Less Than 100 XRP Needed To Become A Millionaire? New Research Suggests

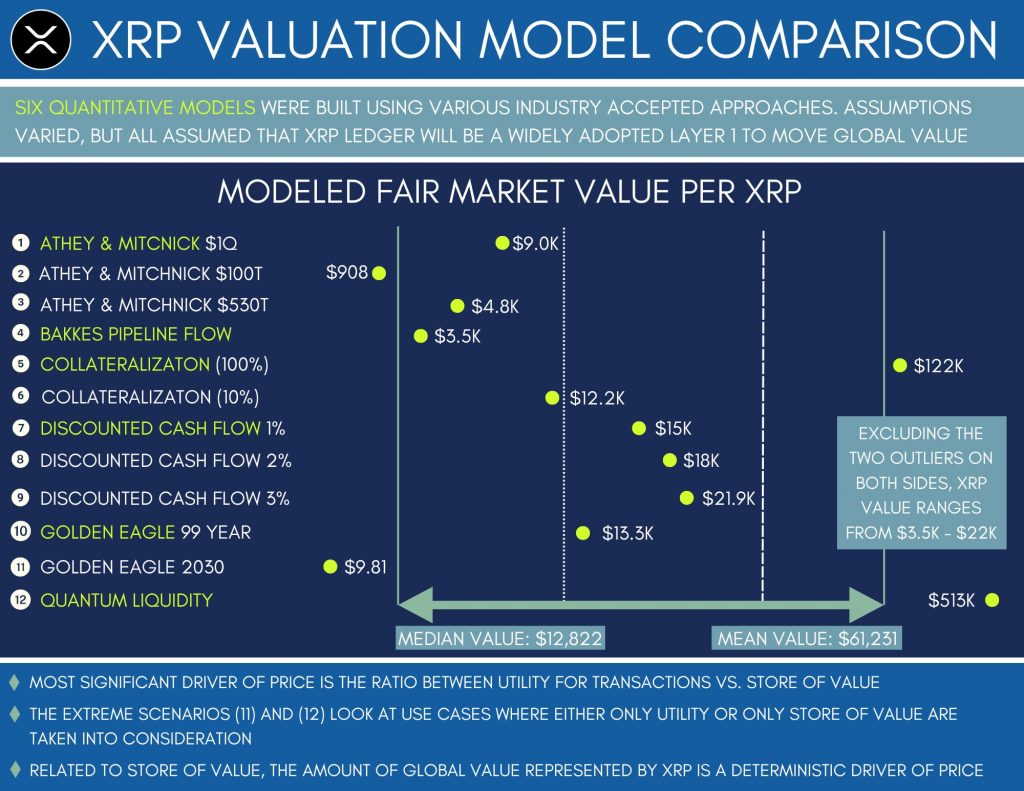

Valhil Capital has published a new research paper assessing the fair value of XRP, and the results are astronomical. The private equity firm explains in the research paper, using six pricing models, that the fair value is somewhere between $3,500 and $21,900 per token. So, as one community member pointed out, it would only take 77.9 XRP to become a millionaire at the median price of $12,822. Even at the most conservative projection of $3,500, 285.8 XRP would be enough to become a dollar millionaire. XRP Price To The Moon? Molly Elmore, Chief Marketing Officer (CMO) at Valhil Capital, shared the whitepaper titled “A Comprehensive Approach To Determine The Fair Market Value Of XRP” via Twitter. According to her, the document is the result of an extensive two-year research conducted by a “larger group of individuals,” the “confidential committee.” The origin of the effort was the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Ripple, which raised the question: if the SEC’s lawsuit harmed retail investors, how could financial damages be calculated? To do this, Valhil Capital argues that it is necessary to examine the extent to which the lawsuit prevented the adoption of the XRP Ledger from realizing its intended use case. Related Reading: Ripple CEO Blasts SEC Chair For Anti-Innovation Stance, XRP Bulls Remain Optimistic Because of this, the concept of fair market value came into discussion, and how it differs from market value. To assess the fair value, the Confidential Committee formed a smaller Valuation Committee in the fall of 2022, composed of individuals who had experience with quantitative and financial valuations. As a result, the Committee establishes six pricing models: Pipeline Flow Model, Athey and Mitchnick Model, 99-Year Golden Eagle Model, Discounted Cash Flow Model, Collateral Model, and a Quantum Liquidity Model. All models relate to various factors, including market conditions, supply and demand, and other relevant considerations. However, the most important driver of the asset price, according to the analysis, is the extent to which the world decides to use XRP to store wealth. According to the white paper, this will happen after people see a modest increase in price from using the asset. For example, the pipeline flow model looks at transaction volume, store of value, supply and demand interaction factors, and the interaction dynamics of competition. It assumes that there will be a “big bang” event triggered by the FX trading volume on the XRPL suddenly exploding. The Theses And Projections Are Controversial It should be noted that the thesis of Valhil Capital should be taken with a grain of salt. Even in the XRP community, founder Jimmy Vallee and his buyback theory are more than controversial. Related Reading: US SEC Sues Binance, Fails To Mention Ripple (XRP) As Security Various well-known members of the community, such as attorney John E. Deaton and CryptoEri have distanced themselves from the buyback theory. Deaton made it clear in February of this year that he will not accept any money from Vallee for his efforts in the Ripple and LBRY cases. The XRP buyback theory dates back to 2021. According to Vallee, XRP will become the world’s reserve currency when government debt reaches unsustainable levels. He posits that this is only possible if governments buy large amounts of XRP, at a much higher price than currently. At press time, the XRP price stood at $0.5209. Featured image from iStock, chart from TradingView.com