Bybit Exchange Review: Is It Safe & Legit to Buy Crypto in 2025?

Bybit is a popular cryptocurrency derivatives exchange with a powerful order-matching engine that can handle 100,000 transactions per second for each contract. Bybit operates as one of the safest and highest-liquidity cryptocurrency trading platforms, with over 60 million users worldwide and over 1,650 digital assets for trading.

In this Bybit exchange review, we will cover what Bybit is, explore its best features, and explain the trading fees. We will also discuss how to open a new account to buy and sell crypto on Bybit. Additionally, we will address the question, “Is Bybit safe and legitimate to buy and sell crypto in 2025?“

Bybit Review: What Is It?

Bybit is a cryptocurrency exchange that has existed since 2018. Its headquarters are in Dubai. This crypto exchange is licensed as a Virtual Asset Service Provider in Dubai and regulated by Cyprus authorities.

The platform is known for offering a wide range of cryptocurrencies. With Bybit, you’ll find over 1,650 cryptocurrencies available for spot trading. Bybit concentrates on advanced trading tools such as providing perpetual futures contracts, margin trading, copy trading, and trading bots.

The exchange is also highly secure, with no significant security breaches. It uses a cold wallet system to store assets securely and provide PoR data transparently. Also, beginners will find the user interface easy to navigate, and there’s plenty of educational content to get started. Plus, there’s an option to earn passive income through staking and liquidity mining.

| Launched | 2018 |

| Headquarters | Dubai |

| Licensed | VASP in Dubai, the Cyprus Securities and Exchange Commission, and Astana Financial Services Authority, Kazakhstan |

| Supported Cryptocurrencies | 1,650+ |

| Trading Features | Spot trading, 100x perpetual futures trading, margin trading, options trading, copy trading, and OTC trading |

| Earn Products | Flexible savings, fixed staking, crypto loans, dual investment, and more |

| Fees | Spot trading: 0.1% maker/taker

Futures trading: 0.02% maker and 0.055% taker Options trading: 0.02% maker and 0.03% taker |

| Security Measures | 2FA, cold storage, withdrawal address whitelisting, anti-phishing code, PoR data, etc. |

| KYC Verification | Yes (mandatory for trading, withdraw up to $20,000/day without KYC) |

| Payment Methods | Bank transfer, credit/debit card, crypto transfer, third-party payment processors like MoonPay, Simplex, Banxa, etc. |

| Mobile App | Yes (Android and iOS) |

| Restricted Countries | The United States, the Chinese Mainland, Hong Kong, Singapore, Canada, France, the United Kingdom, etc. |

Are you new to Bybit? Get up to a $30,000 sign-up bonus and enjoy a 30% discount on trading fees!

Where Is Bybit Located?

Bybit is located in Dubai, United Arab Emirates, where it operates under a license from the Virtual Assets Regulatory Authority (VARA). It also holds regulation from the Cyprus Securities and Exchange Commission and the Astana Financial Services Authority in Kazakhstan. Bybit also opened its first European office in the Netherlands.

What Is The Pros of Bybit?

The pros of using Bybit are advanced trading features, a user-friendly interface, competitive fees, robust security measures, and many supported cryptocurrencies.

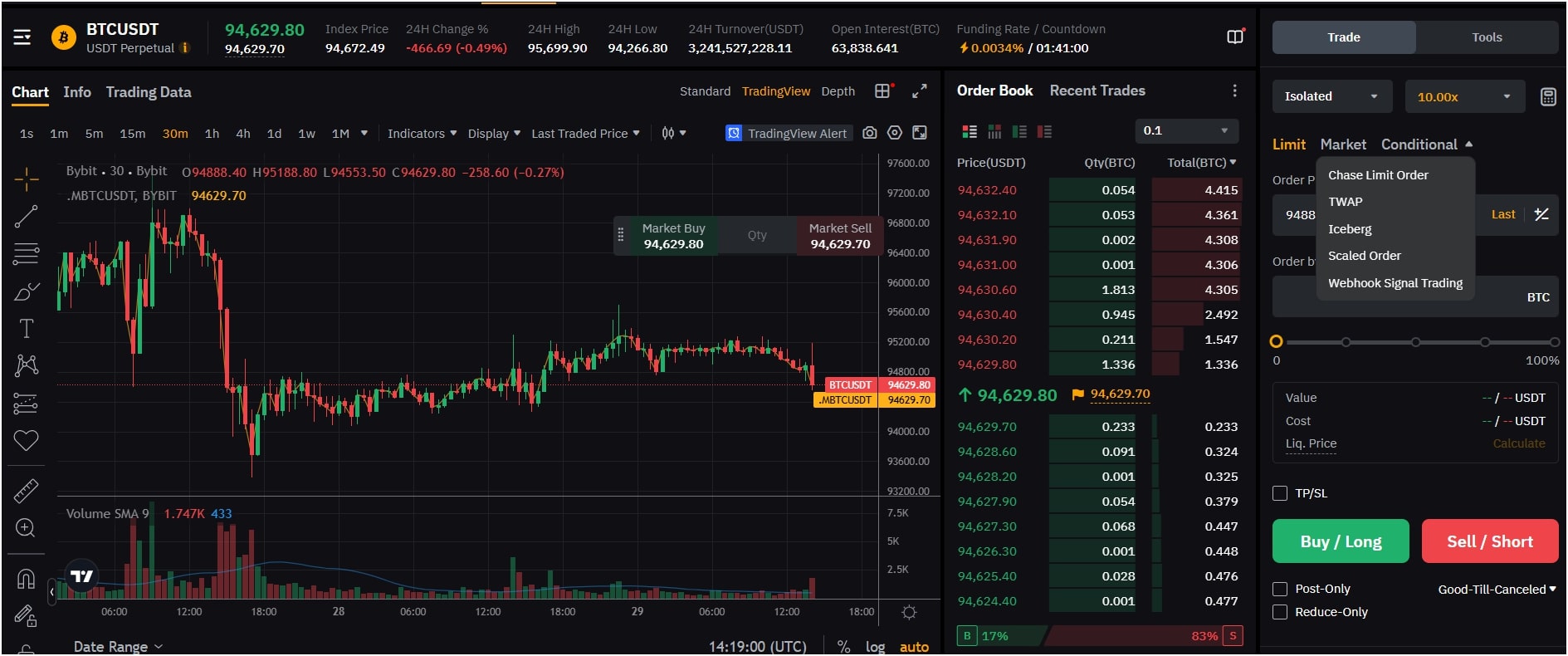

- Advanced Trading Features: Bybit offers advanced trading features such as futures trading, margin trading, copy trading, and options contracts. These trading tools allow you to increase your buying power using leverage. Some contracts on the platform offer up to 100x leverage. The platform also has various orders, such as limit, market, iceberg, and scaled orders.

- User-Friendly Interface: The platform is straightforward, regardless of whether you work at a computer or a phone. It is easy for both beginners and experienced traders. The simple navigation, TradingView integration, and easy deposit and withdrawal make it best for beginners.

- Low Trading Fees: Bybit has low trading fees, which is always suitable for saving money. For futures, taker and maker fees start as low as 0.055% and 0.02%. Spot trading fees are also competitive, around 0.1% maker/taker.

- Strong Security: It uses cold storage to keep most funds safe. It also has two-factor authentication for extra protection. There is no history of major hacks on the platform, which is reassuring for users.

- Wide Range of Supported Cryptocurrencies: Bybit supports more than 1,650 cryptocurrencies. This variety means you can explore and invest in different markets easily. You can invest in all niches like AI, RWAs, NFTs, metaverse, smart contracts, etc.

What Is The Cons of Bybit?

The cons of using Bybit are limited fiat currency support (including no direct fiat-to-bank withdrawals in some countries) and the fact that it is unavailable in the US, Canada, and the UK.

- The limited fiat support: Bybit mainly works as a crypto-to-crypto exchange. Hence, there are very few options for depositing or withdrawing fiat money. Also, in some countries, there is no direct option to withdraw fiat money into your bank account, which can be inconvenient.

- Not Available in Some Countries: Due to crypto rules and regulations in these countries, Bybit doesn’t offer services in the US, UK, and Canada.

How Many Cryptocurrencies Are Available on Bybit?

There are over 1,650 cryptocurrencies available for trading on Bybit, covering all popular sectors, including AI, NFTs, RWAs, layer-1, layer-2, metaverse, GameFi, meme-coins, and more.

Here are some popular cryptocurrencies available on the platform:

- Bitcoin

- Ethereum

- Solana

- Cardano

- Polkadot

- Chainlink

- Avalanche

- Dogecoin

- Shiba Inu

What Are The Best Features of Bybit?

The best features of the Bybit exchange are Bybit derivatives trading, the Bybit trading bot, Bybit copy trading, the Bybit savings and earn program, the Bybit crypto card, and Bybit Launchpool and pre-market trading.

Here is a complete overview of each Bybit feature:

Bybit Derivatives Trading

Bybit futures trading is a way to invest in the price of cryptocurrencies without actually owning them. In derivatives trading, you’ll come across terms like USDT perpetuals, USDC perpetuals, and inverse perpetuals. These sound complicated, but they’re just different types of futures contracts.

USDT perpetual contracts are settled in USDT, a stablecoin pegged to the US dollar. USDC perpetual contracts are similar but use USDC instead of USDT for settlement.

Inverse perpetuals work differently – they are settled in the underlying cryptocurrency itself. For example, if you’re trading a BTC inverse perpetual, it’s settled in Bitcoin, not a stablecoin.

You can trade with up to 100x leverage on futures. This means that if you have $100, you can control a position worth $10,000.

Bybit offers different order types for futures trading:

- Market Order: A market order allows you to buy or sell any cryptocurrency at a present market rate. It is instant and straightforward because you buy the coins right away. But, in this case, you may experience slippage when buying or selling.

- Limit Order: A limit order lets you set the exact price you want to buy or sell. If the market reaches that price, your order will be filled automatically. Nonetheless, the market may not touch your price, and the order will remain unfulfilled.

- TWAP (Time-Weighted Average Price): TWAP breaks your large order into smaller ones, helping to avoid price slippage. This strategy works well when trading in high volume.

- Iceberg Order: An iceberg order hides the full size of your trade, showing only a small part at a time. Once the visible portion is filled, the next part becomes active. This is generally useful to traders who are trading large amounts and don’t want to alert other traders.

- Scaled Order: A scaled order splits a big order into multiple smaller ones, each at a different price level. It’s very useful for setting up trades across a range to cover different market conditions.

Bybit also offers margin trading, which involves borrowing funds to increase your trading amount. You can use up to 10x leverage on Bybit when trading on margin.

Bybit offers two types of margin: isolated-margin and cross-margin.

- An isolated margin means you risk only the amount you’ve set aside for a specific trade.

- Cross margin uses your entire account balance to prevent liquidation. It’s a bit of a double-edged sword. While it can save your position from being liquidated, it also puts your entire balance at risk.

Bybit also has an options trading market. Options trading means buying the right to buy or sell an asset at a specific price before a certain date. But unlike futures, you’re not obligated to follow through. The exchange currently offers only three options contracts – BTC, ETH, and SOL.

Bybit also uses a margin system for options trading. The platform uses two margin modes for options: cross-margin and portfolio margin. Cross margin covers a single position, while portfolio margin calculates risk across your entire portfolio.

Bybit Trading Bot

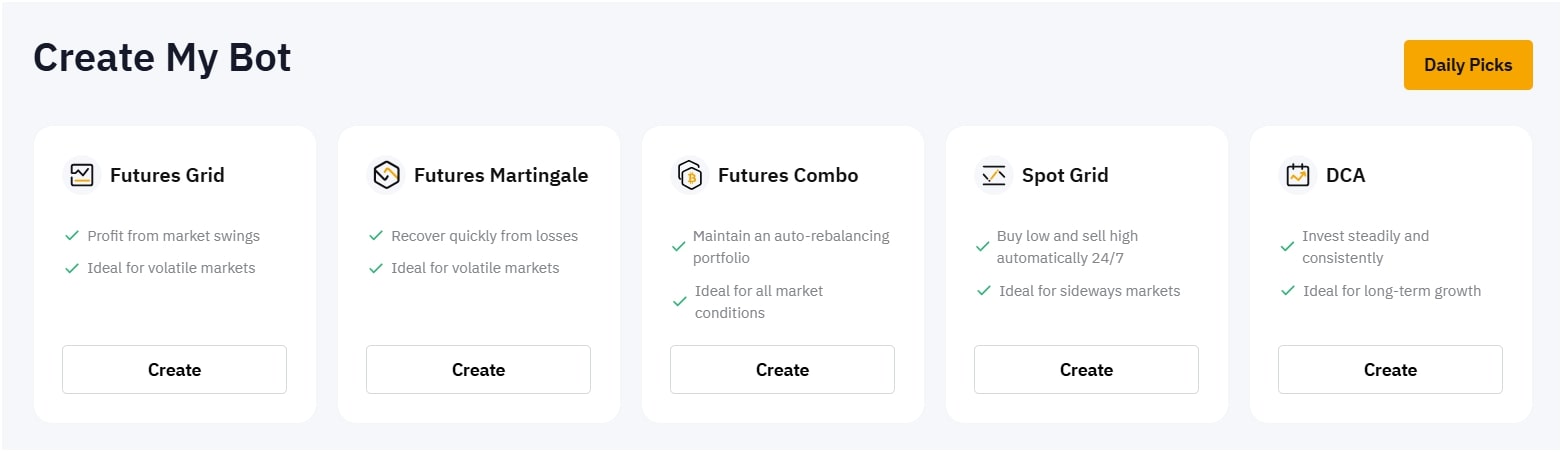

Bybit trading bots are automated tools that trade cryptocurrencies for you. Generally, they work by following a set of rules to execute trades based on market movements. Bybit offers four types of trading bots: Futures Grid, Futures Martingale, Spot Grid, and DCA.

Here is a quick overview:

- Futures Grid Bot: The Futures Grid Bot is known for trading perpetual contracts. It works by placing buy orders below a reference price and sell orders above that price. Think of it as just making a grid of trades at different levels. It works best in markets with many ups and downs, as it profits from every price swing. You can set it as a long or short position, depending on how you predict the market will move.

- Futures Martingale Bot: This is a more aggressive approach. It increases the trade size after losing to recapture the lost amount when the market turns your way. This can be risky in unpredictable markets as it requires much money to sustain the increased trade size. The losses may quickly pile up if the market keeps going against you. So, careful monitoring is really needed, with an excellent understanding of the risks involved.

- Spot Grid Bot: The Spot Grid Bot works on spot markets. Similar to a futures grid bot, it is designed to do one simple task: buy low and sell high. It is ideal for sideways markets where prices tend to be in a range.

- DCA Bot: The Dollar-Cost Averaging Bot is a long-term investment tool allowing you to invest a fixed amount in a cryptocurrency at regular intervals. This DCA strategy reduces volatility effects and removes pressure by trying to time the markets. It’s good for building the portfolio slowly and consistently over time.

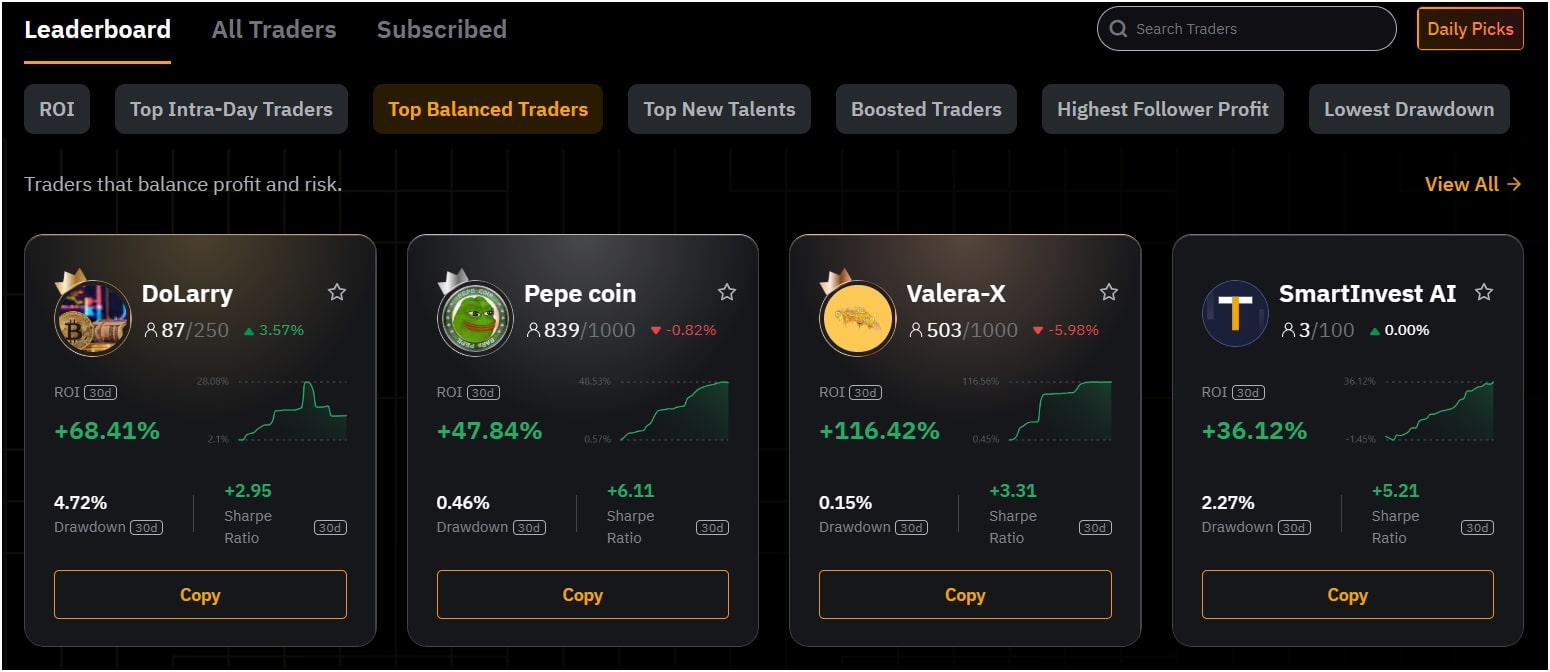

Bybit Copy Trading

Copy trading is a tool that allows you to copy the trades from the Master Traders. You do not have to analyze the market and decide on a trading strategy because a master trader has done this work for you.

It simply works on what ROI the Master Trader provides you, the Masters’ PnL, win rate, or profit-to-loss ratio. Bybit has made it easy to browse through a list of Master Traders, along with detailed stats to help you decide. For example, you can filter by risk level and ROI or find top intraday traders.

Master Traders earn a profit-sharing percentage based on their rank level: 10% for Cadet and Bronze, 12% for Silver, and 15% for Gold. All these motivate them to perform well and have more followers. Once you pick a trader, the trades are automatically mirrored within your account. You can also adjust trading parameters based on your risk level and requirements.

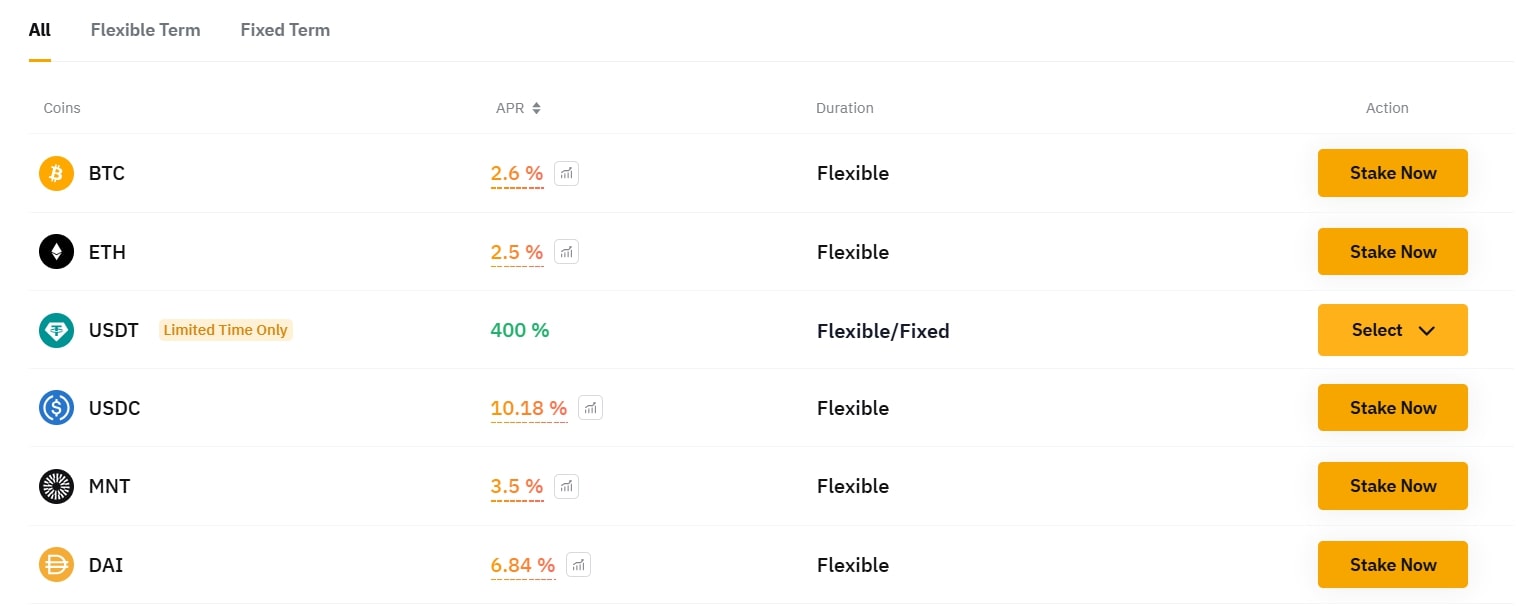

Bybit Savings & Earn Program

The Bybit Savings & Earn Program allows you to grow your crypto holdings passively. You can earn fixed or flexible APYs on your idle assets. Here are different types of Bybit earn products:

- Flexible Savings: Flexible savings allow you to earn interest on your idle crypto assets while keeping your funds accessible for withdrawal. You can deposit and withdraw anytime without any penalties. Hence, it’s perfect if you want liquidity while still earning from your idle assets. Generally, it offers around 10-20% APYs, which is lower than fixed staking.

- Fixed Staking: Fixed staking is the opposite of flexible, as it offers higher interest rates in exchange for locking your funds for a specific period, like 30 or 90 days. This option is great for those confident they won’t need the funds during the staking term. Simply, the longer the lock-in period, the higher the rewards.

- Dual Investment: Dual investment allows you to receive a higher yield by accepting more risk. You have to choose two assets (for example, BTC and USDT) and predict price, and the returns depend on the asset’s price at the settlement date. It’s for advanced users who know the market trend and don’t mind a bit of risk.

- Liquidity Mining: Liquidity mining provides liquidity to the trading pairs on Bybit’s platform and rewards users with incentives. It operates through pools, and you are paid in fees and incentives as you contribute.

- Crypto Loans: Crypto loans by Bybit enable you to borrow funds against your holdings in crypto. Their interest rates are competitive, and they have different loan terms. You can choose between flexible interest rates and fixed term rates (like 7-day, 14-day, or 30-day).

Bybit Crypto Card

The Bybit Crypto Card is an easy way to spend your crypto in the real world. It supports both online and offline payments, and crypto is automatically converted to fiat at the time of purchase.

The card supports popular cryptocurrencies, including BTC, ETH, XRP, TON, USDT, USDC, MNT, and BNB.

Its benefits include rewards for everyday purchases and up to 10% cashback. It even gives subscriptions for partners like Spotify, ChatGPT, Netflix, and Prime Video essentially free through a 100% rebate. In addition, it offers you up to 8% APY on idle assets linked to the card, which means your unused funds will still earn you passive income.

It is accepted across the world where major payment networks are supported, so it makes for a great travel companion as well. Additionally, you can also freeze or unfreeze your card directly through the Bybit app.

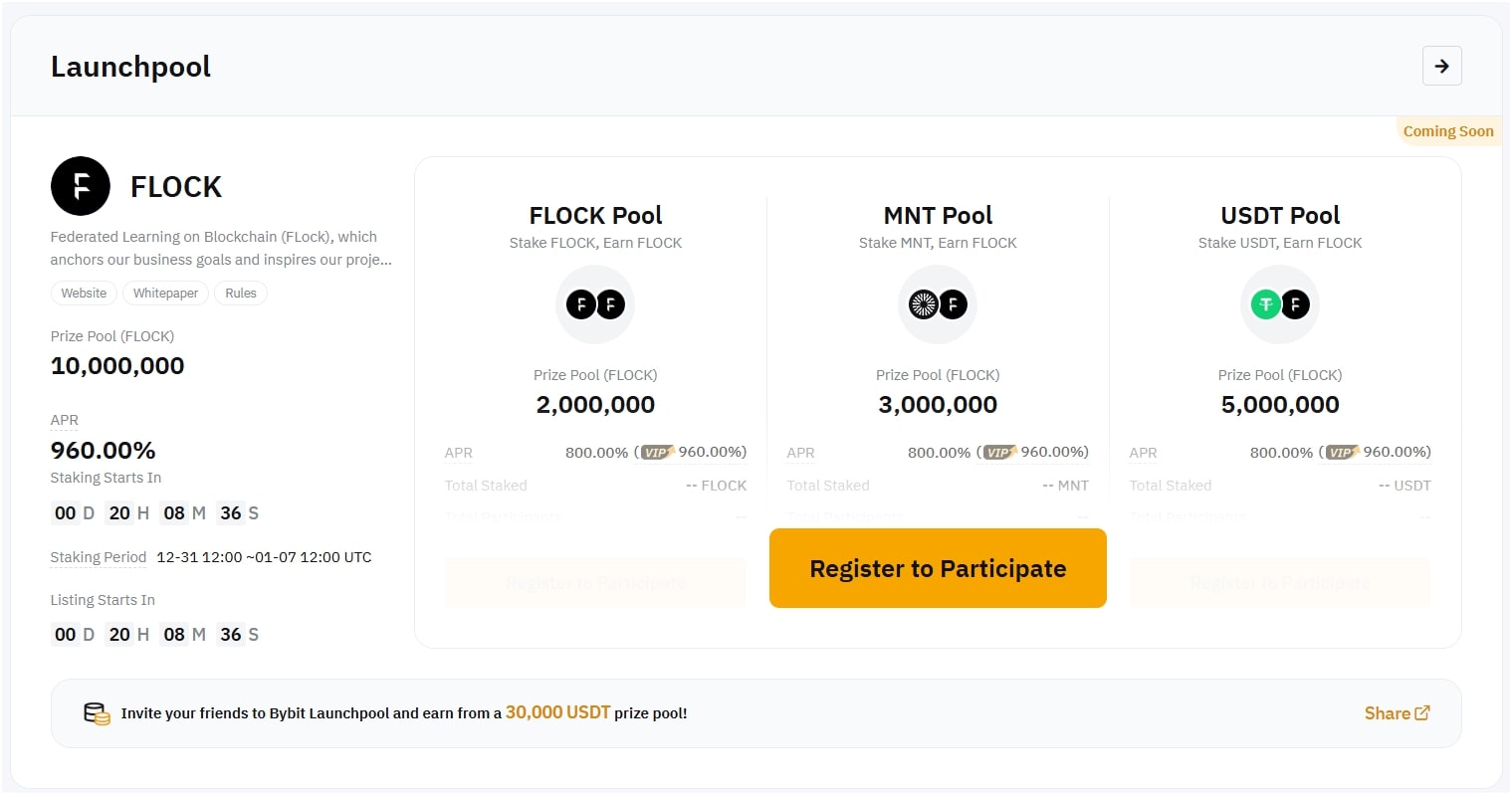

Bybit Launchpool and Pre-Market Trading

Bybit Launchpool is a platform to earn new tokens by staking your existing cryptocurrencies. Let’s say you already have some crypto in your account. Now, you can stake those tokens on Launchpool.

When you stake your crypto, you start earning rewards in the form of new tokens from projects that Bybit is working with. This means you’re holding your assets and at the same time earning more, all without buying something new. The best thing is that you don’t have to lock up your tokens for a long period. You can redeem them anytime you want. Your tokens are, therefore, not locked, and you get to participate in early-stage projects.

Pre-market trading is another feature that lets you trade tokens before they’re officially listed on Bybit. When a new token is about to be listed, you can create orders to buy or sell it even before it hits the spot market.

Bybit allows you to make over-the-counter (OTC) trades, meaning you can set your prices and wait for others to match your orders. This gives you a chance to get the token you want at a price you are really to pay. The trades get settled when both sides match up and the transaction is completed.

What Are Trading Fees on Bybit?

The trading fees on Bybit are 0.1% maker/taker for spot trading and 0.02% maker and 0.055% taker in the futures market, with discounts for high-volume traders. It uses a “maker” and “taker” fee system, which we’ll explain here:

- A “maker” is a trader who adds liquidity to the market. In simple words, you are a maker when you place a trade that does not get filled instantly. For example, you are a maker when you set a limit order, such as buying Bitcoin only if it falls to $90,000.

- A “taker” is a person who withdraws liquidity from the market. This occurs when you place an order that is filled immediately, such as a market order. Bybit charges takers a slightly higher fee than makers.

Spot Trading Fees:

Bybit charges 0.1% maker/taker fees for spot trading. If you’re part of Bybit’s VIP program, these fees can go even lower, starting at 0.08% for takers and 0.0675% for makers at VIP Level 1.

Futures Trading Fees:

For futures trading, Bybit charges a taker fee of 0.055% and a maker fee of 0.02%. Similar to spot fees, these charges are further reduced with joining the VIP program; taker fees start from 0.04% and maker fees start from 0.018% for VIP Level 1.

Options Trading Fees:

For options trading, Bybit charges a taker fee of 0.03% and a maker fee of 0.02%. Similarly, for VIP Level 1, taker fees start at 0.02% and maker fees at 0.015%.

Deposit and Withdrawal Fees:

Bybit does not charge any fees for deposits. You can freely send cryptocurrencies from your wallet or exchanges to Bybit without extra trading costs. But, a fee could be imposed by the wallet provider or the blockchain network on your transaction.

Bybit charges a small withdrawal fee. Bybit doesn’t set the withdrawal fee; the blockchain network determines it. For example:

- Bitcoin (BTC network): The withdrawal fee is 0.000137 BTC. This is lower than many other crypto exchanges.

- Ethereum (ERC-20 network): Withdrawing fee is 0.0015 ETH.

- Tether: The fee is dependent on the network you’re using. For instance, If you’re using the ERC-20 network, that’s on the Ethereum chain, it charges you up to 10 USDT. But if you’re using the Tron (TRC-20) network, then it only charges you 1 USDT.

Liquidation Fees:

Bybit doesn’t charge any liquidation fee for Perpetual and Futures Trading. But, there is a 2% liquidation fee for spot margin trading and crypto loans and a 0.2% fee for options contracts.

How to Open A New Account to Buy and Sell Crypto on Bybit?

To open a new account to buy and sell crypto on Bybit, you need to create a Bybit account, complete KYC verification, deposit funds, and start buying and selling crypto. Here is a step-by-step guide on how to open a Bybit account to buy and sell crypto:

Step 1: Create a Bybit Account

Go to the official Bybit website at “https://www.bybit.com”. Click on the “Sign Up” button, usually in the top right corner of the homepage. You will have to sign up with a personal email address or phone number. Fill up the information, then proceed to set up a very strong password and agree to terms of service.

In the registration process, you will find a referral code field; please apply our Bybit referral code “CNJREVIEW” to get up to $30,000 USDT as a sign-up bonus. You will receive a verification code in your email or phone; use it to complete the registration process.

Are you a new user? Get up to a $30,000 sign-up bonus and enjoy a 30% discount on trading fees!

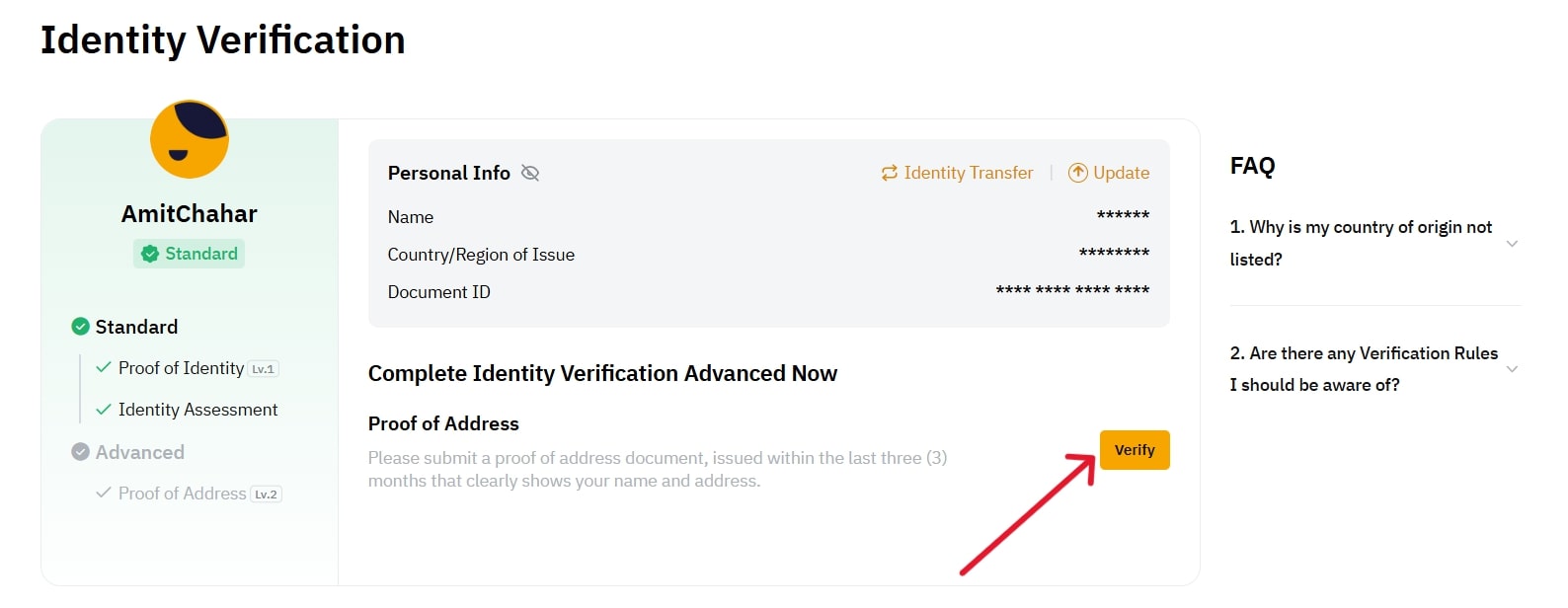

Step 2: Complete KYC Verification

Now, go to the “Account” section, you will find this under the profile icon, and choose “Identity Verification” to start the KYC process. There you’ll be required to fill in personal details, upload ID documents, and probably take a selfie to confirm your identity.

Important Note: Bybit accepts withdrawals without a need for KYC verification, but in order to deposit funds and trade, an ID verification is required. Without KYC, your daily withdrawal amount is limited to 20,000 USDT. Your monthly withdrawal limit remains at 100,000 USDT. On Individual Verification (Standard), the daily withdrawal amount goes up to 1 million USDT. With Individual Verification (Advanced/Pro), it further increases up to 2 million USDT.

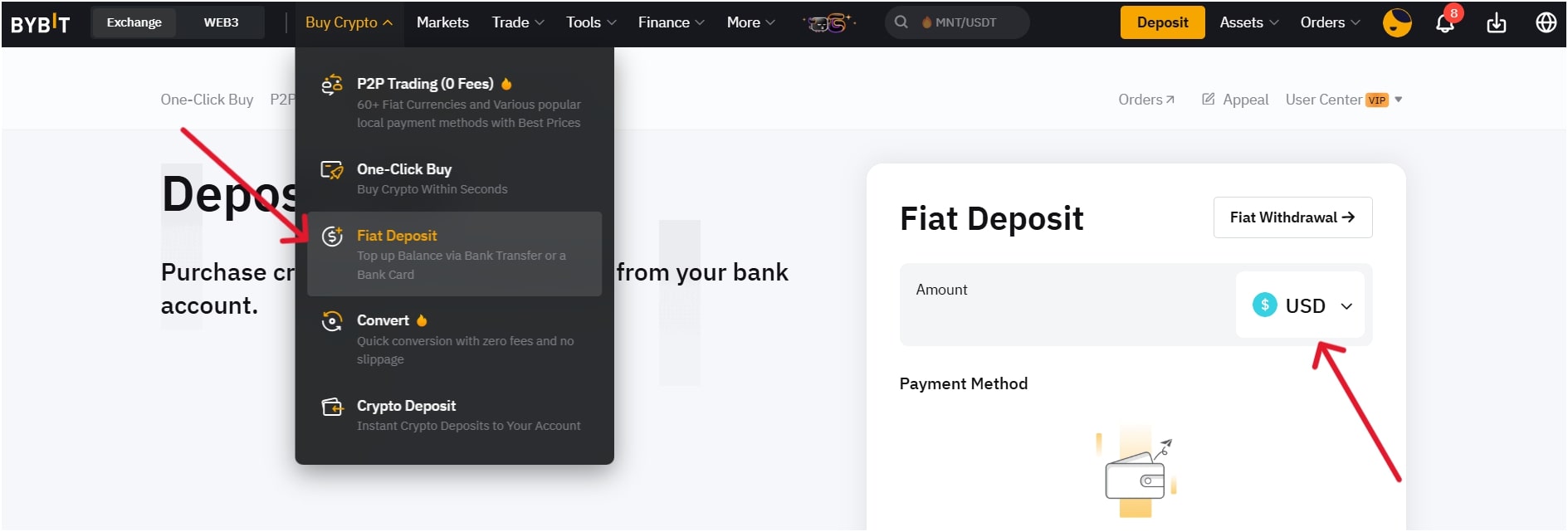

Step 3: Deposit Funds

Bybit offers three different ways to deposit funds, including fiat deposit, P2P trading marketplace, and crypto deposit.

Fiat Currency Deposit: Go to the “Buy Crypto” section, then click on “Fiat Deposit”. Select your preferred fiat currency and proceed with depositing via bank transfer, credit card, or other supported payment methods. Note that fiat deposits are unavailable in some regions.

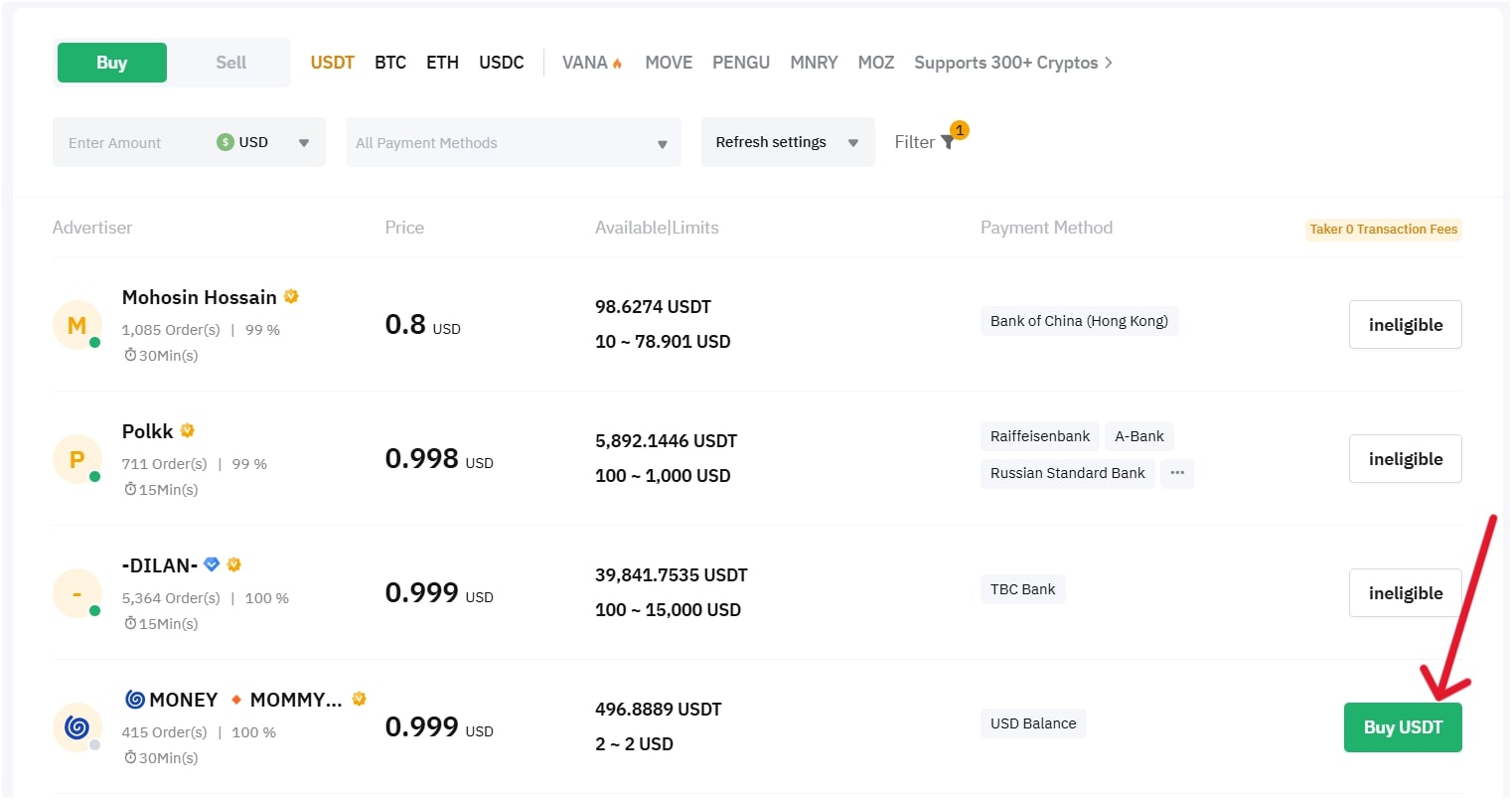

P2P (Peer-to-Peer) Trading: Through the P2P trading platform, you can purchase cryptocurrencies directly from other users. Go to the same “Buy Crypto” section and then select “P2P Trading”. Here, you will be able to select among the available offers (ads) and payment methods and proceed to the escrow transaction process.

Crypto Deposit: You can also deposit crypto into your Bybit account. You will find the “Assets” section in the main menu where you can choose “Deposit”. Now, select the cryptocurrency that you want to deposit and copy the deposit address given. You will then use that address to transfer funds from your external wallet.

Step 4: Start Buying and Selling Crypto

After funding your account, go to the “Market” tab on the Bybit interface. You can find several markets and trading pairs here. You will need to choose your preferred trading pair, say BTC/USDT to access the trading interface.

Bybit offers different order types including market, limit, and more as discussed above. Now, enter the amount and price and confirm the transaction. You can track your open orders, trade history, and account balance under the same dashboard.

What Are the Deposit and Withdrawal Methods on Bybit?

Bybit offers a range of deposit methods, including bank transfers for selected regions, debit cards, and credit cards. The platform also supports third-party payment processors such as Simplex, Banxa, and MoonPay, Google Pay and Apple Pay.

For more options, Bybit’s P2P marketplace supports over 80 local payment methods, from card payments and instant bank transfers to UPI, local e-wallets, and even in-person cash payments.

When it comes to withdrawals, Bybit supports bank transfers, but this feature is limited to certain countries only. Also, to withdraw via bank transfer, you must first make a fiat deposit using the same bank to link your bank account. It also supports cryptocurrency transfers to external crypto wallets.

What Are the Bybit-Supported Countries?

Bybit is available in over 195 countries, including popular ones like Australia, Belgium, Germany, France, Italy, Japan, New Zealand, Poland, Spain, Sweden, Switzerland, Taiwan, United Arab Emirates, Greece, and the Netherlands.

What are the Bybit-Restricted Countries?

Bybit services are restricted in the United States, the Chinese Mainland, Hong Kong, Singapore, Canada, France, the United Kingdom, North Korea, Cuba, Iran, and Russian-controlled regions of Ukraine.

Is Bybit Available in the US?

Bybit is not available in the US due to regulatory restrictions. The platform does not currently meet the requirements set by US financial regulators, such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC). As a result, Bybit restricts US users’ access.

If you are in the US and need alternatives, Coinbase, Kraken, Gemini, and Crypto.com are the best crypto exchanges. They are all fully compliant with US regulations and have a wide variety of cryptocurrencies that can be traded, all with very strong security features and user-friendly interfaces.

Is Bybit good for Beginners?

Yes, Bybit is a good platform for beginners due to its easy-to-use interface, demo account, mobile app, educational materials, and features like copy trading and staking.

Bybit’s easy-to-use interface is designed to be straightforward and intuitive. Even if you’ve never traded before, the layout makes it very simple to navigate and understand.

The demo account is also a standout tool for learning. It allows you to practice trading with virtual money, giving you the chance to understand various Bybit features without risking real money. Also, Bybit’s low minimum deposit of $10, makes it accessible for new traders who are just trying to understand the crypto market.

To help beginners learn, Bybit also offers educational materials like tutorials, guides, and videos. These resources explain crypto trading in simple terms and provide helpful tips for new users. Also, with copy trading, you can follow experienced traders and copy their strategies, which is a great way to learn by observing how professionals trade.

Is Bybit Safe and Legitimate to Buy and Sell Crypto in 2025?

Bybit is safe and legitimate to buy and sell crypto in 2025 with multiple security measures in place such as 2FA, anti-phishing code, withdrawal address whitelisting, cold storage, multi-sig storage, proof of reserves (PoR), SSL encryption, and a bug bounty program.

Bybit Security Features Explained:

- Two-Factor Authentication (2FA): 2FA adds another layer of security to your account. Apart from your password, you will need to provide a code from an authenticator app in order to log in or withdraw funds. It will be hard for hackers to access your account even with your password.

- Anti-Phishing Code: Bybit allows you to set a unique anti-phishing code, which is visible in all official emails coming from the exchange. That way, you know for sure whether the emails you receive are from your exchange or not, and can avoid phishing scams.

- Withdrawal Address Whitelisting: You can whitelist certain wallet addresses for withdrawals. This way, even if someone accesses your account, they cannot withdraw funds to an unapproved address.

- Cold Storage: Most users’ funds are stored in cold wallets, which are not connected to the internet. This minimizes the risk of funds being stolen in case of a cyberattack.

- Multi-Signature Storage: Bybit uses multi-signature wallets, meaning multiple private keys are required to authorize a transaction.

- Proof of Reserves (PoR): Bybit uses the PoR system, which proves that it has enough reserves to cover all users’ funds. This ensures that the exchange is solvent and financially sound.

- SSL Encryption: Your browser communication with Bybit’s servers is encrypted through SSL. This means that hackers cannot access your passwords or account details.

- Bug Bounty Program: Bybit offers a Bug Bounty Program, which encourages ethical hackers to find and report vulnerabilities in their systems. It proactively identifies potential security issues in the system that may need prompt fixing.

Bybit is also a legitimate crypto exchange with over 60 million users worldwide and a daily trading volume exceeding $36 billion. The exchange is licensed and regulated by several authorities, such as the Virtual Assets Regulatory Authority (VARA) in Dubai, the Cyprus Securities and Exchange Commission (CySEC), and the Astana Financial Services Authority (AFSA) in Kazakhstan.

Are you signing up for Bybit? Receive up to $30,000 as a welcome bonus and a 30% trading fee discount for a lifetime.

What Are the Best Alternatives for Bybit?

The best alternatives to Bybit include Binance, Bitget, MEXC, and Coinbase. These crypto exchanges offer a wide selection of features, including spot trading, futures, staking, and unique services focused on various user needs. These platforms have their own pros regarding the number of supported coins, fees, and regions they are available in and therefore are suitable for some users looking for specific benefits.

Here is the comparison table between Bybit alternatives on key aspects such as the launch date, headquarters, licensing, supported cryptocurrencies, features, fees, security, and US availability:

| Bybit | Binance | Bitget | MEXC | Coinbase | |

| Launched Date | 2018 | 2017 | 2018 | 2018 | 2012 |

| Headquarters | Dubai, UAE | No headquarters | Singapore | Mahé, Seychelles | No headquarters |

| Licensed | VARA in Dubai, CySEC in Cyprus, AFSA in Kazakhstan | DASP in France, VASP in Lithuania, and FIU in India | Bitcoin Service Provider (BSP) license in El Salvador | – | FinCEN in the U.S |

| Supported Cryptocurrencies | 1,650+ | 350+ | 1,240+ | 2,910+ | 250+ |

| Features | Spot trading, derivatives, staking, copy trading, demo accounts, and trading bots | Spot trading, futures, staking, NFT marketplace, and BNB Smart Chain ecosystem. | Spot trading, futures, copy trading, staking | Spot trading, futures, copy trade | Spot trading, staking, crypto wallet, custodial services |

| Staking Available | Yes | Yes | Yes | Yes | Yes |

| Spot Fees | 0.1% maker/taker | 0.1% maker/taker | 0.1% maker/taker | 0.05% maker/taker | 0.4% maker and 0.6% taker |

| Security | High | Very High | High | Medium | Very High |

| Payment Methods | Crypto deposits, bank transfers, cards, and third-party providers | Bank transfers, cards, P2P trading local methods (varies by region) | Crypto deposits; fiat options via third-party | Primarily crypto deposits; limited fiat options | Cards, wire transfers, PayPal, SEPA, SWIFT, and others |

| U.S. Availability | No | Binance.US (separate platform) | No | No | Yes |

To sum up, Bybit is the best cryptocurrency trading platform for both beginners and advanced traders. It offers many features like spot trading, derivatives, staking, margin trading, and copy trading. And, with over 1,650 coins and tokens available, you have plenty of options to trade.

Bybit is also known for its competitive fees, excellent security measures, and user-friendly interface, making it a popular choice worldwide. Bybit also provides educational tools and a demo account for beginners. However, it is not available for users in the US, UK, and Canada.

The post Bybit Exchange Review: Is It Safe & Legit to Buy Crypto in 2025? appeared first on CryptoNinjas.