How Balancer And Gnosis Will Make Ethereum Trades More Cost Efficient

Gnosis and Balancer Labs announced the deployment of the Balancer-Gnosis-Protocol (BGP), a new decentralized exchanged running on top of Ethereum. Felix Leupold, Software Engineer Lead at Gnosis, broke down some key points on the protocol and how it will help users to trade with better cost-efficiency.

The Balancer-Gnosis Protocol will converge two components, as part of the cooperation, Balancer’s second iteration Vault System and Gnosis price-finding mechanism. As Leupold explained, the BGP will protect users from Miner Extractable Value (MEV) exploits, but without losing on-chain liquidity.

MEVs are gaining more attention, as more solutions attend to tackle malicious strategies that mostly affect users. As Leupold said, traders on Ethereum’s network can “get rekt by miners and arbitrageurs” when these actors bundle transactions in order to manipulate prices. For example, front and back running, and transaction sandwiching. Leupold added:

BGP batches multiple trades per block and settles all of them at the same price. Ethereum is already batching transactions into discrete blocks so the notion of time-priority within a block is not meaningful.

Ethereum Users Will See The Biggest Benefit

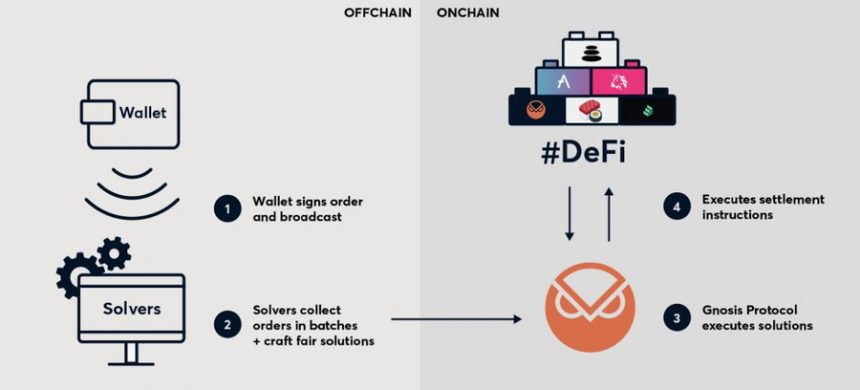

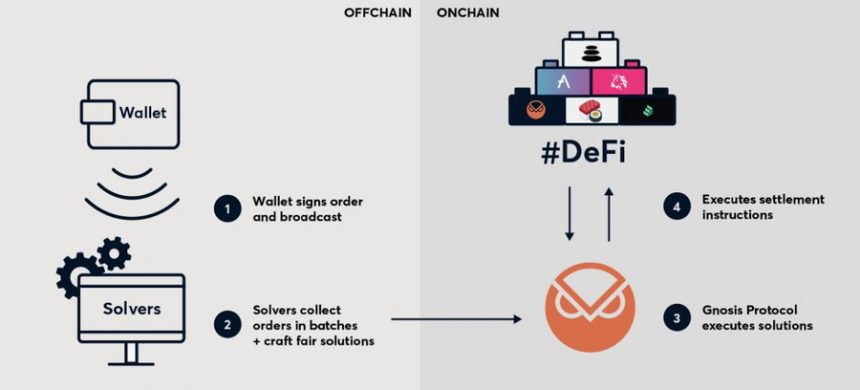

The DEX will be rollout in stages, its Proof-of-Concept is live for developers on the mainnet, CowSwap Exchange. When fully deployed, users will leverage the Gnosis Protocol solution to execute trades after they have been batched, as shown in the image below. The transaction must be signed, collected by a “solver”, batched and sent via the Gnosis Protocol for final settlement with Ethereum’s DeFi ecosystem.

Leupold classified the BGP as a “breakthrough”. After years of development, the solution can “tap into the liquidity of any on-chain protocol” and leverage Flashbots’ tools to prevent a transaction to be sandwiched or affected by manipulation. In a press release, Fernando Martinelli, Balancer CEO said the following on the partnership:

By collaboration, we can out-cooperate the competition-traditional finance-and bring traders unparalleled decentralization, transparency, and value. We’re proud to bring two teams known for great engineering, Balancer Labs and Gnosis, together in this collaboration.

The “solvers” will compete to offer users the best prices. Also, they will have “same or better prices” than in other decentralized exchange protocols with “no need to estimate gas prices yourself”, as Leupold said. Martin Köpperlmann, Gnosis CEO, said:

MEV is a phenomenon currently extracting value of up to 1% of all DEX trades on Ethereum, with value going from users to miners or other arbitrageurs. With BGP, and in particular Gnosis Protocol v2, we built a trading protocol that protects users and makes sure the value stays with them.

Ethereum has been breaking all resistance in the past day. At the time of writing, ETH trades at $2727 after dropping from a new ATH at $2.733. In the daily chart, ETH has a 3.6% profit and a 61.4% profit in the monthly chart.