Semler Scientific Buys 871 More Bitcoin, Enters Top 10 Corporate Holders

Key Takeaways:

- With the acquisition of 871 additional Bitcoin, Semler Scientific has become one of the top 10 corporate Bitcoin holders, with a total of 3,192 BTC.

- The company’s Bitcoin strategy has had an impressive start, with returns surpassing 150% since its inception.

- This move positions Semler Scientific as one of the leading corporate adopters of Bitcoin as a treasury asset.

Introduction: Semler Scientific’s Bold Bitcoin Move

Semler Scientific (NASDAQ: SMLR), a healthcare technology company that provides tools for diagnosing and treating chronic diseases, has surged in the tech and crypto communities through its grand Bitcoin strategy. Amid financial situations such as the increase in inflation and the rise in economic uncertainty, Semler has identified Bitcoin as more than just a speculative investment but a solid store of value and a possible hedge in the face of macroeconomic risks.

Another 871 BTC Acquired: The Details

Briefly put, during the period that passes between 11th of January and 3rd of February, 2025, Semler Scientific was successful in obtaining more Bitcoins. Although some Bitcoin detractors might be reluctant to invest in the cryptocurrency due to its volatility, Semler must be given a big shout out such that its vision may be played out in the long run.

- Acquisition Period: January 11, 2025 – February 3, 2025

- Bitcoin Acquired: 871 BTC

- Total Investment: $88.5 million

- Average Price: $101,616 per BTC

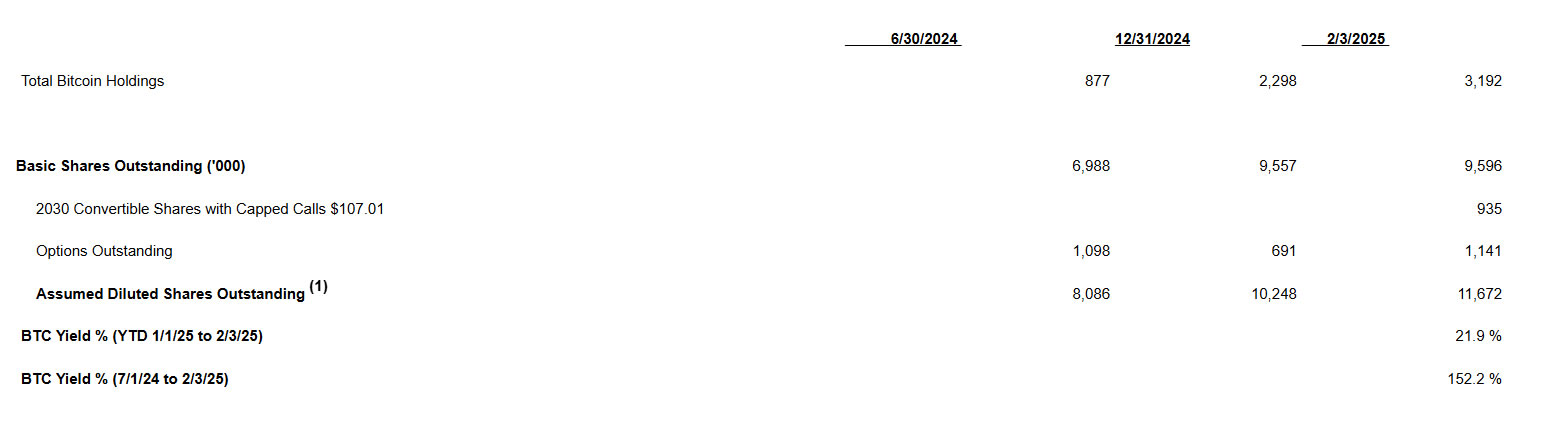

Total Bitcoin Holdings and Impressive Returns

By February 3, 2025, Semler Scientific had accumulated a total of 3,192 Bitcoin, acquired at an average price of $87,854 per BTC, with a total investment of $280 million. This equates to a gain of approximately $313 million if the current market prices continue. The most outstanding? The return on investment.

With 3,192 Bitcoin, Semler Scientific is now among the top ten private companies holding Bitcoin globally, according to Bitcoin Treasuries. This places the company alongside long-time corporate Bitcoin advocates.

| Metric | Value |

| Total Bitcoin Held | 3,192 BTC |

| Total Investment Cost | $280 million |

| Average Purchase Price | $87,854 per BTC |

| Estimated Current Value | Approximately $313M |

The Numbers Don’t Lie: Eye-Popping Returns

- July 1, 2024 to February 3, 2025: Environmental income configuration of 152%

- Year-to-Date (2025): Expenditure of 22%!

Semler’s profit report

This data suggests that, at least for now, Semler’s Bitcoin investment is proving to be a profitable bet. While the past result does not give a definite endorsement of the future, the large profit is an instrument that supports the notion that Bitcoin may be a most valuable abstract asset. You should have in mind though that these returns are very volatile, they can be swayed by the market’s mood and the main economic trends.

Leadership’s Perspective

Eric Semler, Chairman of Semler Scientific, has expressed his satisfaction with the company’s increasing Bitcoin holdings. Besides, he acknowledged the good results of the convertible notes which he said proved very strong investor interest. This shows the trust of the management, that is key when it comes to handling such a disputed asset.

Bitcoin’s Role as a Strategic Reserve Asset

The emergence of some companies like Semler Scientific as investors in Bitcoin demonstrates the rapidly growing trend of those businesses that treat Bitcoin as the strategic reserve of the cash reserve. The attractiveness of Bitcoin as a tool for securing against inflation and world economic instability is becoming more obvious. This uptake signals the transferral of the approach of companies toward digital assets to the view of the role of digital assets in protecting capital reserves.

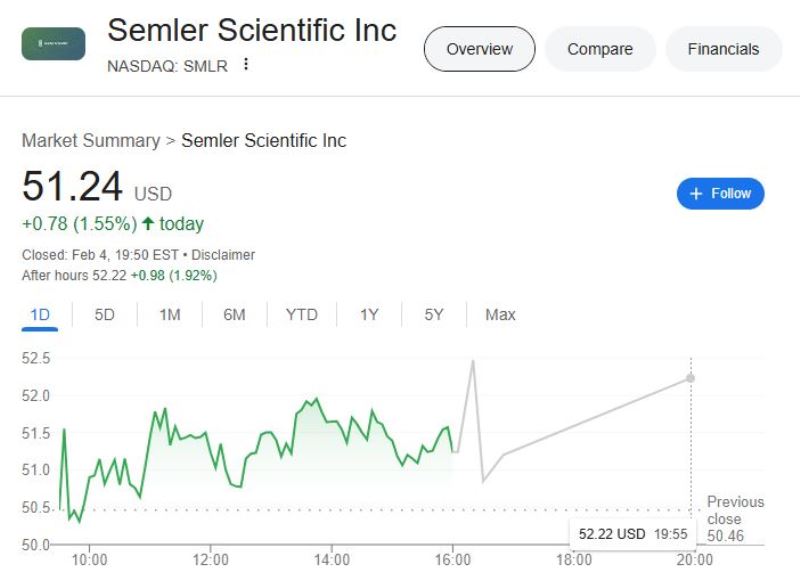

Market Reaction: Semler Scientific’s Stock Price (SMLR)

SMLR stocks took off right away as the report about Semler Scientific’s increased Bitcoin investments hit the market. The company’s shares were up by 1.55% in early trading and became a sign of the market’s trust in the company’s plan. Nevertheless, it should be kept in mind that other factors besides Bitcoin holding can also significantly impact the stocks in the market.

Semler Scientific’s stock price went up 1.55%. Source: Google

More News: MicroStrategy Starts 2025 by Buying 1,070 Bitcoin with a Total Value of $101 Million

Contrasting Approaches: Semler vs MicroStrategy

It is fascinating to see two very different strategic approaches of the companies, that is Semler with MicroStrategy being the dominant corporate action-taker in Bitcoin. Desisting itself from adding additional Bitcoin to its hoarded Bitcoins where the amount summed up to 471,017 having a worth of $46 billion, MicroStrategy firmly decided to retain the existing amounts. This discrepancy seems like it is not just how their risk appetites are satisfied but also their long-term Bitcoin growth outlook. On the one hand is Michael Saylor, who has been the loudest and most ardent maximalist Bitcoin advocate for years, while Semler’s strategy appears to be more realistic, indicative of the fact that Semler is operating in a different sector.

Semler Scientific’s bold move to continue to avail of its money in Bitcoin is a testament to the company’s confidence in the future prospects of this cryptocurrency. The solid and large returns as well as the dynamic growth of gains, combined with Semler Scientific’s ascending place as a top “institutional” Bitcoin owner, are evidence of the company’s breaking ranks and therefore, ascension to the pioneer status.

The post Semler Scientific Buys 871 More Bitcoin, Enters Top 10 Corporate Holders appeared first on CryptoNinjas.