White House Defends Trillion-Dollar Stimulus While Jamie Dimon and Larry Summers Warn of Runaway Inflation

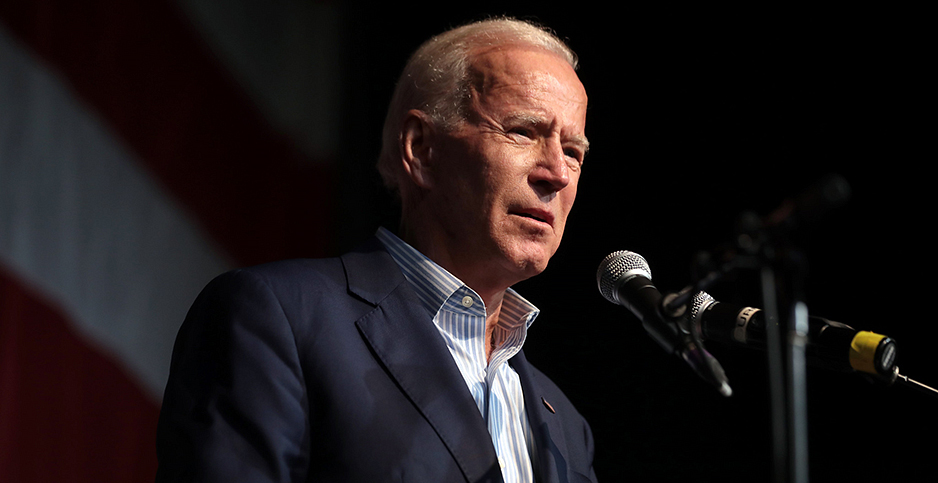

On Wednesday the White House defended President Joe Biden’s trillion-dollar spending proposals despite the criticism concerning rising inflation and low-interest rates. Inflation has risen at unprecedented levels in the U.S. and the average American’s purchasing power is growing less powerful. Now critics like JPMorgan Chase CEO Jamie Dimon and American economist Larry Summers have blasted the Biden administration because they expect inflation to grow “considerably higher.”

Americans Watch Purchasing Power Sink While Analysts Suspect Even More Inflation on the Horizon

Inflation has been a worry for American citizens ever since the U.S. government and Federal Reserve decided to increase the M1 monetary supply like never before in history. Essentially, inflation is the rise in price for goods and services, and the nation’s currency ends up buying fewer goods and services.

Reports show that nearly everything is rising in value, and the U.S. dollar can purchase far less than it could before. Car prices are expected to go through the roof this year, food prices have grown astronomical and pork prices touched a seven-year high. The USDA expects the price of food to rise from 2.5% to 3.5% for the year. It’s quite blatant that the central bank and politician’s often quoted “2% inflation rate” is a myth, as 2021 statistics show prices of goods and services in the U.S. have surged.

Morningstar.com increased its 2021 inflation forecast for the Personal Consumption Expenditures Price Index on Wednesday. “We expect 2021 core inflation of 2.5%,” the prediction notes.

“For 2022-25, our forecast is essentially unchanged; we expect moderate core inflation averaging 2.3%, just above the Federal Reserve’s 2% long-run target,” the Morningstar.com inflation report adds. Meanwhile, on May 26, financial executives and economists have criticized the Biden administration for seeking even more money from the Federal Reserve.

JPMorgan Chase CEO Jamie Dimon spoke about inflation when he testified before the Senate Banking Committee held on May 25. While a great number of financial institutions and Wall Street CEOs argued against “woke capitalism” and “climate change” that day, Dimon spoke about inflation.

The JPMorgan Chase CEO, who manages the largest financial institution by assets held, said the government’s stimulus could get carried away. “If that money is wasted, it is not productively spent, we will have more inflation, less productivity, slower growth and the American democracy you will have lost even more credibility [in the] eyes of the world,” Dimon Stressed.

Despite Jamie Dimon’s commentary, the White House principal deputy press secretary, Karine Jean-Pierre, emphasized to the press that the “President’s plans are working.”

“This is a president who understands about making sure that we’re not wasteful,” she added. “He made sure there was no corruption and no waste. And so he understands how this all works.”

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type = ‘text/javascript’; s.src = ‘https://bitcoinads.growadvertising.com/adserve/app’; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

Larry Summers: ‘Fed’s Will Only Remove the Punchbowl After It Sees Some People Staggering Around Drunk’

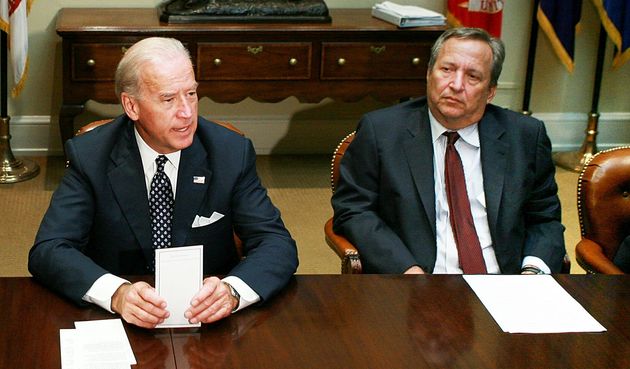

Not everyone agrees with Karine Jean-Pierre and the Biden administration. At the Coindesk 2021 Consensus conference the former Clinton and Obama official, Larry Summers discussed runaway inflation and monetary easing policies as well.

“I think [the] policy is rather overdoing it,” Summers said on Wednesday. “The sense of serenity and complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced.”

“Joe Biden has a historic opportunity to be a great president,” Summers further remarked. “But I think they should learn the lesson of the Johnson administration’s errors that elected Richard Nixon and the Carter administration’s errors that elected Ronald Reagan.”

Summers statements concluded when he said:

The Fed’s idea used to be that it removed the punchbowl before the party got good. Now, the Fed’s doctrine is that it will only remove the punchbowl after it sees some people staggering around drunk. We are printing money, we are creating government bonds, we are borrowing on unprecedented scales. Those are things that surely create more of a risk of a sharp dollar decline than we had before. And sharp dollar declines are much more likely to translate themselves into inflation than they were historically.

Despite Clear Data and Criticism, White House Disagrees America Will See ‘Long-Term Inflation’ and It’s the Fed’s Job ‘First and Foremost’

In recent times as inflation has gripped the American economy, the U.S. dollar index (DXY) plummeted below 90 again growing weaker. Seven days ago the U.S. dollar dropped to a three-year low and economists think the dollar could dip 10% lower. Even though there is lots of data and statistics showing the dollar is weaker and inflation is dislocating the economy, the White House wholeheartedly disagrees.

In response to Larry Summers’ recent critique of Biden economics, a White House official responded and told CNN it does “not see signs of persistent dislocation or long-term inflation.”

The official noted that it does monitor the inflation rates but it’s more in the hands of the U.S. central bank. “Our team closely monitors inflationary pressures but inflation is first and foremost under the purview of the Federal Reserve,” the White House official concluded.

What do you think about Biden’s economic plan and fears of runaway inflation gripping the American economy? Let us know what you think about this subject in the comments section below.