Bank of Israel Releases Preliminary Design for the Digital Shekel: A Deep Dive

Key Takeaways:

- Israel has released the preliminary design for its CBDC, the digital shekel, aiming for a user-friendly and inclusive digital currency.

- The digital shekel will be able to do transactions offline, offering solutions for areas with network connectivity.

- A decision on whether to launch the digital shekel will not be made until after 2026, relying on public feedback and further research.

Israel’s central bank has published the digital shekel’s design

In a major step towards exploring the next-generation money, the Bank of Israel has released the preliminary design for its planned central bank digital currency (CBDC), Digital Shekel (DS). And while a hard launch date is still up in the air, this detailed proposal does hint at what the ecosystem and functionalities, as well as technical architecture and regulatory considerations, the bank is considering. This action comes as part of a wider trend of central banks around the world currently considering CBDCs as a means of updating their financial systems and improving payment networks. However, this is an intricate endeavor that requires significant human involvement.

ISRAEL MOVES CLOSER TO A CBDC!

Bank of Israel Unveils Draft for the Digital Shekel. The central bank has released a comprehensive document detailing the ecosystem, technical framework, and regulatory approach for its potential Digital Shekel. This marks a significant step… pic.twitter.com/GHN1joreVI

— Crypto Patel (@CryptoPatel) March 4, 2025

What is Behind Israel’s CBDC Exploration?

According to the Bank of Israel Steering Committee, there are several motivations to implement a Digital Shekel, including:

- Building a new kind of payment infrastructure: The DS seeks to provide a viable alternative to the incumbent functionalities for digital payments, which could lead to cheaper, more innovative means of transaction.

- Creating better payment infrastructure: A digital shekel developed “from the ground up” could potentially serve as a more efficient and secure means of payment infrastructure for the digital age.

- Strengthening privacy: The DS will offer people more privacy than current digital payment solutions. It permits anonymous payments up to a limit.

- Fighting the “black economy”: The DS could provide a transparent and traceable digital payment option, discouraging tax evasion and illicit financial activities.

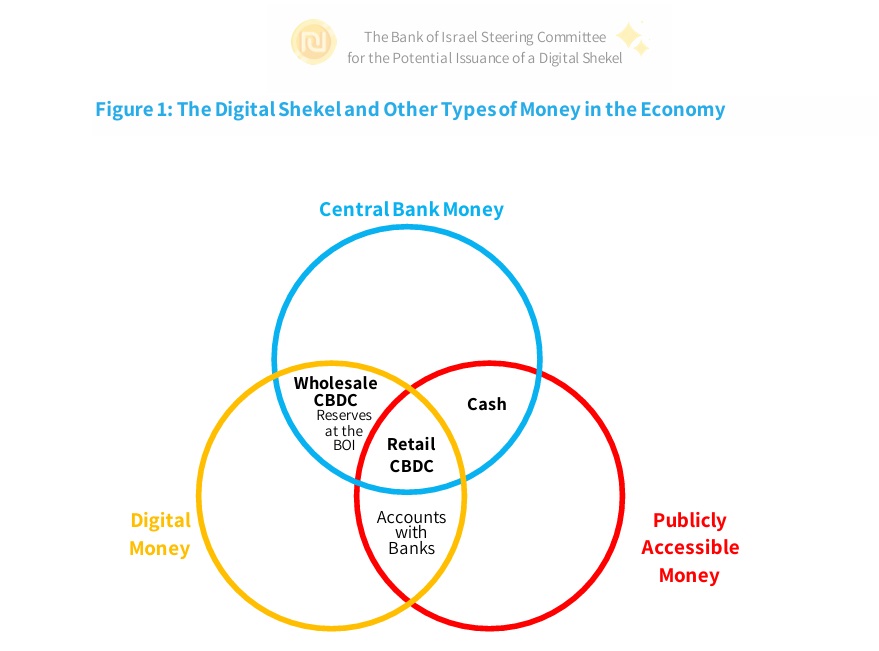

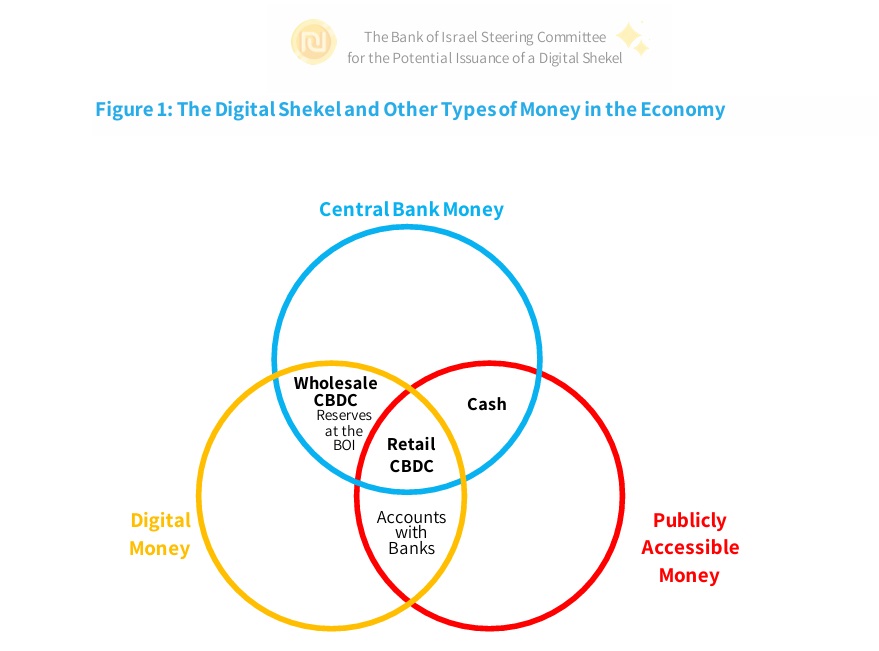

Digital Shekel & Other Money Types. Source: Bank of Israel

A CBDC That Is Inclusive and Accessible

Ensuring that no detail is left behind, one key highlight of the Digital Shekel design is its comprehensive approach to inclusivity. According to the published report, the Bank of Israel wants this CBDC “to all segments of the population. It will be available to the entire public, including children, foreigners (including tourists), all types of businesses, public institutions, and financial entities.”

This vision departs from some previous CBDC proposals, which have largely sought to satisfy the needs of financial institutions.

This ensures that all citizens have access to basic uses of the DS free of charge, making it inclusive for everyone.

Main Features of the Digitized Shekel

The preliminary design describes a number of the digital shekel’s features:

- Offline Functionality: Conducting transactions without internet connectivity. This would provide solutions for regions facing network connectivity challenges.

- Interoperability: Integration with existing payment systems and digital asset networks.

- Settle Now: Immediate clearing and settlement of payments.

If implemented in an effective way, these features could be game-changers in improving the user experience and expanding the adoption of Digital Shekel.

The Two Tier Model and The Private Sector

The Bank of Israel will adopt a two-tier model in which it will issue, and supervise, the new digital shekel, and the private-sector, including, specifically, “Digital Shekel Payment Service Providers” (DSPPs) will onboard users and provide customer-facing services. The PSPs would act as the gateway between end-users and the system and allow them to transact on it. An “Additional Service Providers” (ASP) may provide services to assist with budget management, in the form of enhanced payment apps.

Learning from the “Digital Shekel Challenge”

The Bank of Israel is seeking technology and business input in the “Digital Shekel Challenge.” This initiative will enable the participants to come up with real world use cases for the CBDC designed for innovation and ensuring that the DS is practical for everyday use.

A Gradual and Cautious Tread

Israel is approaching this differently to some countries which have already rolled out CBDCs. A final decision on issuing a Digital Shekel will be taken after 2026. This period would give the Bank of Israel time to conduct thorough research, get public input and account for regulatory issues.

Interoperability

The structure will enable payment where one side is in the digital shekel and the other in, say, a bank account.

They will be working on building connectivity between digital shekels to other systems, using automatic solutions that will ensure interoperability.

Privacy

The privacy of end users was a significant aspect of the CBDC plan.

No information about users’ balances or transactions within the digital shekel will be available to the Bank of Israel or any central entity.

- “There will be no centralized database of personally identifiable information. Only PSPs will hold user data, and certain transactions below specified limits may be made anonymously.”

Design Details and Considerations: A Closer Look

The Digital Shekel Ecosystem:

The proposed ecosystem includes various entities with distinct roles:

- Bank of Israel: The sole issuer of the DS, setting the rules for the system, serving as system manager, and overseeing operations. This entity has full responsibility for the payment and clearing systems.

- Digital Shekel Payment Service Providers (DS-PSPs or PSPs): They provide the framework to connect end-users, handling KYC procedures, providing access technology, and enabling transactions. Without engaging a PSP, end-users can’t operate in the digital shekel system.

- Funding Institutions (FIs): These licensed financial entities allow customers to convert funds between their accounts and DS. FIs enable funding and defunding of DS wallets.

- Additional Service Providers (ASPs): These providers offer services like budget management and payment applications. ASPs will offer advanced payment applications.

- End Users: The public, including individuals, businesses, and organizations, holding balances and performing payment transactions with DS. This includes children, foreigners, and all types of organizations.

Technical Architecture:

The document offers insights into the technological foundation of the DS.

- At the system’s core are the main database and the settlement engine, both to ensure no identifiable information is stored about the end user’s details or the transactions.

- The backend will be indifferent to the technology the end-user uses and all payments will be handled in the same manner, no matter the technology.

- Transactions will be made from any two technologies in a synchronous or asynchronous way.

Data Security

Data security is obviously a big priority when you are talking about a financial system. This has been taken into consideration and the system comes with built-in protective features. These features include:

- Data integrity

- User privacy

- Threat protection

The system will be treated as critical national infrastructure, with standards aligning with the National Cyber Directorate.

The Two-Tier Model: Balancing Privacy and AML:

While end users’ wallets are in the main database, no entity will have access to the end user’s data. PSPs manage the needed interfaces with end users.

The system’s fraud monitoring will assist in monitoring and reducing fraud by offering indicators of risk for each transaction.

Policy, Rules, and Regulations:

The Bank of Israel has outlined key policy considerations to guide the system’s development.

- A system will ensure data integrity, user privacy, and protection against threats.

- The system manager will define the system policies while system participants will be required to stringently meet the policies.

- The system will follow KYC regulations and use advanced methods to make sure it follows anti-money laundering and anti-terrorism financing rules.

What’s Next?

The Bank of Israel will gather feedback from stakeholders on this preliminary design and implement legislative changes for the design. In 2025-2026 the project will focus on:

- Examining economic analysis of the opportunities of issuing digital shekel.

- Learning and deepening familiarity with implementing technologies for the design.

- Adapting the design based on feedback.

More News: ECB Races to Build Wholesale CBDC as Digital Currency Landscape Shifts

Impact on Banking and Financial Stability

Many may be worried about how a CBDC can influence banking and financial stability. Here’s a breakdown on why this is a significant concern:

- A negative impact on cost credit

- Liquidity risks to banking system

The plan has considered the potential impact on end users with the implementation of a limit on the shekels and the risk of any crisis that may affect the supply cost of credit.

The post Bank of Israel Releases Preliminary Design for the Digital Shekel: A Deep Dive appeared first on CryptoNinjas.