Crypto Markets Lose Billions, Weak Hands Capitulate, Stablecoin Market Surpasses $100 Billion

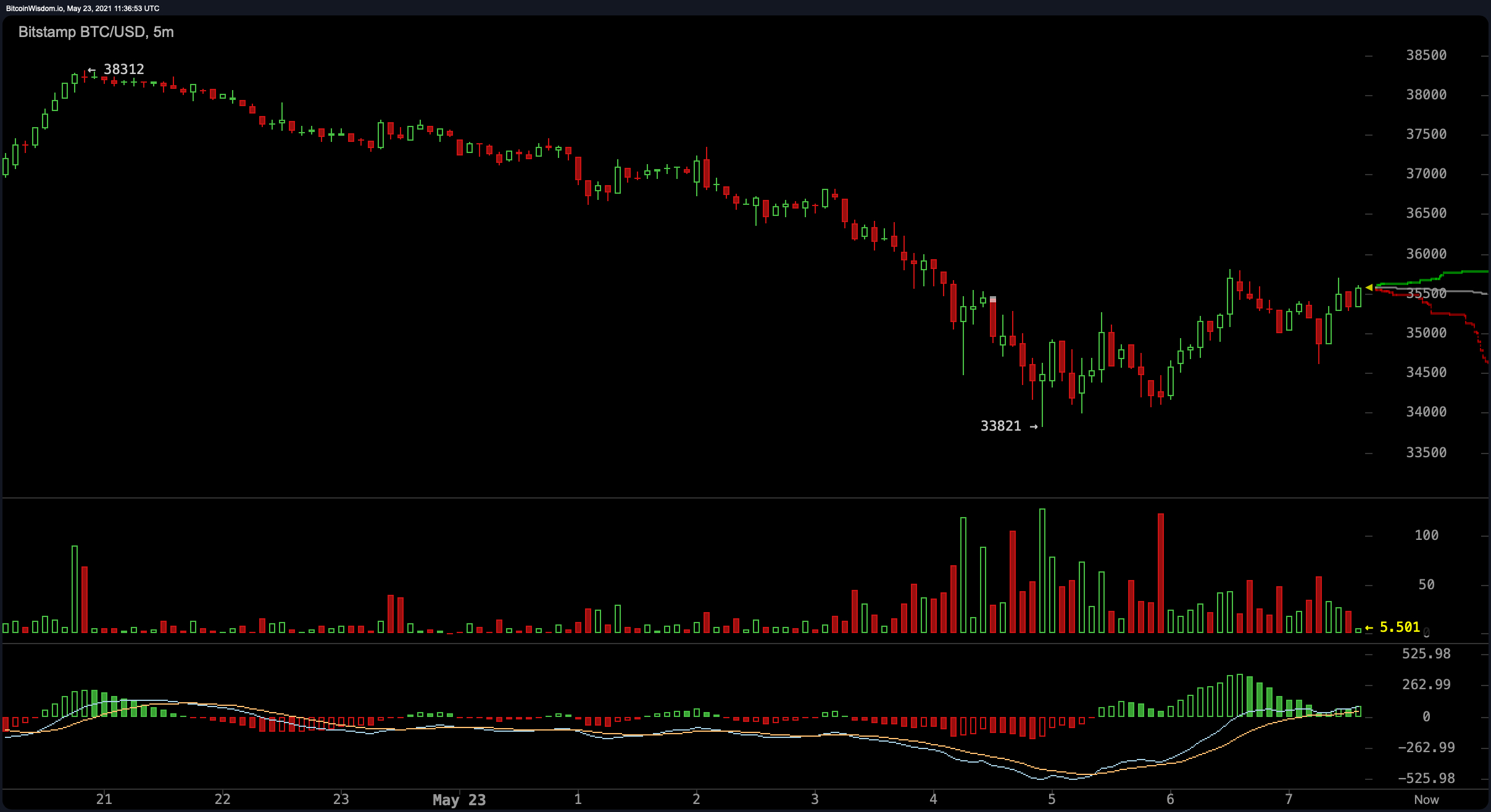

Digital currency markets have shed billions once again, as the entire crypto-economy has been cut down from well over $2 trillion to today’s $1.44 trillion market valuation. Bitcoin was coasting along just above the $38k handle before 9 p.m. (EST) yesterday evening but after that point, sellers started capitulating and the price dropped under $34k.

Crypto Economy Shaves Billions

- Crypto prices are down on Sunday after a number of markets tried to regain strength on Friday and Saturday. Bitcoin (BTC) and a number of other digital assets have lost significant value, as last week’s crypto market losses were some of the biggest in history.

- On Sunday, bitcoin (BTC) is trading for $35,385 per unit and is down 7% today and down 23% during the last seven days.

- BTC dominance has increased since dropping to a low of 40%. Sunday’s stats show BTC dominance is 45.9%, while ethereum (ETH) captures 17.3%.

- The second-largest crypto asset, ethereum (ETH), is down over 11% today and down 39% for the week.

- Out of the top ten crypto assets, the two biggest losers include binance coin (BNB) which shed 53% during the last week and polkadot (DOT), which dropped 53.82% during the last seven days.

- On the other hand, the top ten digital coins that saw the least amount of losses last week include bitcoin (BTC) and dogecoin (DOGE).

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = true; s.type = ‘text/javascript’; s.src = ‘https://bitcoinads.growadvertising.com/adserve/app’; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

While Participants Focus on the Crypto Market Carnage, The Stablecoin Economy Blasts Past $100 Billion in Value

- A number of people on Twitter have been discussing the crypto market carnage. The popular crypto Twitter account Alex Krüger said: “This is how a bear market feels like. Sellers capitulating, spot positions getting liquidated, bitcoin futures curve moving towards backwardation. Be great if this were a ‘bottom signal,’” he added.

- The Twitter account that goes by the name “Light” shared a chart and said: Starting to lever up long here on BTC and ETH. 50% drawdowns are indicative of full capitulation, as is sentiment, with retail panic dumping into low liquidity on the weekend.”

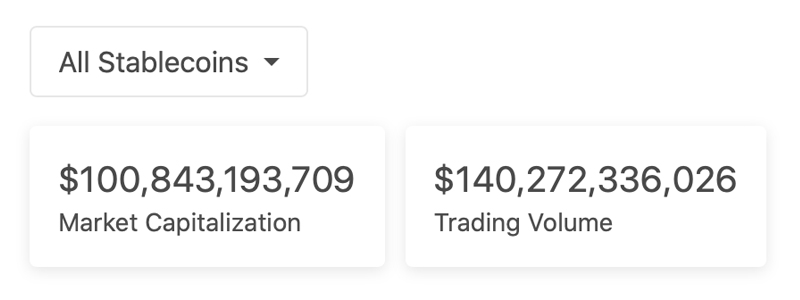

- Meanwhile, while everyone has been looking at the crypto market’s ‘blood in the streets,’ the entire capitalization of fiat stablecoins has crossed the $100 billion mark. Tether (USDT) commands the largest valuation with $59 billion today and usd coin (USDC) holds a valuation of around $19.9 billion.

- The Director of Research at The Block Crypto, Larry Cermak, discussed how market players are using the stablecoin market. “One of the most bullish things about this cycle compared to the previous one is that people are not taking out as much cash but rather letting it sit in stablecoins but still in the ecosystem,” Cermak tweeted on Sunday. “The mentality now is that at the very least you can earn some yield and deploy later.”

What do you think about Sunday’s crypto market action? Let us know what you think about this subject in the comments section below.