World Liberty Financial Invests $4M in AVAX and MNT Despite Portfolio Losses

Key Takeaways:

- Trump Family-Backed WLFI Acquires $2M Worth of AVAX and MNT Tokens.

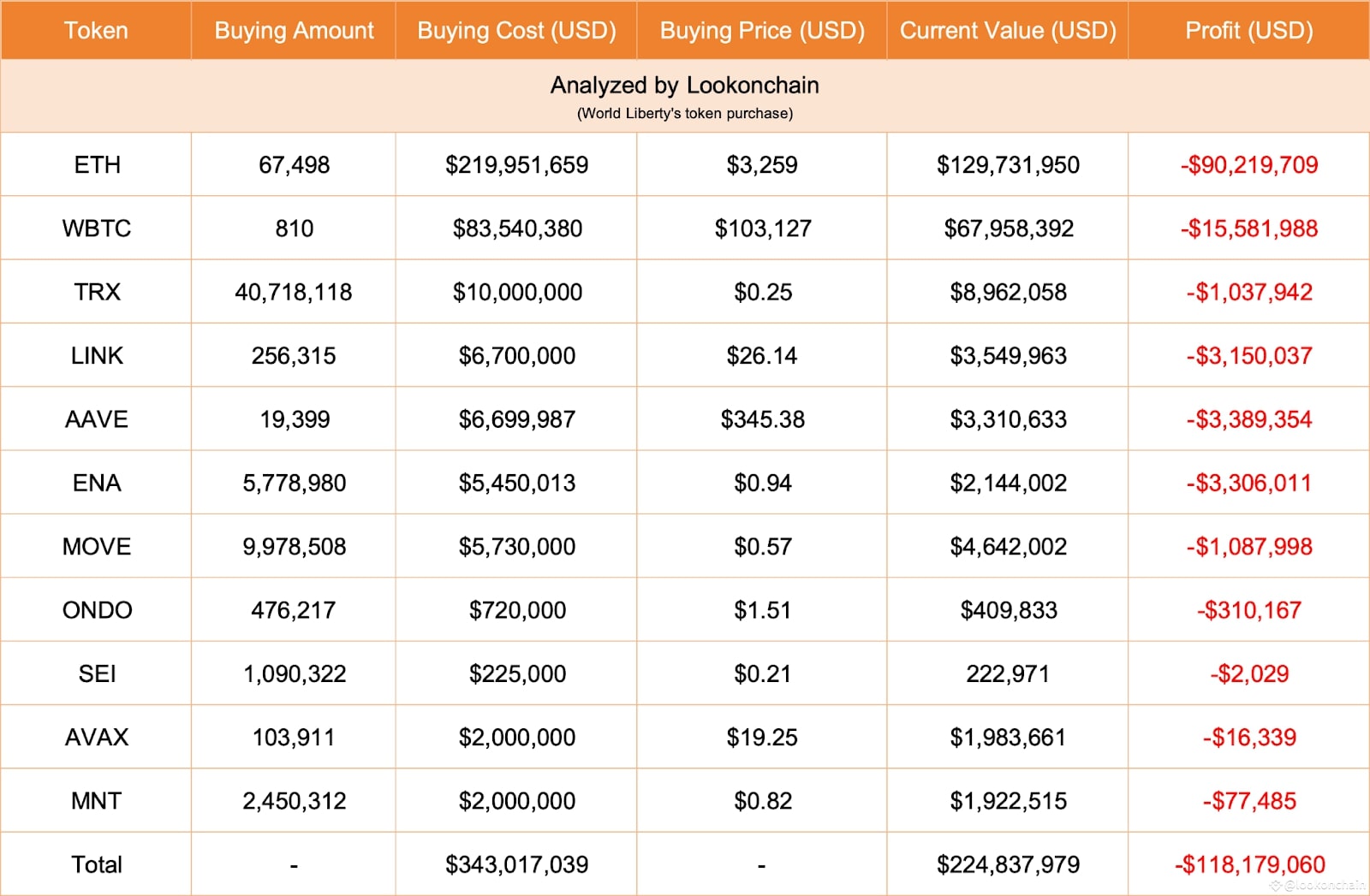

- WLFI holds 11 digital assets across its portfolio and is currently “sitting on” $118 million in unrealized losses.

- Ethereum makes up the biggest chunk of WLFI’s arsenal, posting a loss of $88 million on this asset alone.

WLFI, a well-known DeFi project associated with the Trump family, has made headlines in the DeFi world with its latest investments. The project has invested $4 million into the Avalanche (AVAX) and Mantle (MNT) tokens, despite significant unrealized portfolio losses.

AVAX and MNT: WLFI’s Strategic Crypto Buys

Through its recently completed $550 million token sale, the project bought $2 million each of AVAX and MNT, accumulating 103,911 AVAX tokens and 2.45 million MNT tokens, based on data covered by Arkham Intelligence. This came just days after a purchase of 541,783 SEI. These acquisitions suggest that WLFI may be aiming to diversify its holdings or strategically invest in projects they see as promising for the future.

Significant Portfolio Losses Despite Investments

However, regardless of these tactical purchases, WLFI is facing significant unrealized losses on its entire portfolio. The latest analysis conducted by Lookonchain shows that the crypto venture has put around $343 million in 11 digital assets, but faces unrealized losses amounting to $118 million. This would suggest a tougher period for the firm’s investing strategy.

Ethereum’s Dominance in the Portfolio and Its Heavy Losses

WLFI has 11 digital assets in its portfolio, which are Ethereum, Wrapped Bitcoin, Tron, Chainlink, Aave, ENA, MOVE, ONDO, SEI, AVAX and MNT. Ethereum is the biggest single position, comprising 58% of the portfolio. Even so, this position has also been a major contributor to the book losses, with $88 million of unrealized losses tied to Ethereum alone.

Related News: Trump’s World Liberty Financial Project Makes a Bold $48 Million ETH Purchase

Token Sale Updates and Strategic Partnerships

Web3 ambassador Eric Trump hinted at future developments following the completion of the $550 million token sale. These recent investments could be part of the developments Eric Trump alluded to. Recently, WLFI has announced a partnership with the Sui Foundation, notably towards integrating Sui assets into the WLFI token reserve and collaborating on the product. This tactic may explain the partnerships and their token acquisitions as a means to broaden WLFI’s deployment and widen its use within the DeFi ecosystem.

Speculation on Binance, and Denials

According to recent reports by the Wall Street Journal and Bloomberg, World Liberty Financial was in talks with Binance about establishing business opportunities, which included building a stablecoin. “But both BLFI and Binance CEO Changpeng Zhao have denied any concrete business deals or that they discussed acquiring a stake in Binance. They called the reports baseless and politically driven. Zhao denied such claims, according to local reports, and said no active negotiations were happening between the two parties.

Analysis

WLFI’s recent moves are typical of the competitive nature of the DeFi market. Moreover, while the company expands its diversification with strategic purchases of tokens such as AVAX and MNT, it continues to face heavy unrealized losses, especially on its Ethereum investments. While the company’s partnerships, alongside its other recently denied rumors of a potential collaboration with Binance, suggest some potential strategic intentions, it remains to be seen if they are attainable in the face of continued market volatility and present losses.

Related News: Trump’s World Liberty Financial Acquires Nearly $45 Million

The post World Liberty Financial Invests $4M in AVAX and MNT Despite Portfolio Losses appeared first on CryptoNinjas.