Why this OlympusDAO’s product could be amongst DeFi most lucrative

Taking the market by storm, OlympusDAO’s native OHM is up 95.8% this week alone and 31.1% in the past two weeks. At the time of writing, OHM is trading at $812,76 with 7.3% profits in the 24-hour chart.

With a market cap of just $68 million, OlympusDAO might have gone unnoticed by many investors. However, it has a mechanism called Bonds which promises to be one most important and lucrative in the DeFi sector.

According to research firm Messari, this protocol is attempting to create a stable currency backing every OHM with DAI and OHM-DAI. The objective is to maintain a “fundamental check on inflation” and a currency with an undiluted purchasing power.

Unlike Tether and other stablecoins, OHM is not pegged to any other asset. Its stability is achieved via the DAO (Decentralized Autonomous Organization) when it alters variables to obtain more profitability for stakers.

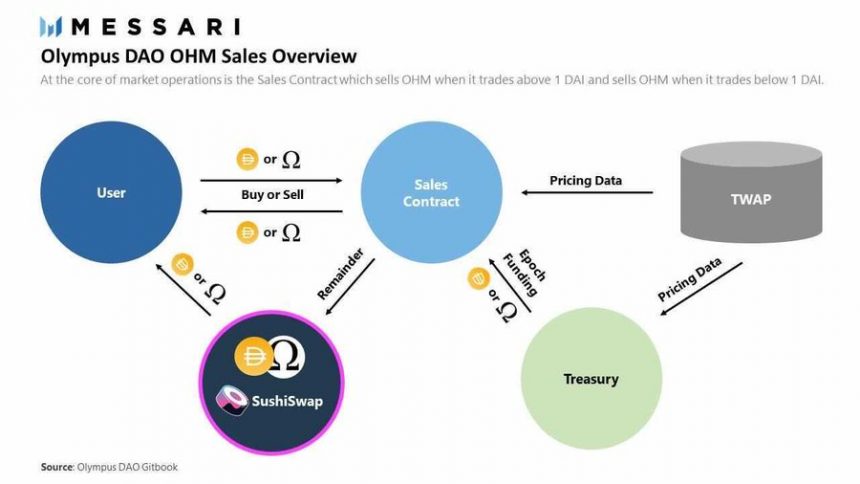

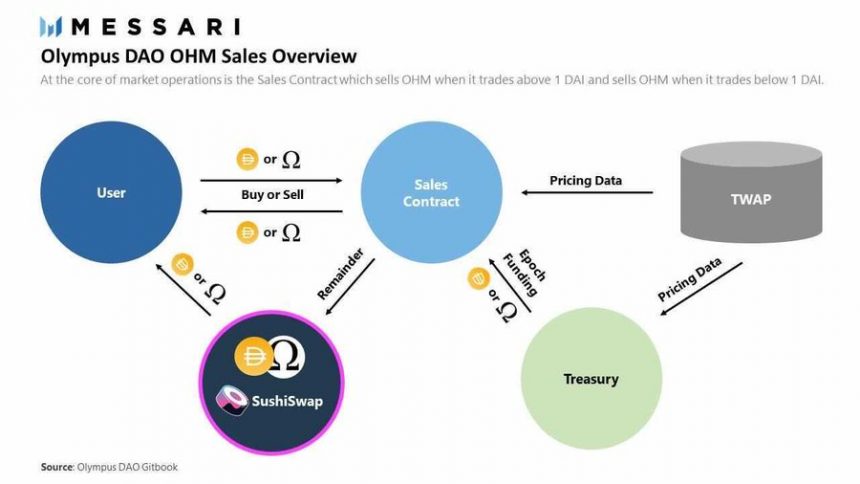

This is done via the sales contract connected to the protocol’s treasury and a liquidity pool (OMH-DAI) on decentralized exchange Sushiswap, as shown below. Messari explains:

When OHM trades above 1 DAI, the protocol mints and sells new OHM. When OHM trades below 1 DAI, the protocol buys back and burns OHM. In each case the protocol makes a profit. Olympus DAO distributes these profits 90% to OHM stakers pro rata and 10% to a DAO.

How OlympusDAO’s bonds operate

The Bonds are a treasury component to get liquidity with it users can trade Stake Liquidity Provider tokens to get OHM directly with the protocol, as an OlympusDAO developer explained.

Once the trade is completed there is a vesting schedule of 5 days. During this time, the user can redeem the tokens but has incentives to get them at a discount. The latter is determined by the number of bonds in the protocol, more bonds are equal to a lower discount.

Via this mechanism, as the developer said, OlympusDAO restrains its own growth, to have become “steadier”.

The liquidity from a bond is locked in the treasury and used to back new $OHM. That liquidity now belongs to the market and, by extension, the token holders. The more liquidity the protocol builds up, the more confident holders can feel.

The users are basically contributing to OlympusDAO by adding liquidity. In retribution, the user gets a reward in OHM at a much cheaper price during a specific period. That way, both the user and the protocol can benefit.

We are already seeing this happen. Since launching bonds a week ago, the protocol has accumulated 26% of the pool (~$1.7m worth of liquidity) pic.twitter.com/kGoPQYGDyq

— ZΞUS Ω (3, 3) (@ohmzeus) April 8, 2021

OlympusDAO offers LP a variety of strategies around OHM which they can leverage to obtain a bigger profit than on the spot market. The developer claims:

All of this serves to create a long-term, sustainable bootstrapping mechanism for the protocol, with participants as the main beneficiaries. A good system shouldn’t offer one opportunity to “make it”; it should offer them in perpetuity with diminishing returns. This is how you produce wealth; slowly, through compounding gains.

Ethereum is trading at $2096,58 with a 1.2% profit in the 24-hour chart, after dropping from its ATH at $2,198.