The End of Tether? Why A Structural Shift In The Market Spells Trouble For USDT

Tether (USDT) is the largest stablecoin in the market, with a market capitalization of over $86 billion as of May 2023. Despite the concerns about the current state of the cryptocurrency market, Tether has continued to dominate the stablecoin space, with its supply growing significantly since the beginning of 2023. However, there are signs that new competitors may challenge its dominance in the future.

USDT’s Reign Over?

According to the researcher and founder of DeFiance Capital, ArthurOx, one factor that may limit Tether’s growth is the emergence of new stablecoins. As investors become more concerned about the risks associated with Tether, they are likely to seek alternatives that offer greater transparency and accountability.

For example, USDC (USD Coin) is a stablecoin fully backed by US dollars held in reserve by regulated financial institutions, and its supply has been growing rapidly in recent years.

Another factor that may limit Tether’s growth is the emergence of decentralized stablecoins. These stablecoins are built on blockchain platforms, offering a decentralized alternative to centralized stablecoins like Tether.

Decentralized stablecoins eliminate the need for a central authority to manage the reserves, as the reserves are held in smart contracts on the blockchain. This offers high transparency and security and eliminates the risk of a central authority mismanaging the reserves or engaging in fraudulent activities.

One example of a decentralized stablecoin is DAI, built on the Ethereum blockchain. DAI is backed by a basket of cryptocurrencies held in smart contracts on the blockchain. This ensures that the value of DAI remains stable while offering high transparency and security.

In addition to these factors, there are also regulatory risks associated with Tether. The stablecoin has come under scrutiny from regulators in the US and other countries, with some calling for greater transparency and oversight. If regulators impose stricter regulations on Tether, this could limit its growth and open up opportunities for other stablecoins to gain market share.

Tether And USDC Show Resilience Amid US Debt Ceiling Drama

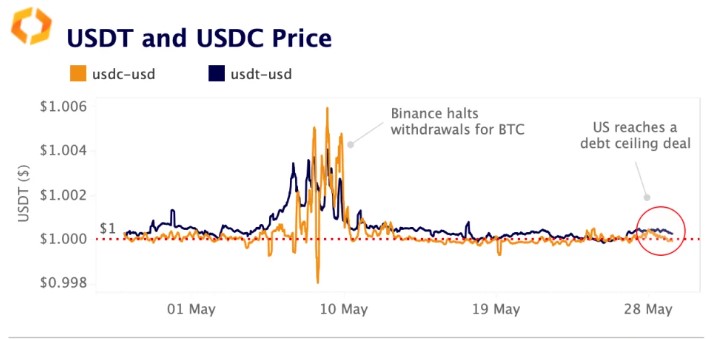

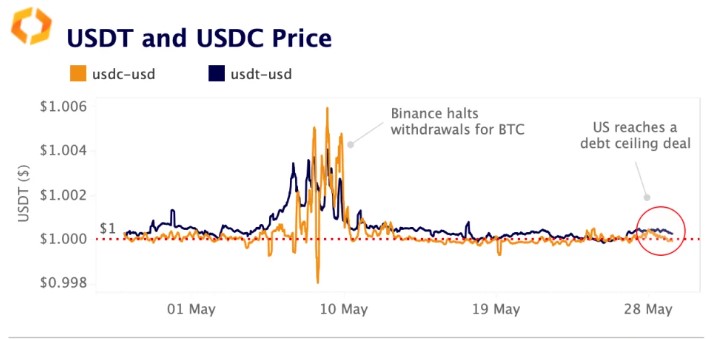

According to a recent report by Kaiko, USDT and USDC have shown little volatility amid the ongoing drama surrounding the US debt ceiling. Despite concerns over a potential US default, USDT and USDC saw little to no price movement over the past two weeks. This suggests that the markets did not view default as the base case scenario and that investors remained confident in the stability of these stablecoins.

Interestingly, USDT and USDC have increasingly been trading in tandem during periods of market stress. For example, when Binance temporarily halted withdrawals for Bitcoin (BTC) earlier this month due to network congestion issues, both stablecoins rose above $1, as seen in the chart above. This suggests that USDC may have gained some safe-haven appeal as U.S. banking troubles eased.

The resilience of USDT and USDC during the debt ceiling drama reflects a wider trend in the cryptocurrency market, where stablecoins have become an increasingly popular way for investors to hedge against volatility.

These developments underscore the growing importance of stablecoins in the cryptocurrency ecosystem. As more investors seek to hedge against market volatility and regulatory uncertainty, the demand for stablecoins will likely grow. Moreover, the emergence of new decentralized finance (DeFi) applications that require stablecoins as a means of exchange and collateral is also fueling demand.

Featured image from Unsplash, chart from TradingView.com