Bitcoin Exchange Inflow Spikes, Is This Bearish?

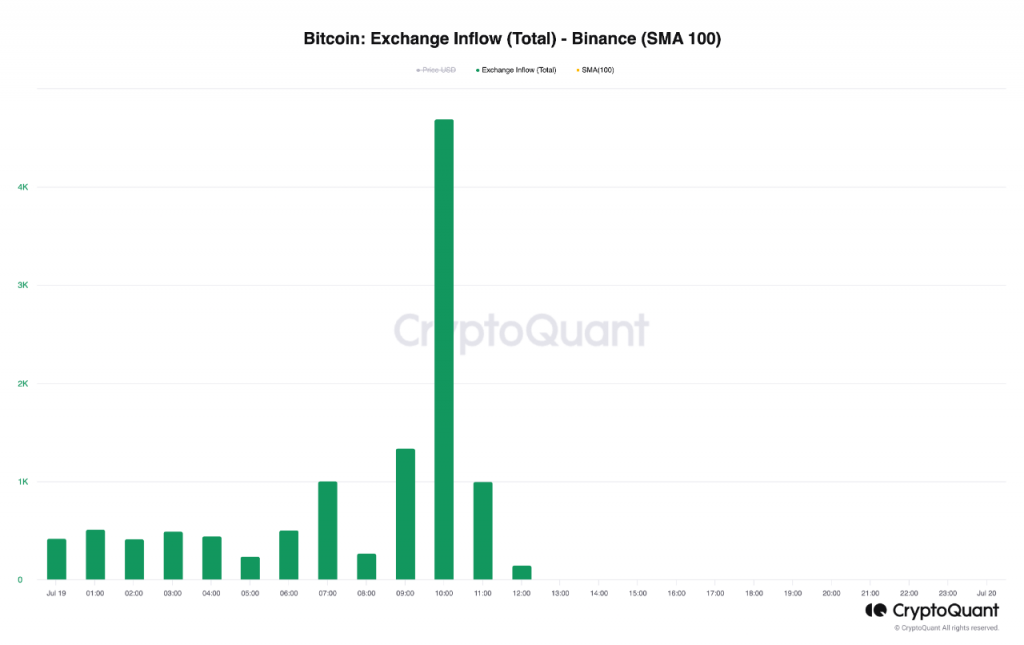

On-chain data shows the Bitcoin exchange inflow towards Binance has spiked during the past day, which may be bearish for the price. Bitcoin Exchange Inflow Has Registered A Large Spike As an analyst in a CryptoQuant post pointed out, a whale has made a large deposit to the cryptocurrency exchange Binance. The relevant indicator here is the “exchange inflow,” which measures the total amount of Bitcoin that investors send to a specific centralized exchange (which, in this case, is Binance). When the value of this metric is high, it means that the holders are depositing large amounts to the platform right now. The investors may have made these transfers for selling-related purposes, depending on which type of exchange these inflows are for. Naturally, if that is the case, the price could feel a bearish effect from the inflows. On the other hand, low values imply the exchange in question isn’t receiving that many coins currently. Such a trend would imply that the market’s selling pressure may be low. Related Reading: Bitcoin Has Broken This Open Interest Pattern, Quant Explains Now, here is a chart that shows the trend in the Bitcoin exchange inflow for the cryptocurrency exchange Binance over the past day: The value of the metric seems to have been quite high in recent hours | Source: CryptoQuant As shown in the above graph, the Bitcoin exchange inflow for Binance has observed a rather large spike in the past day. With this deposit, around 4,451 BTC (approximately worth $133 million at the current exchange rate) has entered the platform’s wallets. Interestingly, this deposit has come from a whale that has bought 20,000 BTC over the last eight months, meaning that the investor still has over 15,000 BTC left in their wallet after the transaction. The whale may have made this transfer to take some profit at the current prices. Since the scale of the deposit is quite sizeable, it could potentially cause bearish ripples in the market. However, as another quant has explained, the deposits have been towards the derivatives side of the exchange and not the spot platform. Looks like the spot exchanges inflow hasn’t moved today | Source: CryptoQuant It would appear likely that the transfer hasn’t been made to sell the coins (at least not directly) but rather for opening positions on the derivatives market. Related Reading: Signal With Perfect Track Record Predicts Bitcoin Bull Market Parabola: Analyst “This category of large wallets rarely moves directly to derivative exchanges,” notes the analyst, given that the size of the wallet in question is in the 10,000+ BTC range, the class of the largest whales on the network. Such a large position can lead to volatility in the Bitcoin price, but unlike selling from spot deposits, this price action may not necessarily be bearish for the asset. BTC Price At the time of writing, Bitcoin is trading around $29,800, down 3% in the last week. BTC has gone downhill during the last few days | Source: BTCUSD on TradingView Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com