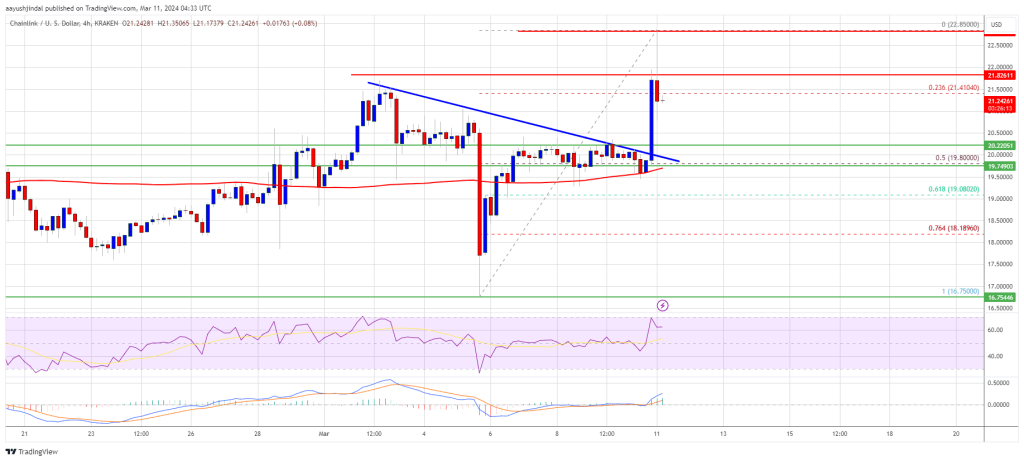

Bitcoin transaction fees have experienced an unprecedented surge, doubling in just one week, as the market rallies towards the coveted $70,000 mark. This surge cannot be solely attributed to the upward trajectory of Bitcoin’s price but is significantly influenced by the sudden rise in Ordinals transactions. Related Reading: Dogecoin Prospects Looking Good: Top Traders Predict $1 Price Tag Ordinals: A Driving Force Behind Fee Escalation Amidst the fervor of Bitcoin’s price rally, Ordinals transactions have emerged as a driving force behind the surge in transaction fees. Our in-depth analysis reveals that Ordinals, which started the week with approximately 48,000 daily inscriptions, witnessed an extraordinary surge, surpassing 93,000 by March 8th. This surge in daily inscriptions has not only contributed to a substantial increase in fees, with the daily average fee standing at around eight BTC but has also added a staggering $3.8 million to the total network fees for the week. Bitcoin market cap currently at $1.3 trillion. Chart: TradingView.com Bitcoin Fees Break Records, Reflecting Market Dynamism Bitcoin’s fee trend for the week has been nothing short of dynamic. While the initial daily fees stood at around 46 BTC, the momentum gained pace around March 5th, surging to an impressive 103 BTC. Towards the end of the week, the daily fee decreased slightly to around 40.7 BTC. Despite the decline, the overall trend indicates a significant increase in daily fees compared to the preceding week, showcasing the dynamism and resilience of the Bitcoin market. Bitcoin’s Ascent Towards $70K And Its Ripple Effect As Bitcoin teeters on the edge of the $70,000 price range, the cryptocurrency market is on the brink of a potential breakthrough. At the time of reporting, Bitcoin was trading at about $68,950, marking a 10% increase in the last seven days. Bitcoin price action in the weekly chart. Source: Coingecko A Closer Look At Bitcoin’s Fee Surge Examining data provided by IntoTheBlock, it becomes evident that Bitcoin’s recent fee surge is not merely a consequence of its price rise. The notable increase in transaction fees, doubling compared to the previous week, is closely tied to the upward movement in the price of BTC. Bitcoin fees more than doubled this week, with Ordinals-related transactions hitting a monthly high. pic.twitter.com/YXh9oMMYSK — IntoTheBlock (@intotheblock) March 9, 2024 This movement has propelled transaction volumes to their highest levels in months, with NewsBTC’s analysis revealing a staggering volume surpassing $100 billion on March 5th and 6th, a level not witnessed since November 2022. Related Reading: Shiba Inu Mania: Price Surges 60% As Burn Rate Heats Up Over 22,000% Ordinals’ Remarkable Contribution To Bitcoin Fees NewsBTC’s detailed evaluation of Ordinals transactions over the past week sheds light on the remarkable contribution of this sector to Bitcoin’s escalating fees. With daily inscriptions skyrocketing and daily fees averaging around eight BTC, Ordinals has made a significant impact on the cryptocurrency landscape, contributing over $430 million in fees to date. Featured image from Karolina Grabowska/Pexels, chart from TradingView