Ethereum Fees Dive: Will This Spark A Surge In Network Activity?

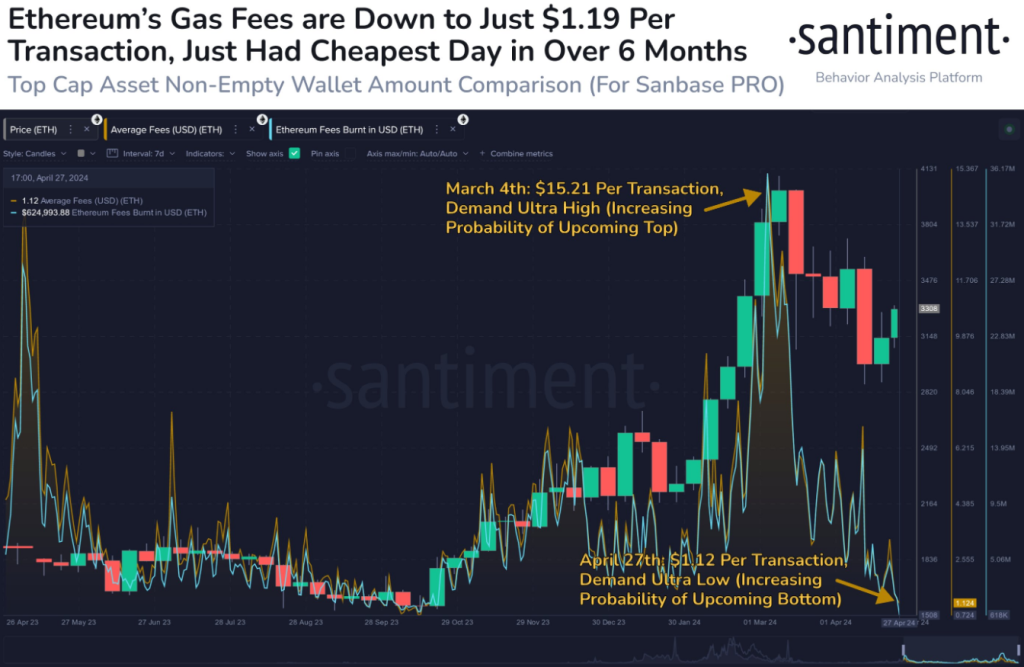

Ethereum, the world’s second-largest cryptocurrency by market capitalization, has seen a dramatic drop in transaction fees, according to a recent analysis by Santiment, a prominent crypto analytics platform.

The report indicates that the average Ethereum transaction fee has plunged to a mere $1.12, marking the lowest daily average cost since October 18th, 2023.

Ethereum Transaction Fees: A Window Into Market Sentiment

This significant decrease in transaction fees has sparked discussions among crypto enthusiasts and analysts alike. Santiment’s analysis suggests a strong correlation between transaction fees and the overall sentiment within the cryptocurrency market.

The analysis highlights that periods of exuberance, often characterized by the “to the moon” narrative and a belief in exponential price gains, tend to coincide with higher transaction fees. Conversely, during market downturns dominated by pessimism, transaction fees typically fall.

#Ethereum‘s average fee level has dipped to just $1.12 per network transaction, the lowest average cost in a day since October 18th.

Traders historically move between sentimental cycles of feeling that #crypto is going “To the Moon” or feeling that “It Is Dead”, which can… pic.twitter.com/8b8rLMLyIf

— Santiment (@santimentfeed) April 28, 2024

Transaction fees serve as a fascinating window into the collective mood of the crypto market, analysts say. By tracking these fees, they can glean valuable insights into investor confidence and underlying demand dynamics.

Lower Fees: Cause For Concern Or Optimism?

The current low transaction fees present something of a conundrum for investors. On the one hand, they could indicate a decline in network activity, potentially reflecting a bearish market sentiment.

However, Santiment’s analysis offers a more optimistic perspective. The report proposes that the lower fees, coupled with the recent easing of network difficulty, could pave the way for a smoother recovery for Ethereum and other altcoins (alternative cryptocurrencies).

While the low fees might signal lower demand, they could also signify a welcome reduction in network congestion, analysts say. This, in turn, could potentially act as a catalyst for Ethereum’s price recovery, although it’s important to note that this might signal a faster turnaround than many anticipate.

Investor Takeaway: Data Is King In The Cryptoverse

The ever-changing landscape of the cryptocurrency market can be daunting for even seasoned investors. Santiment’s data-driven approach, with its emphasis on transaction fees as a sentiment indicator, offers valuable insights for navigating this volatile space.

The Road Ahead For Ethereum

While the analysis offers a compelling interpretation of the current situation, it’s crucial to remember that the cryptocurrency market is complex and influenced by a multitude of factors. The long-term impact of these low transaction fees remains to be seen.

Featured image from Pexels, chart from TradingView