How DeFi Season Could Send YFI To $270,000 Per Token

When Andre Cronje released Yearn Finance (YFI), the DeFi fever was brewing. Two events converge and launched the sector into full madness: Uniswap’s UNI airdrop and governance token YFI breaking every foreseeable resistance to reach $30,000.

At that moment, Bitcoin was trading at approximately $10,000. Now, after a downtrend, YFI seems ready to reach new highs. YFI is trading at $51.386 with 15.4% profits in the 24-hour chart. Over the week, YFI is up 15.9%.

Data from DeFi Pulse point to a highly bullish outlook for DeFi. Picking up the upward momentum from February 2021, the DeFi ecosystem has an all-time high Total Value Locked of $57.9B. Top 3 protocols Compound, Maker, and Aave hold over $20B alone.

Amidst this DeFi Season, trader Sean Nance said YFI could go as high as $270,000 per Token “soon”. According to the trader, YFI’s market at that price would keep it away from the top 10 cryptocurrencies hinting at a further upside movement. Nance said:

I’ve got 270k as a pretty reasonable target on YFI soon. I’m not sure if y’all are prepared for what’s coming to the market.

Yearn Finance aims for improvement

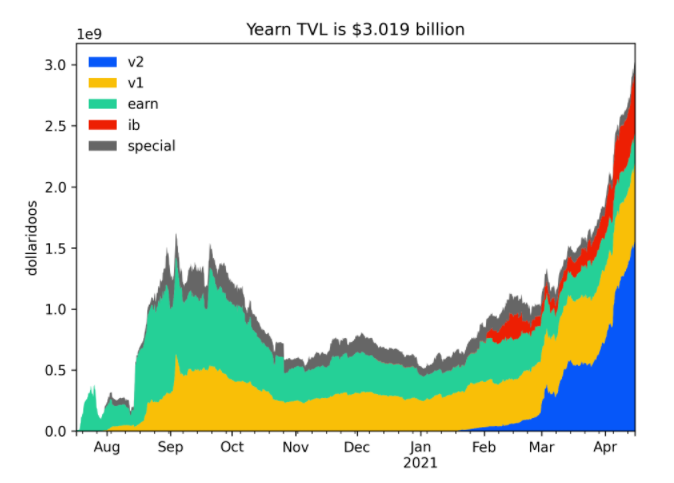

Setting support at $34.170 and $20.335, Nance indicated YFI recommended investors to buy more YFI and YFII. In support of this thesis, investor Daniel Cheung said Yearn Finance’s Total Value Locked reached a new ATH today with YFI price and it stands at $3B.

Cheung revealed to be “massive in YFI” and added Yearn Finance is “undervalued” with a story that is demanding recognition from the sector. At present, Yearn Finance growth could be amongst the highest in DeFi. Therefore, Cheng expects YFI to appreciate further. He added:

The $1.5 billion TVL in V2 alone produces $30 million in management fees. I would not be surprised if with the addition of performance fees across all vaults and yield from Yearn’s treasury farming, run-rate revenue is > $100 million. Markets are starting to appreciate undervalued protocols with outstanding fundamentals (…)

Yearn Finance community seems very active via its governance model. Lawyer Gabriel Shapiro has been working on a new operational governance model with user “Tracheopteryx”.

Via his Twitter handle Shapiro explained this proposal attempts to “craft a governance philosophy” rooted on real-world situations, based on what the lawyer described as “realpolitik”. Shapiro added:

(…) as applied to yearn, we call this philosophy “constrained delegation”: a system in which the primary role of YFI holders is to help decentralize and fine-tune the parameters of legitimate exercises of power within the community.

With an important number of partnerships in place, an active community that could gain more power, and strong fundamentals, YFI could be holding a moon ticket set to depart in the coming months.