Ethereum is an Infinite Canvas for Infinite Ideas

|

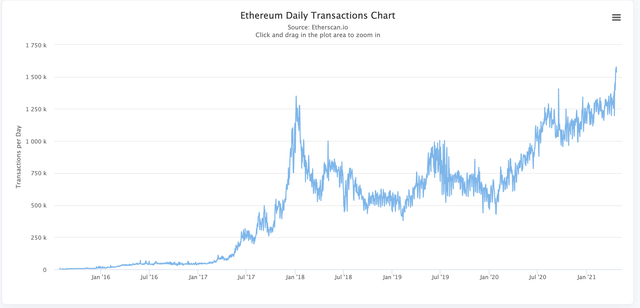

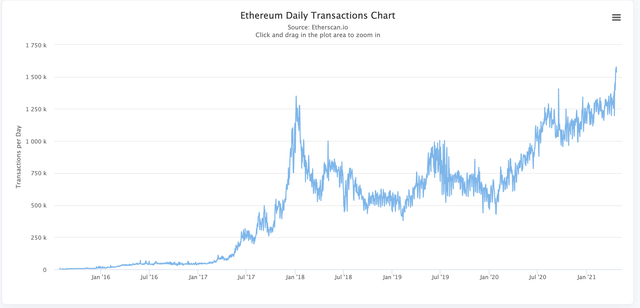

TLDR at the bottom. I started investing in Ethereum early this year, and the more I understood ETH, the more of a no-brainer it was as an investment. I'll be breaking down ETH for the newcomers, and also for the people already in crypto that hasn't had much opportunity to look into Ethereum, to show you how ETH has the potential to surpass BTC, because of its endless utility. Please be advised, this is just based on what I have learned so far since I started dabbling in the crypto space, if there are any inaccuracies, please feel free to point them out. Disclaimer: We are in the middle of a bull market right now, prices may fluctuate so always do your own research before buying. This is not investment advice, merely an explanation of what Ethereum is, and why I decided to invest in it. Utility as a CommodityOn the Ethereum platform, Ether (ETH) is the native token used — meaning ETH is used to process any transaction and changes on the Ethereum blockchain. To power applications and transactions, users and developers use ETH as “gas”, also known as the fee, in order to “fuel” the applications that run on Ethereum. Miners that validate transactions are rewarded through earning the "gas" fees. Gas prices for transactions vary depending on the difficulty of computation. The more complex the transaction, the more expensive it’ll be. For example, sending ETH from one wallet to another is not as much compared to doing a loan on DEX liquidity pools to take advantage of an arbitrage gain. Since ETH is the network's gas, it has utility rather than just being a pure store of value like Bitcoin. As the Ethereum network expands and more developers come into the ecosystem, ETH's demand will increase. The Ethereum network is also constantly breaking ATHs in terms of network traffic and transactions, another sign that utility and demand increase relative to time. Think of it like ETH being oil in the real world. Society needs machinery and vehicles to function, oil powers it, thus, more and more people would want oil in a society where oil is heavily demanded. Breaking ATHs in daily transactions Breaking ATHs in gas used daily Utility in ApplicationsOther than functioning as the network's gas, ETH has a lot of purpose in decentralized finance applications (‘dapps’ or ‘DeFi apps’ for short). An example of this is Maker. Maker allows users to use ETH as collateral, allowing you to generate a stablecoin, pegged to the US dollar, called DAI. Other dapps like AAVE or COMP allow users to use DAI or ETH as collateral to take out loans. Users can then put their loans into a "savings account", earning a nice APY %. If I were to dive into the Defi use cases of ETH, this post will be super long, so I will keep this part short. ETH, in short, can be considered a yield-barring asset, allowing users to explore a whole new financial world, and gain access to more capital in the decentralized finance world. As of today, over $50 billion is locked in DeFi apps, and this amount is also rising. Developers are also flocking to the network, finding new ways to innovate using the network. This already gives ETH so much upside. Unlike a lot of current cryptocurrencies out there, where users are simply holding, buying, and selling them, you can use ETH and in very very real ways with tangible benefits. Total value locked is increasing, relative to time Utility as a Base PairBack in 2017, a large reason for Bitcoin's boom was because it was the only base pair with other altcoins. This meant that people looking to buy altcoins had to first buy Bitcoin, and then swap it with the altcoins they were buying. Looking into the DeFi space, we currently have Decentralized Exchanges (DEX for short), like Uniswap and Sushiswap, that use ETH as the main trading pair for ERC20 tokens/altcoins. This means that anyone who wants to purchase new coins and fund projects that are not yet out on centralized exchanges like Coinbase or Binance has to own some ETH before they are able to swap. This gives ETH utility as a base pair and is the "big boss" of the DeFi ecosystem. Utility as a Store of ValueUltimately, like any other cryptocurrency, and with the increased exposure cryptocurrencies, in general, are getting, ETH will continue to see a gradual increase in its price. There are upcoming projects to improve ETH, like reducing the gas fees on the network. People would see Ether as an attractive store-of-value investment in order to capitalize on the potential growth of the Ethereum platform. Over the past weeks, in the midst of this bull run, we’ve seen ETH ETFs raise hundreds of millions of dollars of capital — with big institutions and investment firms getting involved. Like Bitcoin, institutional investors and retail investors will want to get involved with an asset that can act as a hedge towards fiat. Long-term investors can also stake their ETH, generating more ETH over time. Pair that with the gradual increase in the price of ETH, the passive income one can generate through ETH is a lot more than with traditional fiat currency. ConclusionTo conclude, Ethereum is an asset like no other. It is money, a commodity, and a yield-bearing asset all in one. Owning ETH is like owning programmable money, and quite frankly, that is why I invested in ETH. I'm not in it for a quick buck, I just see it as a whole different type of digital asset that I will be involved with over the next decade or two. TLDR: Wanted to create a post that newcomers can read and understand more about ETH. ETH has incredible utility as a currency, commodity, base pair, and a store of value. submitted by /u/yaotard |