XRP Consolidates Below Crucial Resistance – Analyst Sets $1.60 Target

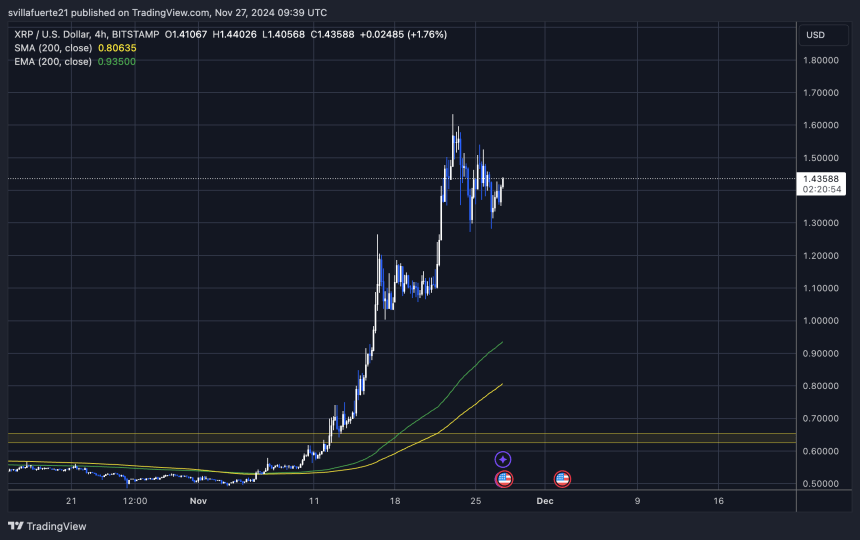

XRP is currently consolidating after a sharp 20% retrace from its recent local high of $1.63, set last Saturday. Despite the pullback, XRP remains a strong contender in the market as it holds firm above critical demand levels, showcasing resilience amid broader market volatility. As Bitcoin flirts with the psychological $100,000 mark, XRP’s price structure continues to signal bullish potential, drawing attention from traders and investors alike.

Crypto analyst and investor Carl Runefelt shared a technical analysis on X, suggesting that XRP could be on the verge of a significant breakout. According to Runefelt, if XRP successfully breaks a key resistance level in its current price range, the asset could retest its local highs of $1.60 in the coming days, setting the stage for another rally.

The overall market awakening has injected optimism into the crypto space, with XRP positioned to benefit from the momentum. However, maintaining strength above its current demand zone is crucial for XRP to sustain its bullish trajectory. Investors are closely watching for confirmation of a breakout, as XRP’s ability to reclaim its recent highs could signal the start of a larger upward trend in the weeks ahead.

XRP Looks Ready To Continue

XRP appears poised for another bullish rally, with technical indicators and market sentiment aligning to suggest a continuation of its upward momentum. As the broader crypto market shows signs of awakening, it stands out as one of the assets with the potential to set new yearly highs in the current cycle. Analysts and investors are increasingly optimistic, with many eyeing the $2 mark as the first significant milestone for XRP bulls.

Crypto analyst Carl Runefelt recently shared a detailed technical analysis on X, highlighting a key development in XRP’s price action. According to Runefelt, XRP is nearing the breakout point of a falling wedge pattern, a historically bullish structure.

If this breakout materializes, XRP could initially target its recent local high of $1.60. Breaking above this supply zone would signal strong buying momentum, paving the way for XRP to aim for new cycle highs and potentially surpass the $2 resistance level.

However, XRP’s journey to new highs isn’t without risks. Should the asset fail to break above the $1.60 level, further consolidation below this price could occur, delaying its bullish trajectory. Such a scenario would likely see XRP retesting key demand zones before attempting another breakout.

As the market collectively inches toward higher valuations, XRP’s performance remains closely tied to its ability to breach critical resistance levels. A successful breakout above $1.60 would not only validate the current bullish setup but also reinforce confidence in XRP’s potential to lead this cycle’s altcoin rally.

Technical Analysis And Key Levels

XRP is currently trading at $1.43, showcasing remarkable resilience after a 200% surge from its November 5th lows. While the price has retraced 20% from the local high of $1.63, XRP’s bullish structure remains intact as the broader crypto market gears up for another potential rally. Analysts and investors are optimistic that the price can sustain its momentum, provided key support levels hold firm.

The $1.27 mark emerges as a critical demand zone for XRP, maintaining the short-term bullish structure that has driven its recent growth. If XRP successfully defends this level, the price is expected to consolidate before making another attempt to surpass the $1.60 resistance. A break above this key level could open the door for further upside, pushing XRP closer to its next major milestones in this cycle.

However, failing to hold above $1.27 could shift market sentiment and lead to deeper corrections. This would challenge XRP’s bullish momentum and potentially test lower support levels, delaying its upward trajectory.

As the market looks primed for continuation, XRP’s ability to stay above critical demand zones will determine its performance in the coming weeks. Investors are closely monitoring these levels as the asset eyes another leg higher.

Featured image from Dall-E, chart from TradingView