Lithium Finance launching IDO with Polkastarter to build out its data oracle solution

Lithium Finance, a decentralized data oracle solution, announced today it will host its IDO on Polkastarter on August 5th. Polkastarter is a fully decentralized protocol for launching new ideas. With Polkastater, projects can raise awareness, build a loyal community, and receive long-term support.

“This comes after the successful launch of our pre-IDO on Convergence earlier in June. Polkastarter partnered with Lithium Finance on our previous pre-IDO. We’re pleased to collaborate with our friends at Polkastarter again for our IDO.”

– The Lithium Finance Team

IDO Sale Details

- IDO Date: August 5th, 2021

- Token Ticker: LITH

- Maximum Total Supply: 10,000,000,000

- Total IDO Allocation: 200,000 USD

- Initial Market Price: 0.006 USD

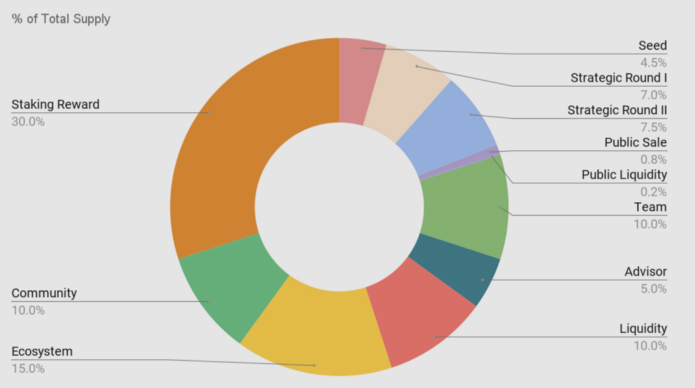

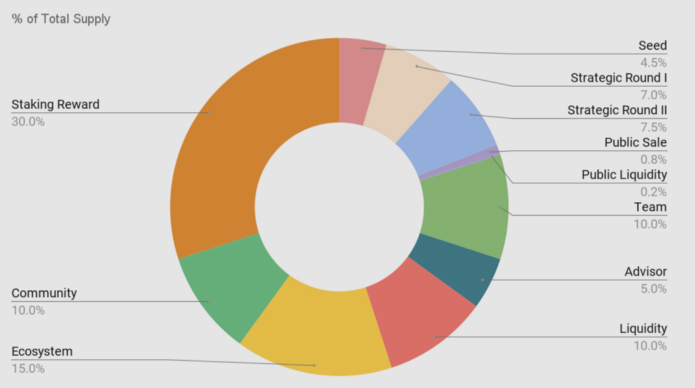

Token Allocation by Percentage

The total strategic sale (consisting of the seed round and two private sale rounds) is 19% of all tokens. Note, funds raised from the IDO will be used for technology development, community building, partnerships, and marketing to build out Lithium Finance.

Token Unlock and Vesting Schedule

- Seed: 0% unlocked at listing. Daily vesting over 1 year.

- Strategic Round I & II: 20% unlocked at listing. Daily vesting over 1 year.

- Public: 100% unlocked at listing.

- Team: 6 months cliff. Quarterly vesting over 2 years.

- Advisor: 6 months cliff. Quarterly vesting over 2 years.

- Liquidity: 5% unlocked at listing. Monthly vesting over 5 years.

- Ecosystem: 2% unlocked at listing. Monthly vesting over 5 years.

- Community: 5% unlocked at listing. Monthly vesting over 5 years.

IDO Notes

- Only whitelisted addresses will be able to access the Lithium Finance IDO sale.

- Eligibility criteria for the Polkastarter pool can be found here.

- Successful whitelist applicants will need to pass KYC and AML requirements.

- Citizens from the following countries will not be eligible to take part in the IDO process: Botswana, Cambodia, China, Comoros, Ethiopia, Ghana, Iran, Iraq, North Korea, Pakistan, Panama, Seychelles, Sri Lanka, Syria, Thailand, Trinidad & Tobago, Tunisia, USA, and Yemen.

- There will be slightly more whitelisted addresses than there are IDO sale spots. Allocation will be secured on a first-come-first-served basis.; extra whitelisting addresses are meant for filling up the allocated spots that are given up.

- KYC emails will be sent via Lithium’s official email, admin@lith.finance If receiving any communication before 29/07/2021 asking for KYC or any personal information, it is NOT Lithium Finance.

The post Lithium Finance launching IDO with Polkastarter to build out its data oracle solution appeared first on CryptoNinjas.