Expert Sets $1 Target For Dogecoin Once It Breaks A Multi-Year Trend – Details

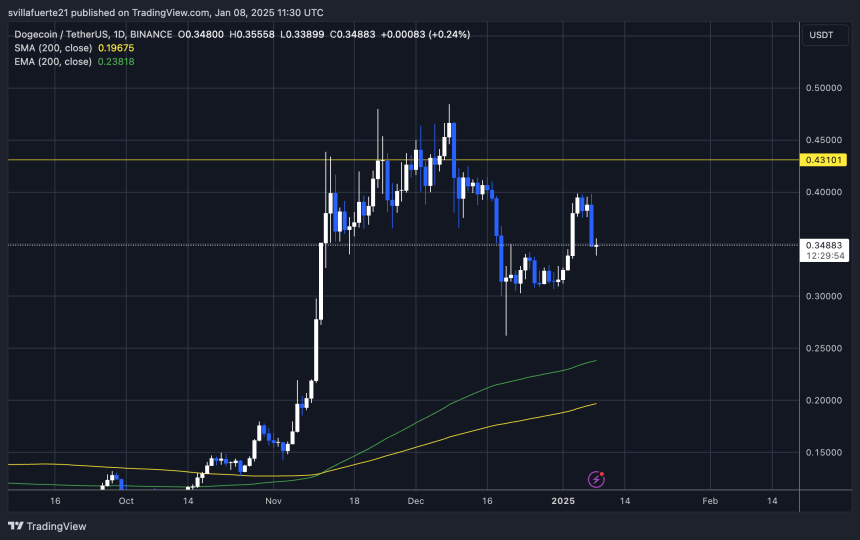

Dogecoin faced a wave of selling pressure yesterday, marking a sharp 14% drop from the $0.39 level. This decline has sparked caution among investors, yet Dogecoin remains resilient, holding at a critical demand level. This zone could prove pivotal for the meme coin’s trajectory, as maintaining this support may lay the foundation for a fresh rally to new highs.

Top analyst CROW recently shared a technical analysis on X, highlighting Dogecoin’s potential to break above its multi-year trendline. According to CROW, such a breakout would be a game-changer, positioning Dogecoin for an aggressive rally. He suggests that $1 is only the first target in a series of upward movements that could redefine the market’s view of DOGE.

The coming days will be crucial as Dogecoin battles between sustaining its current demand zone and the possibility of deeper corrections. With market sentiment split and broader crypto uncertainty, all eyes are on Dogecoin to see if it can capitalize on its strong demand and push through to reclaim its bullish narrative. Investors remain optimistic, awaiting confirmation of DOGE’s next big move in the ever-volatile cryptocurrency market.

Dogecoin Prepares For A Breakout

Dogecoin is holding strong at $0.34, a critical level that previously acted as supply but has now flipped into a robust demand zone. This price action highlights a significant shift in DOGE’s market dynamics, sparking optimism among investors. As the meme coin leader continues to set higher highs, the next target lies within higher supply zones, which could pave the way for further bullish momentum.

Top analyst CROW recently shared a compelling technical analysis, emphasizing the monumental potential of Dogecoin. According to CROW, $1 is merely the first major milestone for DOGE as it emerges from the multi-year downtrend that began in 2021. Breaking free from this long-term bearish structure would not only solidify Dogecoin’s position as a market leader but also open the doors to price discovery, a phrase often associated with explosive gains.

CROW’s analysis points out that Dogecoin’s chart is showing strong signs of accumulation, a critical phase in the market cycle that typically precedes massive rallies. If DOGE manages to reclaim the $1 level, it could trigger an influx of buying pressure, driving the price into uncharted territory. This potential shift underscores Dogecoin’s ability to capture market attention and maintain its place as a top-performing cryptocurrency.

With market sentiment cautiously optimistic and key technical indicators aligning, Dogecoin seems ready to embark on a new chapter of its journey. Investors are closely watching its movement around the $0.34 level, waiting for the breakout that could signal the start of an extraordinary rally.

Price Action Showing Strength

Dogecoin is currently trading at $0.34 after a clean breakdown from the $0.39 mark, a significant level of supply. Despite the recent decline, price action suggests strength as DOGE manages to hold its current level as a key demand zone. This resilience indicates that Dogecoin is positioned for a potential rebound if the broader market sentiment shifts positively.

A market-wide recovery could set the stage for DOGE to challenge last year’s highs. The critical level to watch is $0.43—reclaiming and holding this mark would signal a massive bullish breakout. Such a move would likely draw significant buying pressure, propelling DOGE into a new phase of upward momentum and possibly price discovery.

However, the downside risk remains. If Dogecoin fails to hold above the $0.33 level, selling pressure could intensify, leading to a deeper correction. Investors are keeping a close eye on these key levels as the market navigates through a period of uncertainty.

For now, DOGE’s ability to maintain current demand zones is a positive sign, suggesting that the meme coin still holds potential for a strong recovery and significant gains in the coming weeks.

Featured image from Dall-E, chart from TradingView