Behind The Scenes Of Shiba Inu 12% Plunge: What On-Chain Analysis Tells Us

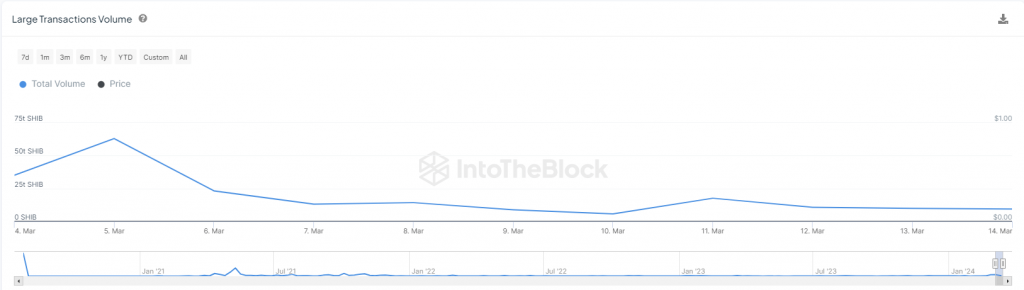

Shiba Inu (SHIB), a popular memecoin, has experienced a notable decline. It dropped nearly 20% over the past week and continued a 13% fall in just the past 24 hours. This downturn occurs amid a broader bearish trend across the crypto landscape. However, detailed on-chain analysis has uncovered specific factors contributing to SHIB’s sharp decline. Related Reading: Crypto Analyst Optimistic About A Shiba Inu Short-Term Surge To $0.000066 Whale Movements And Market Influence Insights from IntoTheBlock have shed light on large transaction activities, often indicative of “whale” movements, which have seen a general decrease since March 5, further compounding the downward pressure on SHIB’s price. The role of speculative trading in influencing SHIB’s market performance has also become increasingly apparent. Data pointing to the holding time of transacted coins suggests a shift towards short-term trading strategies among investors, possibly in pursuit of quick profits. Such behaviors are underscored by a significant reduction in the average holding period of coins, from four weeks to just two months as of mid-March, accompanied by a transaction volume of 2.12 trillion SHIB. This trend towards speculative trading has been a key driver behind the memecoin’s recent price movements, reflecting the broader dynamics within the cryptocurrency market. The decrease in large transactions involving Shiba Inu signifies dwindling confidence among whales, whose actions can profoundly impact market direction. The observed decline in whale activities aligns with a broader caution in the crypto market, where investors reevaluate their positions amid shifting market conditions. Shiba Inu Bright Horizon Despite the current downturn, Shiba Inu remains a focal point within the altcoin sector, buoyed by optimistic predictions from crypto analysts. Related Reading: Crypto Expert Says Dogecoin, Shiba Inu, PEPE, Others Are About To Explode Michaël van de Poppe, a well-regarded figure in the crypto analysis community, has recently posited that altcoins, are set for significant rallies, potentially positioning Shiba Inu for a notable rebound as the market stabilizes. There’s still around 40-60% market capitalization to gain for the #Altcoins. That’s going to be a fun ride for the altcoins in the coming period. pic.twitter.com/qT0FRU4qpY — Michaël van de Poppe (@CryptoMichNL) March 7, 2024 This sentiment is echoed by Shiba Inu’s co-founder, Shytoshi Kusama, who has expressed confidence in SHIB’s ability to lead in the next bull market, citing the project’s comprehensive plans, community support, and execution as key differentiators. No. The community with the strongest tech, vision, plan, supporters, partners, and execution will. #SHIB But if you wanted some impressions why not say hi? https://t.co/jc6qJ11GJ6 — Shytoshi Kusama™ (@ShytoshiKusama) March 6, 2024 Regardless, SHIB has continued its bearish trajectory, with a market price now sitting at $0.00002916 at the time of writing. Featured image from Unsplash, Chart from TradingView