Bitcoin Plunges To $28,500, Will This Historical Support Hold Again?

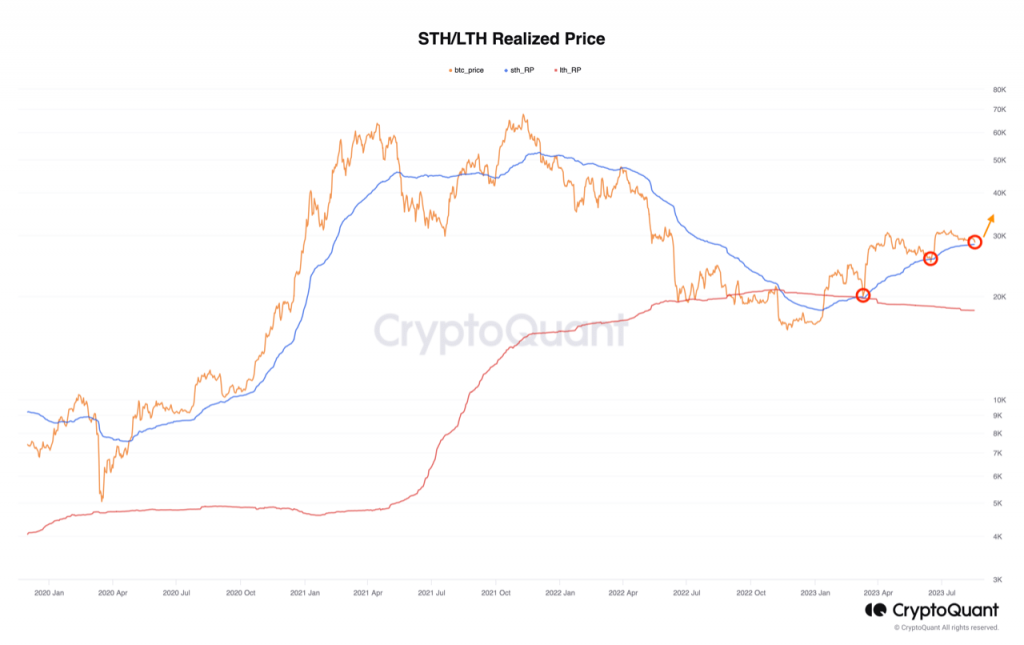

Bitcoin has plunged toward the $28,500 mark during the past day, which happens to be quite near a historically significant support line. Bitcoin Is Now Near The Short-Term Holder Realized Price As pointed out by an analyst in a CryptoQuant post, BTC’s latest drawdown has brought it near the realized price of the short-term holders. The “realized price” here refers to a metric that’s derived from the “realized cap” model of Bitcoin. The realized cap calculates the total valuation of the asset by assuming that the actual value of any coin in circulation is not the current spot price, but the price at which the coin was last transacted on the chain. Since the last transfer price of any coin is likely to represent its buying price, this model accounts for the prices that each investor in the market bought their coins, and hence, the realized cap may be looked at as a measure of the total capital that holders have put into the cryptocurrency. When this model is divided by the total number of coins in circulation, the average cost basis or acquisition price in the market is obtained. This is precisely what the realized price is. Related Reading: Are Bitcoin Whales Selling? This Metric May Suggest So If the Bitcoin spot price goes below this indicator, it means that the average investor has gone underwater. Similarly, breaks above the metric signify a return to profits for the majority of the market. The realized price can also be defined for specific segments of the market. In the context of the current discussion, one part of the market is of relevance: the “short-term holders” (STHs). Here is a chart that shows the trend in the Bitcoin realized price for this cohort: Looks like the value of the metric has approached the price recently | Source: CryptoQuant The STHs include all investors who bought their coins within the last 155 days. The holders that pass beyond this threshold are termed “long-term holders” (LTHs). From the chart, it’s visible that with the latest decline, the Bitcoin spot price has come very close to the STH realized price. This would suggest that these investors as a whole are about breaking even on their investment currently. In the chart, the quant has highlighted how previous retests of this line have gone in this year so far. Interestingly, both back in March and June, the cryptocurrency found support at this metric and observed a sharp rebound. This is a trend that has historically been seen during bullish periods. The reason behind this curious pattern may perhaps be the fact that the STHs look at their cost basis as a profitable point for accumulating more of the asset in such periods, as they believe that the price would only go up in the near future. Related Reading: Bitcoin & Top Assets See High Loss Taking, Is This Bullish? The extraordinary buying pressure at the line may be why the asset finds support at this level as well. This is because the opposite happens during bearish periods, as holders look to escape the market at their break-even point. It now remains to be seen how Bitcoin’s interaction with the STH realized price will go this time around. Naturally, a successful retest would be a positive sign for the rally, as it would show that these investors haven’t yet lost their bullish conviction in the coin. BTC Price At the time of writing, Bitcoin is trading around $28,500, down 3% in the last week. The value of the asset has plunged | Source: BTCUSD on TradingView Featured image from iStock.com, charts from TradingView.com, CryptoQuant.com