curve.

- Georgia: CleanSpark is ramping up its use of immersion cooling technology in its existing facilities. Traditional air-cooled rigs vent heat into the environment but can be difficult to keep cool on the network during warmer months.

- Wyoming: 35 MW (megawatts) of new power contracts signed in Cheyenne, with more on the way. Bitcoin mining requires access to reliable and affordable power and this acquisition reflects CleanSpark’s dedication to obtaining the power necessary for continued growth.

- Tennessee: A 48 MW facility is under construction in Jackson. The new facility will add dramatically to CleanSpark’s hashrate and in the coming quarters will allow them to continue to expand their growing presence in the mining space.

These expansions are not only about increasing Bitcoin production. They are also about varying the company’s geographic footprint and reducing regional regulatory risks; and ensuring access to alternative energy sources. This tactical diversification is indicative of a soundly managed and future-oriented company. By mitigating regulatory risks and securing access to cost-effective energy, CleanSpark sets itself up for sustainable long-term growth.

More News: CleanSpark Hits 10,000 Bitcoin – What’s Driving Their Growth?

The Resourceful Financial: Thriving In The Face Of Market Uncertainty

CleanSpark is financially doing great. The mining company posted a total revenue of $162.3 million for the first fiscal quarter of 2025, a staggering 120% increase year-on-year. The company also reported earnings of $241.7 million, or $0.85 per share, an incredible jump from $25.9 million last year.

It is further enhanced by a recently completed $650 million convertible bond and the completion of an “at-the-market” offering program. CleanSpark now holds about $2.8 billion in assets and $1.2 billion in liquidity owing to these financial maneuvers.

CleanSpark’s emphasis on pure Bitcoin mining and treasury management might raise questions for some investors who prefer diversified revenue streams. However, CleanSpark CEO Zach Bradford has defended this strategy, arguing that focusing solely on Bitcoin mining allows the company to optimize its operations and maximize its exposure to Bitcoin’s potential upside.

CleanSpark’s financial prudence, coupled with its strategic focus, positions it to weather market fluctuations more effectively.

The post CleanSpark Increases Bitcoin Holdings by 6% in March: What to Expect? appeared first on CryptoNinjas.