Will Bitcoin Break Through $70k? Short-Term Holders’ Buy Price Holds The Key

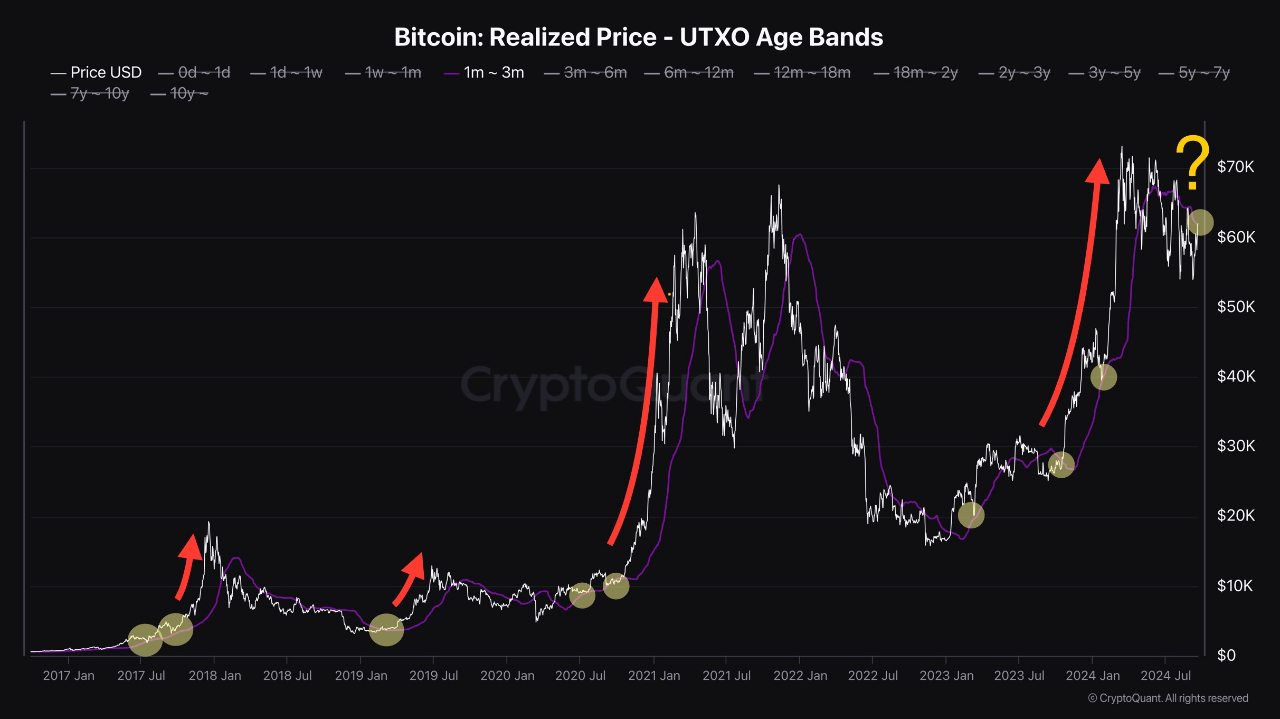

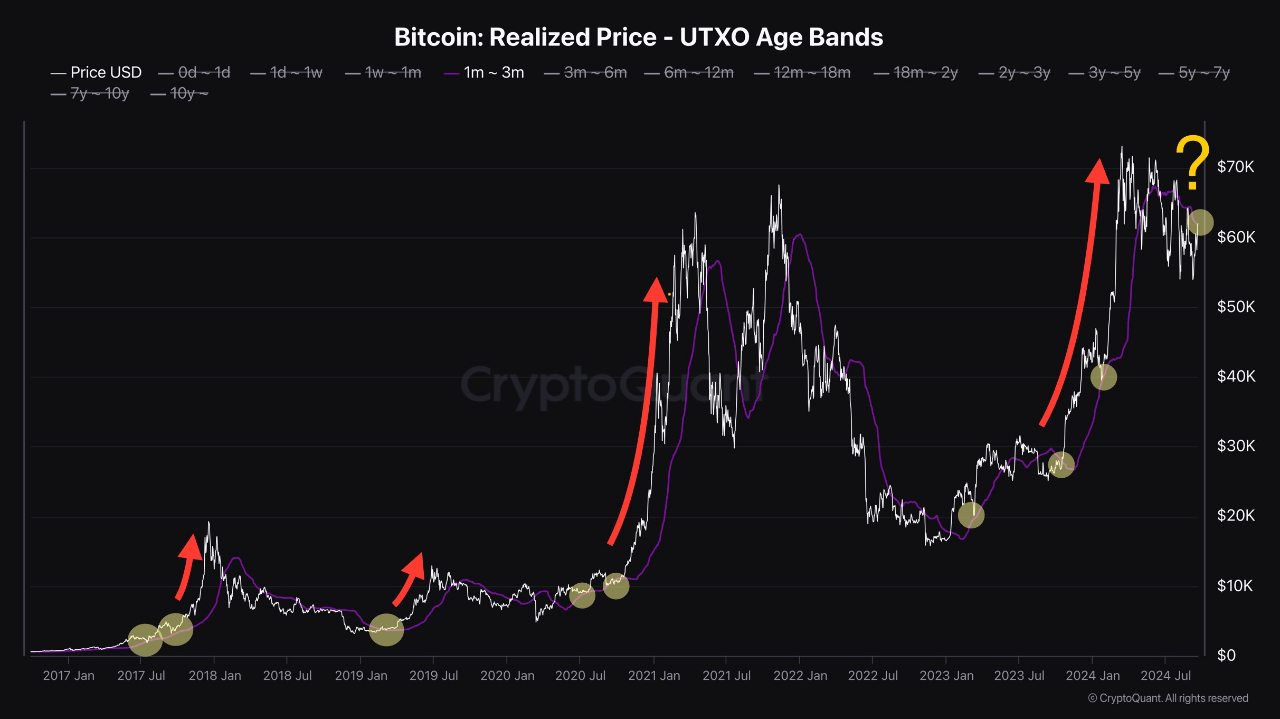

Recent CryptoQuant analysis suggests that short-term Bitcoin holders’ average buy price could be a key factor in predicting the leading crypto’s future movements.

The focus is on holders who have had Bitcoin for months, with historical data indicating that their average buy price often serves as a critical support or resistance level. These short-term holders’ buy prices have been linked to significant shifts in Bitcoin’s market direction.

How Short-Term Holders Buy Price Hints At Future Move

The analysis, provided by an analyst under the pseudonym ‘Avocado Onchain,’ draws attention to the historical instances where Bitcoin’s price either broke through or was rejected by the average buy price of these short-term holders.

The analyst points out that monitoring this average buy price could offer insights into Bitcoin’s potential future trends.

According to the data presented, the average buy price of Bitcoin holders who have held their assets for 1-3 months has repeatedly influenced the cryptocurrency’s price direction.

When Bitcoin’s price successfully breaks through this average buy price, it often leads to a notable bullish trend. Conversely, when the average buy price acts as a resistance point, it can signal the beginning of a bearish phase.

An example highlighted by Avocado was when Bitcoin reached $73,000 earlier this year and then saw subsequent declines. According to the analyst, at that time, Bitcoin failed to surpass the average buy price of these short-term holders, leading to a bearish trend afterward.

This pattern suggests that the average buy price of short-term holders can serve as a reliable on-chain metric for assessing market sentiment.

As Bitcoin’s price approaches these levels, it tends to face critical tests of momentum, which can either confirm or redirect the prevailing market trend.

Bitcoin Rally To $70k Approaching?

Bitcoin is now seeing a gradual push towards the upside following the announced US fed rate cut yesterday. In the past day alone, the asset has surged by 5.8% with a current trading price of $63,054.

Avocado noted:

With the recent announcement of a 50bp rate cut by the U.S. Federal Reserve, Bitcoin is once again attempting to break through the average buy price of 1-3 month holders.

Although it remains to be seen whether Bitcoin will eventually break through the short-term holder buy price level thereby resulting in further bullish momentum, analysts in the crypto space have shared their optimistic outlook on the crypto.

According to crypto analyst, Moustache, Bitcoin has, for the first time in history, seen a “golden cross of the SMA100/SMA200 (W)”.

Moustache revealed that this technical pattern, coupled with the recent US interest rate cut might set the asset up for the most “legendary” price moves in the coming months.

-For the first time in $BTC‘s history, we see a golden cross of the SMA100/SMA200 (W).

and at the same time..

-Fed cuts interest rates for the first time in 4 years

Prepare yourself for some legendary months. pic.twitter.com/mLtwszJ3rf

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof) September 19, 2024

Featured image created with DALL-E, Chart from TradingView