|

As far as I am aware, this type of analysis was first conducted by Benjamin Cowen on his youtube channel on May 13, 2021. I've adjusted and fine-tuned some points of analysis.

Current Bitcoin Cycle Compared to Previous Cycles

BTCUSD Index by Trading View

Key Considerations:

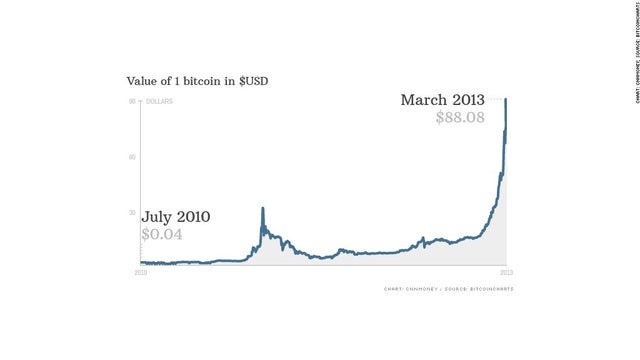

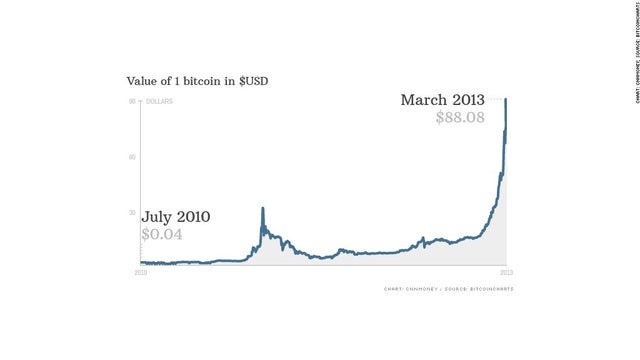

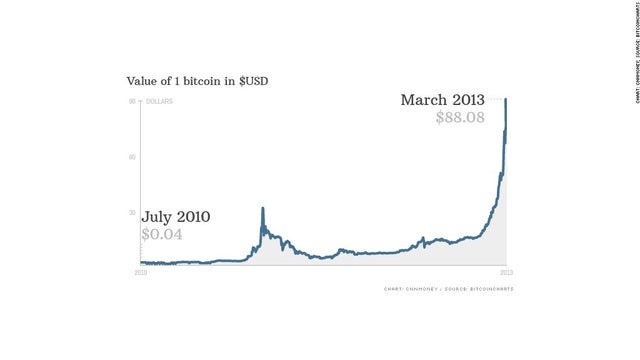

- I took the BTC's snapshots from each halving period until the market peak. An exemption is made for the first cycle in which there is no market data from the genesis block on January 09, 2009—the data starts from July 17, 2010.

- All the cycle comparisons start at the most recent halving on May 11, 2020.

- As of today, we are ~368 days in the current cycle.

Key Takeaways

- BTC's cycle tops have diminishing returns. It's much easier to climb from $1 to $100 compared to climbing from $10,000 to $100,000.

- Since entering the market, BTC's cycles are longer. Although, we only have two data points (2013 & 2017) to confirm this.

- Assuming that the market will have diminishing returns, will grow slower, and will peak later: this cycle is ahead of schedule, like the 2012-2013 cycle.

Possible Outcomes

- "This time is different": Institutional investments, bigger money, boomer FOMO, and mainstream adoption can change the market outlook. BTC may very well defy these assumptions and break the trend—growing higher and faster than the 2017-18 cycle.

- "This time is not different": Equally you can argue that we may see a repeat of 2012-13 where the cycle initially outpaces the previous one but eventually slows down. It's important to note that events concerning Cyprus, Greece propelled the first 2013 Bubble.

Regardless of whether you're bullish or bearish, It's important to remain flexible for either situation. We can only react to the market; your planning will determine how well you react. Beware of confirmation biases; we've had a crazy rally so far, devoid of 80% drops like we'd seen in past markets. That said, the market being optimistic for a long time, doesn't mean it will be at all times. Sentiment can change in an instant; but we experience change over much longer periods.

______

I do hope I left you with a level-headed perspective on things. If my outlook was too bearish for your likening, I'd recommend these rather bullish sentiments: here and here. On the opposite spectrum, I recommend this post.

submitted by /u/M00OSE

[link] [comments] |