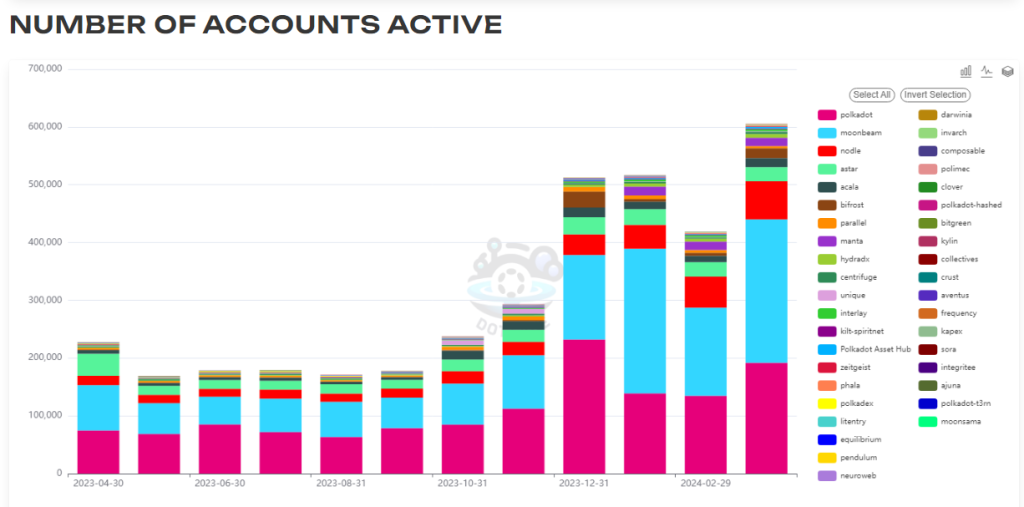

Polkadot, a blockchain platform designed for interoperability between different blockchains, is experiencing a surge in new users, but a disconnect between user growth and network activity is raising questions about its long-term viability. Related Reading: Don’t Miss The Boat! Ethereum Whales Signal Bullish Run With $40 Million Bet Based on the latest figures, DOT tallied an all-time high in active wallets and unique accounts in March, surpassing 600,000 and 5.59 million, respectively. This suggests a growing interest in the platform, potentially driven by the thriving developer ecosystem on Polkadot’s parachains, specialized blockchains that connect to the main Polkadot chain. Moonbeam, a prominent parachain, played a particularly significant role, contributing the highest number of active addresses with nearly 250,000. Source: Data Polkadot Transactions Dip Despite Active User Growth However, despite the influx of new users, the number of transactions on the Polkadot network hasn’t kept pace. While there was a modest increase in transactions compared to February, the current volume remains significantly lower than the peak recorded in December. This inconsistency raises concerns about how actively users are engaging with the network. The possibility exists that users are holding or staking their DOT tokens instead of utilizing them for transactions on the platform. Total crypto market cap is currently at $2.5 trillion. Chart: TradingView Polkadot Price Seeks Stability After Recent Decline The price of Polkadot’s native token, DOT, seems to be finding support around $9. This could indicate a period of consolidation after a decline from its previous highs above $11. While a price increase is typically seen as a positive sign, it’s important to consider it alongside actual network usage. Source: Data Is Polkadot Building Without Using? The current situation with Polkadot presents a paradox. The platform is attracting new users, but they aren’t necessarily translating into active network participants. This could be due to several factors. Perhaps users are waiting for a specific application or service to be built on Polkadot before actively engaging. It’s also possible that technical limitations are hindering user activity. Related Reading: SUI Slips After Hitting All-Time High: TVL Tumbles 12% – Token Price In The Gutter? Further analysis is needed to understand the reasons behind the lagging transactions. Examining the types of transactions occurring on the network could provide valuable insights. For instance, an increase in governance-related transactions might suggest a more engaged user base, even if overall transaction volume remains low. Polkadot’s Future Hinges On Active Network Use While the growth in active wallets and accounts is a positive sign for Polkadot, it’s crucial to convert this interest into actual network usage. The success of Moonbeam demonstrates the potential for a vibrant developer ecosystem on Polkadot. However, broader adoption across various use cases is necessary for the platform to reach its full potential. Featured image from Pexels, chart from TradingView