Why Morgan Stanley is gaining exposure to Bitcoin (BTC)?

In yet another bullish announcement for Bitcoin this week, banking giant Morgan Stanley has filed a document with the Securities and Exchange Commission (SEC) to gain exposure to BTC. Per the document, 12 of Morgan Stanley’s investment funds will allocate capital in BTC financial products.

Morgan Stanley’s investment funds eligible to gain indirect exposure to Bitcoin include Counterpoint Global Portfolio, managed by Dennis Lynch, Asia Opportunity Portfolio, Growth Portfolio, Inception Portfolio, International Advantage Portfolio, among others.

The funds will be able to invest in Bitcoin futures contracts settled in cash or Grayscale Bitcoin Trust (GBTC) shares of the Grayscale firm. Investment in BTC will not have to be ongoing and will be made through a subsidiary that will operate as an exempted company governed by the laws of the Cayman Islands.

The document states that investment in Bitcoin futures may change if regulations on the underlying asset change. In addition, Morgan Stanley states that these financial derivatives have a relatively small trade with other futures and may be subject to manipulation.

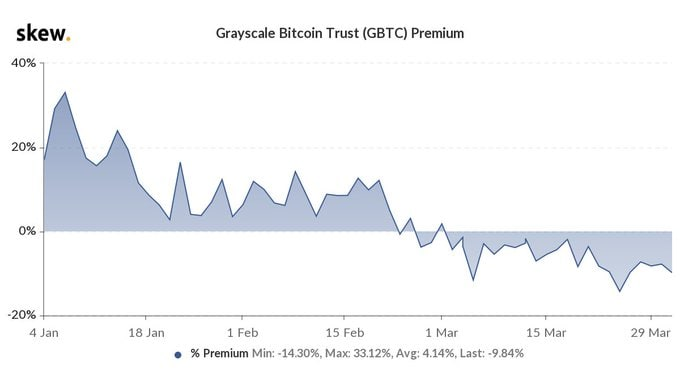

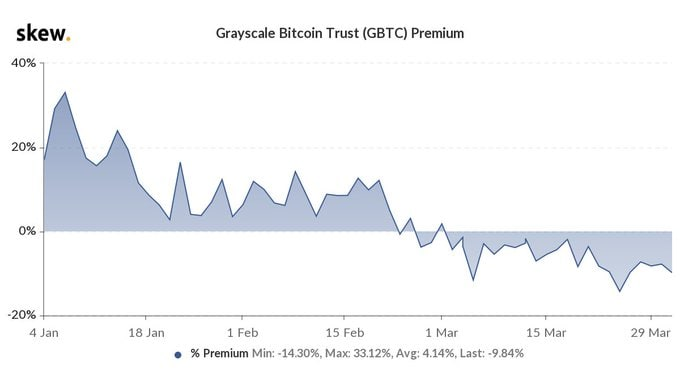

On its possible GBTC holding, Morgan Stanley rates fluctuations in the fund’s premium as one of its potential investment risks. It has “historically” traded at a premium or discount to the price of BTC. In fact, during the entire month of March, the GBTC premium turned negative and reached a low of approximately -10%, as research firm Skew registers. Morgan Stanley’s document claims:

To the extent GBTC trades at a discount to NAV, the value of a Fund’s investment in GBTC would typically decrease, even if the value of GBTC’s underlying holdings in bitcoin does not decrease.

A few weeks ago, Morgan Staley revealed that it would give exposure to Bitcoin to its wealthiest clients via 3 funds created in cooperation with Galaxy Digital and FS Investments, and NYDIG. The bank’s decision was taken after receiving pressure from its clients.

Investor migrating into Bitcoin

The series of announcements from giants such as Goldman Sachs, Morgan Stanley, PayPal, and BlackRock making an expansion of their bet on Bitcoin or an entry into the crypto market seems to be rooted in the current macroeconomics conditions.

BlackRock CIO Rick Rieder recently said that investors have been forced to seek assets that offer yield and appreciation in an inflationary economic environment.

Along those lines, Senior Commodity Strategist for Bloomberg, Mike McGlone, stated that there is a “Commodity supercycle happening in Bitcoin.” This is due to the trend towards digitalization that exists in the world which has been exacerbated by the Covid-19 pandemic.

McGlone highlighted that BTC as a store of value is a solution that, for the first time in history, allows people to store, trade, transport, and transmit wealth with ease all year round. The analyst believes that the world has entered a “paradigm shift” and a situation of “falling dominoes.” McGlone added:

Any investor on the planet who has 100 units of any type of asset knows now that if they don’t allocate at least 1 or 2 of those units to Bitcoin, they are at greater of this digital global reserve asset just continue to do what’s been doing becoming the world’s benchmark digital global reserve asset (and missing it).

BTC is trading at $58,297 and has been moving sideways in the 24-hour chart. On the weekly chart, the benchmark cryptocurrency has gains of 11.4% and 17.5% in the monthly chart.