Expert Take: Bitcoin Has Become A Monetary “Manipulation Gauge”

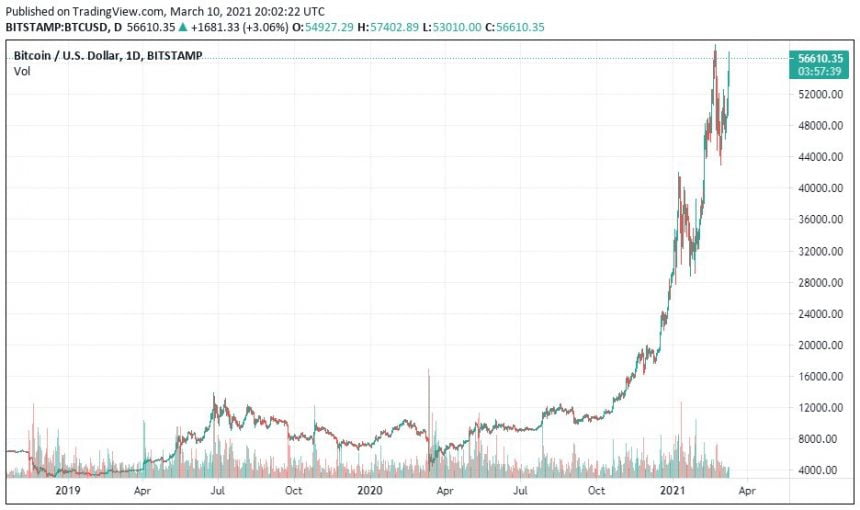

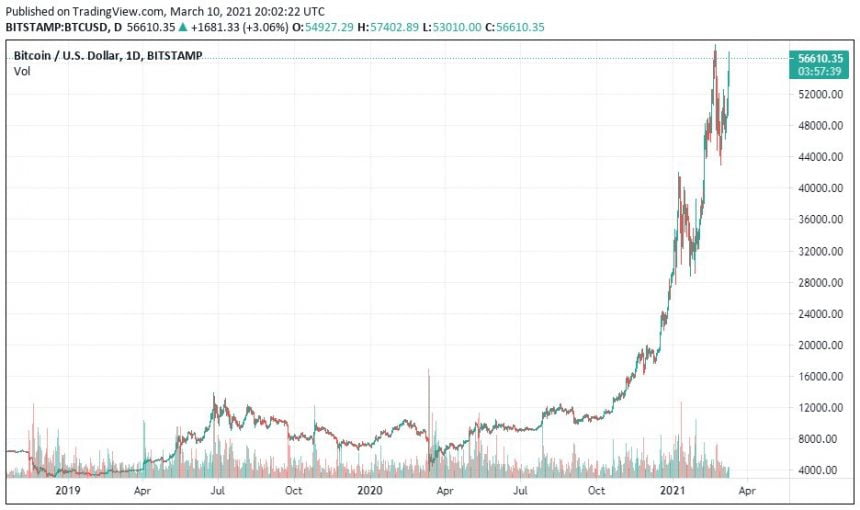

Bitcoin price is once again soaring, retesting resistance near the current all-time high. According to a top expert on the leading cryptocurrency, the asset’s price chart has become a sort of “manipulation gauge” that measures ongoing economic growth “engineering” by governments.

If that’s the case, resistance won’t be able to hold Bitcoin back much longer, as the US House of Representatives has passed another historic $1.9 trillion relief package. Here’s a closer look at how the “manipulation gauge” has reacted so far.

Bitcoin Becomes Solution To Ongoing Government Economic Engineering

During the Great Recession, there were unprecedented bank bailouts and other measures to avoid a catastrophic economic collapse. The Pandora’s box of quantitative easing once opened cannot be stopped.

Since that day, wage gaps and financial inequality only widened. The best attempt at instilling change, was created by Satoshi Nakamoto in 2008.

Related Reading | Bitcoin “Cheat Sheet” Calls For Next Leg Up To $77K

Today, Bitcoin is actively fighting that same fight, and winning. The cryptocurrency’s scarce 21 million BTC supply is proving its value during a time when the fiat money supply is expanding at its fastest pace ever.

Dollars and other global currencies have been created at unprecedented rates to combat the impact of the pandemic, and more stimulus will always be necessary each time the economy weakens.

The rate at which this is happening, is appearing directly on the Bitcoin price chart itself, according to expert Preston Pysh, effectively acting as a “manipulation gauge” against the “engineering” governments are doing in hopes of stimulating economic activity.

Bitcoin has become a manipulation gauge of sorts according to Pysh | Source: BTCUSD on TradingView.com

What The Monetary “Manipulation Gauge” Says Currently

Looking at Bitcoin’s price chart above, the price action is relatively stable – as stable as it gets for a volatile cryptocurrency. But when Black Thursday happens last year, and there’s an enormous spike downward unlike ever before seen.

The extreme move down resulted in such a strong polar move to the upside, further fueled by what has been a perfect storm for the nascent cryptocurrency.

Related Reading | Fund Manager Bashes Bitcoin: An Extreme Form of Libertarian Anarchism

In addition to price rising due to hyperinflation, adoption of the technology is exploding, and institutions are involved for the first time ever, and it has only recently just begun. Gold, which typically performs in this type of environment, has suffered and seen outflows go directly into Bitcoin.

The current bull market uptrend is only poised to continue, as more stimulus packages are on the verge of being passed and funds being distributed directly to businesses and individuals. The risk of hyperinflation remains high, and buying Bitcoin remains the best defense.

Featured image from Deposit Photos, Charts from TradingView.com