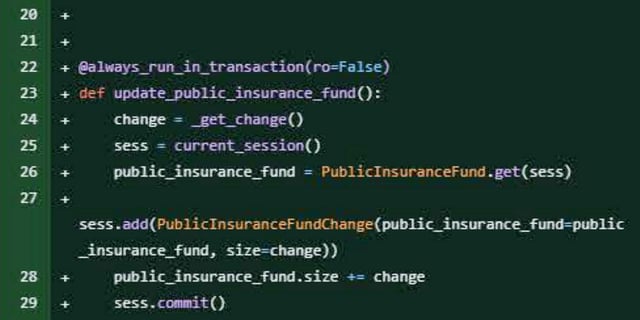

XRP, along with the broader cryptocurrency market, witnessed a significant decline in prices today, as bearish pressure gripped the digital asset. This downward trend has raised concerns among XRP enthusiasts and experts, who are closely analyzing the recent price movements. Bill Morgan, a lawyer and devoted XRP enthusiast, has drawn attention to a compelling observation that draws parallels between the current price drop and a previous significant event. Morgan has pointed out that the recent plummet in XRP’s price bears an uncanny resemblance to the downward spiral witnessed after Judge Torres issued her summary judgment ruling back in July. It’s worth noting that XRP’s price had initially surged to as high as $0.549 on Oct. 3, following Judge Torres’ decision to deny the appeal request my by the Securities and Exchange Commission. XRP has now almost entirely lost the the gains from the recent Torres decision on the SEC’s motion for an interlocutory appeal as it previously almost entirely lost the gains from the summary judgment decision in July pic.twitter.com/Zloa3bcPMD — bill morgan (@Belisarius2020) October 9, 2023 Ripple, the company behind XRP, celebrated this as another victory in their ongoing legal battle with the SEC. However, this surge was short-lived, as profit-taking activities swiftly ensued. Related Reading: Shiba Inu Stagnation: What’s Causing Meme Coin’s Recent Sluggishness? XRP’s Market Snapshot Over the past six days, XRP has experienced a series of declines, with only one day in the green. Notably, during this turbulent period, XRP slipped below both its 50-day and 200-day moving averages, signaling a bearish sentiment in the market. As of the latest data from CoinGecko, XRP’s price stands at $0.497, reflecting a 3.9% decline in the last 24 hours and a 3.1% dip over the past week. Crypto expert Benjamin Cowen weighed in on the situation, characterizing the recent drop in altcoin prices as a typical phase in the market cycle. “Namely, where BTC drops, but BTC dominance goes up because altcoins are dropping more. It is always the most brutal part of the market cycle,” Cowen noted. This perspective underscores the interconnectedness of the cryptocurrency market and the complex dynamics that influence price movements. XRP market cap halfway to the $27 billion level. Chart: TradingView.com Technical Indicators, Potential Scenarios For XRP’s Future Furthermore, technical indicators are hinting at the possibility of a bearish momentum building up for XRP. The Relative Strength Index (RSI) has slipped below the neutral line at 50.0, indicating weakening buying pressure. Additionally, the Moving Average Convergence Divergence (MACD) indicator, which measures momentum changes, is inching closer to a potential bearish divergence. If the MACD line crosses below the signal line, XRP may face further declines. In this scenario, there’s a real possibility that XRP’s price could drop to the September low of $0.47. Falling below this crucial level could result in the altcoin reaching a three-month low. However, if the broader sentiment in the market turns positive, XRP might manage to hold the $0.505 support level. As XRP navigates these turbulent waters, investors and enthusiasts will be closely watching for any signs of a reversal in its fortunes and hoping for a brighter future ahead. (This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk). Featured image from iStock