What’s Sushiswap cooking? Holders prepare for upside move

Decentralized exchange Sushiswap has not lagged behind Uniswap Labs’ v3 announcement. In an official post, they have introduced new products called BentoBox and Kashi Lending. Now, users of the platform have a new tool to maximize their earnings:

BentoBox is a vault, serving as a decentralized “App Store” where you can deposit assets within to enable other Dapps. We are excited to announce that Kashi is our first Dapp within BentoBox, a margin trading platform powered by its lending protocol, allowing users to create lending token pairs of a wide range of however they perceive could optimize returns.

BentoBox will allow its users to generate profits from flash loans and other strategies that build on the product, according to the release. Kashi will be the instrument that will allow the use of tokens stored in BentoBox:

for lending, borrowing, and most importantly, one-click leverage trading transactions.

This announcement coincides with data shared by analyst Ali Martinez, recording an increase in development activity related to the Sushiswap during the last week. As shown in the image below, development activity has been increasing since the beginning of March until reaching a peak on the 13th of this month.

Simultaneously, the analyst has indicated a distribution chart of SUSHI holders indicates that “insiders may be preparing for a bullish impulse”. In the past two days, addresses holding the SUSHI token have grown by 8.10% from 10,000 to 100,000.

In anticipation of a possible bull-run, 15 new “mid-sized” whales have taken a position in SUSHI, since March 24. As a result, buying pressure on SUSHI has shown a significant increase. These investors seem to be confident that SUSHI’s price will prolong its rally in the coming days.

Sushiswap (SUSHI) outperforms UNI

Over the last day, according to DeFi Pulse data, Sushiswap has had a 0.64% increase in total value locked (TVL) to rank 6th in the top 10 DeFi protocols. In contrast, Uniswap has had a 3.40% growth in the same period.

However, governance token SUSHI has seen higher growth in the last 24 hours with gains of 12.3%. On the weekly chart, losses still stand at 16.6%, but on the monthly chart, gains are at 12.4%.

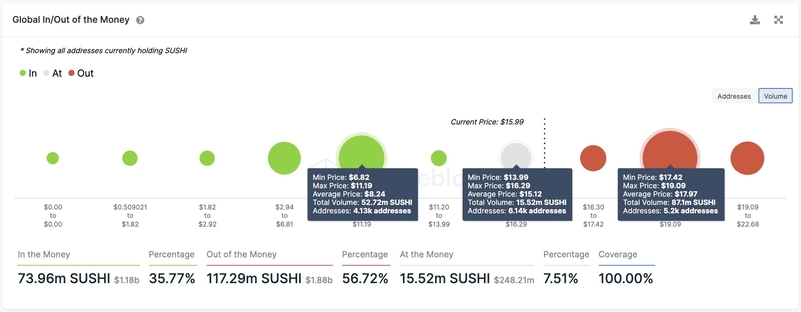

UNI shows gains of 4.7% on the last day and trades at $28.42. In the short term, SUSHI holders may still face significant resistance. IntoTheBlock’s Global In/Out of the Money metric indicates that around 5,200 directions bought 87 million SUSHI in the high $10 range. These investors could take profit at current levels.