Experts Explain Why SEC’s Interlocutory Appeal In Ripple Case Was A Mistake

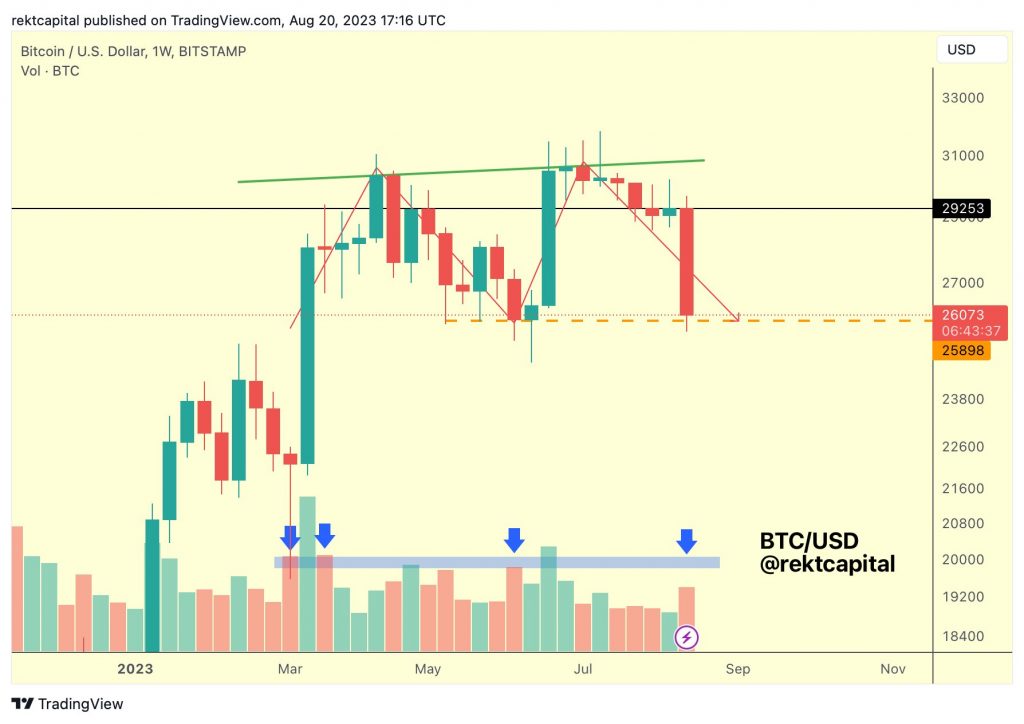

The United States Securities and Exchange Commission (SEC) recently filed an interlocutory appeal following Judge Analisa Torres’ ruling in favor of Ripple. However, an attorney and crypto enthusiast Greg Beuke believes the SEC made a mistake in appealing the decision. SEC Misunderstood Judge Torres’ Ruling Reacting to the news that the SEC had filed a motion to certify an interlocutory appeal, Beuke stated that the regulator “fundamentally misunderstands” the ruling. According to him, the Judge didn’t rule programmatic sales cannot constitute investment contracts. Related Reading: Ethereum Whale Avoids Market Crash, Do They Know Something You Don’t? He explained that Judge Torres only ruled that programmatic sales didn’t constitute investment contracts in this particular case because the SEC failed to establish that XRP investors who bought over exchanges did so, hoping they would profit from Ripple’s efforts. The SEC also failed to adduce any significant evidence to bolster its case. Beuke highlighted that the agency didn’t provide any “single XRP holder” who said he expected to profit from Ripple’s venture despite that being the basis of the SEC’s argument. Instead, it relied on “cherry picked statements from Ripple & select employees,” which the attorney believes was inadequate to discharge the burden of proof placed on the SEC. Beuke further called the SEC’s move of an interlocutory appeal a “huge strategic mistake.” Usually, a party appealing a final ruling can interpret it in a way that bolsters its argument without the Judge who gave the ruling being able to clarify why it made such a judgment. However, in this case, the SEC filed an interlocutory appeal (an appeal before a final order is made) which allows Judge Torres to clarify her ruling and probably put a dent in the SEC’s case, as Beuke argues. He believes that the Judge will make it clear that the SEC failed to discharge its burden of proof. XRP price continues to decline | Source: XRPUSD on Tradingview.com SEC To Lose Its Appeal In Ripple Case? Beuke pointed out that no new evidence can be adduced upon appeal, and neither can the SEC make new arguments. As such, the 2nd circuit will only have the records to work with, and going by it, the regulator provided little or no evidence to prove its case. Related Reading: The $200 Million BNB Bridge Exploiter Just Got Liquidated On Venus While the appeal court might be inclined to accept the SEC’s underlying argument that XRP’s programmatic sales did indeed constitute an investment contract, Beuke has stated the court will avert its mind to Judge Torres’ ruling, which was based “on the undisputed factual record,” which shows that the SEC failed to prove its case. The SEC is likely to lose as it was expected to prove that a “reasonable retail XRP purchaser was aware of Ripple and relied on Ripple’s efforts for profits.” Furthermore, Ripple seems to have a more solid case as the SEC had no reply to affidavits of XRP holders, which prominent XRP lawyer John Deaton brought forward. Featured image from iStock, chart from Tradingview.com