XRP Price Edges Up As Ripple Forms Major Partnership In Japan

Ripple has announced a major partnership with Tokyo-based HashKey DX, a consulting company of the HashKey Group, to deploy XRP Ledger (XRPL)-powered enterprise solutions in Japan’s burgeoning blockchain sector. The announcement led to an immediate 1.9% increase in XRP’s price, although this gain was slightly pared back; as of the latest data, XRP stands 1.1% higher since the news broke.

The Ripple And HashKey Partnership: Details

The collaboration leverages the substantial success HashKey Group has seen in mainland China. HashKey‘s blockchain-powered solutions for supply chain finance have registered over 4,000 companies, including 23 banks and 4,300 suppliers. The total transaction volume through these solutions has exceeded $7 billion, with almost $3 billion in financing transactions.

In Japan, these blockchain solutions will be adapted and deployed through a partnership involving Ripple and SBI Ripple Asia, a joint venture between SBI Holdings and Ripple. The XRPL will be the foundational technology platform. This blockchain specializes in tokenizing and exchanging both crypto-native and real-world assets.

Andy Dan, a representative from HashKey DX, highlighted the efficiency and suitability of XRPL for their needs, stating, “The XRPL was the ideal blockchain infrastructure for us to build our proven supply chain finance solution. With its proven enterprise track record and unmatched performance metrics, including rapid settlement speeds, low costs, and scalability, we are confident in our ability to drive meaningful transformation and introduce innovative, cutting-edge solutions for businesses in Japan.”

Emi Yoshikawa, Vice President of Strategic Initiatives at Ripple, echoed this enthusiasm for the partnership: “We are excited to join forces with HashKey DX and SBI Ripple Asia to introduce XRP Ledger-powered solutions to Japan. This collaboration exemplifies our shared commitment to advancing blockchain technology and delivering tangible value to businesses.”

XRP Price Analysis

The initial spike in XRP’s price post-announcement reflects the market’s optimistic reception of Ripple’s strategic moves. However, the broader price action context reveals more complexity.

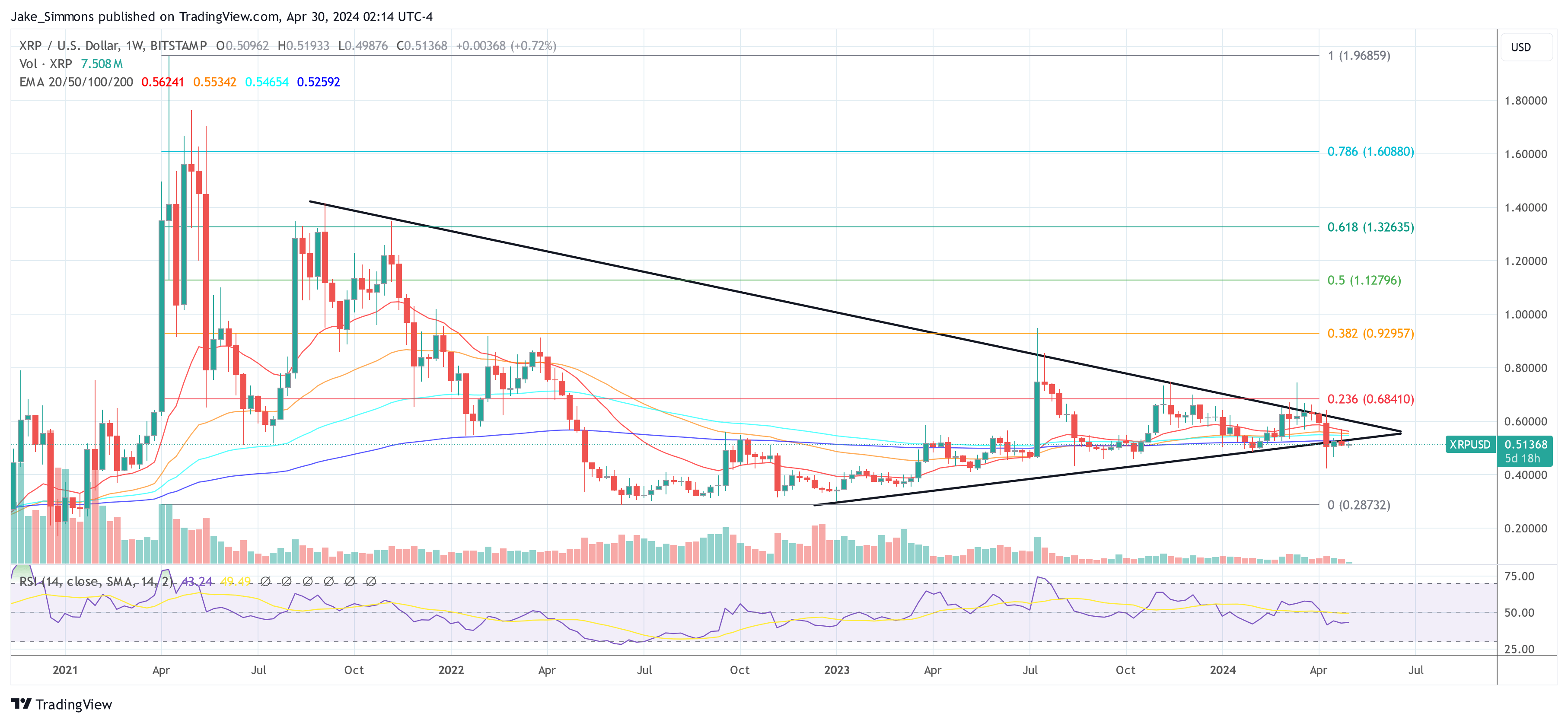

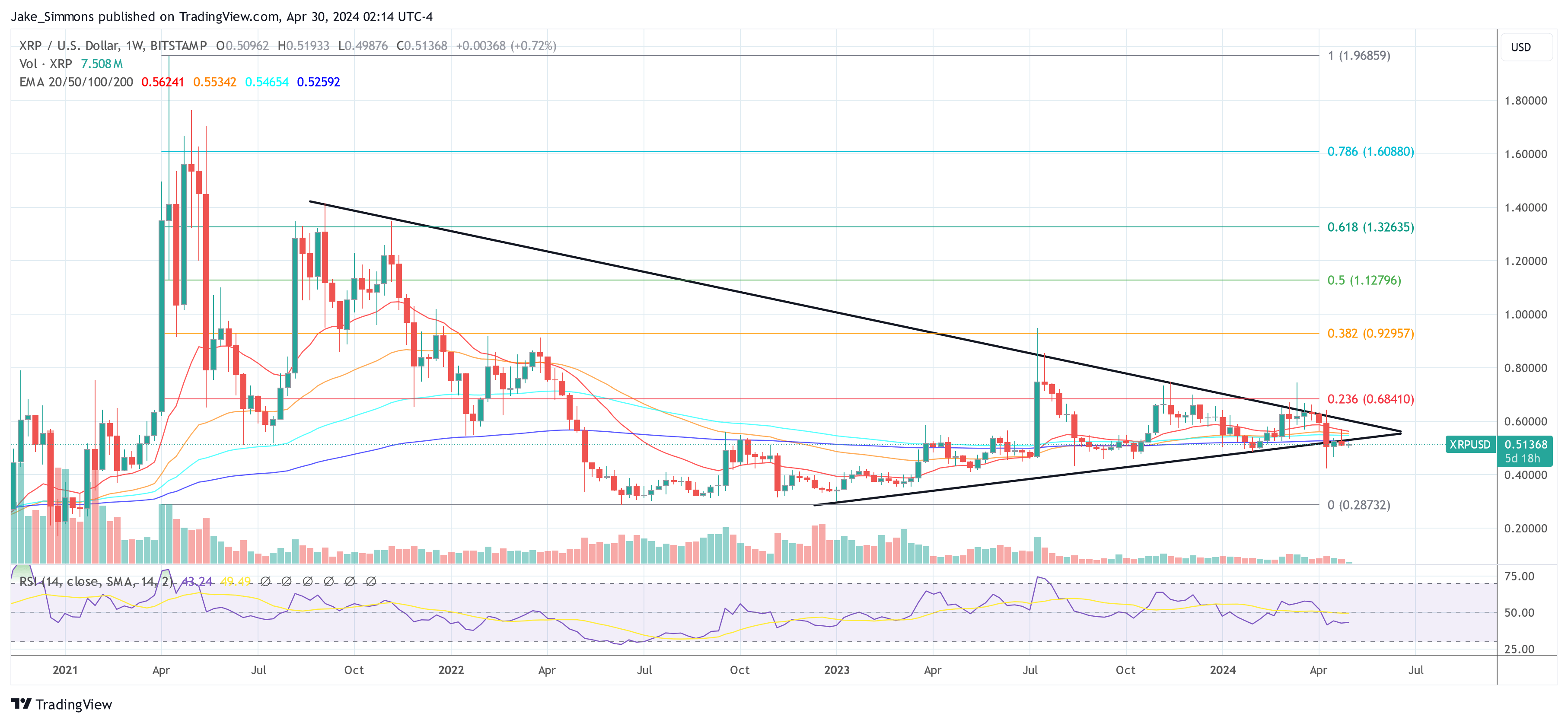

Over recent weeks, XRP has experienced volatility, notably breaking down from a symmetrical triangle pattern on the weekly chart that began forming in September 2021. This pattern typically indicates a period of consolidation, with the eventual breakout direction suggesting the prevailing market force.

Currently, the breakdown suggests that sellers have gained the upper hand, with the triangle now acting as a resistance zone. XRP faces multiple hurdles ahead as it is currently trading below several critical exponential moving averages (EMAs) – 20, 50, 100, and 200-week EMAs, all nested within the former triangle pattern. This setup presents significant resistance levels that need to be overcome for bullish momentum to resume.

The Relative Strength Index (RSI), currently at 49, hovers near the neutral 50 mark, indicating that neither bulls nor bears have definitive control. This neutral position underlines the market’s current uncertainty, waiting for a catalyst that could drive the next significant price movement.

Should the bulls regain control and push the price above the triangle’s resistance, the 0.236 Fibonacci retracement level at $0.68410 could initiate a shift in sentiment and potentially more robust gains for XRP.