Bitcoin Peak Yet To Come: Analysts Share 2025 Bull Market Predictions

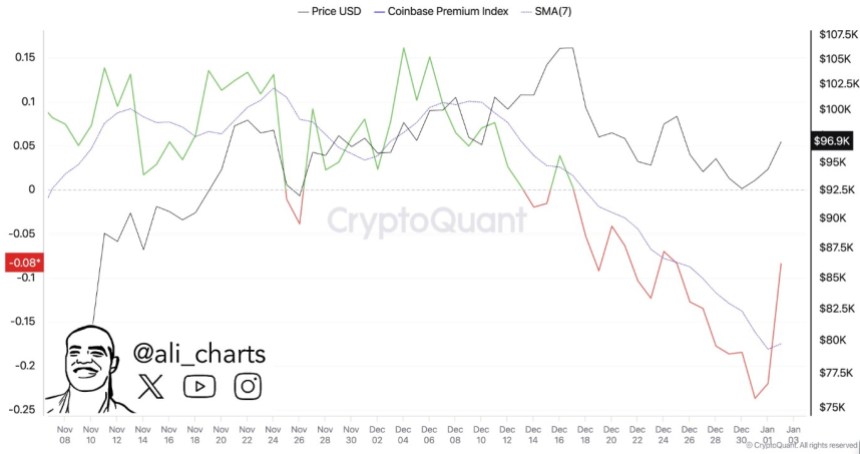

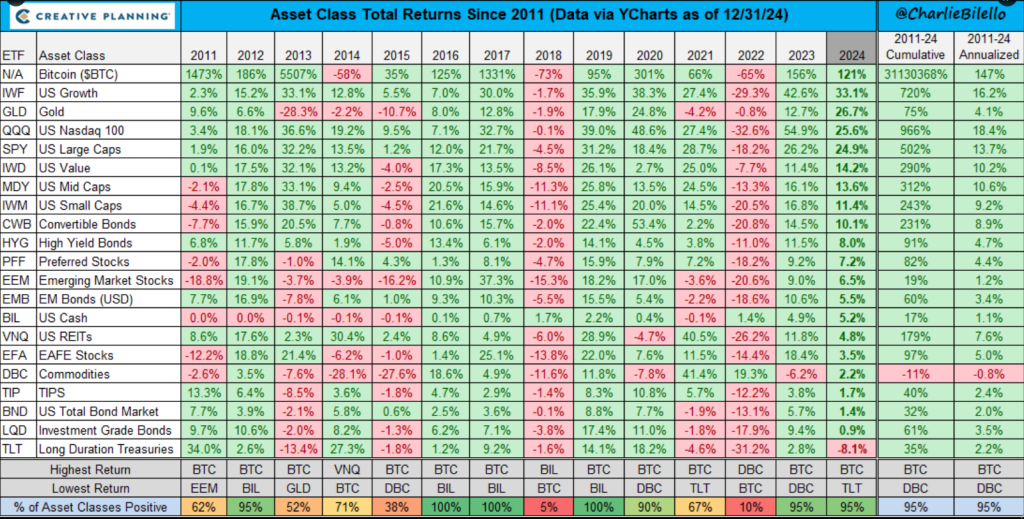

The market is recovering from the end-of-year bleeding that dragged most cryptocurrencies, including Bitcoin (BTC), to monthly lows. As the flagship crypto retests key levels, some analyst shared their predictions for the 2025 bull market and BTC’s performance. Related Reading: Solana-Based Pump.Fun Records $15 Million Daily Revenue As Memecoin Mania Continues Bitcoin Correction Close To An End? Over the last three days, Bitcoin has slowly climbed back to the $96,000 level, briefly trading near the $98,000 mark on Thursday afternoon. Last week, the flagship crypto lost this key range, failing to reclaim it for six days. This zone served as a crucial bounce point since mid-November. However, the New Year recovery sent BTC’s price up nearly 5%, with Bitcoin trading above $96,000 for the past day. Some crypto analysts previously suggested that reclaiming the $97,300 support zone is crucial to reverse BTC’s short-term bearish trend. This level was retested yesterday for the first time in over a week but failed to hold. Despite this, crypto analyst Rekt Capital noted that week 9 of its post-halving “Parabolic Upside Phase” is “slowly ending,” suggesting that BTC’s correction will likely be over soon. The analyst explained Bitcoin enters a parabolic period that lasts around 300 days each cycle after every Halving event. Historically, BTC registers the first major retrace a month after entering price discovery mode. The first “Price Discovery Correction” starts between Weeks 6 and 8 of each parabolic phase and sees pullbacks by at least 25%. This cycle, Bitcoin’s retrace started on Week 7 and saw a 15% correction, which some analysts suggest is due to the trend of smaller corrections. Rekt Capital stated that “once Bitcoin clears its historically corrective weeks,” the flagship crypto will offer plenty of reasons to be bullish. Similarly, the analyst pointed out that BTC’s peak will likely come this year, followed by the “very beginnings of a brand new bear market.” However, he explained that most of the bear market will occur next year, lasting “some 365+ days and be between -65% to -80% deep.” BTC To Perform Well In Q1 Daan crypto trades highlighted that Bitcoin has been “chopping around the $100K level for 6 weeks now, we’ve built up a good amount of liquidity in this area.” He added that from the $100,000 mark and above, “there should be plenty of fuel to propel this higher.” Moreover, the trader noted that BTC is “trading right around the high volume node. Meaning, most volume was traded between these prices. Generally, price moves easier when its able to break away from such a high volume area. The 4H 200MA is guarding that breaking on the top side. The 4H 200EMA below is offering support.” Related Reading: Bitcoin Retests $95,000 Amid 4.2% Surge, Is A New Year Rebound Coming? Daan asserted that a break above the $98,000 mark could “get the party started and start the run back to the all-time highs,” while holding the $95,000 support zone key in the short term. Ultimately, he considers there will be “an interesting race between BTC and ETH this quarter,” as the market’s performance during Q1 is usually “pretty positive.” Based on this historical performance, the trader expects the leading cryptocurrencies to perform well throughout the start of the year. As of this writing, Bitcoin is trading at $97,071, a 1% increase in the weekly timeframe. Featured Image from Unsplash.com, Chart from TradingView.com